Explain The Term Tax Rebate The term tax credit refers to an amount of money that taxpayers can subtract directly from the taxes they owe This is different from tax deductions which

Tax relief refers to any government program or policy designed to help individuals and businesses reduce their tax burdens or resolve their tax related A rebate is a credit paid to a buyer of a portion of the amount paid for a product or service In a short sale a rebate is a fee that the borrower of stock pays

Explain The Term Tax Rebate

Explain The Term Tax Rebate

https://i.ytimg.com/vi/t3pDeVfMeeY/maxresdefault.jpg

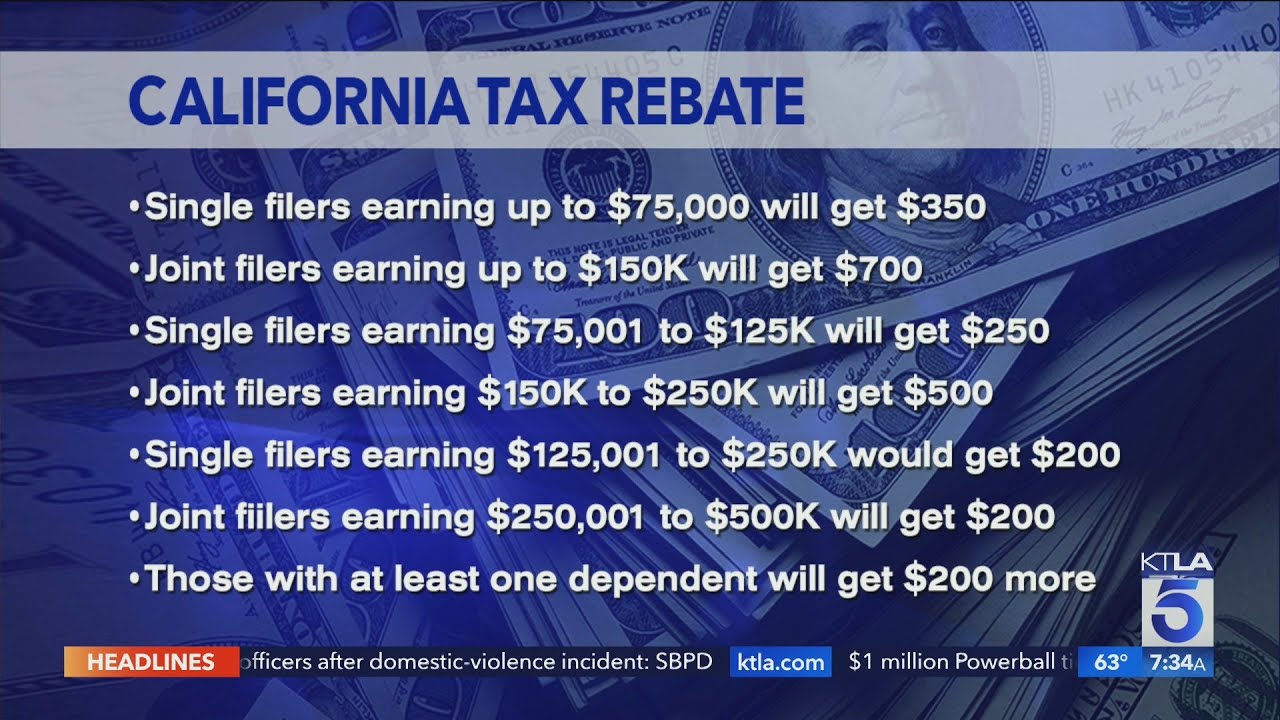

Tax Rebate Of 1 000 Available To Thousands In One State

https://d.newsweek.com/en/full/2336896/tax-rebate-stock-image.jpg

Rebates

https://cljgives.org/wp-content/uploads/2017/08/20170809-MM0000809-rebates.png

Noun C TAX FINANCE uk us Add to word list an amount of money that is paid back to you if you have paid too much tax More than 2 million taxpayers will receive checks A rebate is an amount by which SARS reduces the actual taxes owing depending on certain circumstances SARS will calculate the amount of tax that you owe to them based on your income and expenses throughout the year then if certain conditions apply they ll reduce the amount due The most common rebate in tax terms is for age

Here is the 3 most common Term and language use in Tax planning Tax Exemption Tax Deduction and Tax Rebate here you will learn difference between them Tax rebate a payment from the government that is given to people who meet certain requirements such as being below a certain income level or owning a home A tax rebate is often thought of as a gift from the government however it can also be seen as an incentive to encourage people to purchase items that may not benefit them financially

Download Explain The Term Tax Rebate

More picture related to Explain The Term Tax Rebate

Bonus Property Tax And Rent Rebate Arriving Soon For Eligible

https://www.pennlive.com/resizer/9__l3v8PgaVRb7vyfHFdyNzfxkM=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/OPZBRT6KQNA2DBHYBAEUKDMWK4.png

What Is 87 A Rebate Free Tax Filer Blog

https://blog.freetaxfiler.com/wp-content/uploads/2022/09/Tax-Rebate-1.jpg

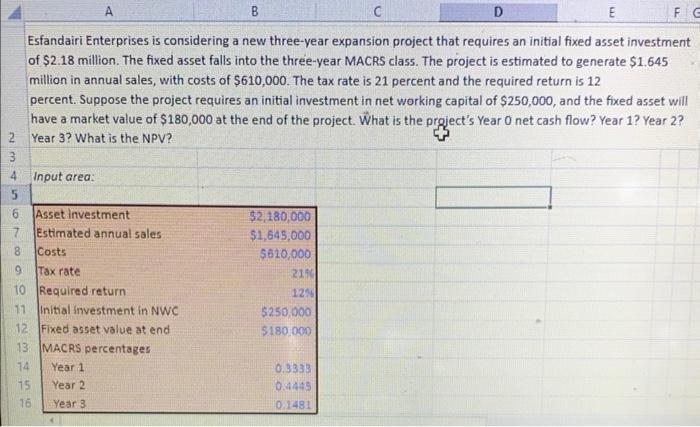

Solved Esfandairi Enterprises Is Considering A New Chegg

https://media.cheggcdn.com/study/35f/35f71d08-84a4-4dc4-b5ee-4a97c6a70070/image

Income tax rebate is like the final bargain that you can claim from your taxable income after you have claimed exemptions and deductions Tax rebate under Section 87A of the Income Tax Act is the final reduction from your tax liability up to Rs 12 500 The purpose of this rebate is to further reduce the tax burden of taxpayers especially in Use this tool to find out what you need to do to get a tax refund rebate if you ve paid too much Income Tax

29 May 2014 at 12 34 A rebate is an amount that SARS takes off your tax owing to them each year depending on how old you are Have a look at the latest rebates published in the 2015 Budget to see which applies to you This entry was posted in Tax Q A and tagged Deductions Bookmark the permalink Tax rebate and TDS Unlike tax exemptions and tax deductions income tax rebates are supposed to be claimed from the total tax payable For example a tax rebate of Rs 12 500 is available for taxpayers with an annual income of up to Rs 5 lakh as applicable to the financial year 2023 24 for taxpayers who opt the old tax regime

More Than 30 000 Homes Get Council Tax Rebate In West Berkshire

https://www.newburytoday.co.uk/_media/img/XWR3OS658K3AP70S77XD.jpg

Income Tax Rebate Under Section 87A Legalraasta

https://www.legalraasta.com/blog/wp-content/uploads/2021/08/Income-tax-rebate-tax-deduction-and-exemption-scaled.jpg

https://www.investopedia.com/terms/t/taxcredit.asp

The term tax credit refers to an amount of money that taxpayers can subtract directly from the taxes they owe This is different from tax deductions which

https://www.investopedia.com/terms/t/tax-relief.asp

Tax relief refers to any government program or policy designed to help individuals and businesses reduce their tax burdens or resolve their tax related

Recovery Rebate Form 1040 Printable Rebate Form

More Than 30 000 Homes Get Council Tax Rebate In West Berkshire

Profitable Ad Spend Done Right Noopd

Tax Rebate Payments Begin Republic Times News

Income Tax Rebate Under Section 87A

2007 Tax Rebate Tax Deduction Rebates

2007 Tax Rebate Tax Deduction Rebates

Tax Rebate For Small And Medium Enterprise Battchoo Yong

UAE To Introduce 9 Corporate Tax On Business Profits From June 1 2023

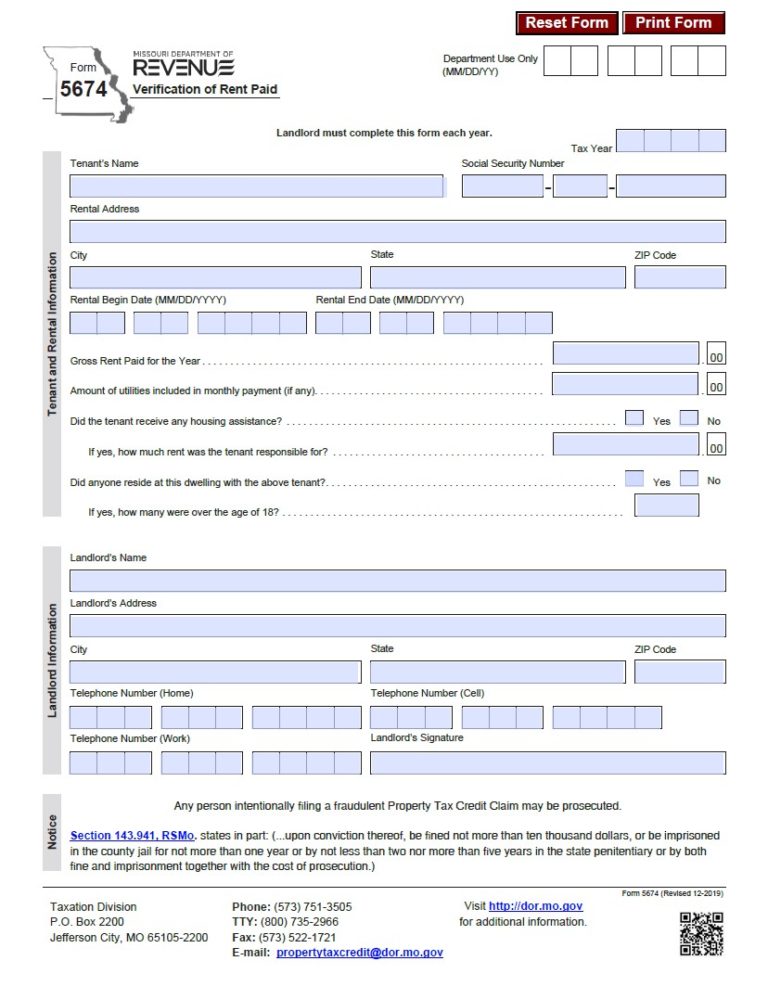

Rent Rebate Tax Form Missouri Printable Rebate Form

Explain The Term Tax Rebate - The term tax refund refers to a reimbursement made to a taxpayer for any excess amount paid in taxes to the federal or state government While taxpayers tend