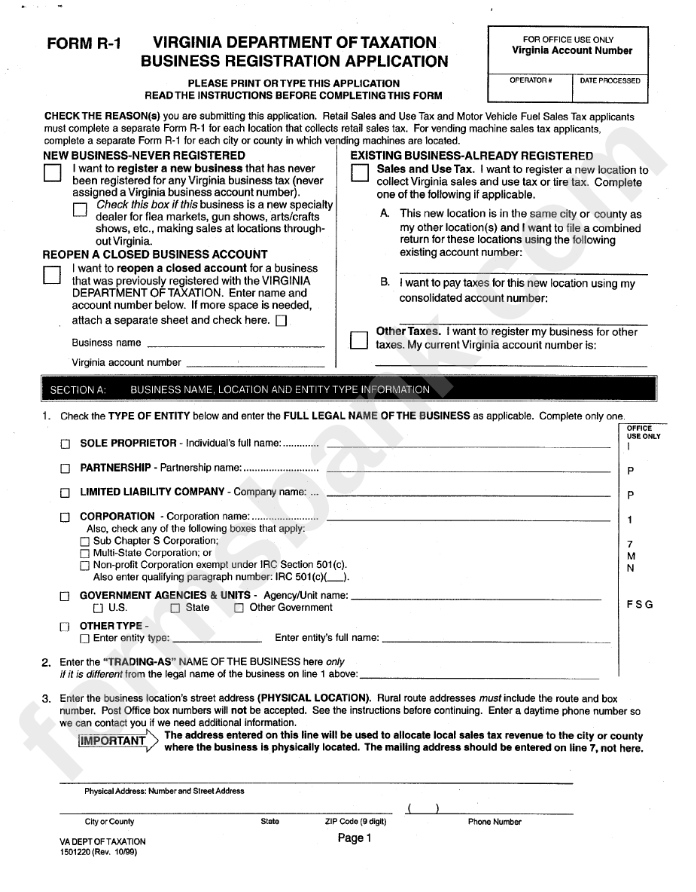

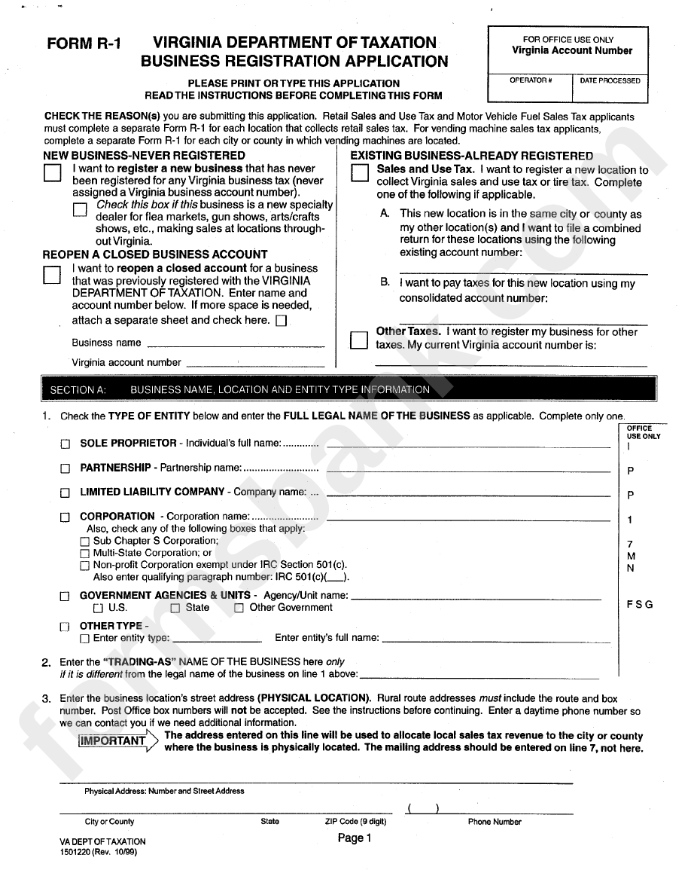

Ev Tax Rebates Virginia Web 31 ao 251 t 2023 nbsp 0183 32 Effective until January 1 2027 Eligibility for rebate amount of rebate A Beginning January 1 2022 a resident of the Commonwealth who purchases a new

Web Specifically the maximum 7 500 federal EV tax credit is made up of two separate 3 750 credits one targeting EV battery minerals and the other EV battery components Web The U S Department of Transportation s DOT NEVI Formula Program requires the Virginia Department of Transportation VDOT to submit an annual EV Infrastructure

Ev Tax Rebates Virginia

Ev Tax Rebates Virginia

https://www.tax-rebate.net/wp-content/uploads/2023/05/Virginia-State-Tax-Rebate-2023.jpg

Virginia Passes EV Rebates Without Funding RTO Insider

https://www.rtoinsider.com/wp-content/uploads/2023/06/150620231686787447.jpeg

Virginia Tax Rebate 2023

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate.jpg

Web 22 ao 251 t 2023 nbsp 0183 32 Electric Car Tax Rebate in Virginia Thanks to the Virginia Electric Vehicle Rebate Program introduced in January 2022 if you purchase an EV or hybrid vehicle Web 18 avr 2023 nbsp 0183 32 The new law allocates 94 million to help low and moderate income households in Virginia reduce their energy bills through the High Efficiency Electric

Web 19 mai 2023 nbsp 0183 32 The state currently receives federal tax incentives toward EV purchases This helps lower the upfront costs associated with electric vehicles Magavern said California incentivizes automakers to Web While a rebate program for EVs has been established in Virginia it remains unfunded The program would provide a rebate of 2 500 to those who purchase a new EV with a base

Download Ev Tax Rebates Virginia

More picture related to Ev Tax Rebates Virginia

2023 Virginia Tax Rebate How To Claim Your State Tax Refund Tax

https://www.tax-rebate.net/wp-content/uploads/2023/04/Tax-Rebate-Virginia-2023-1.jpg

EVs Officially Exempted From Road Tax Until 2025 OKU Also Get Rebate

https://paultan.org/image/2022/02/2022-EV-LKM-road-tax-rebate.jpg

Electric Vehicle EV Incentives Rebates

https://wbmlp.org/docs/rebates/EVs/EV-Tax-Credits-23.png

Web 21 oct 2021 nbsp 0183 32 The Virginia General Assembly approved HB 1979 which provides a 2 500 rebate for the purchase of a new or used electric vehicle If the purchaser of an EV has an income that doesn t exceed 300 Web 9 sept 2023 nbsp 0183 32 The proposed budget would temporarily increase the Virginia standard deduction for the 2024 and 2025 tax years For joint filers the standard deduction in the

Web Local governments may reduce personal property taxes paid on AFVs and low speed vehicles AFVs include vehicles that operate using natural gas liquefied petroleum gas Web Used Vehicle Clean Credit up to 4 000 Beginning January 1 2023 if you buy a qualified used electric vehicle EV from a licensed dealer for 25 000 or less you may be eligible

The Minnesota EV Rebate Explained

https://d2q97jj8nilsnk.cloudfront.net/images/minnesota-ev-rebate-tax-credit.jpg

California s EV Rebate Changes A Good Model For The Federal EV Tax

https://cleantechnica.com/files/2019/11/CVRP-rebates-samples-768x374.png

https://law.lis.virginia.gov/vacodefull/title45.2/chapter17/article8

Web 31 ao 251 t 2023 nbsp 0183 32 Effective until January 1 2027 Eligibility for rebate amount of rebate A Beginning January 1 2022 a resident of the Commonwealth who purchases a new

https://www.edmunds.com/.../tax-credits-rebates-incentives/virginia

Web Specifically the maximum 7 500 federal EV tax credit is made up of two separate 3 750 credits one targeting EV battery minerals and the other EV battery components

West Virginia 2023 EV Tax Credits Guide Calculate Your Savings

The Minnesota EV Rebate Explained

EV Tax Credit Support Climate Nexus May 2019

EV Tax Credit Are You Claiming The Correct Rebates Benefits

Everything To Know About The New EV Tax Credits Virginia Automobile

Virginia EV Tax Credit Incentives Rebates To Help You Save Money

Virginia EV Tax Credit Incentives Rebates To Help You Save Money

West Virginia EV Incentives Home Charger Rebate

EV Tax Credit Are You Claiming The Correct Rebates Benefits

EV Tax Credit Are You Claiming The Correct Rebates Benefits

Ev Tax Rebates Virginia - Web 22 ao 251 t 2023 nbsp 0183 32 Electric Car Tax Rebate in Virginia Thanks to the Virginia Electric Vehicle Rebate Program introduced in January 2022 if you purchase an EV or hybrid vehicle