Family Tax Benefit Part A Calculator Rdl Verkko The max FTB part A payment you can get is 6 380 when your salary is no more than 62 634 If your taxable income is between 62 634 and 111 398 the FTB part A

Verkko We use an income test if your family s adjusted taxable income is between 62 634 and 111 398 This test reduces your FTB Part A by 20 cents for each dollar of income Verkko How much you can get How much Family Tax Benefit FTB you may get How much you get depends on your situation Read more about FTB Part A payment rates You

Family Tax Benefit Part A Calculator Rdl

Family Tax Benefit Part A Calculator Rdl

https://i.ytimg.com/vi/2AgLUdh9nOw/maxresdefault.jpg

What The Family Tax Benefits Changes Could Mean For You Sunshine

https://media.apnarm.net.au/media/images/2015/09/28/IQT_29-09-2015_OPINION_02_ThinkstockPhotos-200405397-001.1_fct1024x768_ct1880x930.jpg

Australia Family Tax Benefit Supplements Payments Requirements

https://ncblpc.org/wp-content/uploads/2023/11/Australia-Family-Tax-Benefit.png

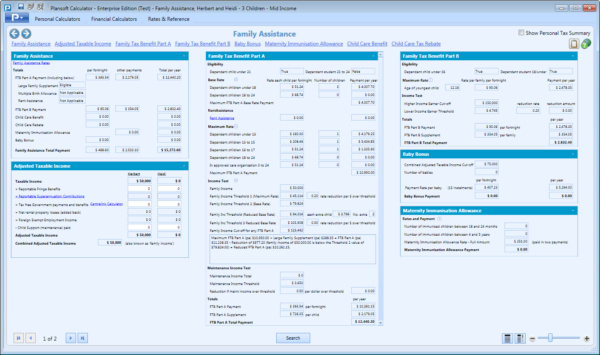

Verkko Family Tax Benefit Entitlement for 30 June 07 Child 5 DOB Nights in care May get Rental Assistance Expected Family Tax Benefit Part A 0 00 Expected Family Tax Verkko Payment rate is given based on family s income over the financial year The amount of benefit given for FTB Part A depends on family income number of children and their

Verkko We look beyond the numbers Services Contact Us Connect with a Specialist RDL Accountants is a leading Business Accountant in Melbourne providing a full range of Verkko 2 tammik 2024 nbsp 0183 32 Introduction This section includes information on FTB objectives FTB eligibility FTB Part A components FTB Part B components determining FTB rates

Download Family Tax Benefit Part A Calculator Rdl

More picture related to Family Tax Benefit Part A Calculator Rdl

Buy Casio Fx 82Ex Original Scientific Calculator Classwiz 274 Function

https://m.media-amazon.com/images/I/71inCeL96aL.jpg

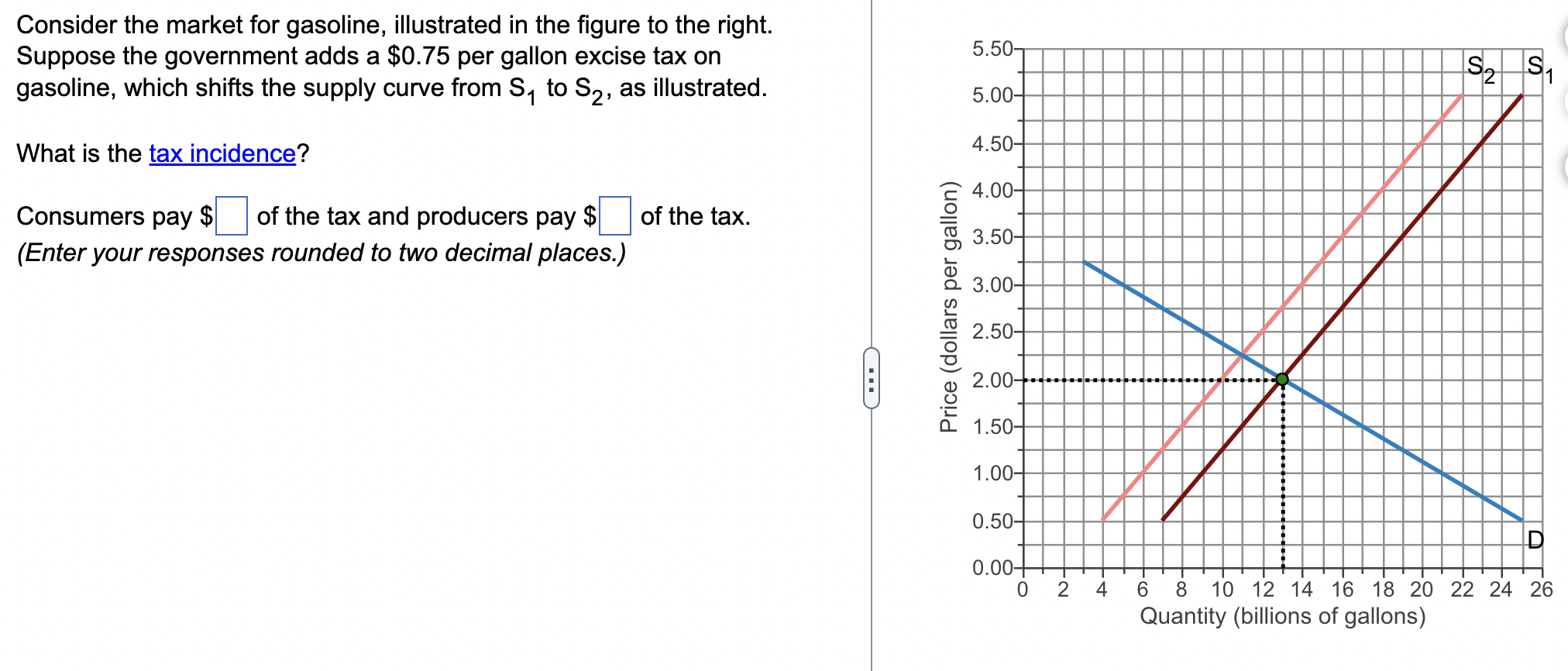

Solved Consider The Market For Gasoline Illustrated In The Chegg

https://media.cheggcdn.com/media/706/706a7674-f636-4129-a547-f01ab2477fa2/phpALGld6

Claim For An Annual Lump Sum Payment Of Family Tax Benefit

https://img.yumpu.com/32296971/1/500x640/claim-for-an-annual-lump-sum-payment-of-family-tax-benefit.jpg

Verkko 1 elok 2010 nbsp 0183 32 Introduction This section outlines how to calculate FTB Part A using Method 2 In this section This section contains the following topics 3 1 8 10 Method 2 Verkko It is made up of two parts FTB Part A is paid per child and the amount paid is based on the family s circumstances FTB Part B is paid per family and gives extra help to

Verkko Cost of Living Comparison Canstar Account What are the rates for the Family Tax Benefit Part A and Family Tax Benefit Part B in 2022 Find out about eligibility and Verkko Family Tax Benefit FTB is a 2 part payment for eligible families to help with the cost of raising children The Family Tax Benefit is made up of 2 parts Part A a payment

Locui Fals Sunet How Much Percentage Calculator R d cin Zdrobi Lene

https://www.calconi.com/assets/pics/rechner/en/percent.png

Understanding The Family Tax Benefit TaxLeopard

https://taxleopard.com.au/wp-content/uploads/family-tax-benefit.jpeg

https://www.bigdream.com.au/family-tax-benefit-calculator

Verkko The max FTB part A payment you can get is 6 380 when your salary is no more than 62 634 If your taxable income is between 62 634 and 111 398 the FTB part A

https://www.servicesaustralia.gov.au/income-test-for-family-tax-benefit...

Verkko We use an income test if your family s adjusted taxable income is between 62 634 and 111 398 This test reduces your FTB Part A by 20 cents for each dollar of income

Can I Invest In Edelweiss Multi Asset Allocation Fund For Higher Tax

Locui Fals Sunet How Much Percentage Calculator R d cin Zdrobi Lene

Australia Family Tax Benefit 2024 Who Is Eligible What Are The Part

Family Tax Benefit Part A

What Is Family Tax Benefit And Is It Taxable Income

Tax Deductions List Artofit

Tax Deductions List Artofit

Plansoft Products Calculator Features Family Assistance Estimates

Shifting Retirement Assets From Tax Deferred To Tax Now By 2026

Is Child Support Taxable Income Child Support Australia

Family Tax Benefit Part A Calculator Rdl - Verkko Family Tax Benefit Entitlement for 30 June 07 Child 5 DOB Nights in care May get Rental Assistance Expected Family Tax Benefit Part A 0 00 Expected Family Tax