Ev Tax Credit 2023 Car List Here Is the EPA s List of EVs Eligible for the Federal Tax Credit We ve gathered every new EV that s currently eligible to earn either the partial 3750 or the full

All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 Who qualifies You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV

Ev Tax Credit 2023 Car List

Ev Tax Credit 2023 Car List

https://thegreencarguy.com/wp-content/uploads/2016/05/GCG-CashandCar-1024x1024.jpg

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Tax Credits ElectricVehicleSolar

https://static.wixstatic.com/media/d01121_9abd5528e3d5421198995c9f6da16436~mv2.png/v1/fit/w_2500,h_1330,al_c/d01121_9abd5528e3d5421198995c9f6da16436~mv2.png

List of vehicles that are eligible for a 30D clean vehicle tax credit and the amount of the qualifying credit if purchased between 2010 and 2022 If you bought a new qualified Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified

The Internal Revenue Service released its list of electric vehicles that will still qualify for the 7 500 federal EV tax credit after strict new supply chain rules go into effect on You can now check if the EV you desire is eligible for a sizable federal tax credit The Internal Revenue Service IRS has released its list of vehicles that qualify for a clean vehicle tax

Download Ev Tax Credit 2023 Car List

More picture related to Ev Tax Credit 2023 Car List

Electric Vehicle Tax Credit Explained 1 800Accountant

https://blog.1800accountant.com/wp-content/uploads/2022/09/EV-Tax-Credits-Explained_blog-header.jpg

The Problem With The 2023 EV Tax Credit YouTube

https://i.ytimg.com/vi/iw4npmFItQI/maxresdefault.jpg

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

https://theicct.org/wp-content/uploads/2022/06/epv-us-tax-credit-fig-jun22.png

As of January 1st 2023 a bunch of electric vehicles became newly eligible for the 7 500 tax credit which passed into law as part of the 430 billion Inflation Reduction Act a year ago The U S Treasury on Monday released a full list of the vehicles with access to U S electric vehicle tax credits under new battery sourcing requirements which

Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act The federal government offers a tax rebate of up to 7 500 to buyers of certain electric vehicles EVs and plug in hybrids PHEVs But the rules that govern

Mary Rice The Truth About The Inflation Reduction Act s Electric

https://riceimpact.com/wp-content/uploads/2022/08/EV-Tax-Credit-Web-Post-1080x675.jpg

EV Tax Credit 2023 All You Need To Know Electric Vehicle Info

https://e-vehicleinfo.com/global/wp-content/uploads/2023/06/EV-Tax-Credit-2023-All-you-need-to-know-2-1024x536.png

https://www.caranddriver.com/news/g43675128/cars...

Here Is the EPA s List of EVs Eligible for the Federal Tax Credit We ve gathered every new EV that s currently eligible to earn either the partial 3750 or the full

https://www.fueleconomy.gov/feg/tax2023.shtml

All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500

How To Claim Your Federal EV Tax Credit Worth Up To 7 500 TurnOnGreen

Mary Rice The Truth About The Inflation Reduction Act s Electric

Tax Credits And Electric Cars AAA Washington Articles News And Advice

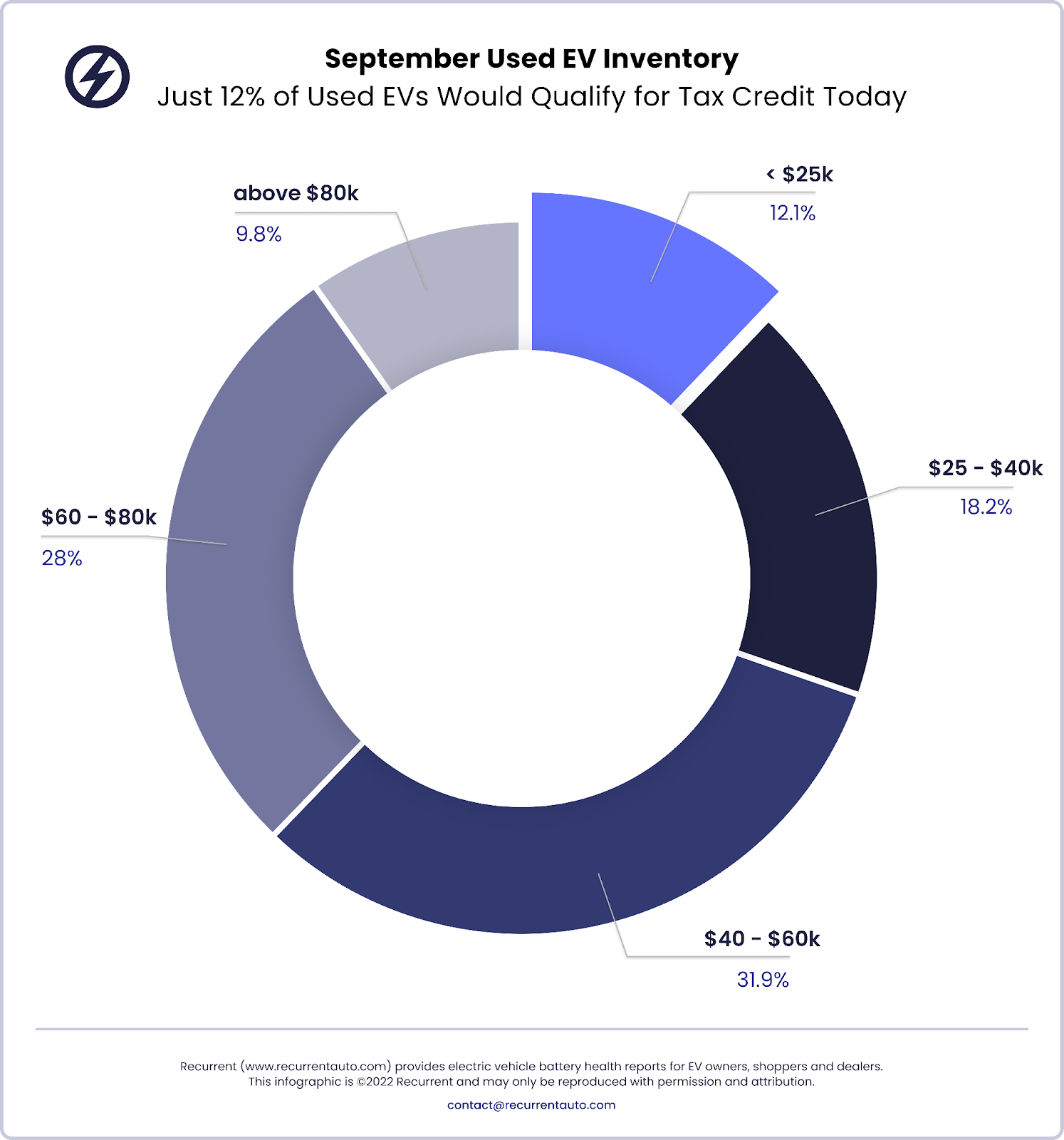

Inflation Reduction Act Used EV Funding Mostly Applies To PHEVs Motor

EV Tax Credits A Whole Lot Of Speculation Interpretation And

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

EV Tax Credit 2023 Who Qualifies For It Claim It With IRS Form 8936

EV Tax Credit 20 EVs That Still Qualify For 2023 Tax Breaks

What Will Change With EV Tax Credits In 2023

Ev Tax Credit 2023 Car List - The EV tax credit has changed and many cars are no longer eligible Here s the list of electric cars made in North America which qualify now