Invite to Our blog, a room where inquisitiveness fulfills information, and where day-to-day topics come to be interesting conversations. Whether you're seeking insights on way of life, technology, or a little whatever in between, you have actually landed in the best area. Join us on this expedition as we dive into the realms of the average and remarkable, understanding the globe one article at once. Your trip right into the interesting and varied landscape of our Explain Deduction From Gross Total Income starts below. Check out the fascinating web content that waits for in our Explain Deduction From Gross Total Income, where we decipher the complexities of different topics.

Explain Deduction From Gross Total Income

Explain Deduction From Gross Total Income

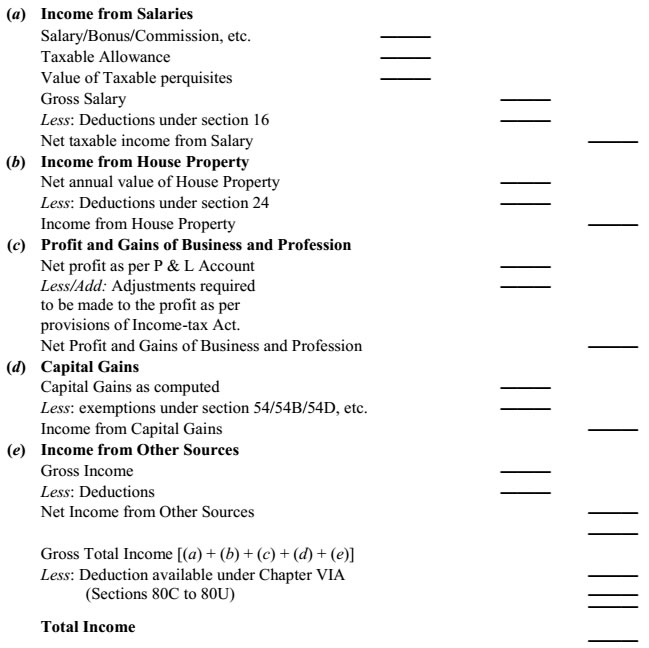

Computation Of Total Income With Deduction U s 80G Other Deductions

Computation Of Total Income With Deduction U s 80G Other Deductions

Deduction From Gross Total Income Section 80A To 80U

Deduction From Gross Total Income Section 80A To 80U

Gallery Image for Explain Deduction From Gross Total Income

Lecture 44 Deduction From Gross Total Income YouTube

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Gross Total Income Section 80B 5 Definations Under I Tax

Solved Please Note That This Is Based On Philippine Tax System Please

Deductions From Gross Total Income Under Section 80C To 80 U Of Income

Qualified Business Income Deduction And The Self Employed The CPA Journal

Qualified Business Income Deduction And The Self Employed The CPA Journal

FAQs On Deduction Available From Gross Total Income Taxmann

Thanks for selecting to explore our web site. We genuinely hope your experience surpasses your assumptions, which you discover all the information and sources about Explain Deduction From Gross Total Income that you are seeking. Our dedication is to give an user-friendly and insightful system, so do not hesitate to navigate with our web pages with ease.