Exemption To Senior Citizens In Income Tax Verkko 29 kes 228 k 2023 nbsp 0183 32 Very senior citizen A senior citizen is granted a higher exemption limit compared to non senior citizens The exemption limit for the financial year 2022 23 available to a resident senior citizen is Rs 3 00 000 The exemption limit for non senior citizen is Rs 2 50 000

Verkko Higher income exemption limit Senior citizens are required to pay tax over the income of Rs 3 00 000 while this limit is Rs 5 00 000 for super senior citizens This benefit is not available for the ordinary individuals as the Verkko 1 jouluk 2023 nbsp 0183 32 2024 standard deduction over 65 The just released additional standard deduction amount for 2024 returns usually filed in early 2025 is 1 550 1 950 if unmarried and not a surviving spouse

Exemption To Senior Citizens In Income Tax

Exemption To Senior Citizens In Income Tax

https://www.rodneyjstrange.com/wp-content/uploads/2019/05/Elderly-Tax-Exemption-1.jpg

Harris County Homestead Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-3.png

House Of Representatives Files Bill Of Tax Exemption For Senior

https://filipinojournal.com/wp-content/uploads/2021/03/senior_citizen_task_force_web.jpg

Verkko 4 tammik 2023 nbsp 0183 32 For tax year 2022 the base standard deductions before the bonus add on for older adults are 25 900 for married taxpayers who file jointly and qualifying widow er s 19 400 for heads of household 12 950 for single taxpayers and married taxpayers who file separately Many older taxpayers may find that their standard Verkko Very Senior Citizens For ordinary individual tax payers the basic exemption limit upto which he is not required to pay any tax is presently fixed at Rs 2 50 lakh for AY 2021 22 However for Senior Citizens the basic exemption limit is fixed at a higher figure of Rs 3 lakh Super Senior Citizens do not have to pay any tax or file return upto

Verkko 28 jouluk 2023 nbsp 0183 32 Under the old tax regime the basic exemption limit for senior citizens Resident individuals aged 60 years or above is 3 lakh This means that their income up to 3 lakh is exempt from income tax Verkko 17 elok 2023 nbsp 0183 32 Tax Information for Seniors amp Retirees Older adults have special tax situations and benefits Understand how that affects you and your taxes Get general information about how to file and pay taxes including many free services by visiting the Individuals page

Download Exemption To Senior Citizens In Income Tax

More picture related to Exemption To Senior Citizens In Income Tax

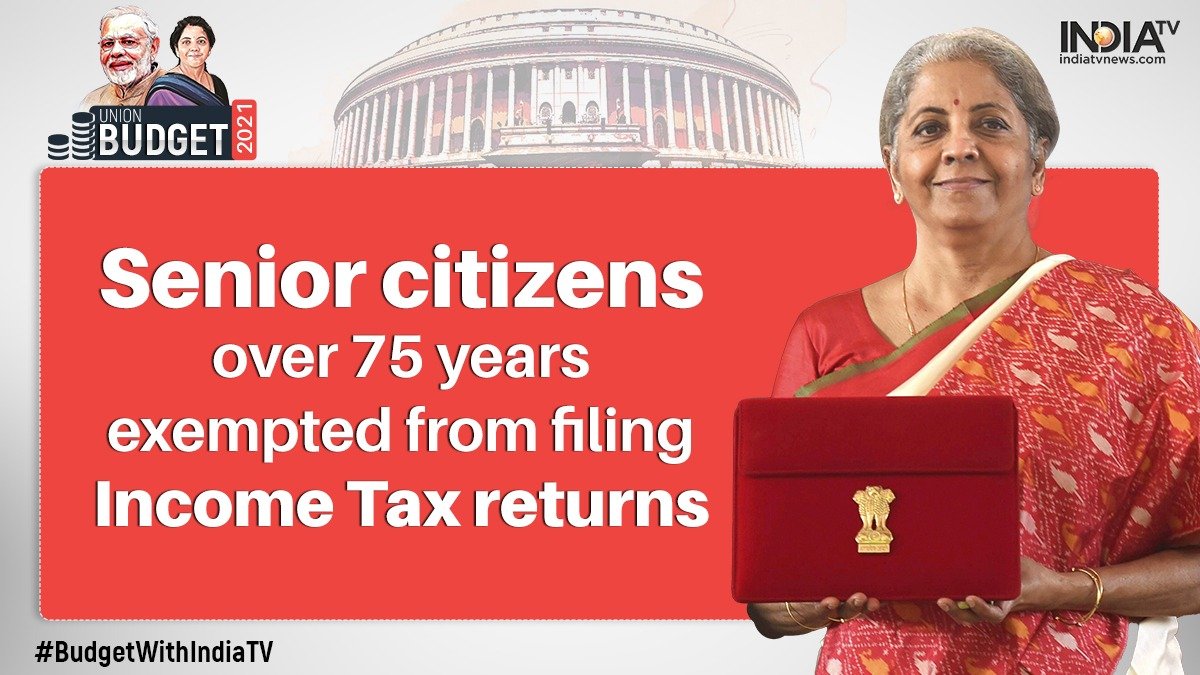

Budget 2021 Income Tax Returns Exemption Senior Citizens Above 75 Years

https://resize.indiatvnews.com/en/resize/newbucket/1200_-/2021/02/eth6sfpu0auony6-1612164111.jpg

ITR Filing Exemption From Filing Income Tax Returns For Senior

https://static.tnn.in/thumb/msid-93016201,imgsize-100,width-1280,height-720,resizemode-75/93016201.jpg

Senior Citizens Get Special Exemption In Income Tax Know 5 Big

https://indiarag.com/wp-content/uploads/2022/06/Senior-citizens-get-special-exemption-in-income-tax-know-5.jpg

Verkko Credit for the Elderly or Disabled You must file using Form 1040 or Form 1040 SR to receive the Credit for the Elderly or Disabled Be sure to apply for the Credit if you qualify please read below for details Who Can Take the Credit The Credit is based on your age filing status and income You may be able to take the Credit if Verkko Important points to note if you select the new tax regime Please note that the tax rates in the New tax regime is the same for all categories of Individuals i e Individuals Senior citizens and Super senior citizens Individuals with Net taxable income less than or equal to Rs 5 lakh will be eligible for tax rebate u s 87A i e tax liability will be NIL in

Verkko 18 maalisk 2021 nbsp 0183 32 House Bill No 8832 which Ordanes filed earlier this month would grant income tax exemptions to employed Filipinos age 60 and above It also exempts their holiday pay overtime pay night shift Verkko Senior citizens often enjoy certain privileges when it comes to income tax They are granted exemptions and benefits to alleviate their tax burdens and provide financial relief during retirement To qualify for these exemptions senior citizens must meet specific eligibility criteria primarily based on age and income thresholds

Module 2 Introduction TO Income TAX MODULE 2 Introduction To Income

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/2ebc8de11ae6b27dadd9a043e635b63a/thumb_1200_1553.png

Income Tax Rules For Senior Citizens Income Tax Exemption For Senior

https://i.ytimg.com/vi/dBjjL3-Qu4E/maxresdefault.jpg

https://taxguru.in/income-tax/what-are-the-tax-benefits-available-to...

Verkko 29 kes 228 k 2023 nbsp 0183 32 Very senior citizen A senior citizen is granted a higher exemption limit compared to non senior citizens The exemption limit for the financial year 2022 23 available to a resident senior citizen is Rs 3 00 000 The exemption limit for non senior citizen is Rs 2 50 000

https://cleartax.in/s/income-tax-slab-for-senior-citizen

Verkko Higher income exemption limit Senior citizens are required to pay tax over the income of Rs 3 00 000 while this limit is Rs 5 00 000 for super senior citizens This benefit is not available for the ordinary individuals as the

Income Tax Slabs For Senior Citizens FY 2022 23 AY 2023 24

Module 2 Introduction TO Income TAX MODULE 2 Introduction To Income

Senior Citizen Income Tax Benefits Piggy Blog

Income Tax Appellate Tribunal Recruitment Https www itat gov in

Strategic Approaches Unleashing The Potential For Tax Savings In

6 Benefits In Income Tax For Senior Citizens TaxAdda

6 Benefits In Income Tax For Senior Citizens TaxAdda

AMT In Income Tax Basics Applicability Exemptions And Credit Of

Sample Letter Exemption Doc Template PdfFiller

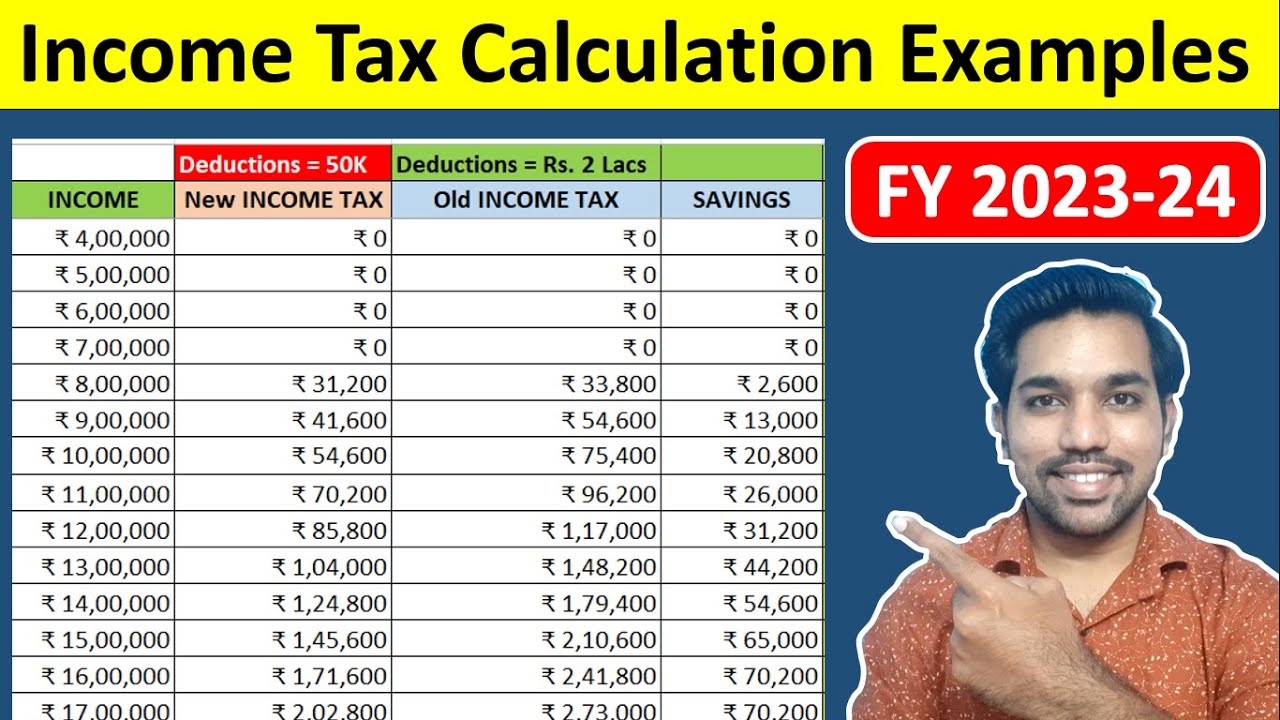

Income Tax Calculator FY 2023 24 2022 23 FinCalC Blog

Exemption To Senior Citizens In Income Tax - Verkko 4 tammik 2023 nbsp 0183 32 For tax year 2022 the base standard deductions before the bonus add on for older adults are 25 900 for married taxpayers who file jointly and qualifying widow er s 19 400 for heads of household 12 950 for single taxpayers and married taxpayers who file separately Many older taxpayers may find that their standard