Evergy Rebates 2024 Published January 25 2024 Written by CLEAResult We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and

The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project

Evergy Rebates 2024

Evergy Rebates 2024

https://img.tdworld.com/files/base/ebm/tdworld/image/2021/09/16x9/Anterix_and_Evergy.6149a8b1d20be.png?auto=format,compress&fit=crop&h=556&w=1000&q=45

Evergy On LinkedIn EnergizingCareers

https://media-exp1.licdn.com/dms/image/C4E22AQF2LOie3IxmHQ/feedshare-shrink_2048_1536/0/1593104400931?e=2147483647&v=beta&t=cRumxvd7ZxkzHgjjsk2zZzkE7WbnxMyeuxZr1StzKgE

Evergy Slashes Planned Renewable Energy Additions Proposes More Natural Gas Kansas Reflector

https://kansasreflector.com/wp-content/uploads/2021/07/DSC3644-scaled.jpg

The Inflation Reduction Act of 2022 created two programs to encourage home energy retrofits Home Efficiency Rebates HOMES to fund whole house energy efficiency retrofits and the Home Electrification and Appliance Rebates HEEHRA to help low moderate income households go electric through qualified appliance rebates Office of State and Community Energy Programs Home Energy Rebate Programs Requirements and Application Instructions Home Energy Rebate Programs Requirements and Application Instructions Updated October 13 2023 Washington DC 20585 202 586 5000 Sign Up for Email Updates

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent In addition to the energy efficiency credits homeowners can also take advantage of the modified and extended Residential Clean Energy credit which provides a 30 Q Are there incentives for making your home energy efficient by installing alternative energy equipment updated April 27 2021 A Yes the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property

Download Evergy Rebates 2024

More picture related to Evergy Rebates 2024

Evergy Customers Called To Say Their Piece About Proposed 14 Rate Increase

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1dwYf9.img?w=1280&h=720&m=4&q=79

Evergy Rate Hike Approved In Missouri

https://townsquare.media/site/468/files/2020/02/RS7792_468462303.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

EVERGY HOME GYM Evergy BUMPER COLOR 10kg Disc Private Sport Shop

https://static.privatesportshop.com/img/p/3726545-11295033.jpg

Thanks to the new tax credits and rebates they ll come at a significant discount for qualified households Households with income less than 80 of AMI 840 rebate up to 100 of equipment and installation costs Households with income between 80 150 AMI 840 rebate up to 50 of equipment and installation costs Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

On Aug 16 2022 President Biden signed the Inflation Reduction Act IRA into law which included 8 8 billion in rebates for home energy efficiency and electrification The Inflation Reduction Act IRA a federal law established in 2022 allocates 391 billion dollars for energy and climate change actions nationwide Under this law Illinois EPA Office of Energy will administer two US Dept of Energy USDOE programs the Home Energy Performance Based Whole House Rebates or Home Efficiency Rebates Section 50121 and the High Efficiency Electric Home Rebate

Evergy Energy Rebates On Solar Lighting HVAC Automation And More

https://goenergylink.com/wp-content/uploads/2018/02/utah-solar-energy-company-1-e1566080906400.jpg

EVERGY HOME GYM Evergy B010400N 30cm Plyobox Private Sport Shop

https://static.privatesportshop.com/img/p/3905690-11696794.jpg

https://www.clearesult.com/insights/january-updates-on-inflation-reduction-act-home-energy-rebates

Published January 25 2024 Written by CLEAResult We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

Smith Wesson Shield EZ Holiday Rebate H H Shooting Sports Oklahoma City

Evergy Energy Rebates On Solar Lighting HVAC Automation And More

DEC Savage Rascal Rebate Gun Rebates

KCP L Is Now Evergy Take Advantage Of New Rebates Kansas City HVAC Company

Rebates For Seniors Mark Coure MP

EVERGY HOME GYM Evergy ELITE 37 5kg Mancuernas X2 Private Sport Shop

EVERGY HOME GYM Evergy ELITE 37 5kg Mancuernas X2 Private Sport Shop

CAT Rebates W L Inc

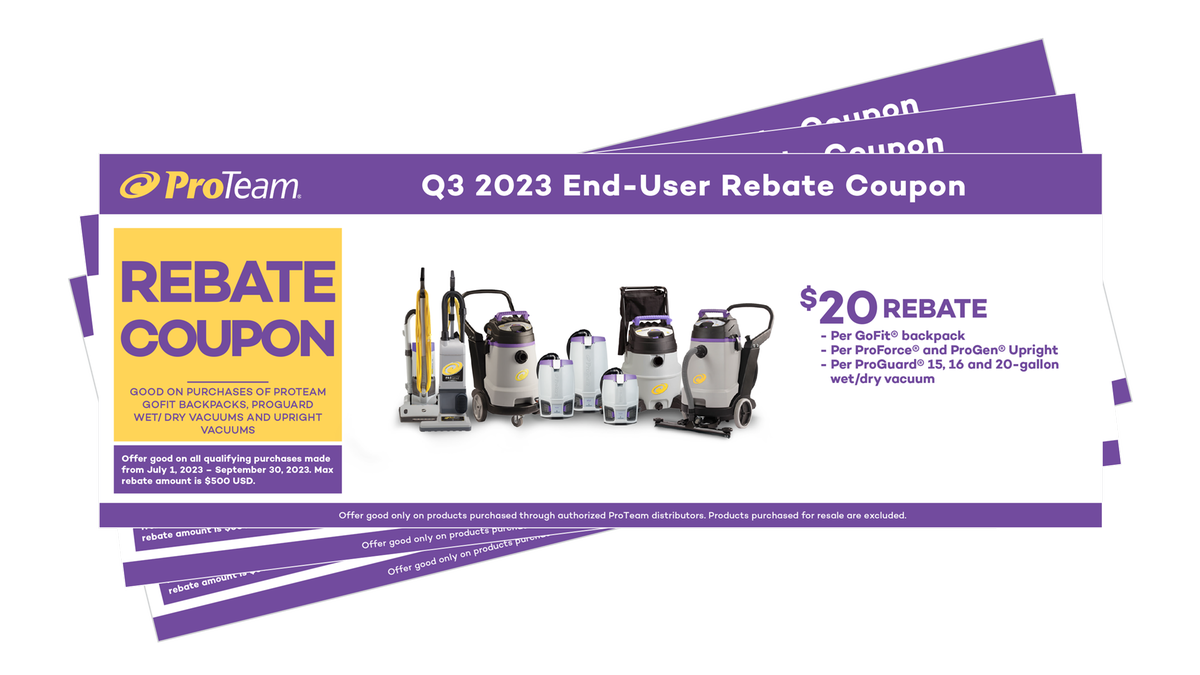

Manufacturer Rebates CleanFreak

Energy Rebates ChopAir

Evergy Rebates 2024 - Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent In addition to the energy efficiency credits homeowners can also take advantage of the modified and extended Residential Clean Energy credit which provides a 30