Explanation Of Exemptions And Rebates In Service Tax Law Web 3 juil 2019 nbsp 0183 32 Income tax exemption v s tax deduction Income tax exemptions are provided on particular sources of income and not on the total income It can also mean that you do

Web 19 ao 251 t 2021 nbsp 0183 32 Federal tax law allows taxpayers to deduct a number of different personal expenses from their taxable income each year However according to the U S Internal Web 11 d 233 c 2022 nbsp 0183 32 An exemption reduces the amount of income that would otherwise be taxed Until the end of 2025 personal exemptions have been repealed and replaced by higher

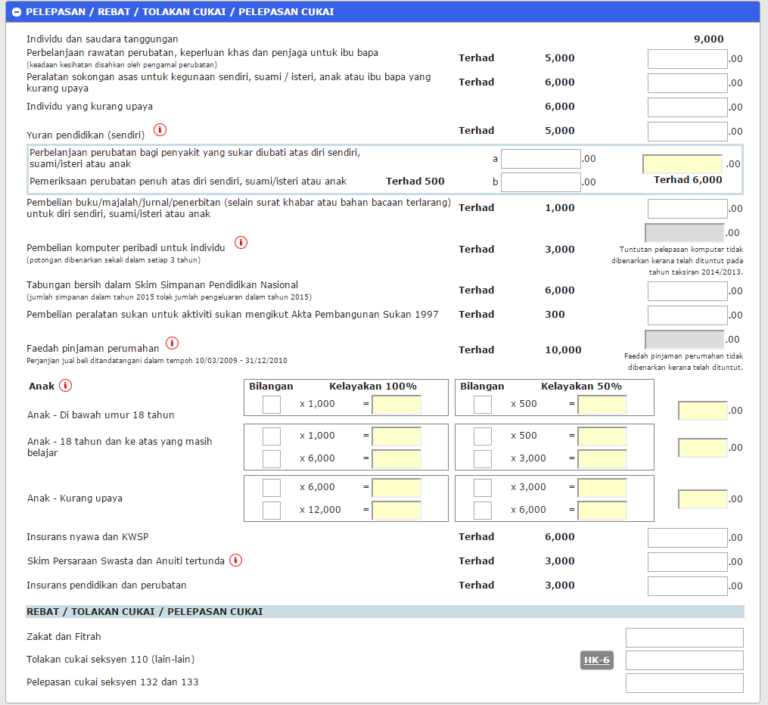

Explanation Of Exemptions And Rebates In Service Tax Law

Explanation Of Exemptions And Rebates In Service Tax Law

https://ringgitplus.com/en/blog/wp-content/uploads/2020/02/Tax-Rebates.jpg

Understanding Income Tax Reliefs Rebates Deductions And Exemptions

https://ringgitplus.com/en/blog/wp-content/uploads/2020/02/Tax-Exemptions-1.jpg

Difference Between Income Tax Deductions Exemptions And Rebate Plan

https://www.planyourfinances.in/wp-content/uploads/2019/11/Difference-Between-Income-Tax-Deductions-Exemptions-and-Rebate.jpg

Web Understanding the difference between Tax Deduction Tax Exemption and Tax Rebate Tax Among the many words that get associated with income tax two stands out the most Web was designed in part to tax energy products so as to reflect both energy content and CO 2 emissions as under the current ETD most of the minimum tax rates arebased on the

Web 5 f 233 vr 2021 nbsp 0183 32 Here s a quick look at those portions of Income Tax Act that describe benefits by way of exemptions deductions and rebates Before we assess these benefits to Web De tr 232 s nombreux exemples de phrases traduites contenant quot exemptions and rebates quot Dictionnaire fran 231 ais anglais et moteur de recherche de traductions fran 231 aises

Download Explanation Of Exemptions And Rebates In Service Tax Law

More picture related to Explanation Of Exemptions And Rebates In Service Tax Law

Gift Tax Limit 2023 Explanation Exemptions Calculation How To Avoid It

https://www.carboncollective.co/hubfs/Gift_Tax_Limit_2022.png#keepProtocol

Exemptions In ACCA In 2022 ACCA Exemption Detailed

https://i.ytimg.com/vi/RtSJy7idX3s/maxresdefault.jpg

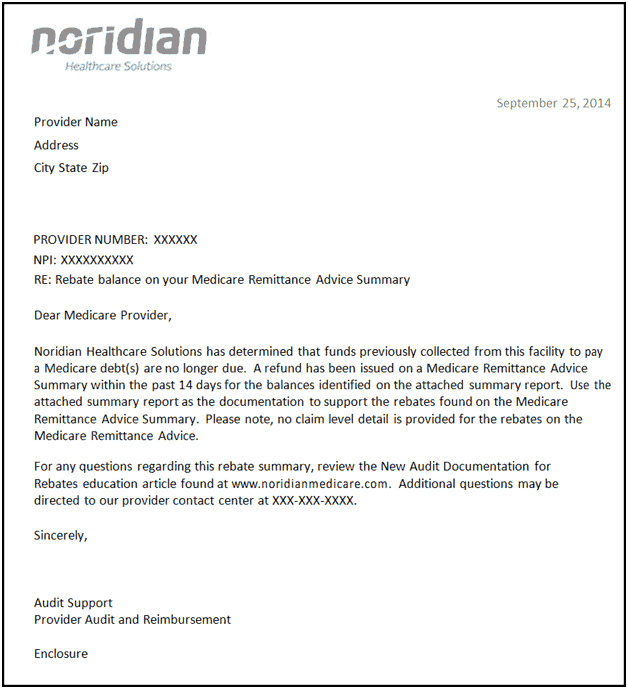

Sample Cover Letter For Medicard Reimbursement Reimbursement

https://med.noridianmedicare.com/documents/10529/2685652/rebate-summary-letter.png

Web Traductions en contexte de quot rebates or tax exemptions quot en anglais fran 231 ais avec Reverso Context Financial support in the form of rebates or tax exemptions should be introduced Web 22 mai 2022 nbsp 0183 32 This article provides an exhaustive overview of the exemptions available under Section 10 of the Income Tax Act 1961 with relevant case laws and illustrations

Web 27 avr 2022 nbsp 0183 32 Definition A tax exemption is an allowance that reduces or eliminates the taxes owed by an individual or organization Exemptions can apply to many different Web Exemption Deduction and Rebate are three terms that are commonly come across when filing for taxes These are three ways that a taxpayer can avail for tax concessions

7 Useful Income Tax Exemptions For The Salaried

https://taxguru.in/wp-content/uploads/2019/08/Useful-income-tax-exemptions-for-the-salaried-employees.jpg

Online Tax Planning In Pan India Not Compulsory Rs 999 hour ID

https://5.imimg.com/data5/SELLER/Default/2021/9/XA/QI/RE/137936497/tax-planning-500x500.jpg

https://cleartax.in/s/difference-between-tax-exemption-vs-tax...

Web 3 juil 2019 nbsp 0183 32 Income tax exemption v s tax deduction Income tax exemptions are provided on particular sources of income and not on the total income It can also mean that you do

https://escalon.services/blog/confused-between-the-terms-tax-exemptio…

Web 19 ao 251 t 2021 nbsp 0183 32 Federal tax law allows taxpayers to deduct a number of different personal expenses from their taxable income each year However according to the U S Internal

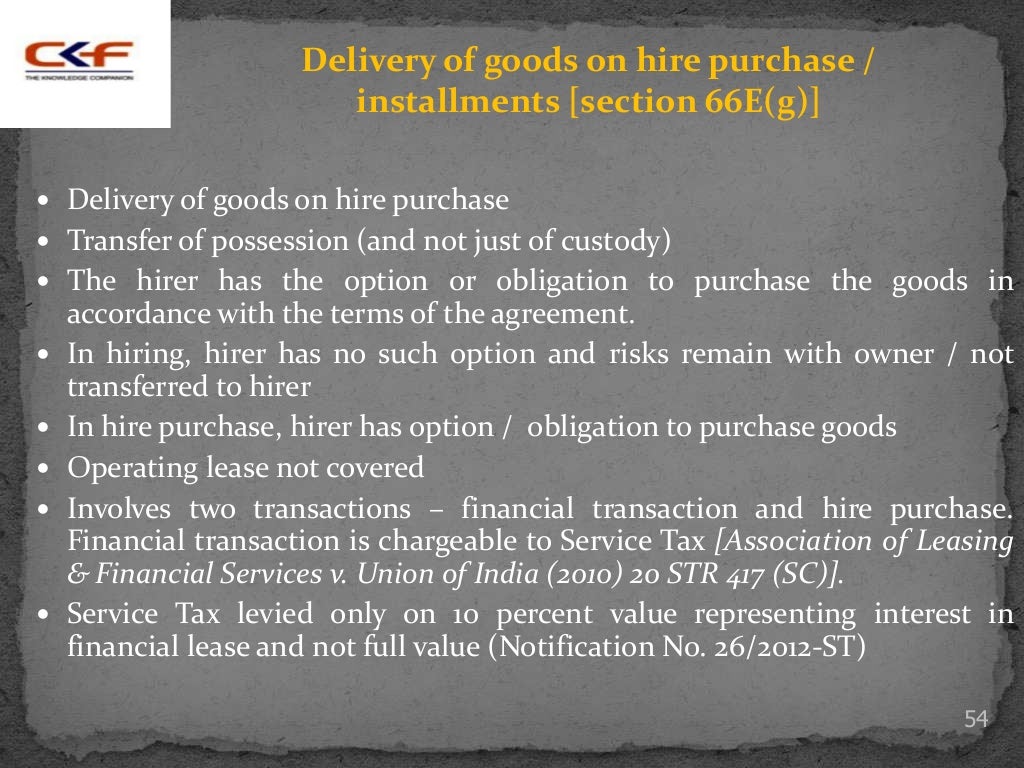

Service Tax Law Simplified Session Ii

7 Useful Income Tax Exemptions For The Salaried

What Is The Income Tax Slab For Women In India

Difference Between Exemption And Deduction Difference Between

How To Submit Income Tax 2019 Through E Filing LHDN Malaysia

REAL ESTATE TAX EXEMPTIONS OR REBATES FOR NON RESIDENTS YLG Yazdani

REAL ESTATE TAX EXEMPTIONS OR REBATES FOR NON RESIDENTS YLG Yazdani

Service Tax Law Simplified Session Ii

Services Tax Law Practice Volume 1 And 2 By Bloomsbury India

Service Tax Law Simplified Session Ii

Explanation Of Exemptions And Rebates In Service Tax Law - Web Understanding the difference between Tax Deduction Tax Exemption and Tax Rebate Tax Among the many words that get associated with income tax two stands out the most