Example Of Tax Law In The Philippines Taxes in the Philippines are classified into two basic types national taxes and local taxes National taxes are paid to the national government through the BIR Meanwhile local

Navigate the Philippines tax landscape with our guide Understand key policies meet deadlines and employ strategies to ensure compliance and minimize tax While among the objectives of the TRAIN Law was to simplify taxation and make it fairer and more efficient the track that it had to pursue during the legislative deliberation was

Example Of Tax Law In The Philippines

Example Of Tax Law In The Philippines

https://gptstore.ai/res/gpts/_VFuCRVN1w-1987-philippines-constitution-guide

Tax Law In The Philippines Covers National Taxes Which Refer To

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/5243d3a4c51591e97a2486568f9f6bb1/thumb_1200_1553.png

The Effects Of Taxation Law In The Philippines PDF

https://imgv2-1-f.scribdassets.com/img/document/438209603/original/742c1f367c/1708995682?v=1

There are four main types of national internal revenue taxes income indirect value added and percentage taxes excise and documentary stamp taxes all of which are Prohibition against taxation of non stock non profit educational institutions and proprietary educational institutions exempt from property and income taxes as well as customs

Citizens of the Philippines and resident aliens must pay taxes for all income they have derived from various sources which include but are not limited to compensation On December 19 2017 Pres Rodrigo Duterte signed Republic Act RA 10963 or Tax Reform for Acceleration and Inclusion more commonly known as the TRAIN law It

Download Example Of Tax Law In The Philippines

More picture related to Example Of Tax Law In The Philippines

Key Principles Of Contract Law In The Philippines PDF Offer And

https://imgv2-2-f.scribdassets.com/img/document/408008572/original/0a9ff69113/1707453096?v=1

The Powerful Judiciary And Rule Of Law In The Philippines PDF Rule

https://imgv2-2-f.scribdassets.com/img/document/208353816/original/85039eaeff/1702711224?v=1

Lecture 05 Philippine Tax Laws Sources Of Tax Laws Income Taxation

https://i.ytimg.com/vi/95ljrxnTqCA/maxresdefault.jpg

Basis of Taxation The tax base for domestic corporations and resident foreign corporations is taxable income gross income less allowable deductions 30 regular corporate Income Tax is a tax on a person s income emoluments profits arising from property practice of profession conduct of trade or business or on the pertinent items of gross

The National Internal Revenue Code Tax Code 2 lays down the rules on taxation in the Philippines It identifies who should pay taxes and the types of taxes Quick Tax Info Box Philippines Edition Taxation in a Nutshell The process where the government collects money taxes from people and businesses to fund public services

Law najah edu

https://law.najah.edu/media/filer_public_thumbnails/filer_public/14/2e/142e5b45-f706-47e5-9bcf-332177aefef3/taxlaws.jpg__1200x675_q85_crop_subsampling-2_upscale.jpg

CPE LAws Module The E commerce Act Is A Law In The Philippines That

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/ca57e48ad1e9c38b87176ccc210c36d1/thumb_1200_1553.png

https://filipiknow.net/tax-in-the-philippines

Taxes in the Philippines are classified into two basic types national taxes and local taxes National taxes are paid to the national government through the BIR Meanwhile local

https://grit.ph/tax

Navigate the Philippines tax landscape with our guide Understand key policies meet deadlines and employ strategies to ensure compliance and minimize tax

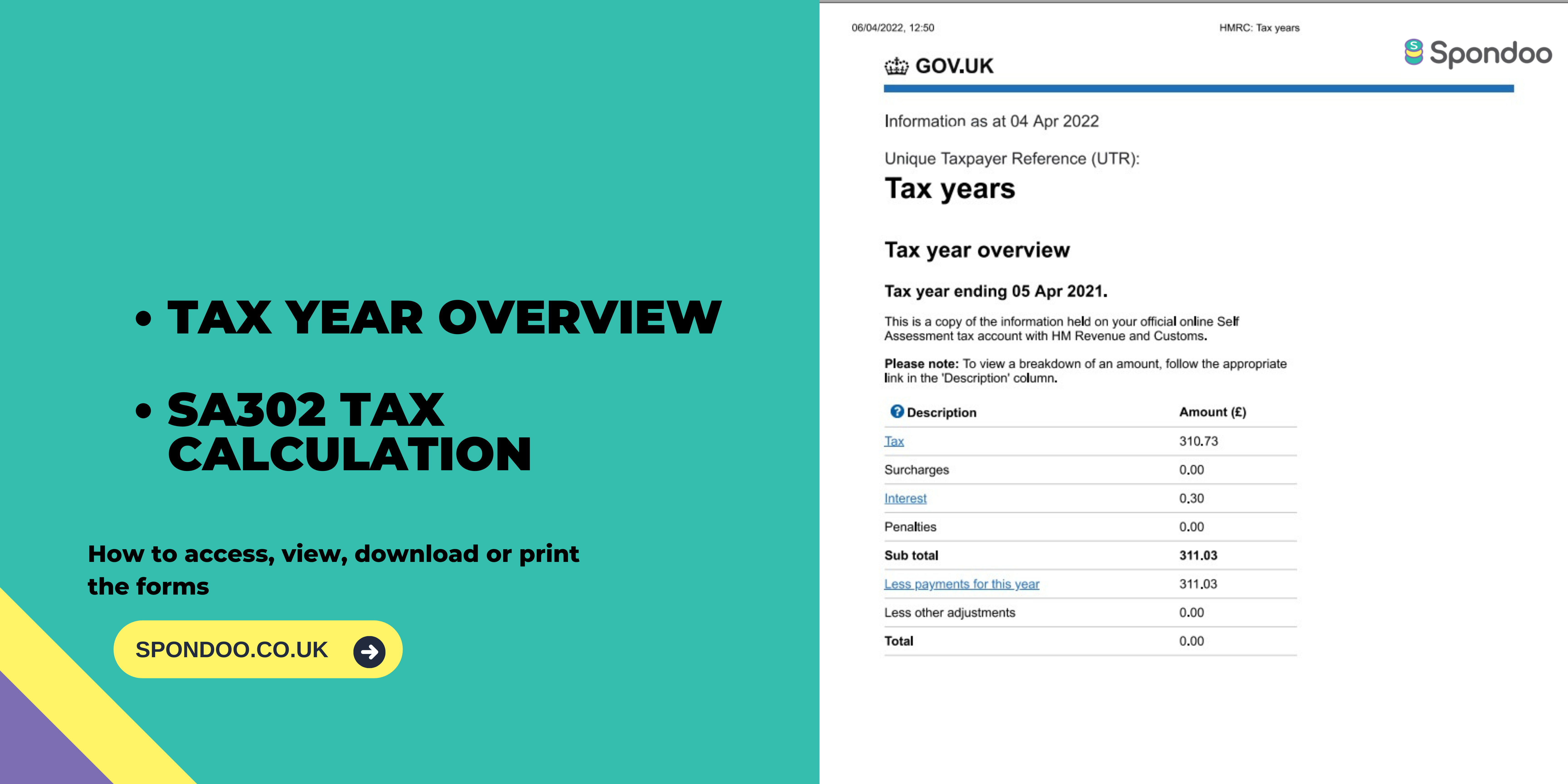

Difference Between Sa302 And Tax Year Overview What You Provide Your

Law najah edu

LAW This Will Tackle The Anti Bouncing Checks Law In The Philippines

Tax Law In The Philippines

What Is Government Procurement Act Law In The Philippines What Is

Application Of The Doctrine Of Incorporation Harmonizing International

Application Of The Doctrine Of Incorporation Harmonizing International

List Of Business Laws In The Philippines In The Philippines There

Law Military In The Philippines Article VII Section 18 Of The 1987

Income Tax Act 1 3 Notes On Law Of Taxation PART THE INCOME

Example Of Tax Law In The Philippines - There are four main types of national internal revenue taxes income indirect value added and percentage taxes excise and documentary stamp taxes all of which are