Exemption In Income Tax For Assessment Year 2022 23 Employer shall deduct Advance Personal Income Tax on any payment which falls under section 5 made to his employee as specified by the Commissioner General 2 Changes in Reliefs Individuals Type of Relief Year of Assessment Y A First nine month period of the Y A 2022 2023 01 04 2022 31 12 2022 Balance three month period of the Y A 2022

Q1 What are the due dates for filing of Income tax Returns for the Assessment Year 2022 23 The due dates for filing of ITRs for various types of assessees are as follows Situations Original due date If assessee is required to furnish a report of transfer pricing TP Audit in Form No 3CEB 30 11 2022 If the assessee is a partner in a Date of furnishing of Return of Income under sub section 1 of section 139 of the Act for the Assessment Year 2022 23 which is 31 st October 2022 in the case of assessees referred in clause a of Explanation 2 to sub section I of section

Exemption In Income Tax For Assessment Year 2022 23

Exemption In Income Tax For Assessment Year 2022 23

https://edutaxtuber.in/wp-content/uploads/2021/02/pexels-photo-6120207.jpeg

Income Tax Calculation 2022 23 How To Calculate Income Tax FY 2022 23

https://i.ytimg.com/vi/aTDYGbVWpas/maxresdefault.jpg

Certificate Of Tax Exemption For Scholarship school Financial Assistance

https://www.santaritapampanga.gov.ph/wp-content/uploads/337017880_3509334926016762_2512877965322669185_n.jpg

Taxable Income for FY 2022 23 Tax Rate under new regime Tax Payable Tax Rate under old regime Tax Payable Upto 2 50 000 Exempt Exempt From 2 50 001 5 00 000 5 12 500 5 12 500 Regime taxpayers have the option to claim various tax deductions and exemptions In case of non business cases option to choose the regime can be exercised every year directly in the ITR to be filed on or before the due date specified under section 139 1

Updated on 21 May 2024 01 08 PM India s income tax system is progressive meaning tax rates increase with higher income levels The income tax slabs specify the applicable rates for different The assessment year AY is the year that comes after the FY This is the time in which the income earned during FY is assessed and taxed Both FY and AY start on 1 April and end on 31 March For instance for FY

Download Exemption In Income Tax For Assessment Year 2022 23

More picture related to Exemption In Income Tax For Assessment Year 2022 23

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/497/332/497332566/large.png

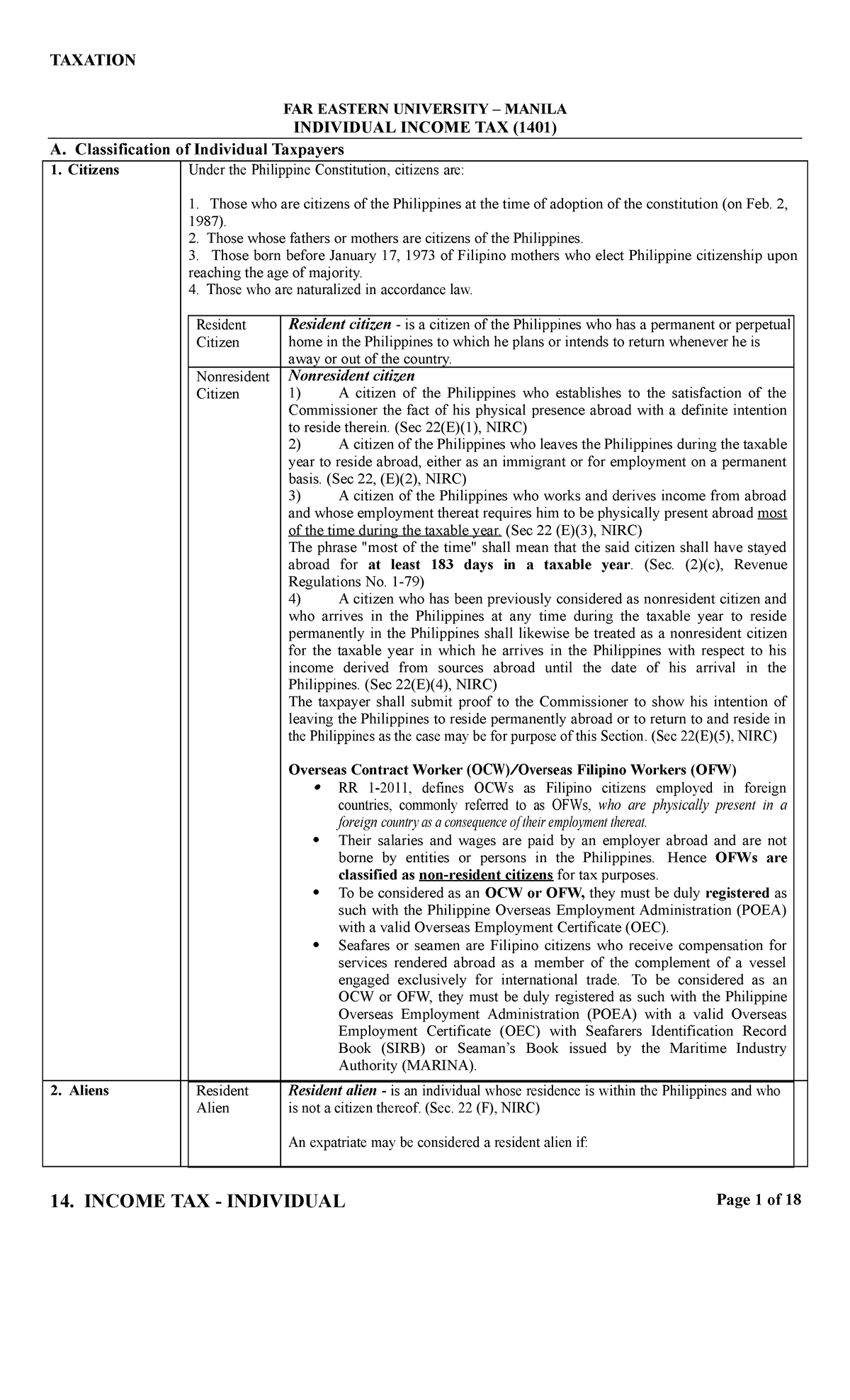

14 Individual Income Tax 14 INCOME TAX INDIVIDUAL Page 1 Of 18

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/4d966e49d5a44496b768338cc972ac91/thumb_1200_1976.png

Form Rev 1220 Pennsylvania Exemption Certificate Printable Pdf Download

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/form-rev-1220-pennsylvania-exemption-certificate-printable-pdf-download-1.png?w=950&ssl=1

What is the Due Date to File an Income Tax Return Who Should File an Income Tax Return What Documents are Required to File ITR How to File ITR for FY 2023 24 AY 2024 25 How to File ITR with Tax2win What Will be the Next Steps After e filing of Income Tax Returns How to e file ITR with Form 16 1 Due Dates and Applicable ITR Forms FAQ 1 What are the due dates for filing of Income tax Returns for the Assessment Year 2023 24 The due dates for filing of ITRs for various types of assessees are as follows FAQ 2 Which form should a taxpayer use to file his income tax return for the assessment year 2023 24 Dive Deeper

Income tax exemptions and benefits available to women taxpayers are enumerated below However if a woman taxpayer opts for the new tax regime these deductions need to be foregone IF an individual or HUF opt for OLD slab rate not opting New Tax Regime u s 115BAC then all exemption deduction as per provisions of income tax are allowed and following slab rates are applicable for FY 2022 23 AY 2023 24

Income Tax Rate Malaysia 2023 Calculator Printable Forms Free Online

https://i2.wp.com/d3q48uqppez4lq.cloudfront.net/wp-content/uploads/2019/03/malaysia-income-tax-rates-2013-2018.png

2017 PAFPI Certificate of TAX Exemption Certificate Of

https://www.certificateof.com/wp-content/uploads/2018/06/2017-PAFPI-Certificate-of-TAX-Exemption.jpg

http://www.ird.gov.lk/en/Lists/Latest News Notices...

Employer shall deduct Advance Personal Income Tax on any payment which falls under section 5 made to his employee as specified by the Commissioner General 2 Changes in Reliefs Individuals Type of Relief Year of Assessment Y A First nine month period of the Y A 2022 2023 01 04 2022 31 12 2022 Balance three month period of the Y A 2022

https://www.taxmann.com/research/income-tax/top...

Q1 What are the due dates for filing of Income tax Returns for the Assessment Year 2022 23 The due dates for filing of ITRs for various types of assessees are as follows Situations Original due date If assessee is required to furnish a report of transfer pricing TP Audit in Form No 3CEB 30 11 2022 If the assessee is a partner in a

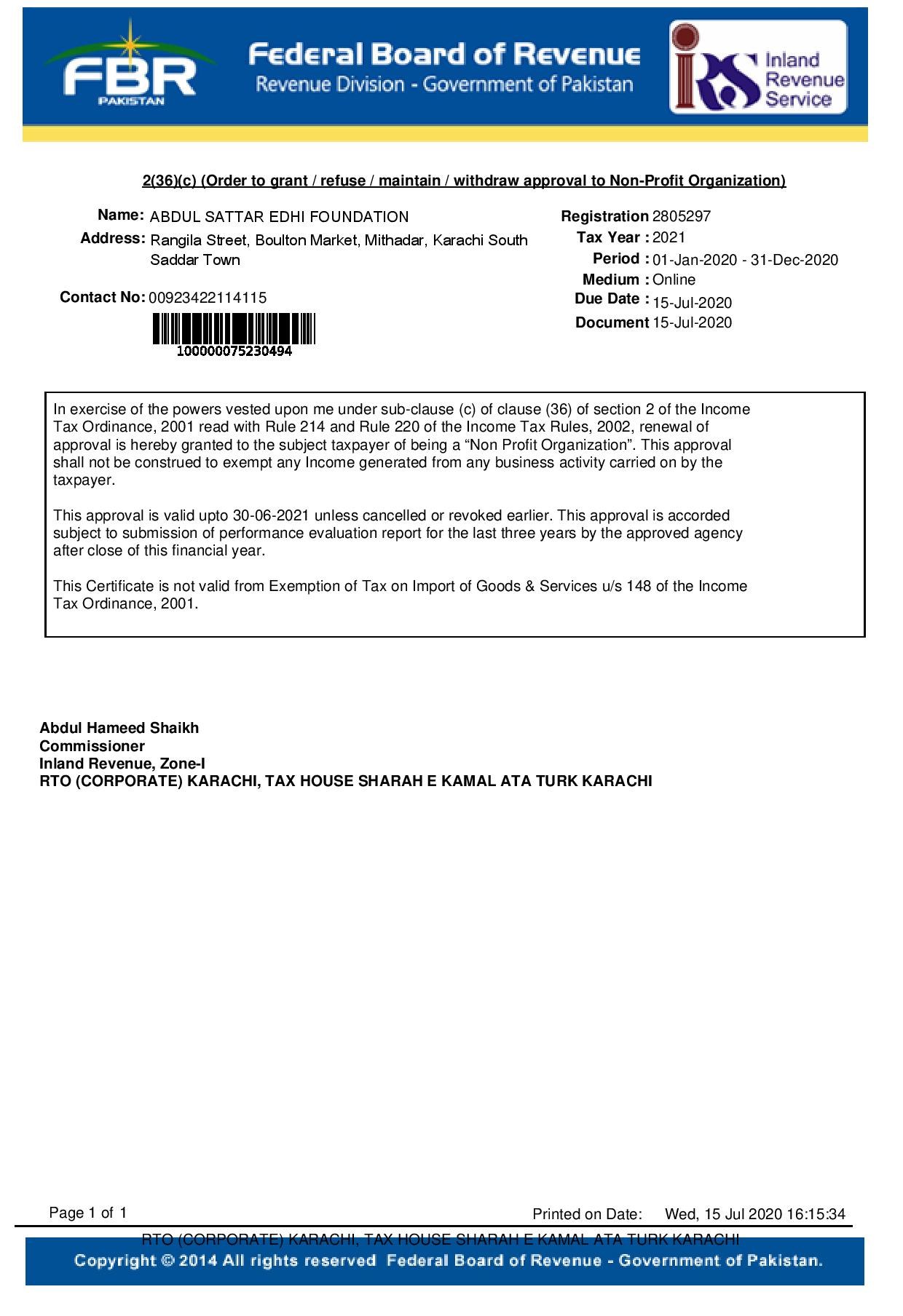

Tax Exemption Certificate SACHET Pakistan

Income Tax Rate Malaysia 2023 Calculator Printable Forms Free Online

2022 Tax Brackets Lashell Ahern

Watch The Videos How To E Filling Income Tax For 2020 21 Financial

Income Tax Calculation Example 2 For Salary Employees 2023 24

Best Online Income Tax Return Software In Bangladesh

Best Online Income Tax Return Software In Bangladesh

Exemption Certificate Edhi Welfare Organization

Processing Of Returns Claims Under Section 143 1 Of The Income tax Act

Income Tax Calculation Ay 2022 23 Excel ZOHAL

Exemption In Income Tax For Assessment Year 2022 23 - Standard Deduction For FY 2023 24 the limit of the standard deduction is Rs 50 000 for both the old and the new regime As per Budget 2023 salaried taxpayers are now eligible for a standard deduction of Rs 50 000 under the new tax regime also from the financial year 2023 24 Read more on Standard Deduction