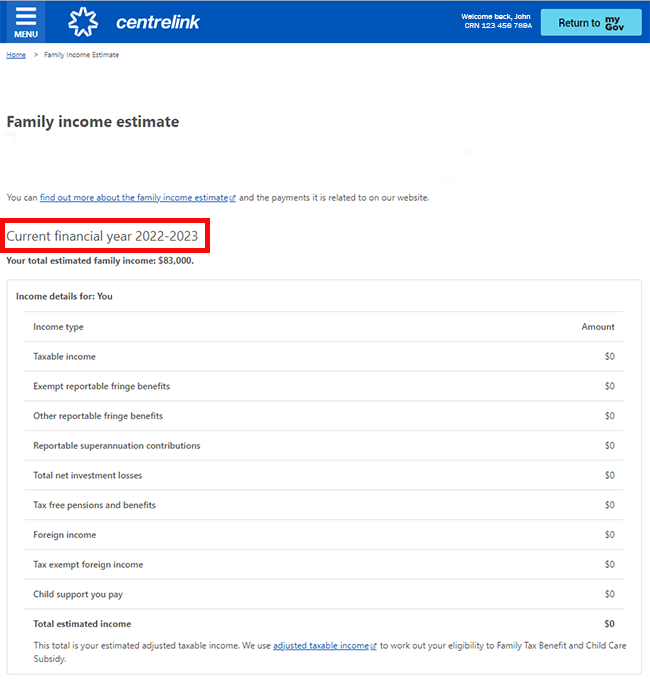

Family Tax Benefit Household Income Complete the following steps to claim Family Tax Benefit Before you start check if you can get it Your options and obligations for Family Tax Benefit We compare your income estimate with

The standard rate of FTB Part A is the maximum annual amount payable for all FTB children based on their age without including the supplements and without applying the Family Tax Benefit FTB is a payment from Services Australia Who can get it To get this you must have a dependent child or full time secondary student aged 16 to 19 who isn t getting a pension payment or

Family Tax Benefit Household Income

Family Tax Benefit Household Income

https://indianpsu.com/wp-content/uploads/2022/03/Income-Tax-scaled.jpg

How To Claim The Family Tax Benefit One Accountancy

https://oneaccountancy.com.au/wp-content/uploads/2022/09/Lodgment-Reminder-Family-Tax-Benefit-Recipients-e1663163157328.png

Claim For An Annual Lump Sum Payment Of Family Tax Benefit

https://img.yumpu.com/32296971/1/500x640/claim-for-an-annual-lump-sum-payment-of-family-tax-benefit.jpg

FTB Part B provides extra help for single parent families and couple families 1 1 M 50 with one main income earner General provisions for eligibility apply to individuals Family Tax Benefit Family Tax Benefit FTB is a payment that helps eligible families with the cost of raising children Visit the Services Australia website to learn more about eligibility and applying for the Family Tax Benefit Opens in a

To qualify for the FTB a person must meet an income test The FTB Part A is paid per child The amount an applicant will receive depends on their family s circumstances have an Families with an adjusted taxable income between 62 634 and 111 398 will have their FTB Part A rate reduced by 20 cents for every dollar of income over 62 634 Your payment will stop reducing when it reaches the

Download Family Tax Benefit Household Income

More picture related to Family Tax Benefit Household Income

Solved 2 EJ Company s Taxable Income In Four Previous Years Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/56a/56afedef-cacb-4e5f-9a43-a87b2c6770b5/phpzGNXP7.png

Income Classification Malaysia JasmineewaLeach

https://25174313.fs1.hubspotusercontent-eu1.net/hub/25174313/hubfs/Imported_Blog_Media/income-classification1-2.jpg?width=1080&height=1080&name=income-classification1-2.jpg

Family Tax Benefit PART A PART B Care For Kids

https://www.careforkids.com.au/image/blog/socialimage/cd7ae634-c645-4db7-b26e-f7c1993bdc9d

The first tax benefit Part A is per eligible child you care for the second Part B is paid out per family for single parent families non parental carers and for some families that only have the one main source of income Family Tax Benefit Part B is paid per family for single parent families non parent carers and some families that have only one main income Parents and carers of children with disability or

In Australia there are two main categories of Family Tax Benefits Part A and Part B Part A offers a payment for each child with the sum determined by factors such as your Families earning up to 80 000 are able to have up to 90 of their child care costs subsidised If you earn over 80 000 you may still be eligible for a subsidy starting from 90

Income Tax Benefits On Housing Loan In India

https://blog.saginfotech.com/wp-content/uploads/2016/09/income-tax-benefit.jpg

How Does Family Tax Benefit Really Work Grandma s Jars

https://grandmasjars.com/wp-content/uploads/2018/03/income-level.png

https://www.servicesaustralia.gov.au › family-tax-benefit

Complete the following steps to claim Family Tax Benefit Before you start check if you can get it Your options and obligations for Family Tax Benefit We compare your income estimate with

https://guides.dss.gov.au › family-assistance-guide

The standard rate of FTB Part A is the maximum annual amount payable for all FTB children based on their age without including the supplements and without applying the

Proposed Legislation The Tax Relief For American Families And Workers

Income Tax Benefits On Housing Loan In India

Family Tax Benefit Residential Property Or Estate Tax Concept Stock

You re Richer Than You Realize A New Record In Median Household Income

Family Income Benefit Life Assurance Tailored To Your Family Needs

Florida Food Stamps Calculator Smarter Florida

Florida Food Stamps Calculator Smarter Florida

Centrelink Online Account Help Update Your Family Income Estimate And

General Income Tax And Benefit Guide

Income Tax Benefits On Home Loan Loanfasttrack

Family Tax Benefit Household Income - We use your family income estimate to work out how much family assistance to pay you This includes Family Tax Benefit FTB and Child Care Subsidy CCS