Exel Energy Rebate And A Tax Credit Minnesota Web 7 mars 2022 nbsp 0183 32 The Residential Energy Efficient Tax Credit is a nonrefundable tax credit equal to 26 of qualifying expenditures falling to 22 in 2023 on residential solar

Web 10 juil 2023 nbsp 0183 32 The Minnesota Department of Revenue announced today the process to send 2 4 million one time tax rebate payments to Minnesotans This rebate was part of Web We offer a number of program and rebate options to our residential and business customers and even offer a rebate finder tool Learn more

Exel Energy Rebate And A Tax Credit Minnesota

Exel Energy Rebate And A Tax Credit Minnesota

https://savkat.com/wp-content/uploads/2019/09/IRS-Form-5695-SAVKAT-Solar.jpg

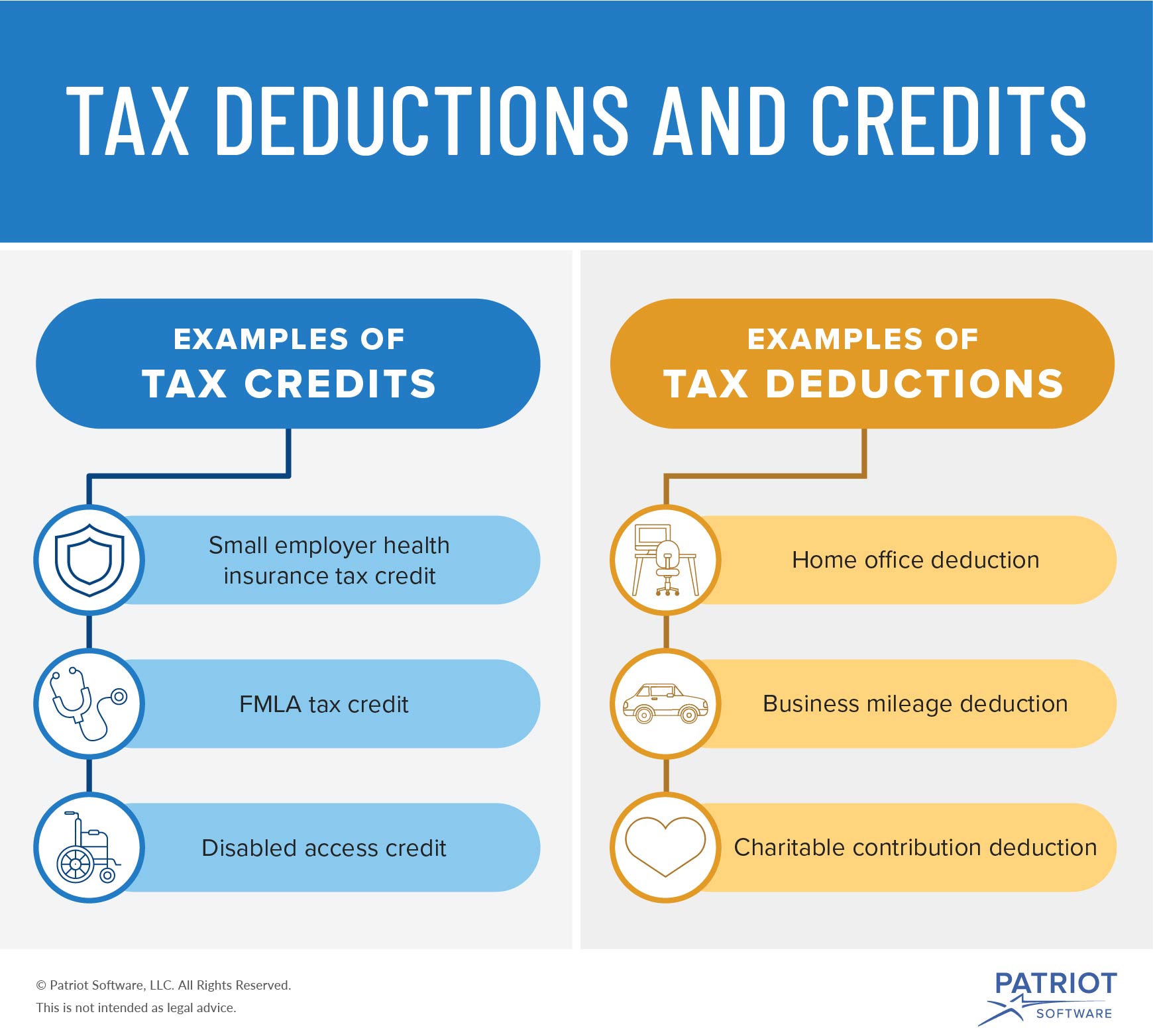

Business Tax Credit Vs Tax Deduction What s The Difference

https://www.patriotsoftware.com/wp-content/uploads/2019/12/business-tax-credit-vs-tax-deduction-visual.jpg

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

Web Minnesota residents are eligible for solar incentives like the federal solar tax credit net metering tax exemptions and utility company rebates Web 17 ao 251 t 2022 nbsp 0183 32 Besides tax credits for industries and utilities that use renewable fuels the Inflation Reduction Act rewards consumers who adopt home energy efficiencies with rebates and offers tax credits to

Web Rebates covering 50 100 of the cost of installing new electric appliances including super efficient heat pumps water heaters clothes dryers stoves and ovens In Minnesota Web 19 mai 2023 nbsp 0183 32 But this week DFL legislators greenlit 216 million in additional spending for energy initiatives including roughly 140 million in new spending from Minnesota s general fund and more than

Download Exel Energy Rebate And A Tax Credit Minnesota

More picture related to Exel Energy Rebate And A Tax Credit Minnesota

Residents Urged To Cash Energy Rebate Cheques Rotherham Metropolitan

https://www.rotherham.gov.uk/images/Council_Tax_rebate.JPG

Set Up A Council Tax Direct Debit To Receive Energy Rebate Quickly

https://newsroom.shropshire.gov.uk/wp-content/uploads/energy-rebate-1024x576.jpg

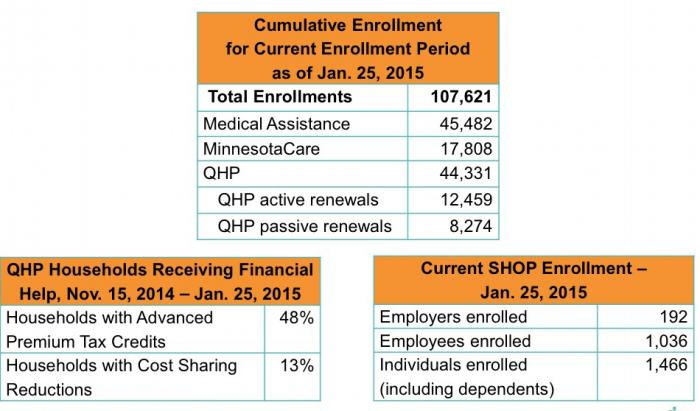

Minnesota What s Going On With The Tax Credits UPDATE blame

https://acasignups.net/sites/default/files/Google ChromeScreenSnapz497_0.jpg

Web 24 mai 2023 nbsp 0183 32 ST PAUL Minn Governor Tim Walz recently signed legislation that directs the Minnesota Department of Revenue to distribute direct tax rebate payments to Web Earn a rebate and reduce energy costs for the appliance that is the second largest energy user in your home Go To Water Heaters Insulation amp Air Sealing Earn a rebate and

Web Xcel s RPS is 31 5 by 2020 All other Minnesota utilities requirement is 25 by 2025 Minnesota RPS Solar Carve Out Solar carve outs require a certain percentage of the Renewable Portfolio Standards to be met with Web 5 juil 2023 nbsp 0183 32 The average cost of a solar panel system in Minnesota ranges from 14 578 to 19 722 according to EnergySage You may feel wary of paying the state s 6 875

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Direct_Pay.png

Solar Tax Credits Rebates Missouri Arkansas

https://soleraenergyllc.com/wp-content/uploads/2022/07/Graphic-1000x1024.jpg

https://www.revenue.state.mn.us/sites/default/files/2022-03/h…

Web 7 mars 2022 nbsp 0183 32 The Residential Energy Efficient Tax Credit is a nonrefundable tax credit equal to 26 of qualifying expenditures falling to 22 in 2023 on residential solar

https://www.revenue.state.mn.us/press-release/2023-07-10/department...

Web 10 juil 2023 nbsp 0183 32 The Minnesota Department of Revenue announced today the process to send 2 4 million one time tax rebate payments to Minnesotans This rebate was part of

2023 Residential Clean Energy Credit Guide ReVision Energy

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

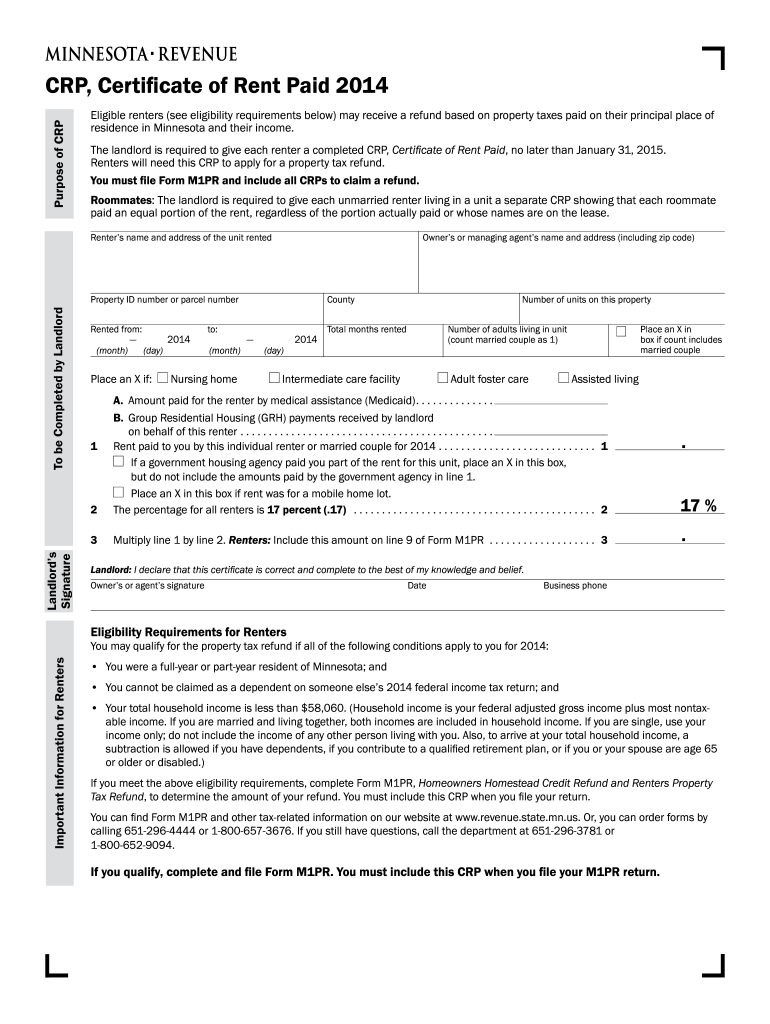

Renter s Property Tax Refund Minnesota Department Of Revenue Fill Out

Solar Tax Credit Everything A Homeowner Needs To Know Credible

Inflation Reduction Act Green Credits And Rebates Green Mountain Energy

First Payments Of 150 Energy Rebate Made To Worcester Council Tax

First Payments Of 150 Energy Rebate Made To Worcester Council Tax

Energy Efficient Rebates Tax Incentives For MA Homeowners

Difference Between Tax Exemption Tax Deduction And Tax Rebate The

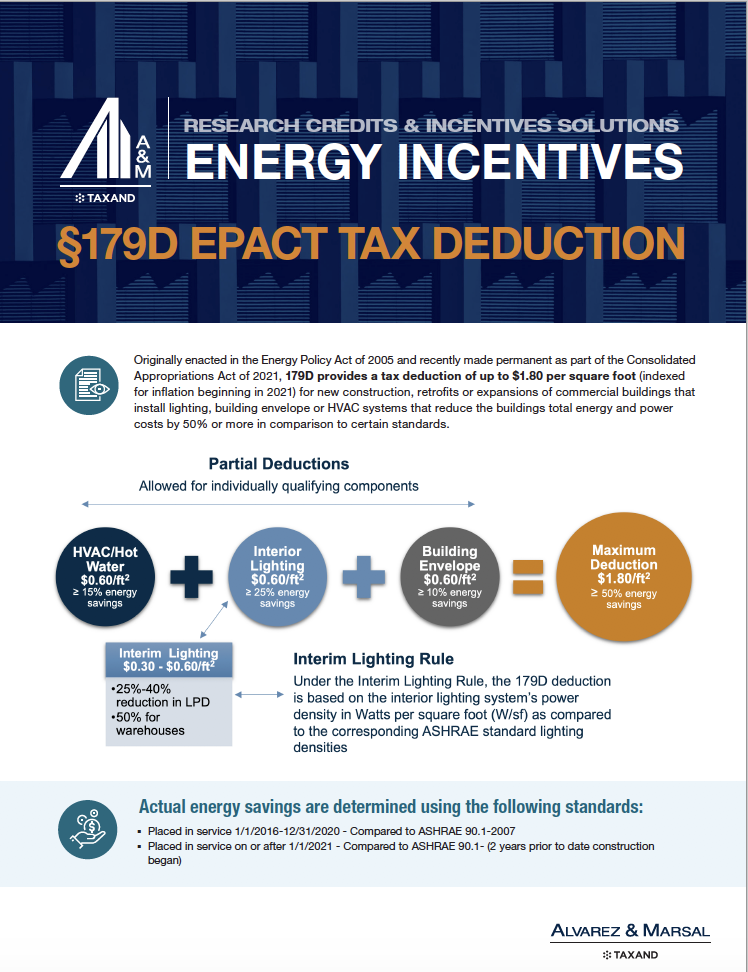

Energy Incentives 179D EPact Tax Deduction Alvarez Marsal

Exel Energy Rebate And A Tax Credit Minnesota - Web 17 ao 251 t 2022 nbsp 0183 32 Besides tax credits for industries and utilities that use renewable fuels the Inflation Reduction Act rewards consumers who adopt home energy efficiencies with rebates and offers tax credits to