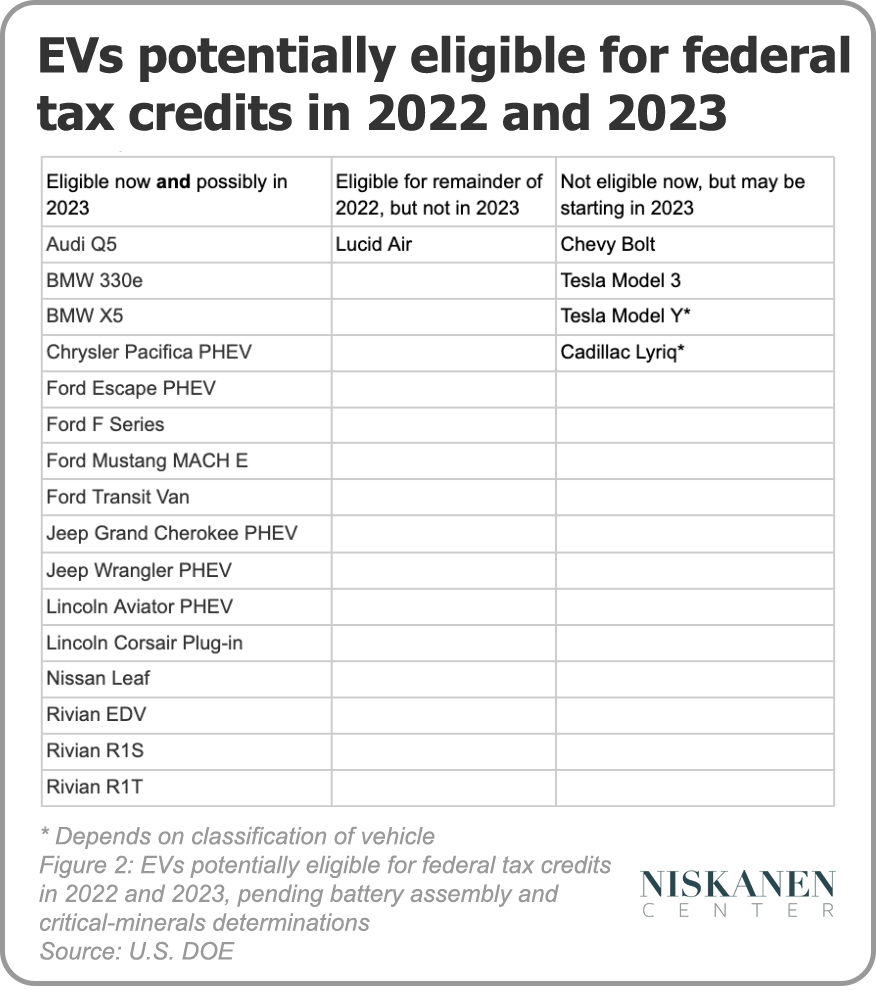

Ev Tax Credit 2024 Income Limit The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit in 2024

Another new EV tax credit benefit in 2024 If you re buying a clean vehicle you may have the option as of Jan 1 2024 to take the EV tax credit as a discount at the point of sale when you What are the income limits to qualify for any federal EV tax credits Modified adjusted gross income limits are 150 000 for individuals 225 000 for heads of households and 300 000 for

Ev Tax Credit 2024 Income Limit

Ev Tax Credit 2024 Income Limit

https://i2.wp.com/insuremekevin.com/wp-content/uploads/2018/10/2019-Covered-California-Medi-Cal-Income-Chart.jpg

Has Federal EV Tax Credit Been Saved The Green Car Guy

https://thegreencarguy.com/wp-content/uploads/2016/05/GCG-CashandCar-1024x1024.jpg

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

A 7 500 tax credit for electric vehicles has seen substantial changes in 2024 It should be easier to get because it s now available as an instant rebate at dealerships but fewer models The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel

Under the Inflation Reduction Act the used EV tax credit now offers a credit amounting to 30 of the sale price with a maximum limit of 4 000 This offers consumers potentially significant savings when purchasing new and used electric vehicles Income thresholds and vehicle price caps A new electric vehicle EV can help you reduce your carbon footprint and access a tax credit of up to 7 500 As of 2024 the federal government expanded the tax break to allow you to choose between applying the credit to your taxes or getting a discount on your EV purchase

Download Ev Tax Credit 2024 Income Limit

More picture related to Ev Tax Credit 2024 Income Limit

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit Taxpayers who meet the income requirements and buy a vehicle that satisfies the price battery and assembly restrictions are eligible to receive up to 7 500 from the government as a tax

[desc-10] [desc-11]

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

https://electrek.co/wp-content/uploads/sites/3/2022/11/EV-tax-credit-flowchart.jpg?quality=82&strip=all&w=1024

The New EV Tax Credit In 2023 Everything You Need To Know Updated

https://caredge.com/wp-content/uploads/2021/11/ev-tax-credit-update-2022.png

https://www.nerdwallet.com/article/taxes/ev-tax...

The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit in 2024

https://www.kiplinger.com/taxes/ev-tax-credit

Another new EV tax credit benefit in 2024 If you re buying a clean vehicle you may have the option as of Jan 1 2024 to take the EV tax credit as a discount at the point of sale when you

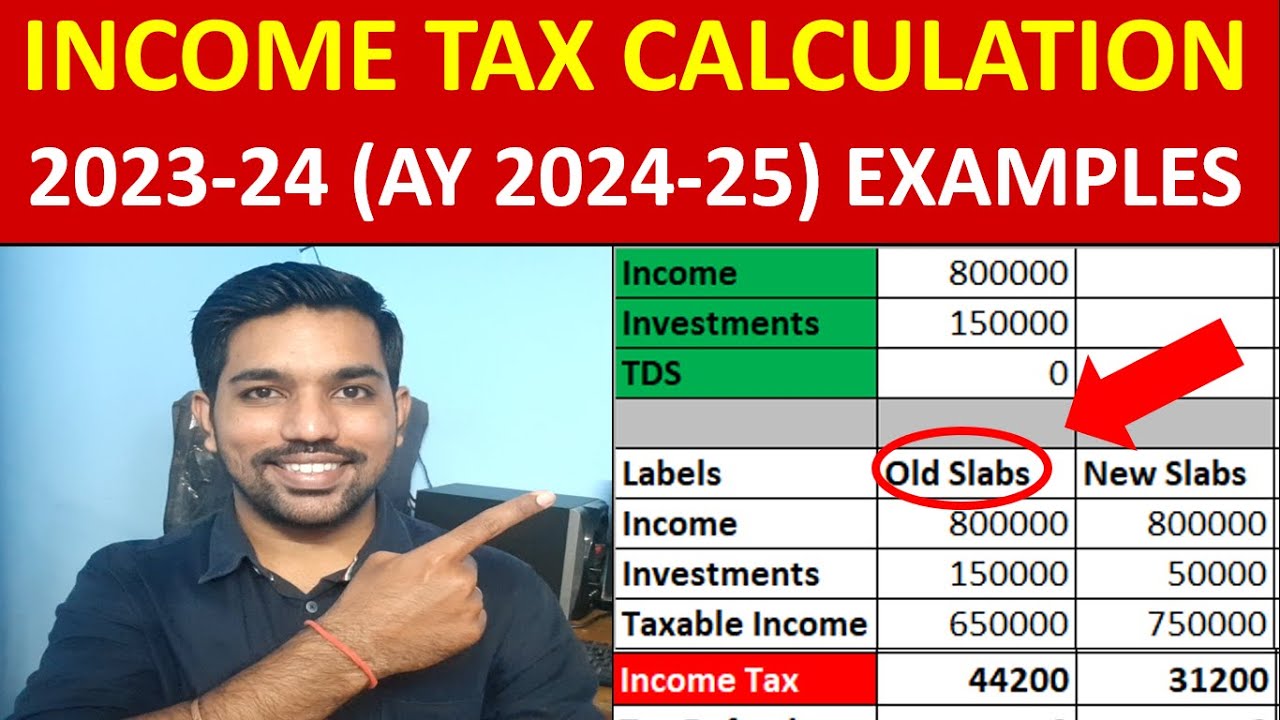

How To Calculate Income Tax 2023 24 AY 2024 25 Tax Calculation

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

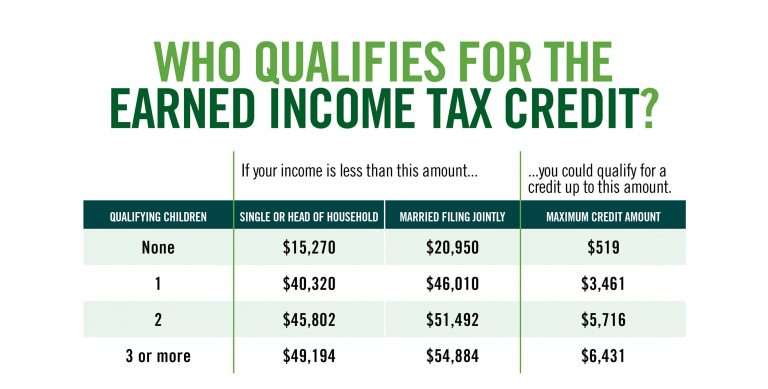

Earning Income Tax Credit Table

Earned Income Tax Credit For Households With One Child 2023 Center

Income Tax Calculator FY 2023 24 2022 23 FinCalC Blog

Earned Income Tax Credit EITC Who Qualifies

Earned Income Tax Credit EITC Who Qualifies

.png)

Health Insurance Income Limits For 2023 To Receive ACA Premium S

How To Calculate Tax In Australia One Click Life

Federal EV Tax Credits Are About To Become Scarce Who Should Get Them

Ev Tax Credit 2024 Income Limit - [desc-13]