Ev Tax Credit Income Limit 2022 If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit in 2024 Income limits for new qualifying electric vehicles You won t qualify for the EV tax credit if you are single and your modified adjusted gross income exceeds 150 000

Ev Tax Credit Income Limit 2022

Ev Tax Credit Income Limit 2022

https://vada.com/wp-content/uploads/2022/08/EV-Tax-Credits-Facebook-Post.png

Has Federal EV Tax Credit Been Saved The Green Car Guy

https://thegreencarguy.com/wp-content/uploads/2016/05/GCG-CashandCar-1024x1024.jpg

EV Tax Credit Rules Are Becoming More Complicated Local News Today

https://i2.wp.com/image.cnbcfm.com/api/v1/image/106916725-1627308432240-gettyimages-1330261567-bth_014_7-21-2021_chargingstationforelectricvehicleinpennsyl.jpeg

Tucked inside the massive Inflation Reduction Act of 2022 that was signed into law in August is a complex set of requirements around which EVs and other clean vehicles do and do not qualify for a The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in

If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit has an income cap too 150 000 for a household 75 000 for a Simply put the Inflation Reduction Act includes a 7 500 tax credit at the point of sale for new EVs and 4 000 for used EVs The new tax credits replace the old incentive system which only

Download Ev Tax Credit Income Limit 2022

More picture related to Ev Tax Credit Income Limit 2022

Why Getting A 7 500 EV Tax Credit Will Be Easier In 2024 WSJ

https://images.wsj.net/im-865215/social

New US EV Tax Credit Here s Everything You Need To Know

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AAX9y19.img?w=1920&h=1080&m=4&q=50

The EV Tax Credit Is Changing In 2024 Here Are 10 Cars That Still

https://cdn.gobankingrates.com/wp-content/uploads/2022/08/2022-chevrolet-bolt-ev-2LT_shutterstock_editorial_12769567bd.jpg

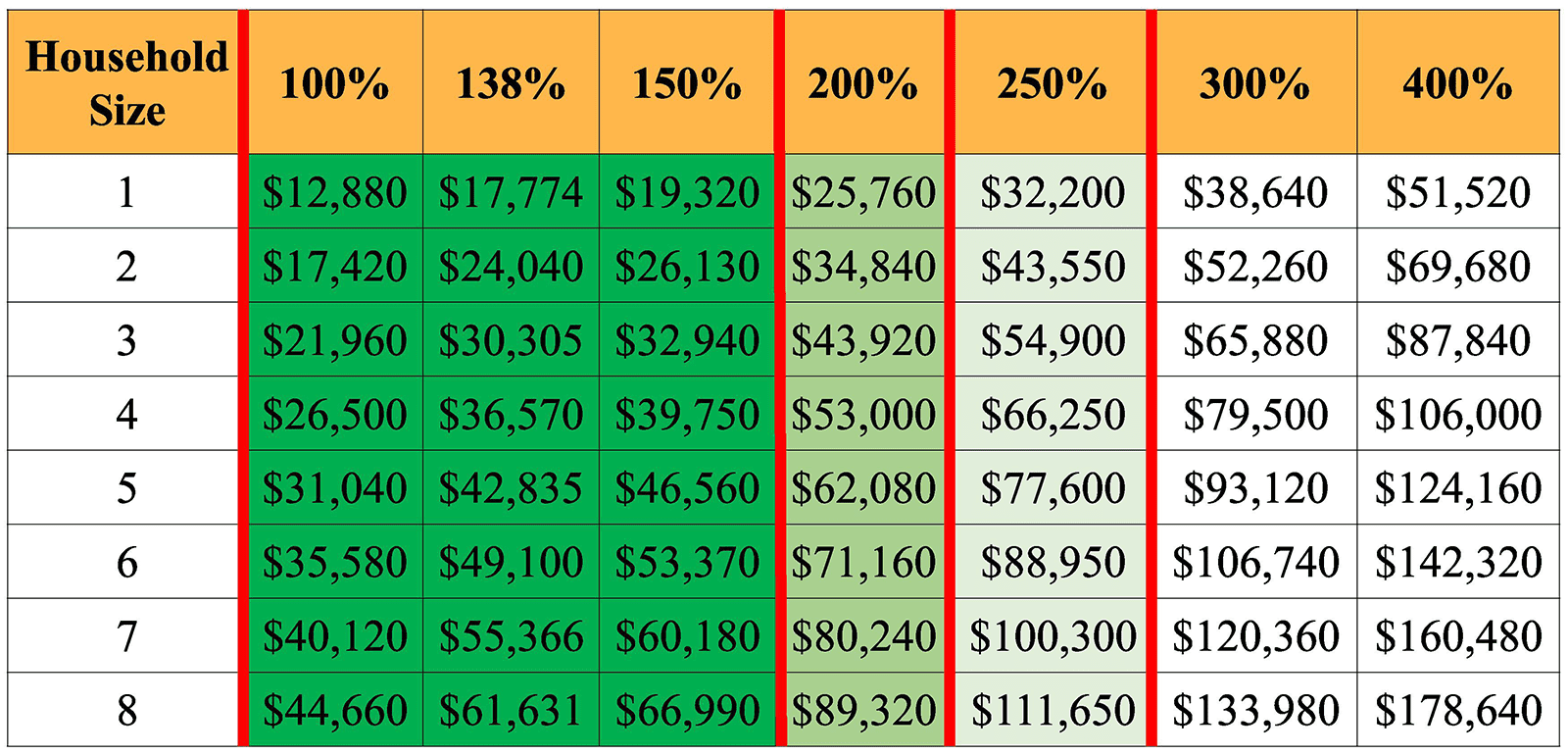

Eligible purchasers must also meet max income requirements 150 000 for individuals 225 000 for the head of household and 300 000 for joint filers There are of course limiting To assist consumers identifying eligible vehicles the Department of Transportation and Department of Energy published new resources today to help those

Effective immediately after enactment of the Inflation Reduction Act after August 16 2022 the tax credit is only available for qualifying electric vehicles for which final assembly The credit is worth between 2 500 and 7 500 for the 2022 tax year and eligibility for claiming the credit depends on the number of electric vehicles sold by the

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

EV Tax Credits How To Get The Most Money For 2023 PCMag

https://i.pcmag.com/imagery/articles/07exK2ZPavoZ2piutV24U3q-1.fit_lim.size_1600x900.v1660151815.jpg

https://www.irs.gov/credits-deductions/credits-for...

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

https://www.nerdwallet.com/article/tax…

The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit in 2024

Dependent Care Fsa Or Child Tax Credit 2022 Kitchen Cabinet

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

ACA Tax Credits To Help Pay Premiums White Insurance Agency

EV Tax Credit 2024 Income Limit For New Used Electric Vehicles

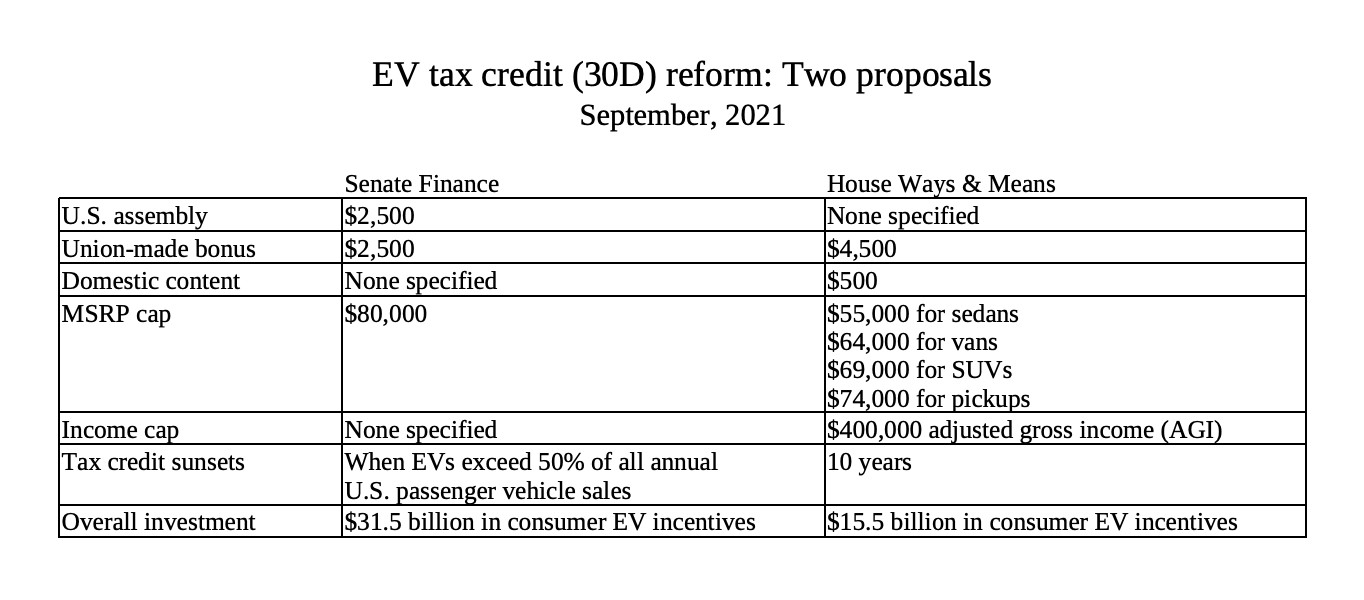

EV Tax Credit Boost At Up To 12 500 Here s How The Two Versions Compare

See The EIC Earned Income Credit Table Income Tax Return Income

See The EIC Earned Income Credit Table Income Tax Return Income

What Cars Are Eligible For The 7500 EV Tax Credit It s Complicated

The Federal Solar Tax Credit Increased Extended Solaria

This Tax Day End The EV Tax Credit Taxpayers Protection Alliance

Ev Tax Credit Income Limit 2022 - Inflation Reduction Act extends 7 500 tax credit but with price income caps Among the limitations for a car to be eligible for the tax credit would be its price