Exemptions From Realty Transfer Tax In Pennsylvania Web Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted for improvements to property transferred by deed

Web 3 Feb 2003 nbsp 0183 32 See Title 61 PA Code Section 91 154 However a transfer of real estate from a family member to a family farm corporation or family farm partnership including a Web In an action in which taxpayers presented constitutional challenges to the imposition of a tax at the 1 rate established by the Pennsylvania Realty Transfer Tax Act within the context of a real estate transfer in which one party to the transaction is exempt the Act did not discriminate against parties dealing with the Federal government in

Exemptions From Realty Transfer Tax In Pennsylvania

Exemptions From Realty Transfer Tax In Pennsylvania

https://www.upnest.com/1/post/files/2021/08/shutterstock_1060115645-1.jpg

Determining Philadelphia Realty Transfer Tax When Sales Price Is Below

https://www.worldwidelandtransfer.com/wp-content/uploads/2019/09/Philadelphia-Realty-Transfer-Tax-838x556.jpg

Philly Realty Transfer Tax What Is It And How Does It Work

https://www.phila.gov/media/20220228083416/Transfer-Taxpic-1050x700.jpg

Web 9 Dez 2022 nbsp 0183 32 The Pennsylvania Department of Revenue Department issued Realty Transfer Tax Bulletin 2022 01 on December 5 2022 The Bulletin addresses issues of tax payment and refund procedures for Web 1867 and The Realty Transfer Tax Act 72 P S 167 167 3283 3292 unless otherwise noted Source The provisions of this Chapter 91 adopted May 10 1967 amended

Web Many conservation related property transactions are excluded from having to pay state and local realty transfer taxes in Pennsylvania Sales of real estate and conveyances of Web A document that evidences the transfer of real estate pursuant to the statutory consolidation or merger of two or more corporations 15 Pa C S 167 1921 1932 or 15 Pa

Download Exemptions From Realty Transfer Tax In Pennsylvania

More picture related to Exemptions From Realty Transfer Tax In Pennsylvania

New Change To Pennsylvania Inheritance Tax Law Takes Effect

https://www.ammlaw.com/media/k2/items/cache/1f927a512a9909833c7b57ab40062fc5_XL.jpg

Real Estate Transfer Tax What Are They Where Does The Money Go

https://assets.site-static.com/userFiles/2282/image/uploads/agent-1/Transfertax_v2.png

Tax Exempt Tax Bind Consulting

https://taxbind.net/application/uploads/2018/09/tax-exempt.jpg

Web Veterans organizations with a valid tax exemption under 501 c 19 of the Internal Revenue Code of 1986 are now exempt from realty transfer tax This change applies Web 17 Feb 2023 nbsp 0183 32 In Pennsylvania there are a few different kinds of real estate transactions that are exempt from transfer taxes Certain sales made to or by government

Web The 1 percent state realty transfer tax is generally due when a document that transfers title to real estate as defined by 72 PS Section 8101 C of the Pennsylvania Code is Web In an action in which taxpayers presented constitutional challenges to the imposition of a tax at the 1 rate established by the Pennsylvania Realty Transfer Tax Act within the

Sample Letter Exemption Doc Template PdfFiller

https://www.pdffiller.com/preview/497/332/497332566/large.png

Realty Transfer Tax And Long Term Leases Update Unruh Turner Burke

https://www.utbf.com/wp-content/uploads/transactional/2017/02/Realty-Transfer-Tax-PA.jpg

https://www.revenue.pa.gov/TaxTypes/RTT

Web Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted for improvements to property transferred by deed

https://revenue-pa.custhelp.com/app/answers/detail/a_id/709

Web 3 Feb 2003 nbsp 0183 32 See Title 61 PA Code Section 91 154 However a transfer of real estate from a family member to a family farm corporation or family farm partnership including a

Exemptions From Minimum Wage Overtime Rules

Sample Letter Exemption Doc Template PdfFiller

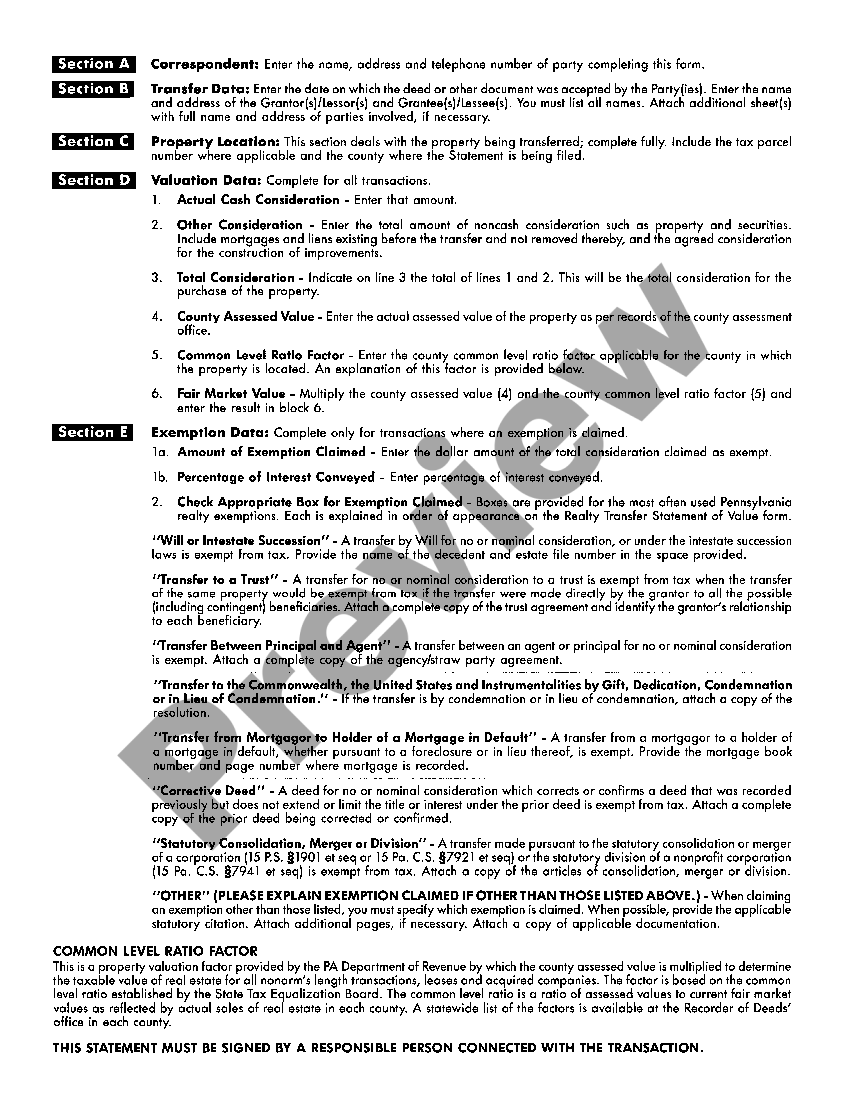

Allegheny Pennsylvania Realty Transfer Tax Statement Of Consideration

Hecht Group Churches And Transfer Taxes Exemptions And Exceptions

Tax Exemptions For Property Managers Landlords First Light Property

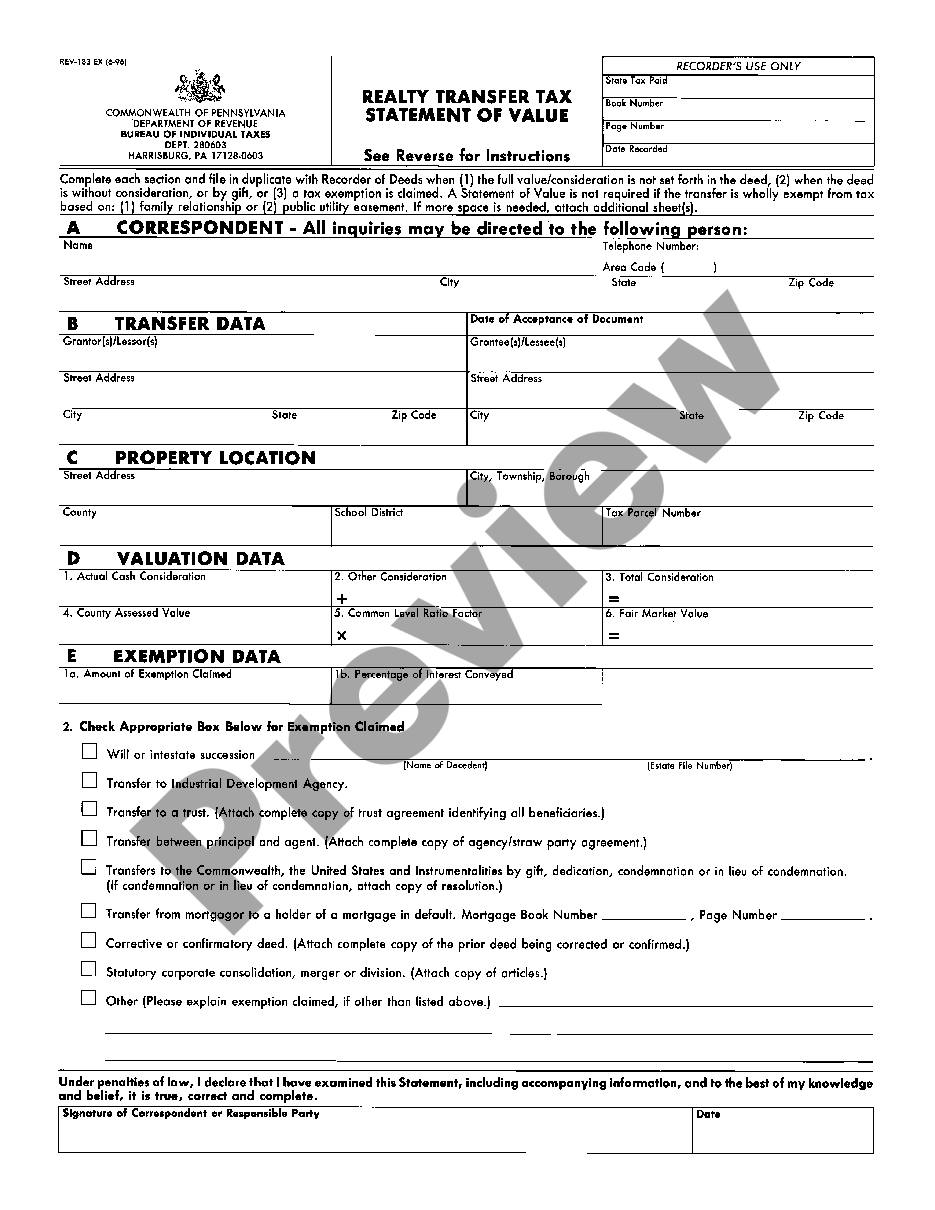

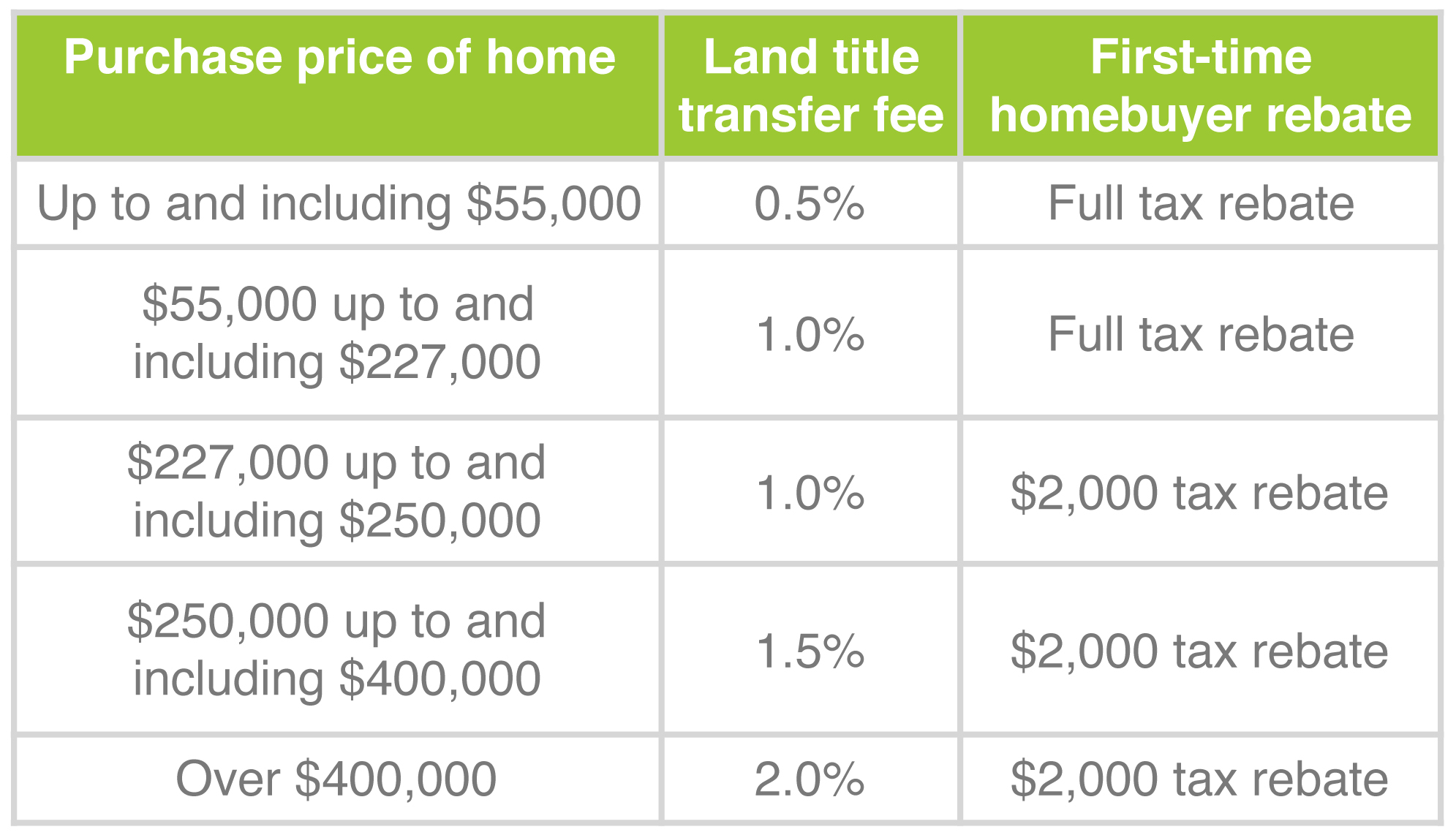

What Do I Need To Know About Property Transfer Tax Silver Law

What Do I Need To Know About Property Transfer Tax Silver Law

Policy Basics Tax Exemptions Deductions And Credits Center On

Pennsylvania Realty Transfer Tax Statement Of Consideration Statement

Land Transfer Taxes 101 Susan Bandler Toronto Real Estate

Exemptions From Realty Transfer Tax In Pennsylvania - Web a A document which evidences a specific or residuary devise of real estate by will or under intestate law and a document under an orphan s court adjudication allocating realty to a