Excess Of Rent Paid Over 10 Of Basic Salary The amount of tax deduction that can be claimed over HRA is the least of the following Actual rent paid minus 10 of the basic salary or Actual HRA offered by the

Excess of rent paid annually over 10 of annual salary Basic salary DA You can also use our free HRA calculator tool to compute the HRA exemption limit on your salary The HRA tax exemption can be calculated either Excess of rent paid annually over 10 of annual salary Basic salary DA 90 000 The HRA exemption under section 10 13A will be Rs 90 000 being the least of all three amounts mentioned above

Excess Of Rent Paid Over 10 Of Basic Salary

Excess Of Rent Paid Over 10 Of Basic Salary

https://media.licdn.com/dms/image/D4D12AQFwNf2DeRshtA/article-cover_image-shrink_720_1280/0/1662698458991?e=2147483647&v=beta&t=PlNrCVs9qcfP2rOFeNUJtzQOuBNUpfPacjk6q5oEJ5Q

In A Company An Employee Is Paid As If His Basic Salary Is Less Than

https://1.bp.blogspot.com/-z7RKYdPpkvw/YJUwCihyDFI/AAAAAAAAATo/_rHbKbV6Y8MFPZv-cRQfOC-mR7cCKYv6gCLcBGAsYHQ/s826/Screenshot%2B%2528147%2529.png

Basic Salary Gross Salary Net Salary

https://i.pinimg.com/736x/93/a3/25/93a32509a07abb6ce332aa5497faacf1.jpg

You cannot claim more than 50 of your basic salary for HRA exemption if you are living in a rented accommodation in a metro city For non metro cities the maximum claim amount For most employees House Rent Allowance HRA is a part of their salary structure Although it is a part of your salary HRA unlike basic salary is not fully taxable Subject to certain conditions a part of HRA is exempted

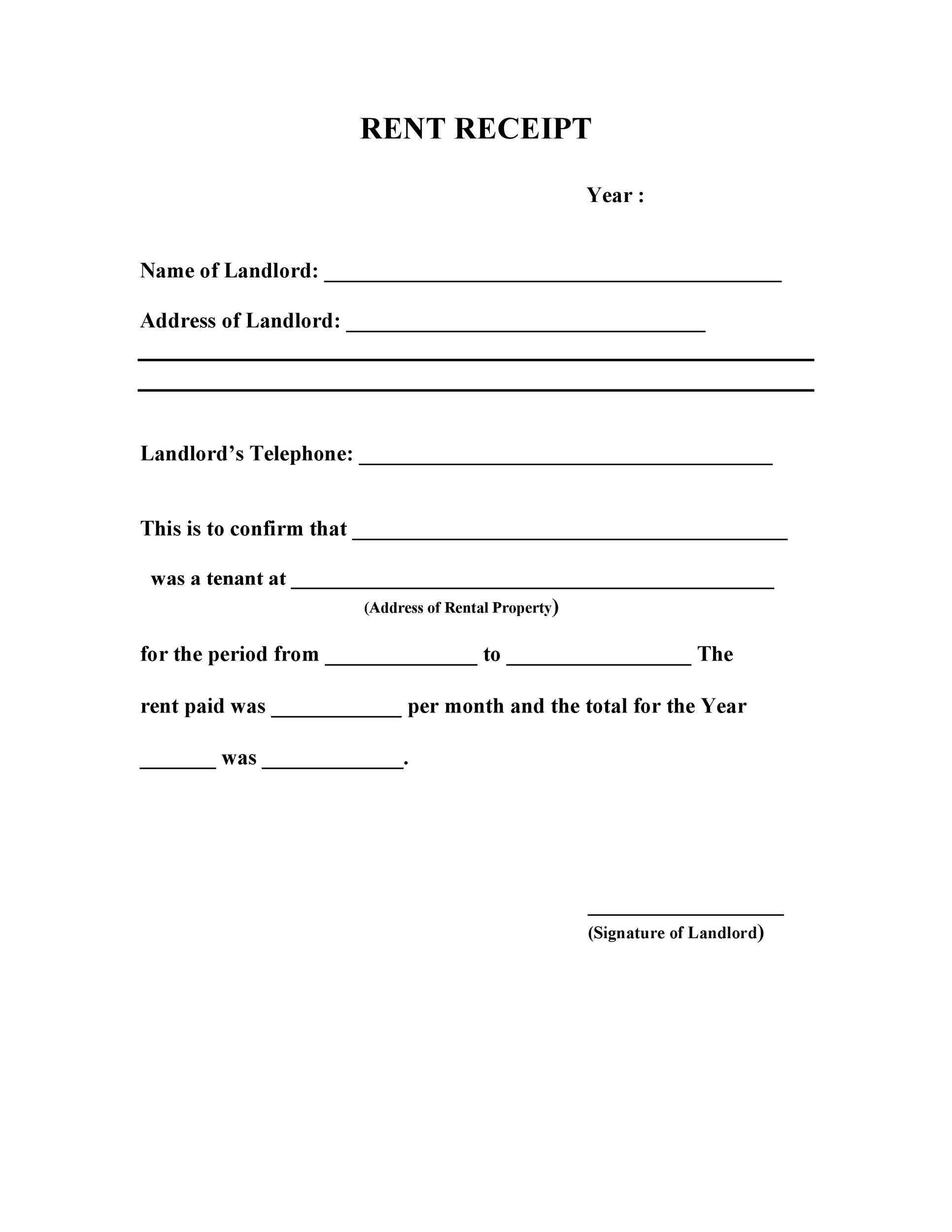

10 of Basic Salary Rs 24 600 So Actual Rent minus 10 of Basic Salary becomes Rs 1 20 000 Rs 24 600 Rs 95 400 This is how HRA calculation works ALSO READ How to Calculate Income Tax using Salary Payslip HRA The actual rent on your house rent receipt minus 10 of your basic salary 50 of your basic salary for metro cities and 40 for people living in non metro cities The remaining amount is taxed as per the tax slab you re in

Download Excess Of Rent Paid Over 10 Of Basic Salary

More picture related to Excess Of Rent Paid Over 10 Of Basic Salary

House Rent Allowance A Know How Tax Lane

https://taxlanes.files.wordpress.com/2015/04/hra-calculation-hra-exemption-rules.jpg

Renting And The Law Deadline For Certificate Of Rent Paid Tax Forms

https://ruslan.ch/8663fbfd/https/0cfc28/chorus.stimg.co/20404897/1klein1226.jpg?h=630&w=1200&fit=crop&bg=999&crop=faces

When Can A Landlord Increase The Rent

https://www.ashburnham-insurance.co.uk/wordpress/media/landlord-increase-rent.jpg

HRA calculator computes the Ideal Rent based on your Salary breakdown i e Basic Salary Dearness Allowance HRA received and the City of Residence This is the optimal amount of rent that can be paid to claim the maximum amount HRA is house rent allowance paid by employer to meet taxpayer rent expenses and this amount is tax free up to certain extent Updated per latest Union Budget 2024 Calculation HRA is exempt to the extent of the minimum

Section 80GG allows self employed or salaried individuals to claim an HRA deduction or rent paid over 10 of their income or salary The top limit is 25 which indicates that rent paid in the HRA is calculated by considering the lowest value among the following actual HRA received 50 of basic salary DA for individuals in metro cities or 40 for non metro cities and

Renting Laws By Reliance Real Estate Issuu

https://image.isu.pub/210302080620-1b37c8c8079101aeb3cb9b4205991d72/jpg/page_12.jpg

Top 10 Tax Saving Tips

https://media-exp1.licdn.com/dms/image/C5612AQGvNHfIfbUjvw/article-cover_image-shrink_720_1280/0/1614857241806?e=2147483647&v=beta&t=DQEjtQAUh7pl9HS3EdLcOBx3LRLC8OBGKnLtSqmjvPI

https://www.paisabazaar.com › tax › hra-calculation

The amount of tax deduction that can be claimed over HRA is the least of the following Actual rent paid minus 10 of the basic salary or Actual HRA offered by the

https://tax2win.in › guide › hra-house-rent-a…

Excess of rent paid annually over 10 of annual salary Basic salary DA You can also use our free HRA calculator tool to compute the HRA exemption limit on your salary The HRA tax exemption can be calculated either

Fillable Online Pdgb Sample Rent Payment Ledger PDF

Renting Laws By Reliance Real Estate Issuu

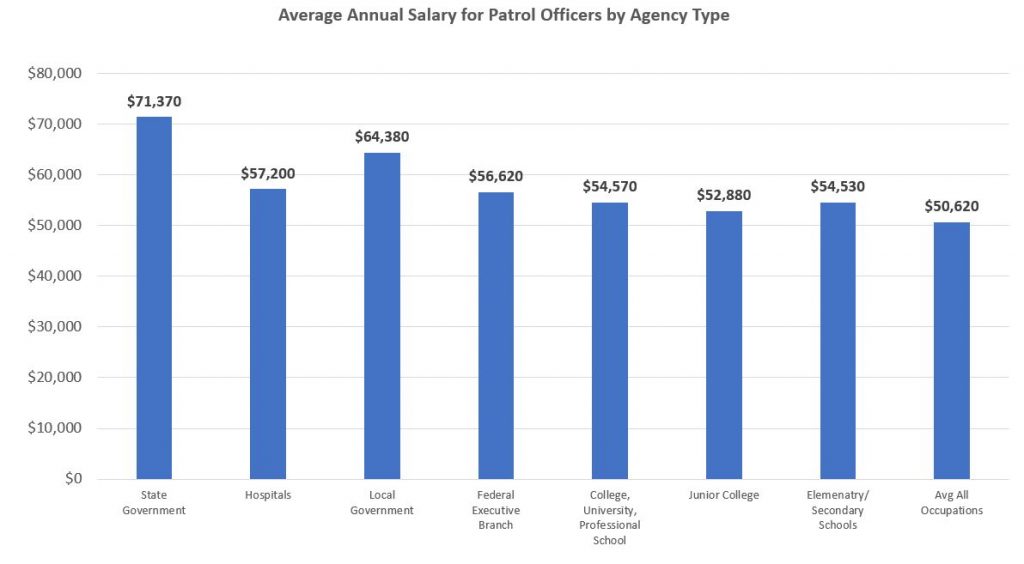

Average Annual Salary By Agency Type Discover Policing

Basic Salary Liberal Dictionary

Salaried Individual Not Receiving HRA Can Still Claim Deduction Of Rent

How The Date Range On Landlord Statements Actually Work Juvo

How The Date Range On Landlord Statements Actually Work Juvo

Income Tax Return Filing In Kerala Income Tax Consultant

Free Printable Rent Receipt Template Keep Track Of Rent Payments

Printable Rent Receipts Free

Excess Of Rent Paid Over 10 Of Basic Salary - The actual rent on your house rent receipt minus 10 of your basic salary 50 of your basic salary for metro cities and 40 for people living in non metro cities The remaining amount is taxed as per the tax slab you re in