Family Tax Benefit Calculator Part B The amount of Family Tax Benefit Part B we ll pay you depends on the age of your youngest child and your income Income test for FTB Part A The amount of Family Tax Benefit FTB Part A you get depends on your family s income

Your payments will reduce by 0 20 for each dollar of income earned over 6 497 You won t be eligible for FTB part B when the secondary earner s salary is over 30 149 Family Tax Benefit Part A and Part B Calculator in Australia Centrelink Payment and Service Finder can help you work out how much money you may get It can work out amounts of Centrelink payments including pensions and allowances Family Tax Benefit child care fee assistance To use the Payment and Service Finder answer the questions and choose a payment you want to estimate

Family Tax Benefit Calculator Part B

Family Tax Benefit Calculator Part B

https://i0.wp.com/smarterflorida.com/wp-content/uploads/2013/09/SNAP-Average-Monthly-Benefit-Amount-for-2022.png?ssl=1

Family Tax Benefit Calculator HaleafSylvi

https://i.pinimg.com/originals/41/63/8f/41638fad4707b0e86cf27ceae235b0fc.jpg

Family Tax Benefit Calculator FAMILY TAX BENEFIT CALCULATOR

http://bit.ly/TfRHKM

There are 2 parts to FTB Find out more about eligibility on the Services Australia website FTB Part A eligibility FTB Part B eligibility Find out more about how much you can get on the Services Australia website How to get it Claim online Sign in to myGov to start a claim Family Tax Benefit Family Tax Benefit FTB is a payment that helps eligible families with the cost of raising children It is made up of two parts FTB Part A is paid per child and the amount paid is based on the family s circumstances FTB Part B is paid per family and gives extra help to single parents and some couple families

Family Tax Benefit Part B provides extra assistance to single parent families and families with one main income Family Tax Benefit Part B is subject to an income test and can be paid until the youngest child in your care turns 16 or until the end of the calendar year in which they turn 18 if they are in full time secondary study provided Key facts Family Tax Benefit FTB is a government payment to help with the cost of raising children It is made up of 2 parts Part A and Part B You need to meet certain requirements to be eligible for these payments What is the Family Tax Benefit Who is eligible for Family Tax Benefit Part A How much does the Family Tax Benefit Part A

Download Family Tax Benefit Calculator Part B

More picture related to Family Tax Benefit Calculator Part B

.png)

Maternity Leave Benefit Calculator In Excel Free Download

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi1MrG23e0s_qKTlKXeSlVAzIh3yCpPMGTmD-5gfBes-Q94_lYEhb1vlyxTUYXsZpUU7Yg1Iu3-qpyvR7VjO1rOvR23GQw2q4ldDlrPBZnrZZgQbJrsodY4O9XUs3KDwZrbl9tvGbop_dnxfvaJl0QxVK4kfSFtwkned6dg1o6mACZiHEC2GmDVWIgq/s1920/Photo_1651079444090 (1).png

Family Tax Benefit PART A PART B Care For Kids

https://www.careforkids.com.au/image/blog/socialimage/cd7ae634-c645-4db7-b26e-f7c1993bdc9d

Foreign Social Security Taxable In Us TaxableSocialSecurity

https://i0.wp.com/cdn2.hubspot.net/hub/109376/file-1514722889-jpg/images/SocialSecurityWorksheet.jpg

Calculating the FTB Part B rate The rate of FTB Part B is affected by the age of the youngest child whether the individual is a single parent or a member of a couple whether the individual is a grandparent or great grandparent the level of income shared care and parental leave pay Effect on standard rate of FTB Part B because of PLP 3 1 1 20 Current FTB rates income test amounts Summary This topic includes FTB Part A standard rates FTB Part A supplement FTB Part B standard rates FTB Part B supplement FTB Part B primary income earner limit 1 1 I 45 income free area higher income free area maintenance income free area newborn supplement newborn upfront

What are the rates for the Family Tax Benefit Part A and Family Tax Benefit Part B in 2022 Find out about eligibility and how to claim Payment rate is given based on family s income over the financial year The amount of benefit given for FTB Part A depends on family income number of children and their age Here you can calculate payment rate for FTB Part A using this simple online Australian Family Tax Benefit Calculator

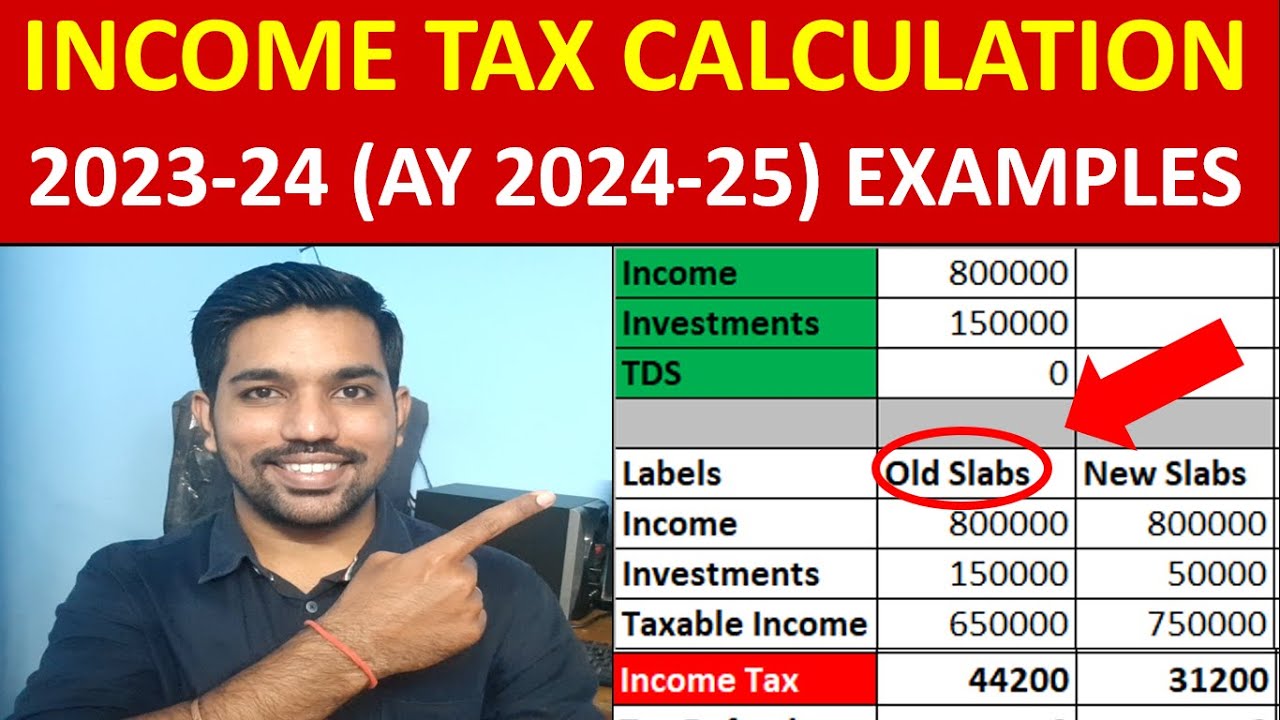

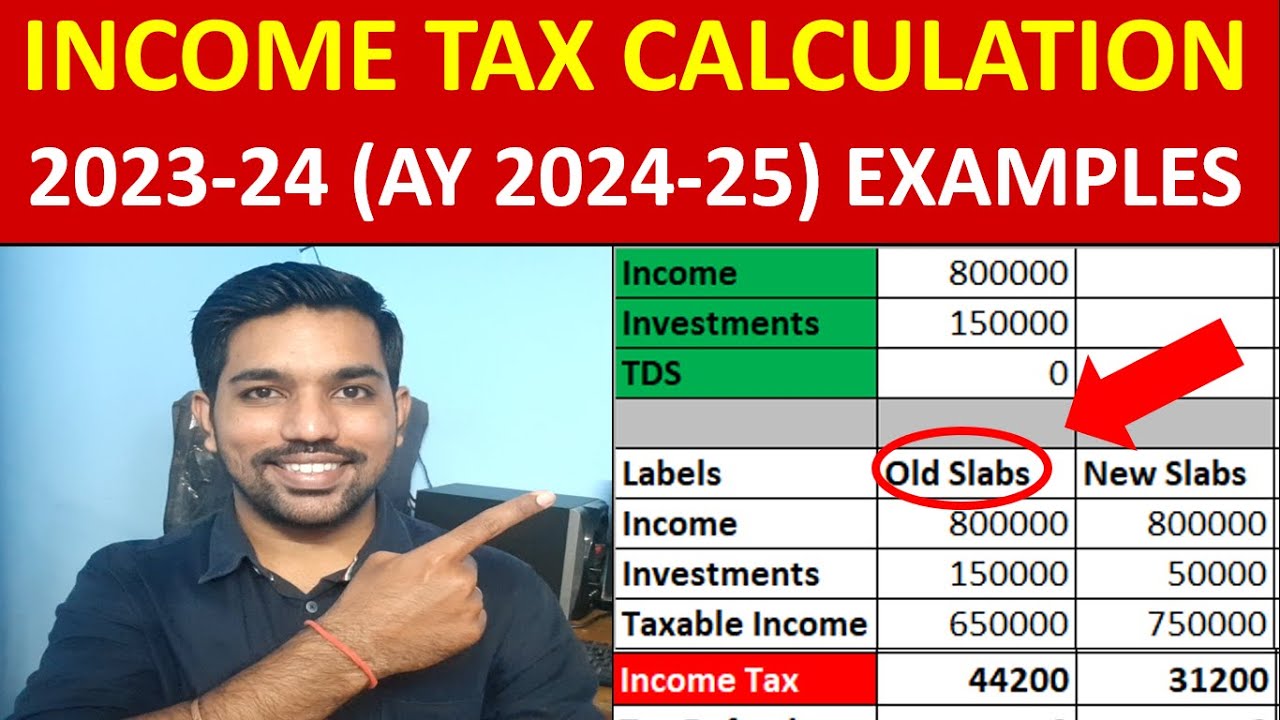

How To Calculate Income Tax 2023 24 AY 2024 25 Tax Calculation

https://i.ytimg.com/vi/H0NdeSQ2ZKQ/maxresdefault.jpg

Family Tax Benefit Residential Property Or Estate Tax Concept Stock

https://thumbs.dreamstime.com/z/family-tax-benefit-residential-property-estate-concept-members-house-dollar-money-bags-rows-rising-coins-depicts-home-195723204.jpg

https://www.servicesaustralia.gov.au/how-much...

The amount of Family Tax Benefit Part B we ll pay you depends on the age of your youngest child and your income Income test for FTB Part A The amount of Family Tax Benefit FTB Part A you get depends on your family s income

https://www.bigdream.com.au/family-tax-benefit-calculator

Your payments will reduce by 0 20 for each dollar of income earned over 6 497 You won t be eligible for FTB part B when the secondary earner s salary is over 30 149 Family Tax Benefit Part A and Part B Calculator in Australia Centrelink

Tax Calculator 2022 Working Out Tax Relief After 2022 Australian

How To Calculate Income Tax 2023 24 AY 2024 25 Tax Calculation

How Does Family Tax Benefit Really Work Grandma s Jars

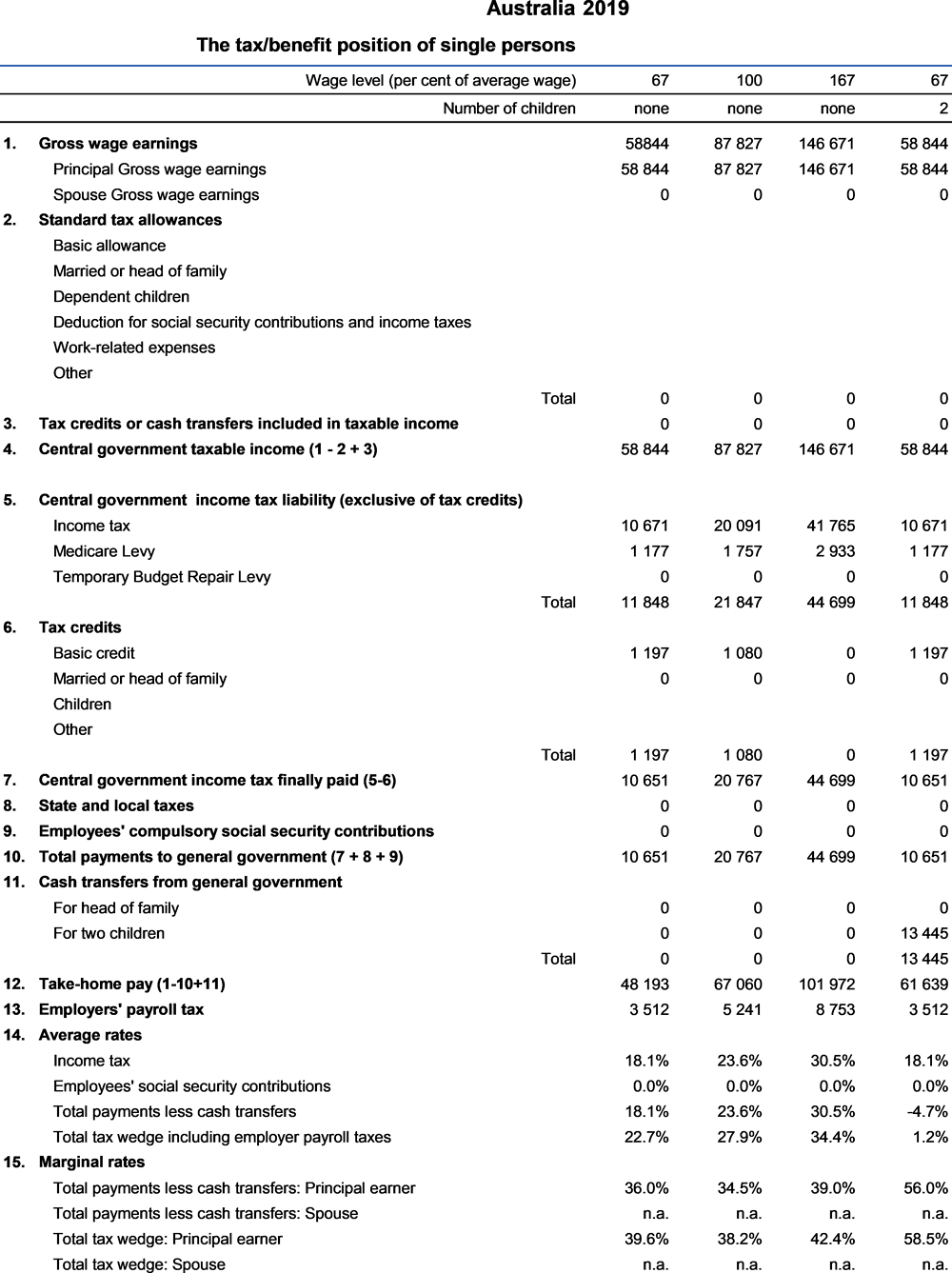

Australia Taxing Wages 2020 OECD ILibrary

Family Tax Benefit Cuts More Than 130 000 Single Parents Would Lose Out

Family Tax Benefit Calculator HaleafSylvi

Family Tax Benefit Calculator HaleafSylvi

Family Tax Benefit Part A Base Rate Tax Walls

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

Home Loan Tax Benefits Calculator

Family Tax Benefit Calculator Part B - Key facts Family Tax Benefit FTB is a government payment to help with the cost of raising children It is made up of 2 parts Part A and Part B You need to meet certain requirements to be eligible for these payments What is the Family Tax Benefit Who is eligible for Family Tax Benefit Part A How much does the Family Tax Benefit Part A