Exemption For Long Term Capital Gain On Sale Of Land Verkko 19 marrask 2023 nbsp 0183 32 Posted Oct 5 2022 Succession planning is an important process for farmers and ranchers especially those who have held their farms for generations

Verkko Updated 4 January 2024 This helpsheet explains how certain disposals of land including leases are treated for Capital Gains Tax CGT But it s only an introduction If Verkko 19 huhtik 2023 nbsp 0183 32 Section 54EE Exemption on sale of any long term capital asset on investment in units of a specified fund A taxpayer can claim the exemption by

Exemption For Long Term Capital Gain On Sale Of Land

Exemption For Long Term Capital Gain On Sale Of Land

https://assetyogi.com/wp-content/uploads/2015/06/capital-gain-on-sale-of-land-income-tax-exemption-889x500.jpg

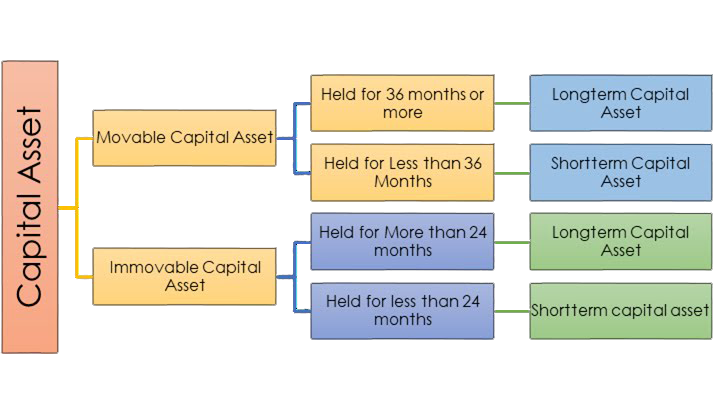

Capital Gain Tax Long Term Capital Gains Short Term Capital Gains

https://fibota.com/wp-content/uploads/2020/09/Capital-gain-on-sale-of-immovable-property-1.jpg

Long Term Vs Short Term Capital Gains Tax Ultimate Guide Ageras

https://assets-prod.ageras.com/assets/frontend/upload/resources/lt-capital-gains-tax-brackets.png

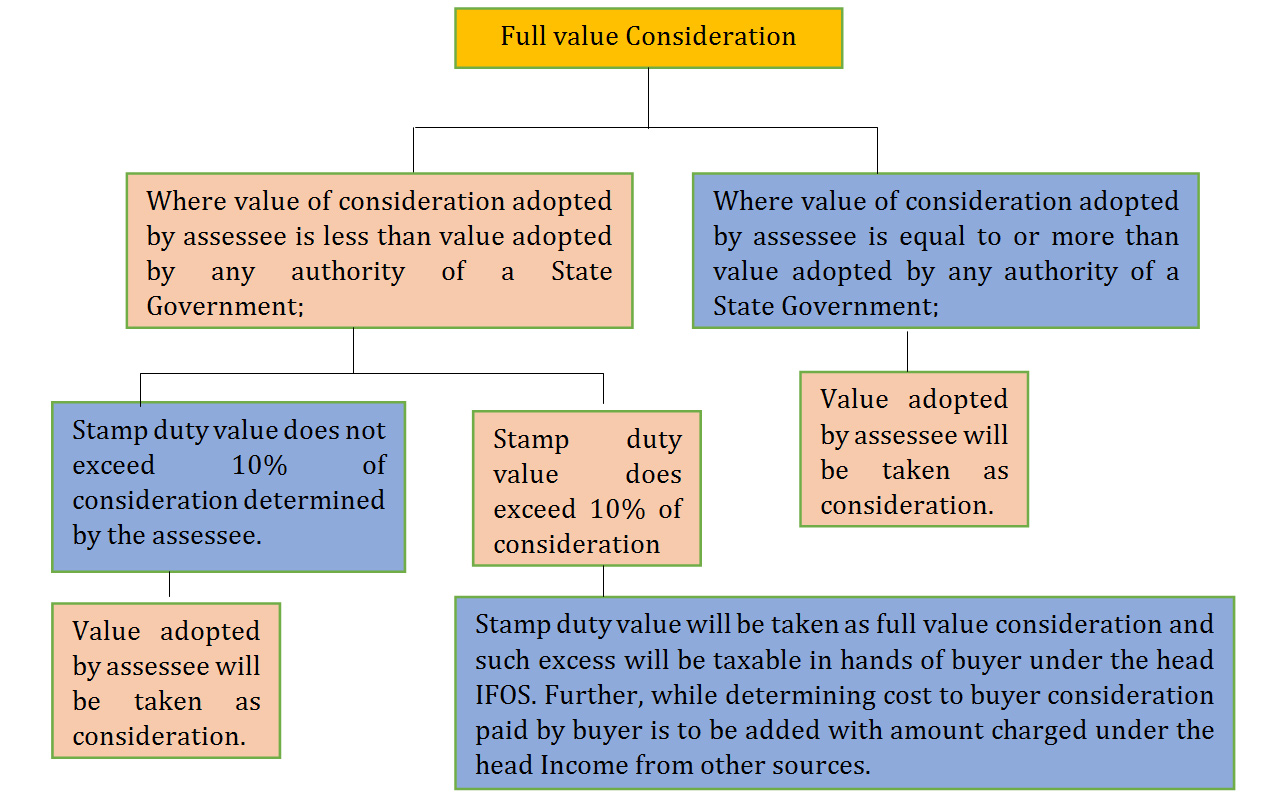

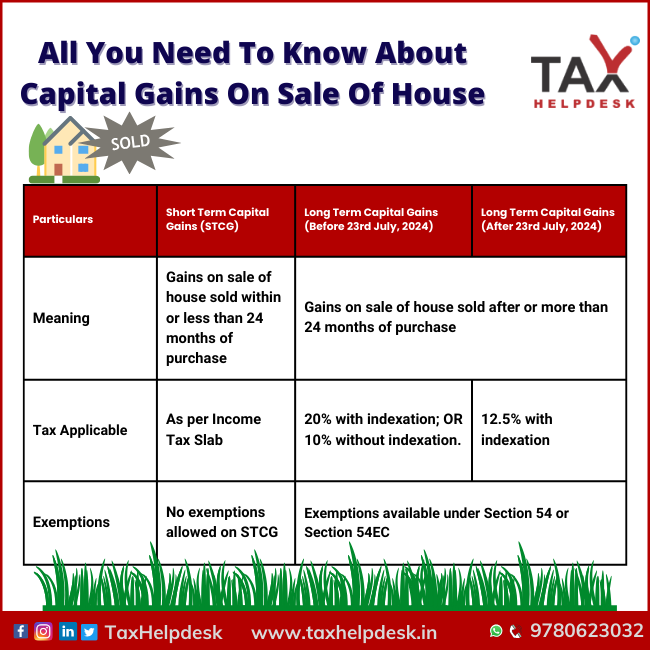

Verkko Exemption under Section 54 The exemption under section 54 is allowed only if the capital gain arises from the transfer of a long term capital asset being a residential Verkko Long term capital gains are taxed at a flat rate of 20 Tax Exemptions on Capital Gain on Sale of Land You can avail tax exemption on capital gain on sale of land residential amp urban agricultural land

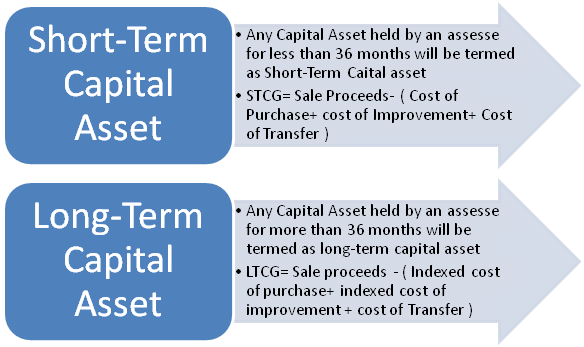

Verkko 2 tammik 2024 nbsp 0183 32 You have a capital gain if you sell the asset for more than your adjusted basis You have a capital loss if you sell the asset for less than your Verkko 6 maalisk 2023 nbsp 0183 32 Exemption Amount Long Term Capital Gain OR Cost of new asset land whichever lesser CGAS available Yes deposit by return filing due date Additional Conditions 1 If new asset

Download Exemption For Long Term Capital Gain On Sale Of Land

More picture related to Exemption For Long Term Capital Gain On Sale Of Land

Capital Gains Meaning Types Taxation Calculation Exemptions

https://efinancemanagement.com/wp-content/uploads/2020/06/Capital-Gain.png

How To Calculate Capital Gains Tax On Property How To SAVE Capital

https://financialcontrol.in/wp-content/uploads/2019/09/Calculation-of-Long-Term-Capital-Gain.jpg

Long Term Capital Gain Tax On Shares Tax Rates Exemption

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2022/11/long-term-capital-gain-on-shares-image.jpg

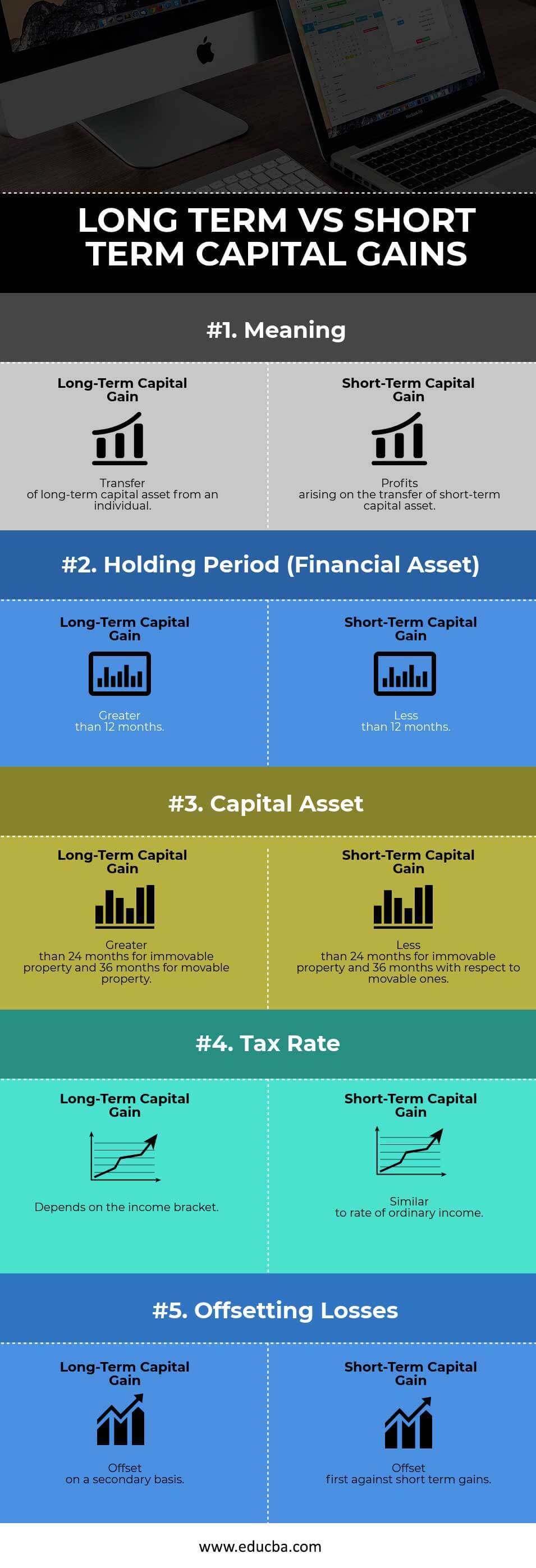

Verkko 15 maalisk 2023 nbsp 0183 32 Long term Capital Gains LTCG Long term capital gains occur when you hold land for equal to or over 12 months before transferring The gains from the transfer are LTCG The investor s tax Verkko 5 hein 228 k 2022 nbsp 0183 32 Calculations of Capital Gain Tax on sale of House Property and Exemption available under Income Tax Act What is Capital Gain According to

Verkko Capital gains derived from the sale of shares are tax exempt Capital gains from the sale of real estate are subject to a separately assessed real estate profit tax of up to Verkko 15 kes 228 k 2023 nbsp 0183 32 If you have a capital gain from the sale of your main home you may qualify to exclude up to 250 000 of that gain from your income or up to 500 000 of

How To Calculate Long Term Capital Gains From Sale Of House Property

https://www.succinctfp.com/wp-content/uploads/2012/11/Calculation-of-Long-Term-Capital-Gain.jpg

The Beginner s Guide To Capital Gains Tax Infographic Transform

https://www.transformproperty.co.in/blog/wp-content/uploads/2014/08/Capital-gains-tax-infographic.jpg

https://www.realized1031.com/.../is-farmland-exempt-from-capital-gains …

Verkko 19 marrask 2023 nbsp 0183 32 Posted Oct 5 2022 Succession planning is an important process for farmers and ranchers especially those who have held their farms for generations

https://www.gov.uk/government/publications/land-and-leases-the...

Verkko Updated 4 January 2024 This helpsheet explains how certain disposals of land including leases are treated for Capital Gains Tax CGT But it s only an introduction If

How To Calculate Capital Gains Tax On Real Estate Investment Property

How To Calculate Long Term Capital Gains From Sale Of House Property

Long Term Vs Short Term Capital Gains 5 Most Amazing Differences

All You Need To Know About Capital Gains On Sale Of House

Save Tax Save Capital Gains Tax On Property Sale Save Tax On

How To Set off Short Term Long Term CAPITAL LOSSES On Stocks

How To Set off Short Term Long Term CAPITAL LOSSES On Stocks

How To Save Capital Gain On Sale Of Residential Property Section 54 Of

Capital Gains Tax India Simplified Read This If You Invest In Stocks

Can You Take A Home Loan And Also Claim LTCG Tax Exemption

Exemption For Long Term Capital Gain On Sale Of Land - Verkko 6 maalisk 2023 nbsp 0183 32 Exemption Amount Long Term Capital Gain OR Cost of new asset land whichever lesser CGAS available Yes deposit by return filing due date Additional Conditions 1 If new asset