Ev Tax Credit Income Limit 2021 Verkko 6 lokak 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 167 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the 167 30D tax credit The IRA also added a new credit for previously owned clean vehicles under 167 25E of

Verkko 11 elok 2021 nbsp 0183 32 The amendment would also limit the tax credit to EVs that cost less than 40 000 Jonathan M Gitlin 8 11 2021 6 18 AM Verkko 11 elok 2021 nbsp 0183 32 As part of the new federal budget the US Senate approved an amendment introduced by Senator Deb Fischer R NE to introduce a limit on the price of electric cars eligible to the 7 500 federal

Ev Tax Credit Income Limit 2021

Ev Tax Credit Income Limit 2021

https://static.wixstatic.com/media/d01121_9abd5528e3d5421198995c9f6da16436~mv2.png/v1/fit/w_2500,h_1330,al_c/d01121_9abd5528e3d5421198995c9f6da16436~mv2.png

8 Incredible Tips What Is Dependent Care Credit Outbackvoices

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Verkko 7 tammik 2023 nbsp 0183 32 If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit has an income cap too 150 000 for a household 75 000 Verkko 24 marrask 2023 nbsp 0183 32 This tax credit is intended to make buying an electric vehicle more affordable The credit ranges from 2 500 to 7 500 depending on the capacity of the electric battery

Verkko 2 syysk 2022 nbsp 0183 32 Some manufacturers that have vehicles assembled in North America have sold 200 000 EVs That matters because under the old rule there was a 200 000 vehicle cap on the credits Once a manufacturer Verkko 30 marrask 2021 nbsp 0183 32 For individuals the maximum income would be 250 000 and for single income households the income limit would be 375 000 The version proposed earlier on Oct 28 would have provided a

Download Ev Tax Credit Income Limit 2021

More picture related to Ev Tax Credit Income Limit 2021

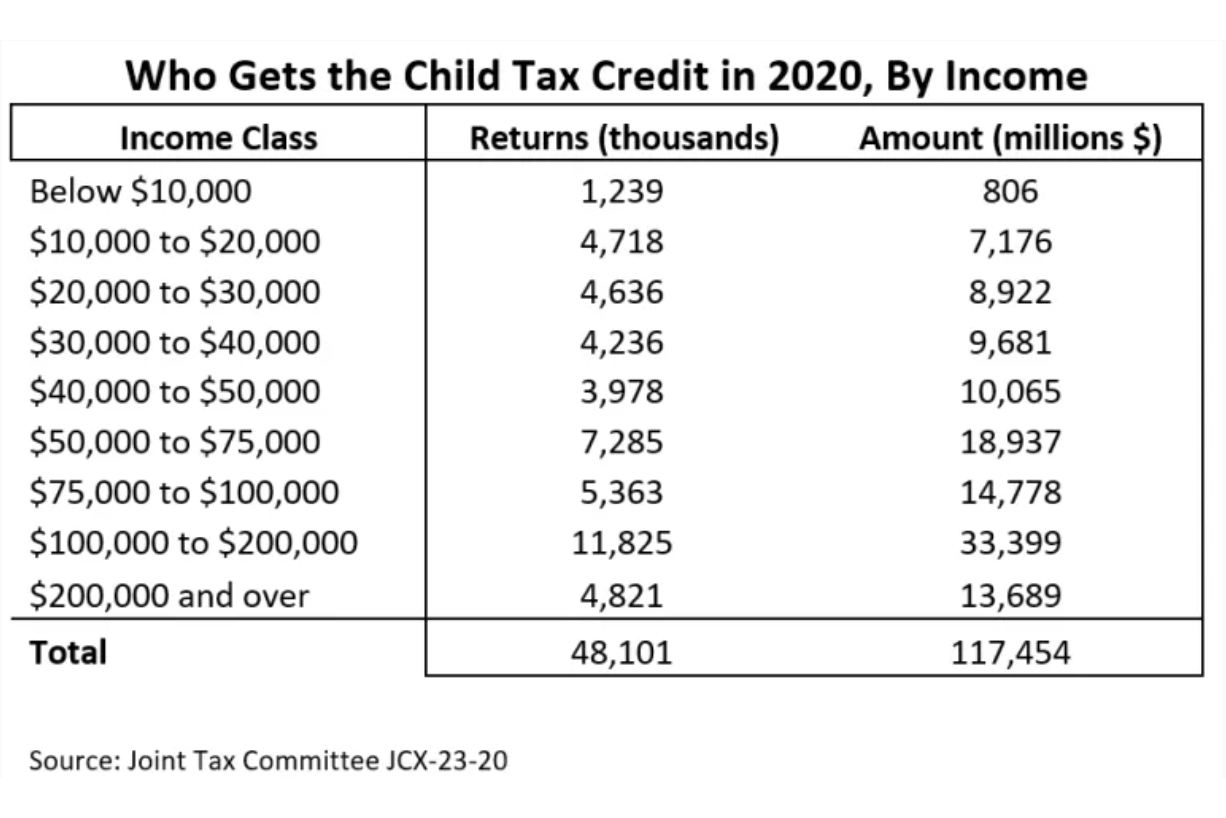

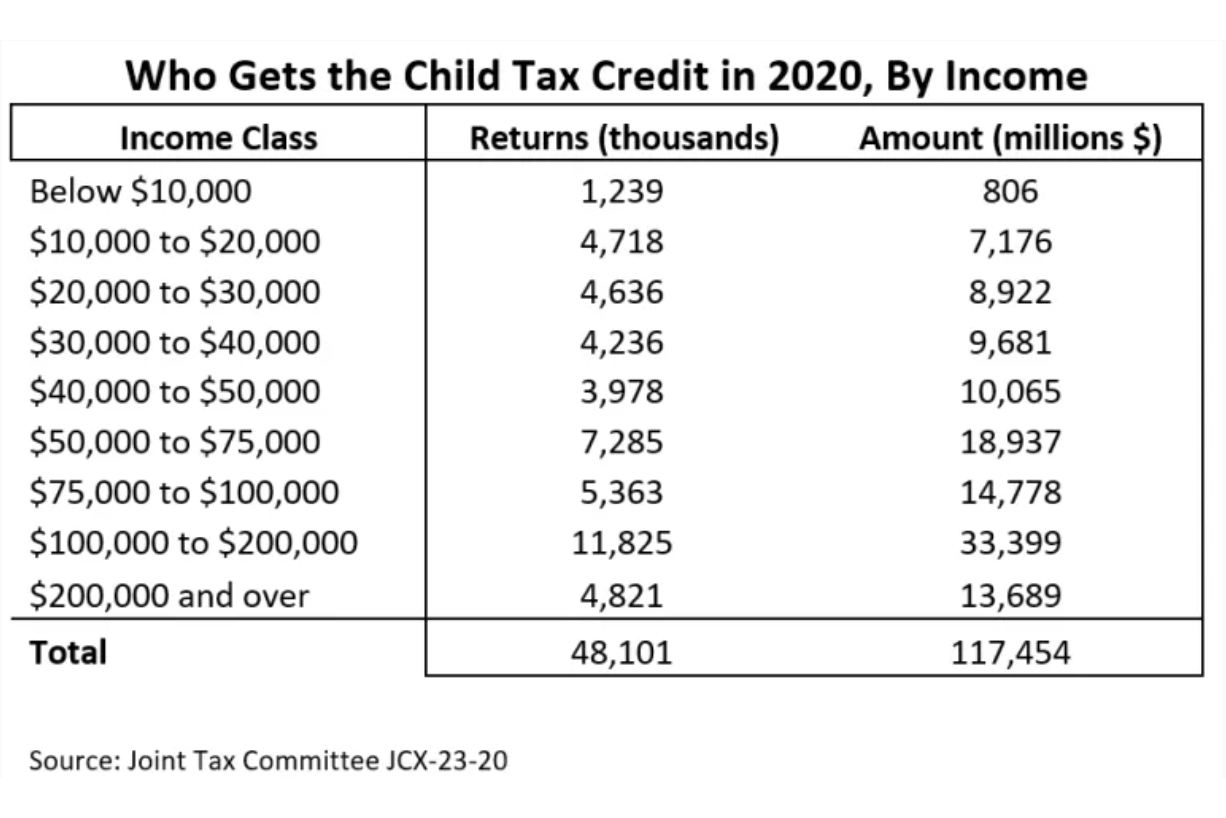

Child Tax Credit Income Limit 2024 Credits Zrivo

https://www.zrivo.com/wp-content/uploads/2021/01/Child-Tax-Credit-Income-Limit.jpg

The New EV Tax Credit In 2023 Everything You Need To Know Updated

https://caredge.com/wp-content/uploads/2021/11/ev-tax-credit-update-2022.png

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

https://electrek.co/wp-content/uploads/sites/3/2022/11/EV-tax-credit-flowchart.jpg?quality=82&strip=all&w=1024

Verkko Consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle tax credit on their annual tax filing Starting in 2024 the Inflation Reduction Act establishes a mechanism that will allow car buyers to transfer the credit to dealers at the point of sale so that it can directly reduce the purchase price Verkko 3 marrask 2021 nbsp 0183 32 The new proposal limits the full EV tax credit for individual taxpayers reporting adjusted gross incomes of 250 000 or 500 000 for joint filers down from 400 000 for individual filers

Verkko last updated 3 January 2023 The EV tax credit rules have changed Here s what you need to know Comments 0 Image credit Ford Thanks to the Inflation Reduction Act the federal EV Verkko 17 elok 2022 nbsp 0183 32 What is the Inflation Reduction Act s EV tax credit Simply put the Inflation Reduction Act includes a 7 500 tax credit at the point of sale for new EVs and 4 000 for used EVs The

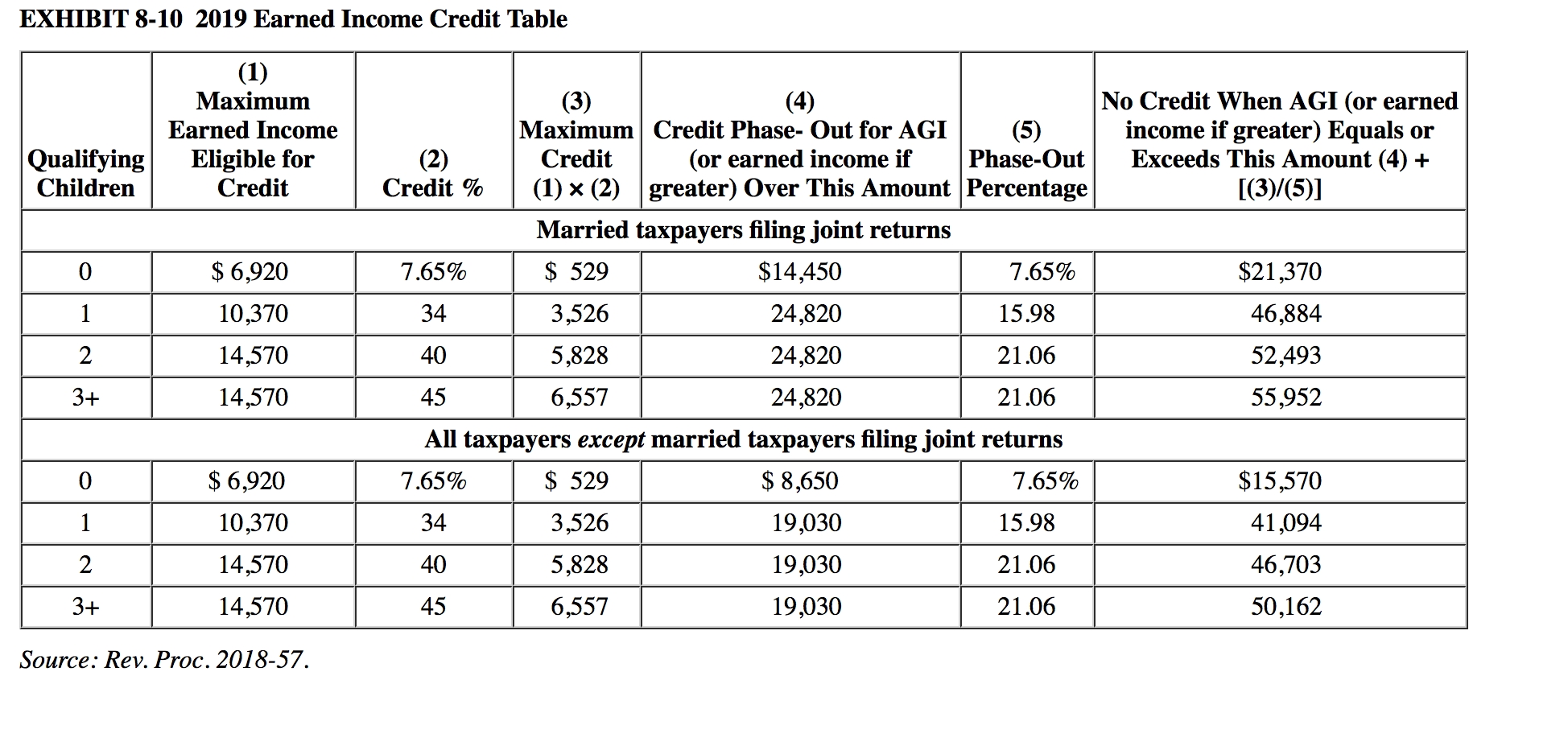

See The EIC Earned Income Credit Table Income Tax Return Income

https://i.pinimg.com/originals/aa/af/be/aaafbed0a4b639f5c32ede742b5dd17b.png

U S Federal EV Tax Credit Update For January 2019

https://cdn.motor1.com/images/mgl/kw3bM/s1/u-s-federal-ev-tax-credit-update-for-january-2019.jpg

https://www.irs.gov/newsroom/topic-b-frequently-asked-questions-about...

Verkko 6 lokak 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 167 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the 167 30D tax credit The IRA also added a new credit for previously owned clean vehicles under 167 25E of

https://arstechnica.com/cars/2021/08/senate-votes-to-restrict-ev-tax...

Verkko 11 elok 2021 nbsp 0183 32 The amendment would also limit the tax credit to EVs that cost less than 40 000 Jonathan M Gitlin 8 11 2021 6 18 AM

Your First Look At 2023 Tax Brackets Deductions And Credits 3

See The EIC Earned Income Credit Table Income Tax Return Income

EV Tax Credit 2023 New Rule Changes And What s Ahead Kiplinger

EV Tax Credit 2024 Credits Zrivo

What Is The Income Limit For Aca Subsidies 2022 2022 Top Virals

Child Tax Credit 2022 Income Limit Phase Out TAX

Child Tax Credit 2022 Income Limit Phase Out TAX

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

8 Photos Earned Income Credit Table 2019 And Review Alqu Blog

2023 Tax Brackets The Best Income To Live A Great Life

Ev Tax Credit Income Limit 2021 - Verkko If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh The maximum