Family Tax Benefit Rebate Web You may be eligible for the Economic Support Payment If you claim Family Tax Benefit as a lump sum you ll get the payment with your lump sum amount if you re eligible How much you get depends on your situation Read more about FTB Part A payment rates

Web Raising kids Growing up Top payments Child Care Subsidy How to manage your payment If you get both Child Care Subsidy and Family Tax Benefit If you get both Child Care Subsidy and Family Tax Benefit We pay both the subsidy and Family Tax Benefit FTB based Web We start balancing your Family Tax Benefit FTB for 2022 23 from July on this page What information we need to balance your FTB If you separated from a partner If you were single and got an income support payment What information we need to balance your FTB

Family Tax Benefit Rebate

Family Tax Benefit Rebate

https://grandmasjars.com/wp-content/uploads/2018/03/income-level.png

Pennsylvanians For The U S FairTax Act Contact The PA FairTax

http://www.pafairtax.org/images/FTrebatetable.jpg

Family Assistance Legislation Amendment Participation Requirement

http://www.aph.gov.au/binaries/library/pubs/bd/2009-10/10bd044_001.gif

Web 14 ao 251 t 2023 nbsp 0183 32 family allowance at the minimum and more than minimum rate Family tax payment FTP Part A and Family tax assistance FTA Part A FTB Part B replaced basic PP guardian allowance FTP Part B FTA Part B dependent spouse rebate with Web The Family Energy Rebate helps NSW family households with dependent children cover the costs of their energy bills The rebate gives eligible energy account holders a credit on an energy bill of up to 180 It is available for both retail and on supply customers

Web 21 mars 2023 nbsp 0183 32 Eligible retail applicants can get 180 per year from the NSW Family Energy Rebate without a DHS Concession Card or Health Care Card However if you have a DHS Concession Card or Health Care you can get 250 per year by combining the NSW Web The NSW Family Energy Rebate is up to 198 per embedded network on supply household per financial year You will also receive a one off 500 National Energy Bill Relief Household Payment in financial year 2023 24 if you meet the eligibility criteria your

Download Family Tax Benefit Rebate

More picture related to Family Tax Benefit Rebate

Family Tax Benefit Freeze To Pay For Childcare Plan

https://cdn.thinglink.me/api/image/901083684080189442/1024/10/scaletowidth#tl-901083684080189442;1043138249'

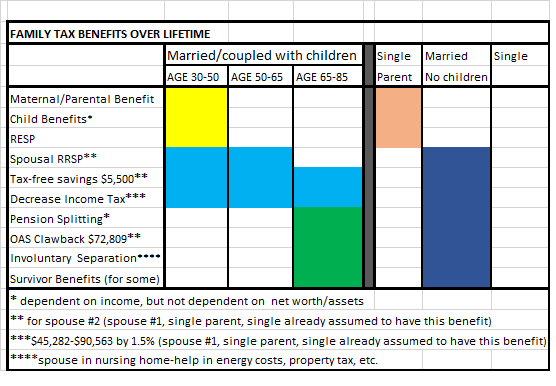

Divorced separated Financial Fairness For Singles

http://www.financialfairnessforsingles.ca/wp-content/uploads/2016/08/family-tax-benefits-over-lifetime1.png

Family Tax Benefit Form Pdf Australian Guid Step by step Instructions

https://fatlosslabs.com/blogimgs/https/cip/data.formsbank.com/pdf_docs_html/199/1991/199152/page_1_thumb_big.png

Web A credit of up to 180 can be applied to an eligible energy account holder s energy bill as a result of the Family Energy Rebate Those who qualified for and received the Family Tax Benefit FTB from the Department of Human Services DHS in the prior fiscal year are Web We pay Family Tax Benefit FTB Part A per child The amount we pay you depends on your family s circumstances FTB Part B eligibility We may pay you FTB Part B if you re a single parent a grandparent carer or if you re a member of a couple with one main income

Web The NSW Family Energy Rebate helps people with dependent children pay their electricity bills The NSW Family Energy Rebate is up to 180 per retail on market household per financial year You will also receive a one off 500 National Energy Bill Web What the maximum rate is The maximum rate for FTB Part A depends on the age of the child you get it for The maximum rate for each child per fortnight is 213 36 for a child 0 to 12 years 277 48 for a child 13 to 15 years 277 48 for a child 16 to 19 years

How To Calculate Family Tax Benefit

https://goldenopportunities.ca/wp-content/uploads/2018/11/Maximize-Family-Assets-with-Tax-Credits.png

Family Tax Benefit Form Pdf Australian Guid Step by step Instructions

https://fatlosslabs.com/blogimgs/https/cip/data.formsbank.com/pdf_docs_html/347/3479/347914/page_1_thumb_big.png

https://www.servicesaustralia.gov.au/how-much-family-tax-benefit-you...

Web You may be eligible for the Economic Support Payment If you claim Family Tax Benefit as a lump sum you ll get the payment with your lump sum amount if you re eligible How much you get depends on your situation Read more about FTB Part A payment rates

https://www.servicesaustralia.gov.au/if-you-get-both-child-care-subsidy...

Web Raising kids Growing up Top payments Child Care Subsidy How to manage your payment If you get both Child Care Subsidy and Family Tax Benefit If you get both Child Care Subsidy and Family Tax Benefit We pay both the subsidy and Family Tax Benefit FTB based

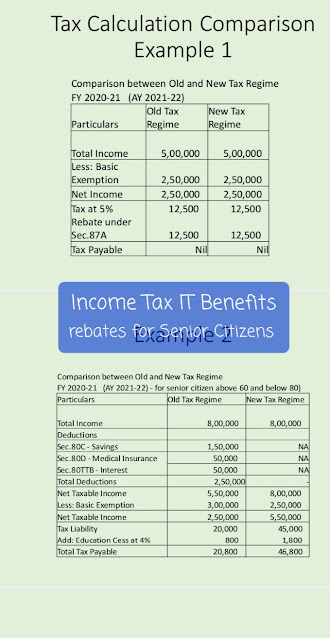

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

How To Calculate Family Tax Benefit

Anything To Everything Income Tax Guide For Individuals Including

Centrelink Online Account Help Update Your Child s Education Details

Social Issues Parliament Of Australia

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

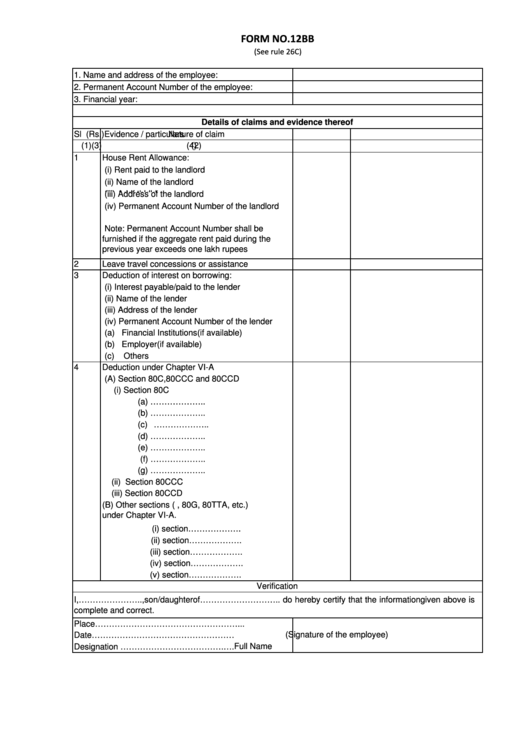

Form 12 Bb Form To Claim Income Tax Benefits Rebate Printable Pdf

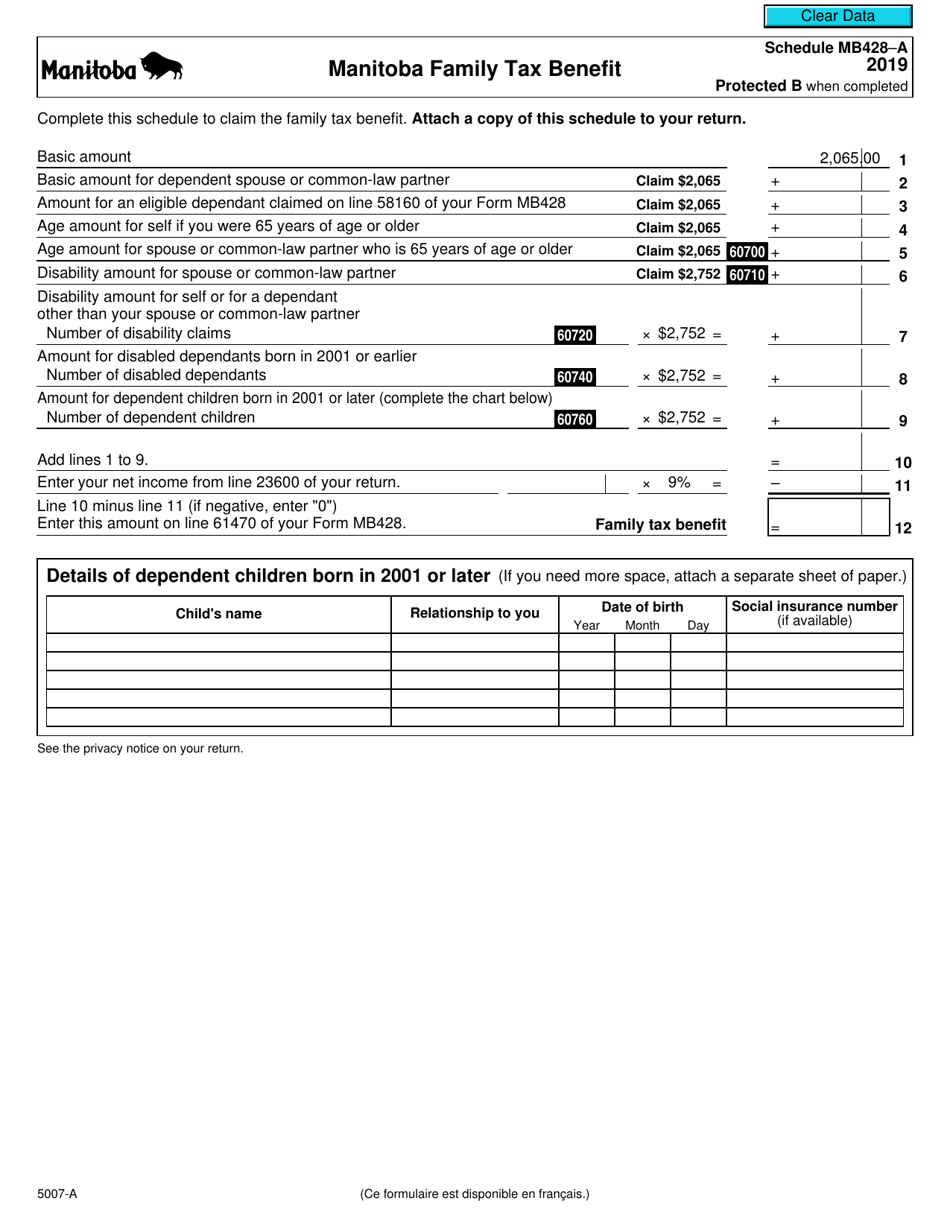

Form 5007 A Schedule MB428 A Download Fillable PDF Or Fill Online

Family Tax Benefit Rebate - Web Family Tax Benefit FTB is a payment that helps eligible families with the cost of raising children It is made up of two parts FTB Part A is paid per child and the amount paid is based on the family s circumstances FTB Part B is paid per family and gives extra