Ev Tax Credit 2023 Massachusetts As of August 9 2023 the MOR EV Standard rebate of 3 500 for purchases or leases of eligible new light duty battery electric vehicles BEVs and fuel cell electric vehicles

Consumers can receive up to 7 500 in federal tax credits when purchasing a new eligible electric vehicle and up to 4 000 when purchasing a used eligible electric vehicle As of The Massachusetts Offers Rebates for Electric Vehicles MOR EV program makes electric vehicles EVs more affordable for Massachusetts residents businesses and

Ev Tax Credit 2023 Massachusetts

Ev Tax Credit 2023 Massachusetts

https://www.affinitiv.com/wp-content/uploads/2023/03/ev-tax-credit2-scaled-e1679077955590.jpg

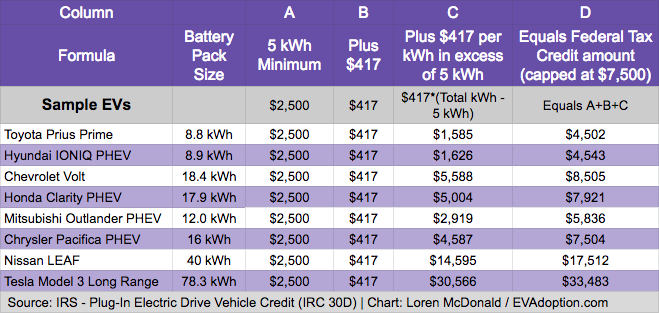

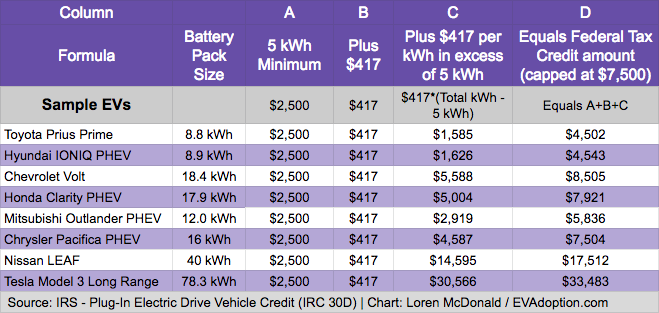

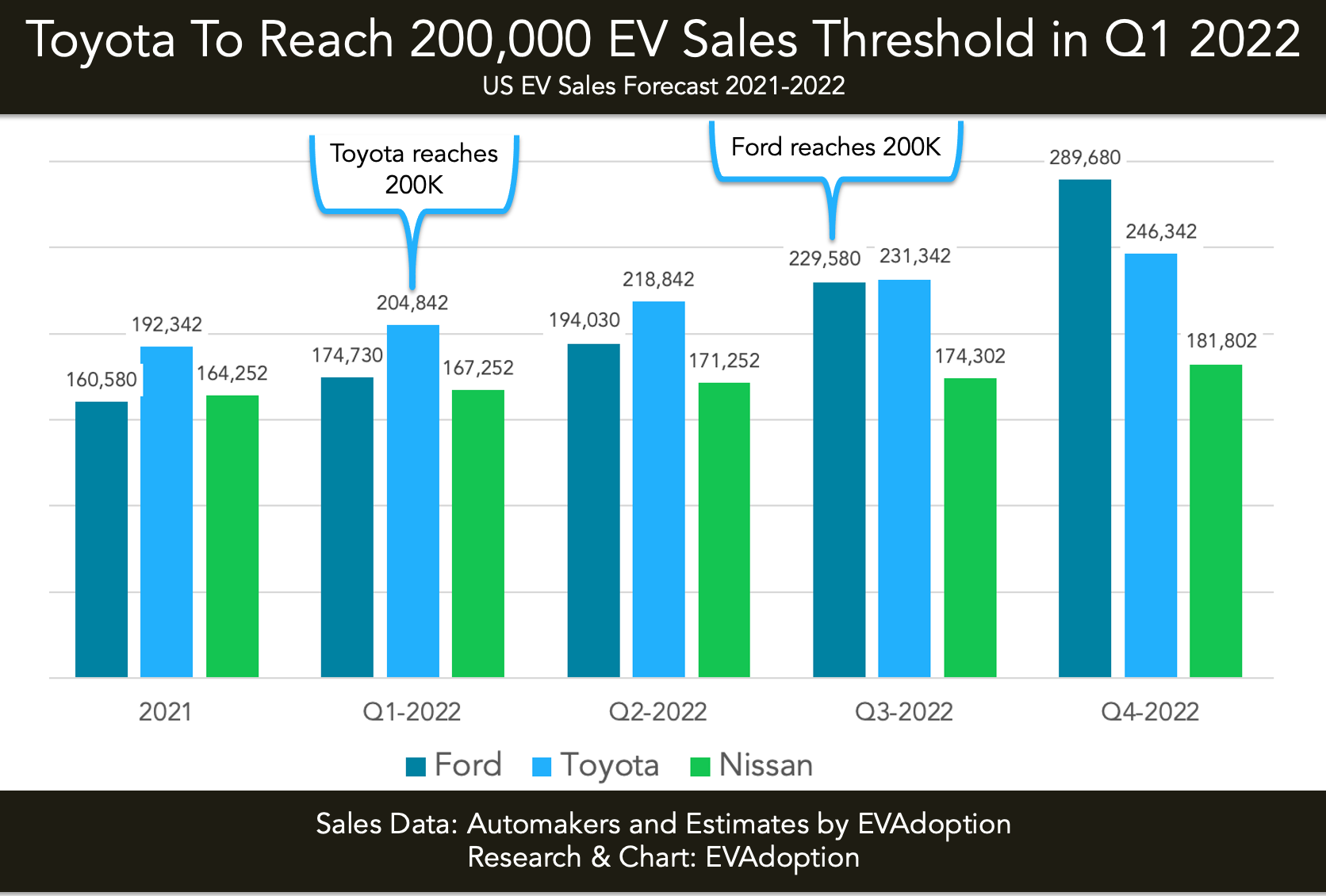

How The Federal EV Tax Credit Amount Is Calculated For Each EV EVAdoption

https://evadoption.com/wp-content/uploads/2019/03/Sample-EVs-Federal-EV-tax-credit-amount-calculation.png

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

https://electrek.co/wp-content/uploads/sites/3/2022/11/EV-tax-credit-flowchart.jpg?quality=82&strip=all&w=1024

As of December 6 2023 MOR EV offers an additional 1 000 rebate to Massachusetts residents who have purchased or leased an eligible EV on or after August 8 2023 and New Vehicles to be eligible for a MOR EV Standard rebate the Total MSRP may not exceed 55 000 Used Vehicles to be eligible for a MOR EV Used rebate the final

New plug in hybrid vehicles that costs 50 000 or less are still eligible for a 1 500 rebate though this rebate will be phased out sometime in the Spring of 2023 Some notable changes include a new rebate program for used EVs extra incentives for lower income residents and for the first time point of sale rebates to

Download Ev Tax Credit 2023 Massachusetts

More picture related to Ev Tax Credit 2023 Massachusetts

IRS EV Tax Credit 2023 Who Can Qualify Qualified Vehicles

https://teqip.in/wp-content/uploads/2023/01/cfe69sh325Y5BRMCUpTwrE.jpg

EV Tax Credit 2023 2024 How It Works What Qualifies NerdWallet

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2022/08/GettyImages-1252669337-ev-tax-credit-electric-vehicle-tax-credit-2400x1440.jpg

A Complete Guide To The New EV Tax Credit

https://techcrunch.com/wp-content/uploads/2022/09/math-calculation-ev.jpg

Massachusetts residents participating in one of more than a dozen income assistance programs from RAFT Residential Assist to Families in Transition to Does Massachusetts Have Tax Credits For Buying New EVs Yes The Massachusetts Department of Energy Resources offers rebates of up to 3 500 for the purchase or lease of a new eligible

Qualifying buyers who participate in certain state programs or who meet income criteria can get a rebate on a used EV that costs 40 000 or less with a model For the first time the federal government will now offer a tax credit for buying a pre owned electric vehicle which experts say could go a long way toward

Learn The Steps To Claim Your Electric Vehicle Tax Credit

https://andersonadvisors.com/wp-content/uploads/2023/04/Electric-vechiles.jpg

Federal EV Tax Credit Phase Out Tracker By Automaker EVAdoption

https://evadoption.com/wp-content/uploads/2021/06/200000-EVs-Manufacturer-Forecast-Chart.png

https://www.mass.gov/doc/november-6-2023-draft-mor...

As of August 9 2023 the MOR EV Standard rebate of 3 500 for purchases or leases of eligible new light duty battery electric vehicles BEVs and fuel cell electric vehicles

https://www.mass.gov/info-details/state-and...

Consumers can receive up to 7 500 in federal tax credits when purchasing a new eligible electric vehicle and up to 4 000 when purchasing a used eligible electric vehicle As of

New EV Tax Credits The Details Virginia Automobile Dealers Association

Learn The Steps To Claim Your Electric Vehicle Tax Credit

Federal EV Tax Credit Phase Out Tracker By Automaker EVAdoption

How The Federal EV Tax Credit Can Save You 7 500 On A New Plug in Vehicle

EV Tax Credit Are You Claiming The Correct Rebates Benefits

10 Cheapest EVs When Taking Advantage Of U S Federal EV Tax Credit

10 Cheapest EVs When Taking Advantage Of U S Federal EV Tax Credit

Which Electric Cars Are Still Eligible For The 7 500 Federal Tax

How Do The Used And Commercial Clean Vehicle Tax Credits Work Blink

BMW Electric Plug in Hybrid Vehicle Tax Credit Update For 2023

Ev Tax Credit 2023 Massachusetts - Some notable changes include a new rebate program for used EVs extra incentives for lower income residents and for the first time point of sale rebates to