Export Refund Time Limit Deemed exports is furnished On perusal of the above it is clear that clause b of Explanation 2 under section 54 of the CGST Act is applicable for determining relevant

Time Limit The exporter has two years from the relevant date that is either the date of GST payment or the date of invoice issuance whichever is later to file a refund claim Application Process 1 You have to file refund application in Form GST RFD 01 at GST Portal You can file for refund of multiple tax periods in one refund application 2 You have to provide turnover

Export Refund Time Limit

Export Refund Time Limit

https://www.atozworldtrade.com/img/slide1.jpg

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

Return Refund Policy LumenZa

https://storage.googleapis.com/shy-pub/289513/1692382103131_55removebg.jpeg

GST refund process for exports under the present return filing Export with payment of IGST Exporters can claim the refund of IGST paid at the time of export The GST refund process for exports No Section 54 6 of CGST Act provides for grant of provisional refund of 90 of the total refund claim in case the claim relates to refund arising on account of zero rated

What is the time limit for claiming GST Export Refund The time limit for claiming GST Export Refunds is two years from the date of export Can I claim GST For sanction of refund Export value indicated in the tax invoice by an exporter should be the transaction value as determined in terms of section 15 of the CGST Act 2017

Download Export Refund Time Limit

More picture related to Export Refund Time Limit

L export Altoatesino Sfiora Il 10 Di Crescita Nel 2015

http://www.altoadigeinnovazione.it/wp-content/uploads/2016/03/container-export-dock-441989_1920.jpg

Time Limit For Refund Application Under GST

https://taxguru.in/wp-content/uploads/2021/08/Refund-Application.jpg

Refund A Label Created In Shippo Shippo

https://support.goshippo.com/hc/article_attachments/4870687925787/Refund_in_billing.gif

Editorial Team Everything you need to know about the export of goods with payment of IGST how to claim a refund and common problems you might face during To qualify for a refund under this procedure seeArticle 1 Directive 86 560 EEC during the refund period a business must NOT have been based in any EU country or territory

The entire process of refunding tax paid on exports of goods can be completed in seven days from the date of application submitted Online Procedure To 1 Exporting without Paying IGST Exporters can claim a refund on unutilized input credit without paying IGST upfront No separate application is needed

Refund Of ITC Paid On Exports Of Goods And Services Without Payment Of

https://tutorial.gst.gov.in/userguide/refund/assets/images/CR 22885_Image 2.png

Refund Policy Broccoli Boxes Sensory Kits For Kids

https://static.subbly.me/fs/subbly/userFiles/broccoli-boxes-606924cfed246/images/0222050740375-refund-policy.png?v=1625448404

https://cbic-gst.gov.in/pdf/Circular-166-22-2021-GST.pdf

Deemed exports is furnished On perusal of the above it is clear that clause b of Explanation 2 under section 54 of the CGST Act is applicable for determining relevant

https://www.mygstrefund.com/gst-refun…

Time Limit The exporter has two years from the relevant date that is either the date of GST payment or the date of invoice issuance whichever is later to file a refund claim Application Process

Departing 07 EXPORT

Refund Of ITC Paid On Exports Of Goods And Services Without Payment Of

SC Allows IGST Export Refund As It Was To The Extent Of Customs Component

VAT Intrastat

Latest GST Update On Cancelled Transactions Due To Lockdown Export

How To Check Your Income Tax Refund Status Arthgyaan

How To Check Your Income Tax Refund Status Arthgyaan

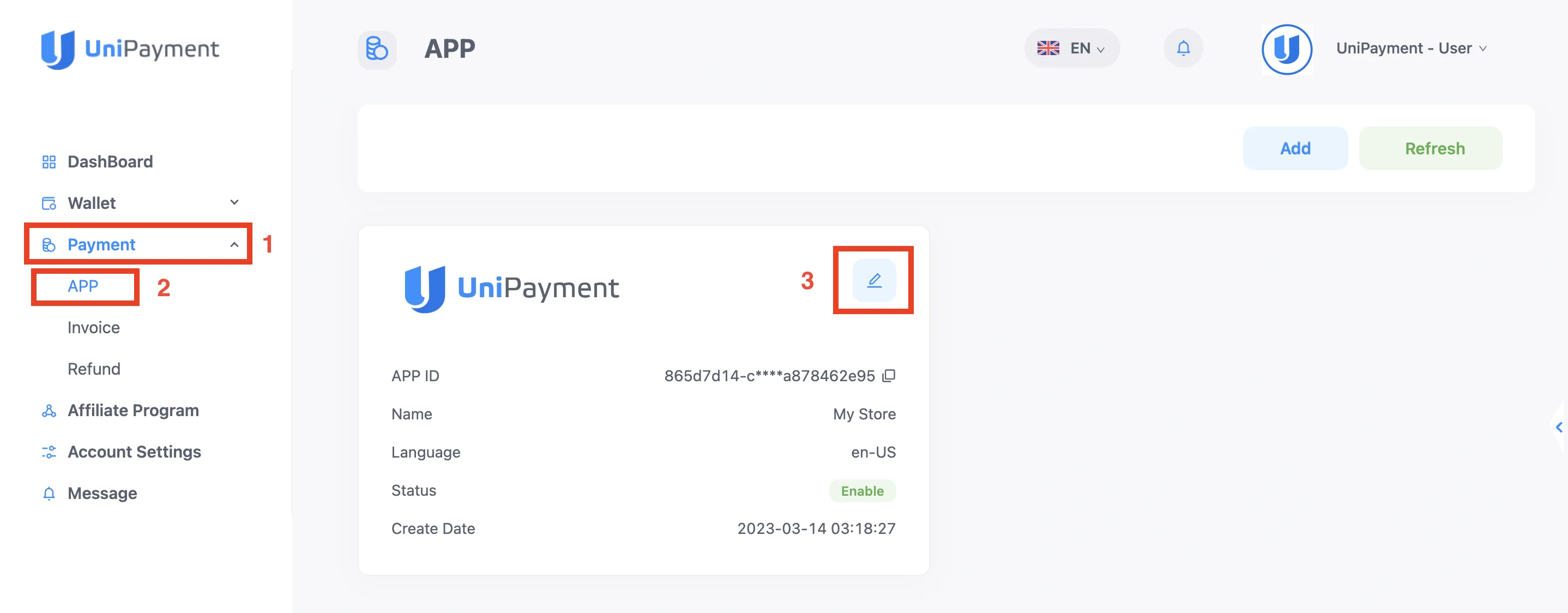

Automatic Refund Guide UniPayment

Assam Direct Recruitment Refund Application Fees Refund Date

Refund A Label Created In Shippo Shippo

Export Refund Time Limit - What is the time limit for claiming GST Export Refund The time limit for claiming GST Export Refunds is two years from the date of export Can I claim GST