Family Income Threshold For Child Care Rebate Web 30 juin 2021 nbsp 0183 32 Annual cap Families earning more than 190 015 and under 354 305 will have a subsidy cap of 10 655 per year per child Families earning under 190 015 will

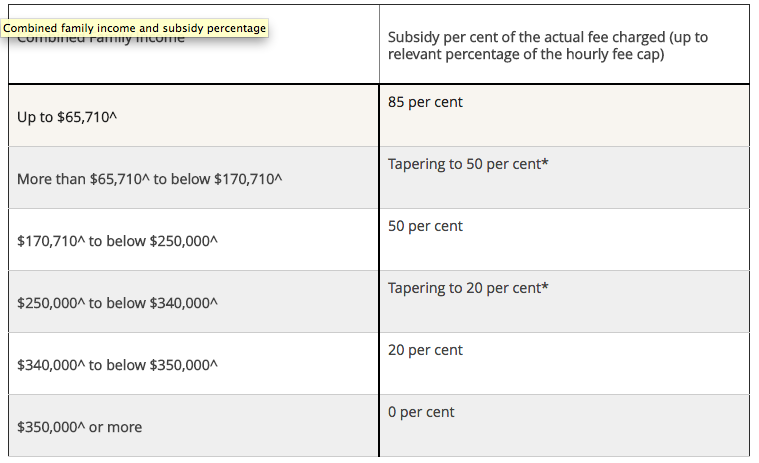

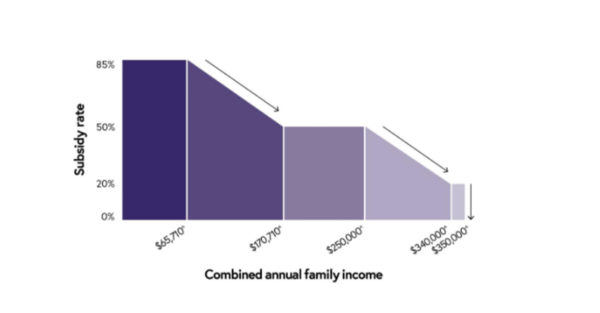

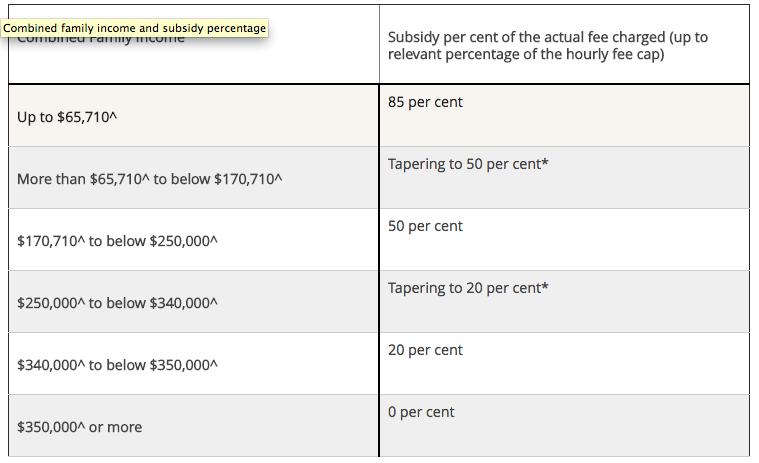

Web The Child Care Subsidy percentage you re entitled to depends on your family s income Your number of children in care can affect it You may get a higher Child Care Subsidy Web Families must meet eligibility criteria to get CCS Parents must care for their child at least 2 nights per fortnight or have 14 share of care be liable for child care fees at an

Family Income Threshold For Child Care Rebate

Family Income Threshold For Child Care Rebate

https://www.ellaslist.com.au/ckeditor_assets/pictures/1682/content_family_income_subsidy_childcare.png

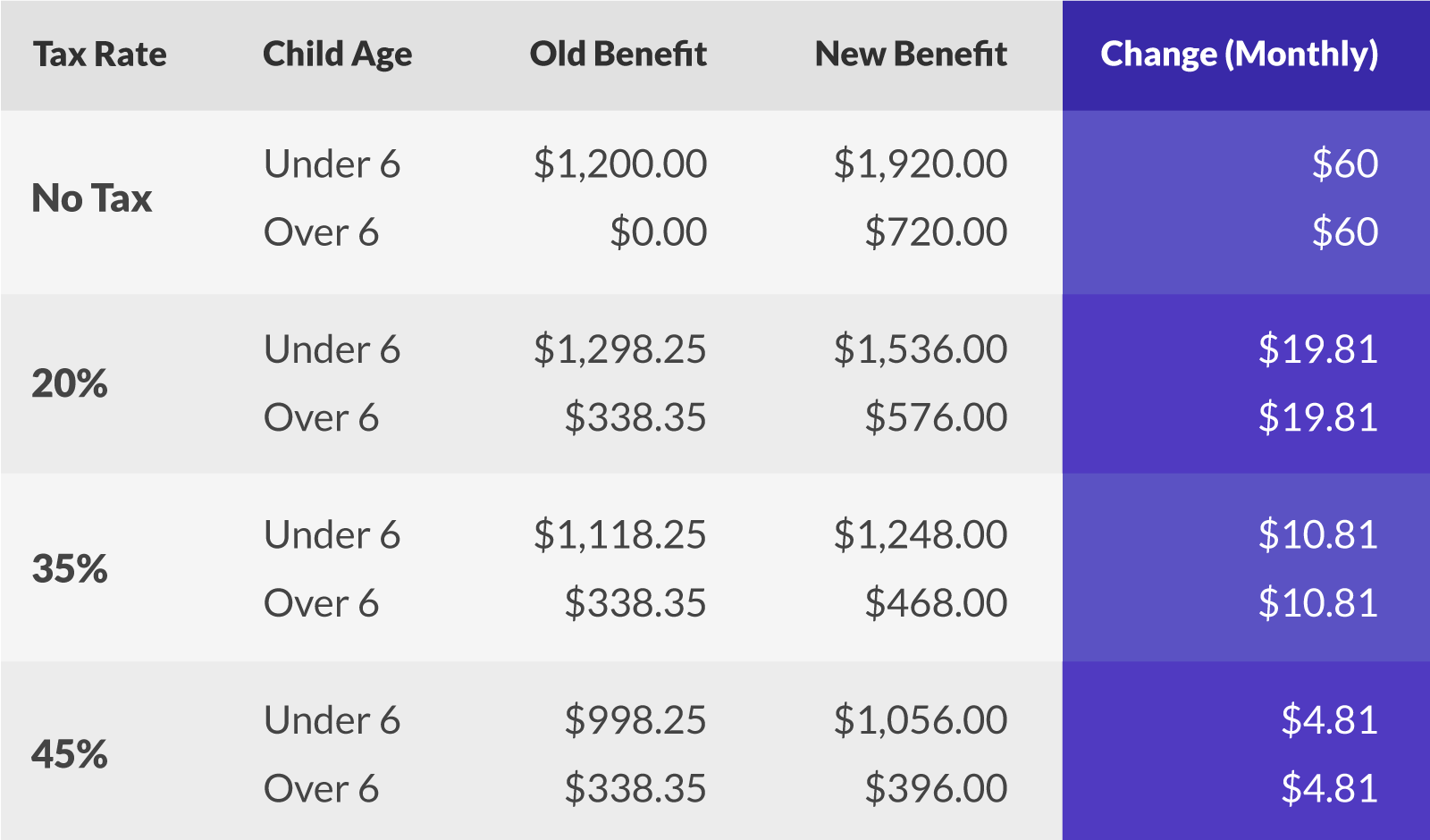

Child Care Rebate Tax Brackets 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/how-canada-s-revamped-universal-child-care-benefit-affects-you.png

Child Care Rebate Changes 2017 What It Means For You

https://cdn.newsapi.com.au/image/v1/30e248ff2877200e614bc2ca3adf011b

Web lodge a tax return tell us if you don t need to lodge a tax return You must confirm your family income by 30 June of the following financial year Read about time limits if you Web 3 juin 2009 nbsp 0183 32 From 1 July around 800 000 Australian families will receive more help with child care costs following the indexation of child care rates and changes to income

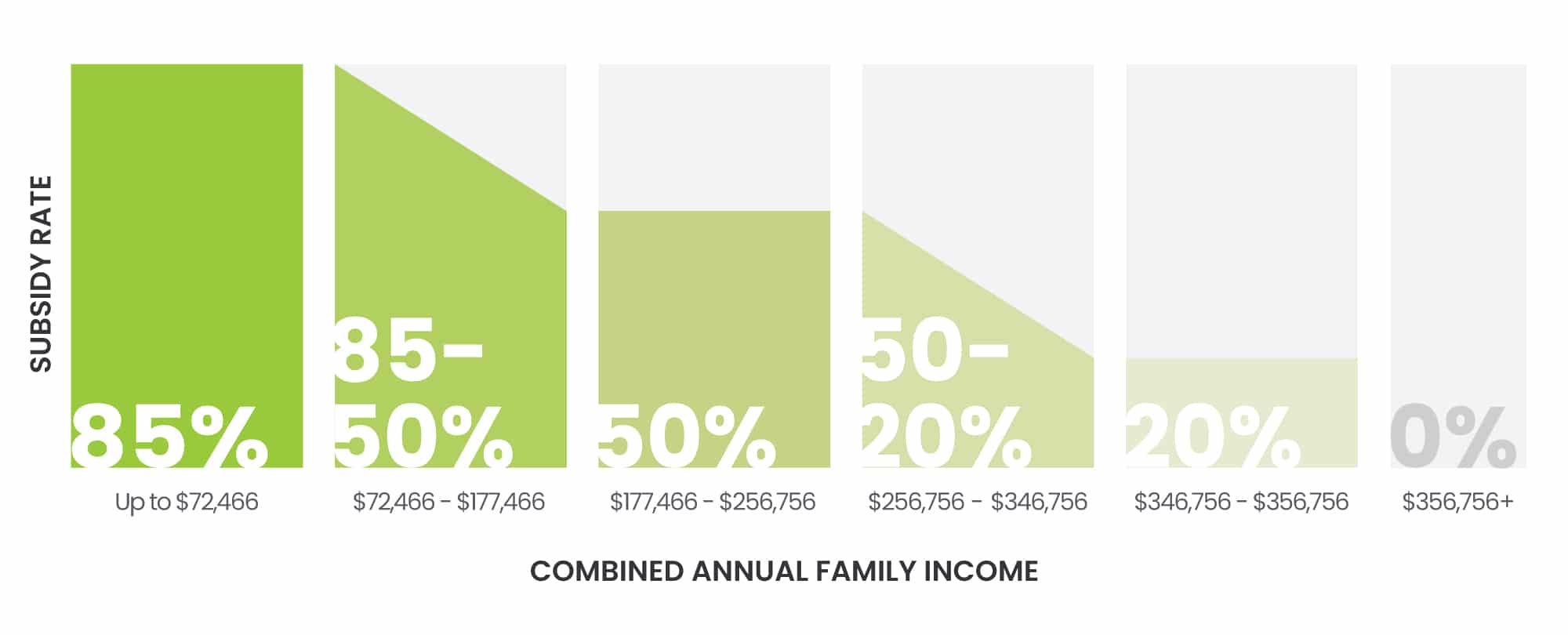

Web Child Care Subsidy Income Test 2023 Updates From July 2023 The maximum CCS rate will be lifted to 90 for families earning 80 000 or less CCS rates will be increased for Web your family s combined income is under 362 408 your family has more than one CCS eligible child aged 5 or younger If your family has more than one child aged 5 or

Download Family Income Threshold For Child Care Rebate

More picture related to Family Income Threshold For Child Care Rebate

PHI Rebates And MLS Rate And Income Threshold Pre FPHII Years

https://www.researchgate.net/profile/Zhiming-Cheng-3/publication/350891060/figure/tbl2/AS:1013006175596544@1618530901722/PHI-Rebates-and-MLS-Rate-and-Income-Threshold-Pre-FPHII-Years.png

How To Apply For Child Care Subsidy In 2022 23 SOEL

https://soel.wa.edu.au/wp-content/uploads/2022/07/child-care-subsidy-income-test-22-23.jpg

Data Stories CNS Maryland

https://cnsmaryland.org/wp-content/uploads/2023/05/Cursor_and_Child_care_prices_account_for_more_of_median_family_incomes_in_Somerset_and_Baltimore_City__data_shows_–_CNS_Maryland-640x450.png

Web 10 juil 2023 nbsp 0183 32 use an approved child care service be responsible for paying the child care fees meet residency and immunisation requirements Read the full conditions under who Web If a family earns more than 189 390 per year and less than 353 680 then the total amount of CCS they can receive in 2020 21 is 10 560 per child the annual cap Families earning less than 189 390 per year do

Web 10 juil 2023 nbsp 0183 32 The income cap for eligibility has been increased from 356 756 to 530 000 That will mean more higher income families will be eligible Caregivers don t need to do anything to get the increased rate Web Family Tax Benefit Child Care Subsidy Additional Child Care Subsidy You should check with the Australian Taxation Office if you are unsure about what income is

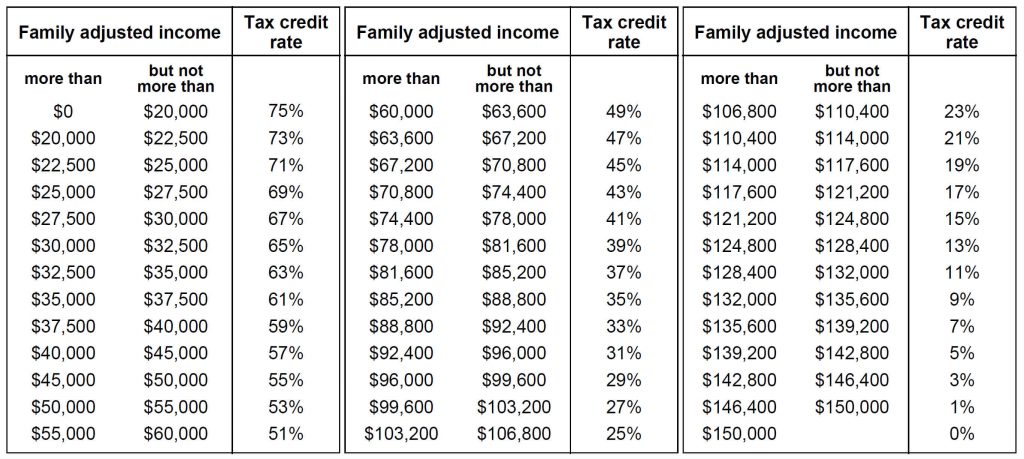

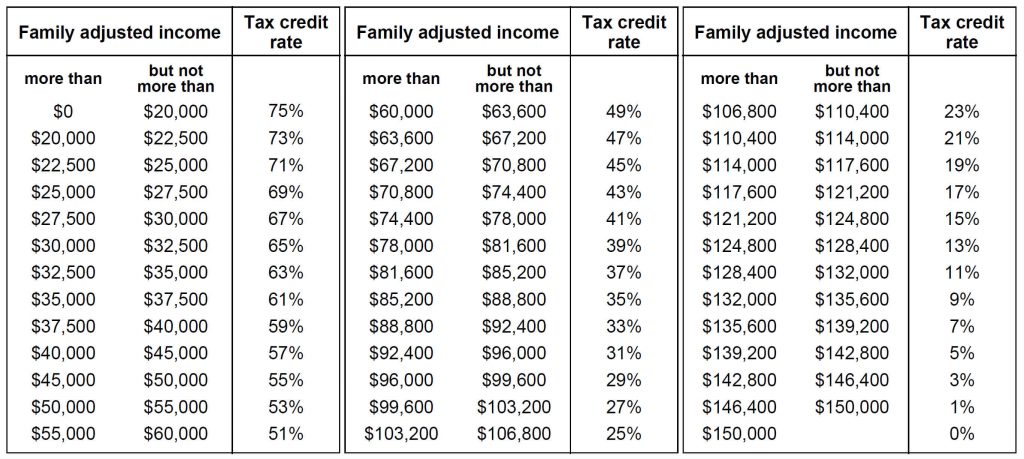

Ontario Childcare Tax Credit Refundable Tax Credit For Low income

https://www.taxory.com/wp-content/uploads/2021/01/childcare-access-and-relief-from-expenses-tax-credit-1024x459.jpg

Five Things You Need To Know About The New Child Care Subsidy

https://cdn.babyology.com.au/wp-content/uploads/2017/11/childcarerebate-600x313.jpg

https://www.education.gov.au/early-childhood/announcements/child-care...

Web 30 juin 2021 nbsp 0183 32 Annual cap Families earning more than 190 015 and under 354 305 will have a subsidy cap of 10 655 per year per child Families earning under 190 015 will

https://www.servicesaustralia.gov.au/how-much-child-care-subsidy-you...

Web The Child Care Subsidy percentage you re entitled to depends on your family s income Your number of children in care can affect it You may get a higher Child Care Subsidy

Problems Accessing Care For Previously Eligible Parents 2012 2013 And

Ontario Childcare Tax Credit Refundable Tax Credit For Low income

ECO Scheme 2018 To 2022 Government Proposals For ECO Grants

T22 0188 Repeal Child Tax Credit CTC Earned Income Threshold By

Ontario Child care Rebates Unlikely To Happen In May Sector Says

Child Care Benefit Claim Form Notes Australia Free Download

Child Care Benefit Claim Form Notes Australia Free Download

Legislator Proposes Three Child Care Rebates From Missouri ValueWalk

What The Changes To Child Care Rebates Mean For YOUR Family Keep Calm

Next Steps South West A Guide To Student Finance

Family Income Threshold For Child Care Rebate - Web your family s combined income is under 362 408 your family has more than one CCS eligible child aged 5 or younger If your family has more than one child aged 5 or