Family Pension Tax Rebate Web 12 mai 2016 nbsp 0183 32 You can claim tax relief on most contributions you make towards registered pension schemes This includes a group life policy personal non group life policy

Web 3 avr 2023 nbsp 0183 32 Tax relief is paid on your pension contributions at the highest rate of income tax you pay So Basic rate taxpayers get 20 pension tax relief Higher rate taxpayers can claim 40 pension tax relief Web 14 avr 2017 nbsp 0183 32 Standard Deduction on family pension under the new tax regime Rs 15 000 or 1 3rd of the pension amount whichever is lower Budget 2022 It has been proposed

Family Pension Tax Rebate

Family Pension Tax Rebate

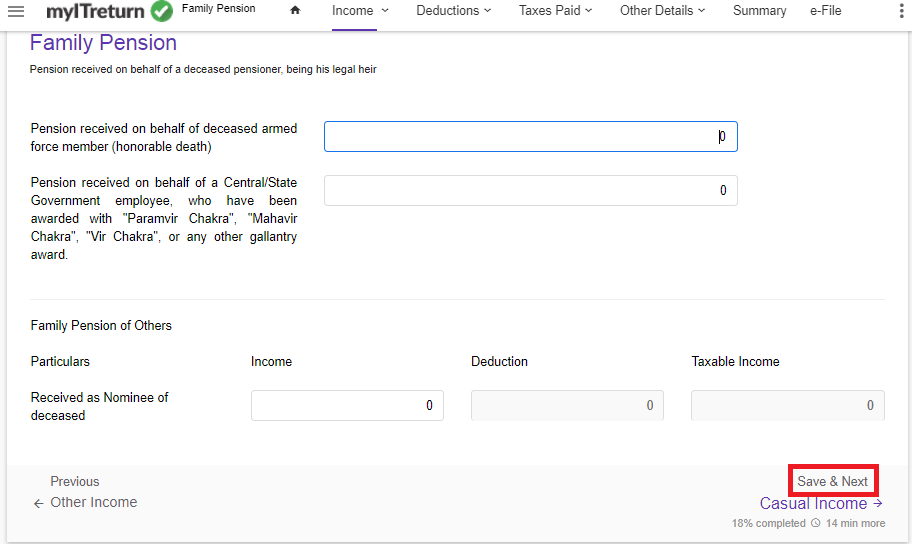

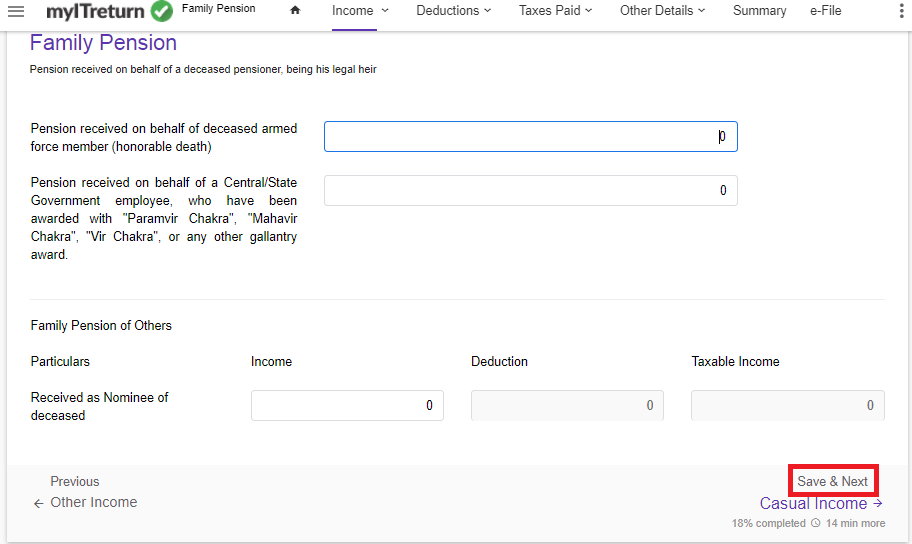

https://help.myitreturn.com/hc/article_attachments/4443201140121/mceclip2.png

How To Add Family Pension MyITreturn Help Center

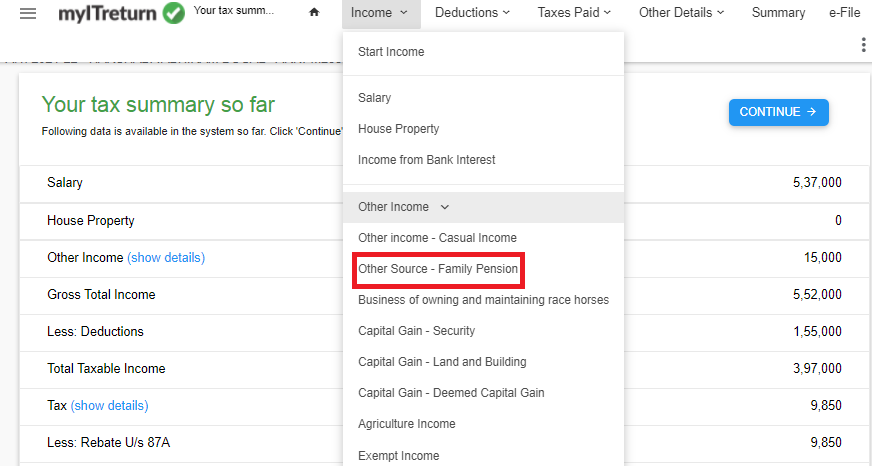

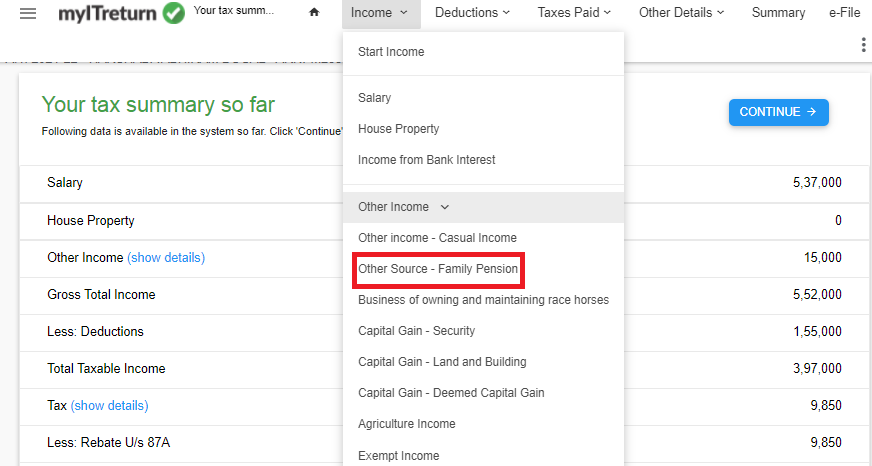

https://help.myitreturn.com/hc/article_attachments/4443198407065/mceclip1.png

How To Add Family Pension MyITreturn Help Center

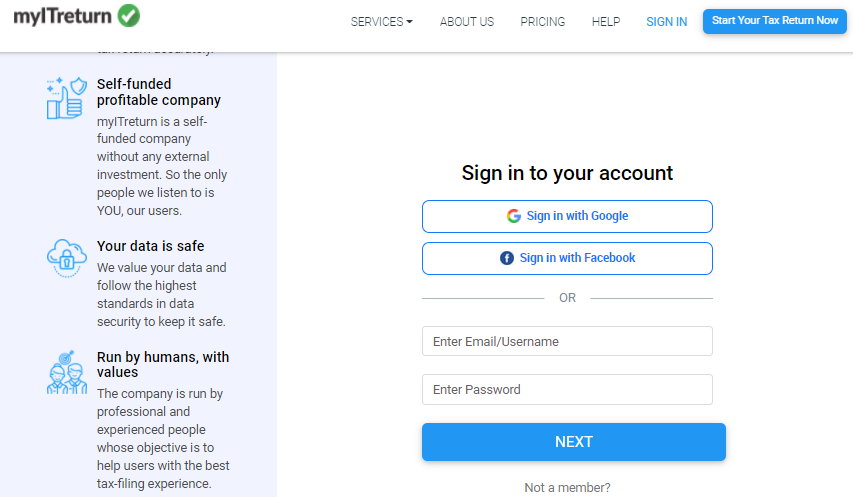

https://help.myitreturn.com/hc/article_attachments/4443213135513/mceclip0.png

Web 7 nov 2022 nbsp 0183 32 How to tell if you re due a pension tax refund You may have been affected by this and could be due a refund from HMRC if you are over 55 the age you re allowed to Web 22 avr 2022 nbsp 0183 32 Family pension exemptions on uncommuted pensions are set to a maximum of 15 000 or a third of the pension received whichever is lower The

Web 21 d 233 c 2022 nbsp 0183 32 An uncommuted amount is partially taxable The exemption applies to one third of the pension amount or Rs 15 000 whichever is lesser For instance Mr Web 7 f 233 vr 2023 nbsp 0183 32 FAMILY PENSION INCOME TAX RULES I FAMILY PENSION MEANING AND TAXABILITY I Got a Family Pension Here s What You Need to Know about the

Download Family Pension Tax Rebate

More picture related to Family Pension Tax Rebate

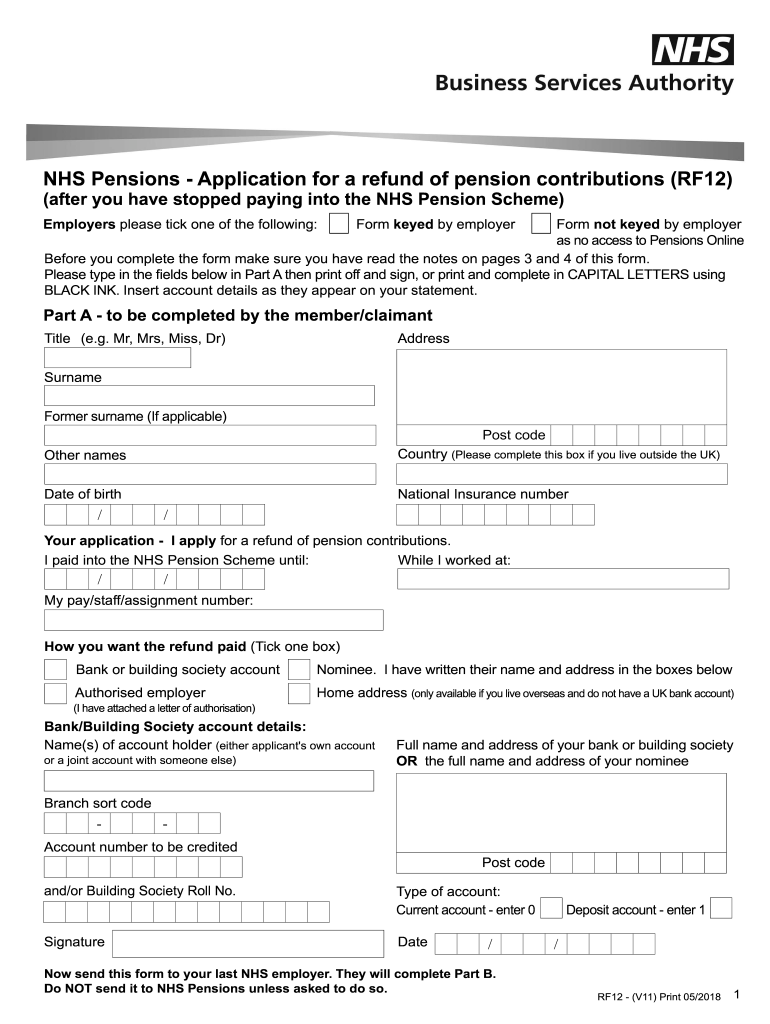

Rf12 Pension Form Nhs Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/443/483/443483630/large.png

P50 Tax Form What Is A P50 Form Swiftrefunds co uk

https://www.swiftrefunds.co.uk/wp-content/uploads/2019/04/P50-form.png

Pension Rebates

https://www.ngshire.vic.gov.au/files/assets/public/image-resources/finance-amp-customer-service/pension-cards/ineligible-cards-3.png

Web There are two ways you can get tax relief on your pension contributions These are known as relief at source and net pay If you re in a workplace pension your employer chooses Web When a pension is received by a family member of the retired individual after his death it is known as a family pension and is taxable as income from other sources as per section

Web Family pension is taxable after allowing an exemption of 33 33 or Rs 15000 whichever is less For example a family member receives a monthly pension of Rs 50 000 So Web 7 sept 2023 nbsp 0183 32 A basic rate tax relief of 20 is automatically applied on the whole amount You can claim an extra 20 tax relief on 163 30 000 the amount you paid higher rate tax

Pension Rebates

https://www.ngshire.vic.gov.au/files/assets/public/image-resources/finance-amp-customer-service/pension-cards/eligible-cards.png

Disability Support Pension With Single Parent Fortnightly Payment 944

https://i.pinimg.com/originals/e1/7e/6d/e17e6d37a3d665b894554542ada9f144.jpg

https://www.gov.uk/guidance/self-assessment-claim-tax-relief-on...

Web 12 mai 2016 nbsp 0183 32 You can claim tax relief on most contributions you make towards registered pension schemes This includes a group life policy personal non group life policy

https://www.which.co.uk/money/pensions-an…

Web 3 avr 2023 nbsp 0183 32 Tax relief is paid on your pension contributions at the highest rate of income tax you pay So Basic rate taxpayers get 20 pension tax relief Higher rate taxpayers can claim 40 pension tax relief

Pension Rebates

7th Pay Commission How To Calculate Your Latest Pension Oneindia News

SEMAINE NATIONALE DES PENSIONS DE FAMILLE APR MIS

Working With Pensions Contingent Tax Liabilities For Family Law

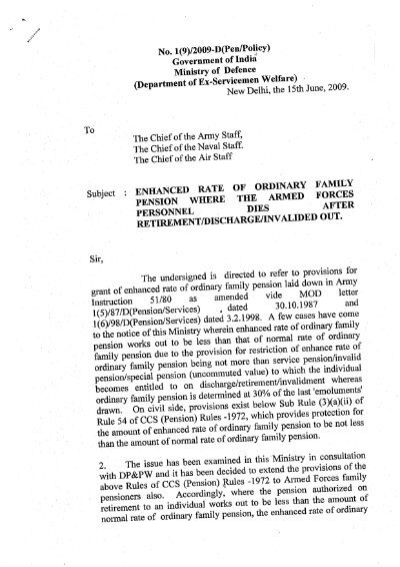

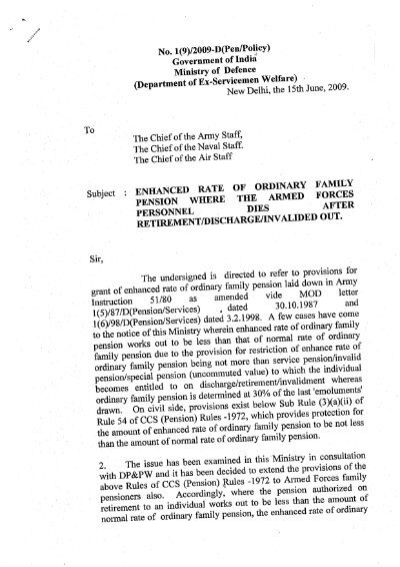

Enhanced Rate Of Ordinary Family Pension Where The Armed Forces

Enhanced Rate Of Ordinary Family Pension Where The Armed Forces

D finition De Pension De Famille Dictionnaire Fran ais

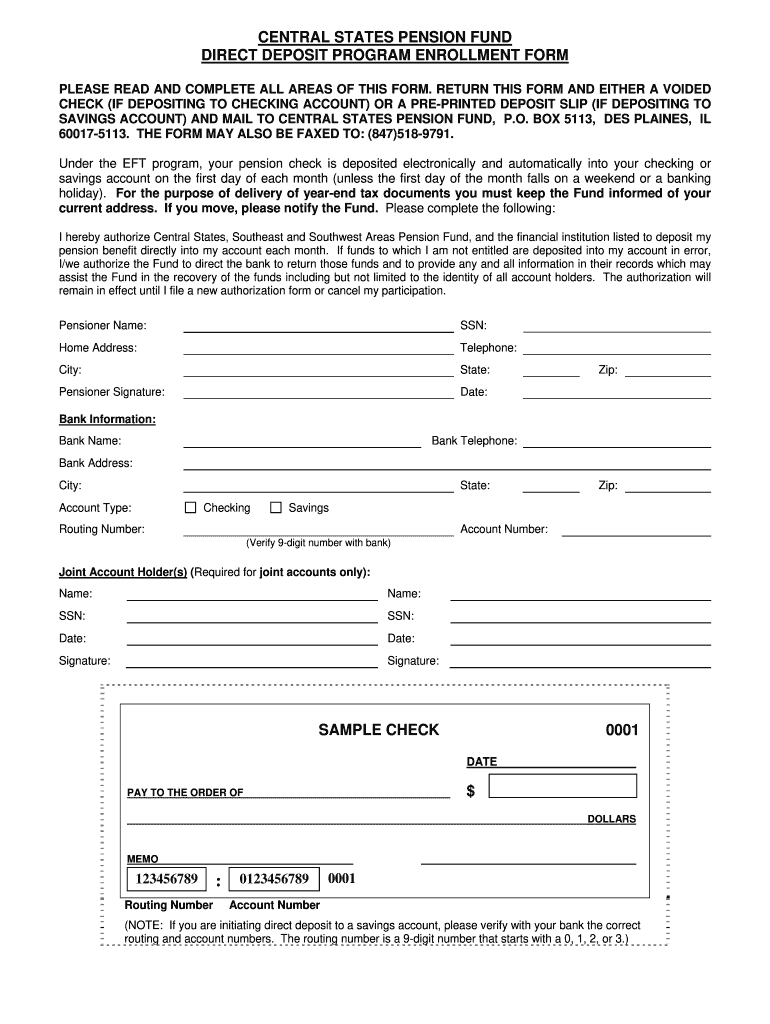

Pension Direct Deposit Form Fill Out Sign Online DocHub

Illinois Families To Receive Tax Rebates Thanks To Joyce supported Measure

Family Pension Tax Rebate - Web 21 d 233 c 2022 nbsp 0183 32 An uncommuted amount is partially taxable The exemption applies to one third of the pension amount or Rs 15 000 whichever is lesser For instance Mr