Exemption In Income Tax For Senior Citizens Senior citizens can benefit from Section 80TTB introduced in Finance Budget 2018 allowing a deduction of up to Rs 50 000 on specified interest income The section is applicable

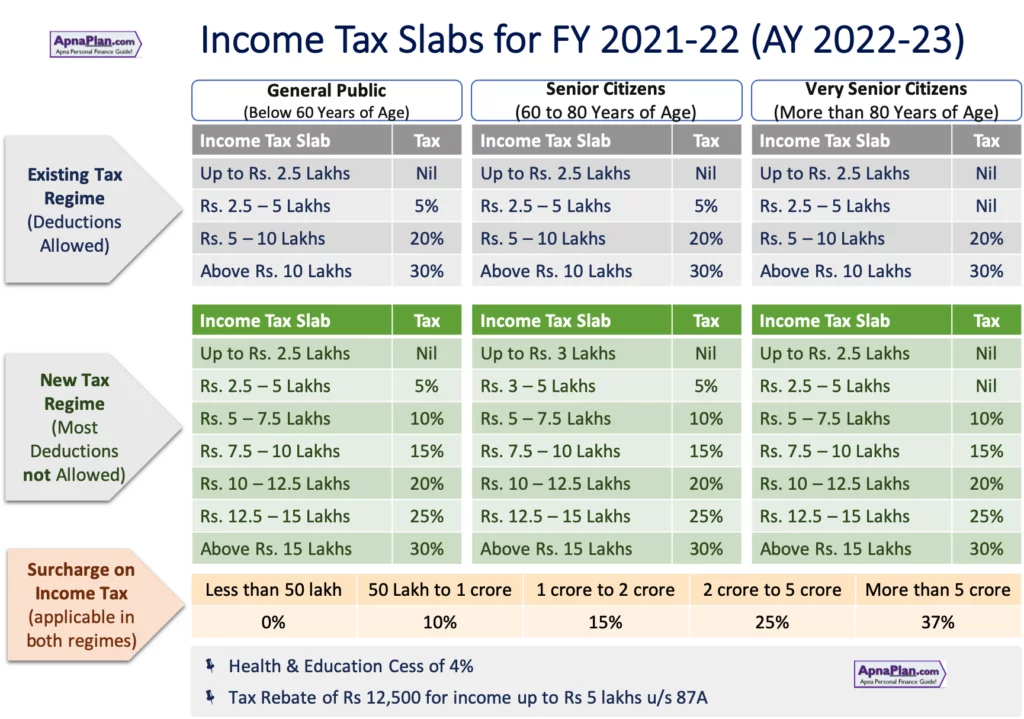

Are my wages exempt from federal income tax withholding Determine if your retirement income is taxable Use the Interactive Tax Assistant to get retirement income The income tax exemption limit is up to Rs 3 lakh for senior citizens aged above 60 years but less than 80 years Surcharge and cess will be applicable Income tax slab for Individuals aged more than 80 years

Exemption In Income Tax For Senior Citizens

Exemption In Income Tax For Senior Citizens

https://www.rightsofemployees.com/wp-content/uploads/2023/01/Investment-Plan-For-Senior-Citizen.jpg

INCOME TAX FOR SENIOR CITIZEN YouTube

https://i.ytimg.com/vi/Sawj8HoQeG8/maxresdefault.jpg

8 Income Tax Benefits To Senior Citizens For A Y 21 22 YouTube

https://i.ytimg.com/vi/dytVoG1Gxp4/maxresdefault.jpg

Income tax exemption for senior citizens Senior citizens 60 years and above can claim a standard deduction of Rs 50 000 annually on their pensions This deduction applies to annuity payments which are taxed Learn about the income tax exemptions deductions and rebates available for senior citizens 60 80 years and super senior citizens 80 years in India Compare the benefits under old and new tax regimes and find out how

The government is ensuring that tax that is owed is paid by introducing the most ambitious ever package to close the tax gap raising 6 5 billion in additional tax revenue per year by 2029 30 Compare the tax rates and exemptions for senior and super senior citizens under the old and new tax regimes for FY 2024 25 AY 2025 26 Learn how to calculate your

Download Exemption In Income Tax For Senior Citizens

More picture related to Exemption In Income Tax For Senior Citizens

What Are The Income Tax Slabs For Senior Citizens In India

https://thefindstory.com/wp-content/uploads/2021/12/Income-Tax-Slabs-for-Senior-Citizens-In-India.jpg

Senior Citizens ITR Updated New Income Tax Slab For Senio Flickr

https://live.staticflickr.com/65535/48096548407_f75980f2c2.jpg

Income Tax Slabs Rates And Exemptions For Senior Citizens Know How

https://cdn.zeebiz.com/sites/default/files/2023/02/26/229140-income-tax-for-senior-citizen.jpg

Learn how to claim the extra standard deduction for people aged 65 or older which can reduce your taxable income and save you money Find out the eligibility criteria amounts and how to For 2025 married couples over 65 filing jointly will also see a modest benefit The extra deduction per qualifying spouse will increase from 1 550 in 2024 to 1 600 in 2025 a

Under the old tax regime a super senior citizen is eligible for a basic income exemption limit of Rs 5 lakh whereas in the revised new tax regime the basic income The IRS announced the annual inflation adjustments for tax year 2025 including standard deductions marginal rates alternative minimum tax exemption amounts and more

Senior Citizen Income Tax Calculation 2021 22 Excel Calculator

https://i.ytimg.com/vi/Ww-ESeJgiP8/maxresdefault.jpg

Income Tax Slabs For Senior Citizens FY 2022 23 SuperCA

https://superca.in/storage/app/public/blogs/1673417389.jpg

https://cleartax.in

Senior citizens can benefit from Section 80TTB introduced in Finance Budget 2018 allowing a deduction of up to Rs 50 000 on specified interest income The section is applicable

https://www.irs.gov › individuals › seniors-retirees

Are my wages exempt from federal income tax withholding Determine if your retirement income is taxable Use the Interactive Tax Assistant to get retirement income

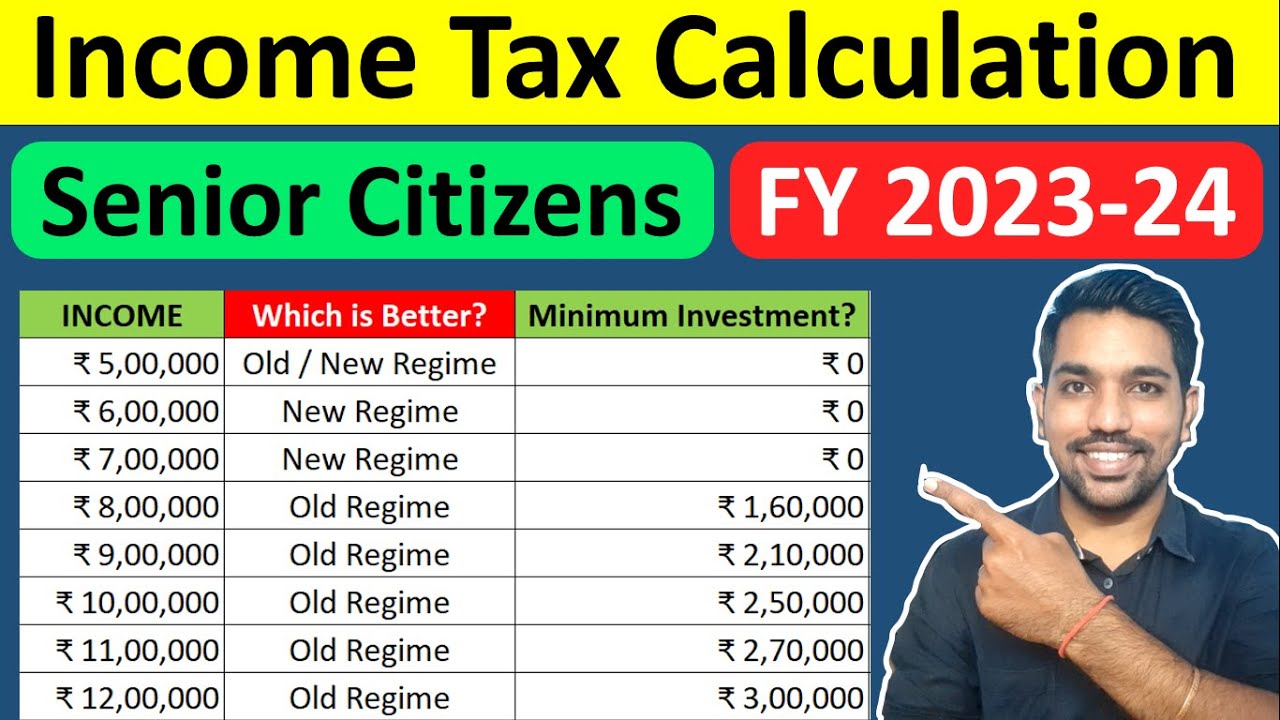

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

Senior Citizen Income Tax Calculation 2021 22 Excel Calculator

Income Tax Slabs For Senior Citizens FY 2022 23 AY 2023 24

20 Online Tax Estimator BenHollyanne

Income Tax India On Twitter RT nsitharamanoffc As Announced In

INCOME TAX CALCULATOR Income Tax For Senior Citizens TAXCONCEPT

INCOME TAX CALCULATOR Income Tax For Senior Citizens TAXCONCEPT

Income Tax Calculator For FY 2022 23 Kanakkupillai

Income Tax For Senior Citizens Pensioners Overview

Senior Citizens Vs Super Senior Citizens Income Tax Benefits Compared

Exemption In Income Tax For Senior Citizens - Income tax exemption for senior citizens Senior citizens 60 years and above can claim a standard deduction of Rs 50 000 annually on their pensions This deduction applies to annuity payments which are taxed