Farm Tax Rebate Ontario Web Effective January 2022 the Government of Ontario introduced a second optional subclass for both the industrial and commercial subclasses to provide further support to small

Web One of the ways the Government of Ontario supports agriculture is through the Farm Property Class Tax Rate Program also known as the quot Farm Tax Program quot If you are Web 24 janv 2022 nbsp 0183 32 1 Ontario farm businesses that gross 7 000 or more in annual farm income are required by law to register their businesses with Agricorp each year under

Farm Tax Rebate Ontario

Farm Tax Rebate Ontario

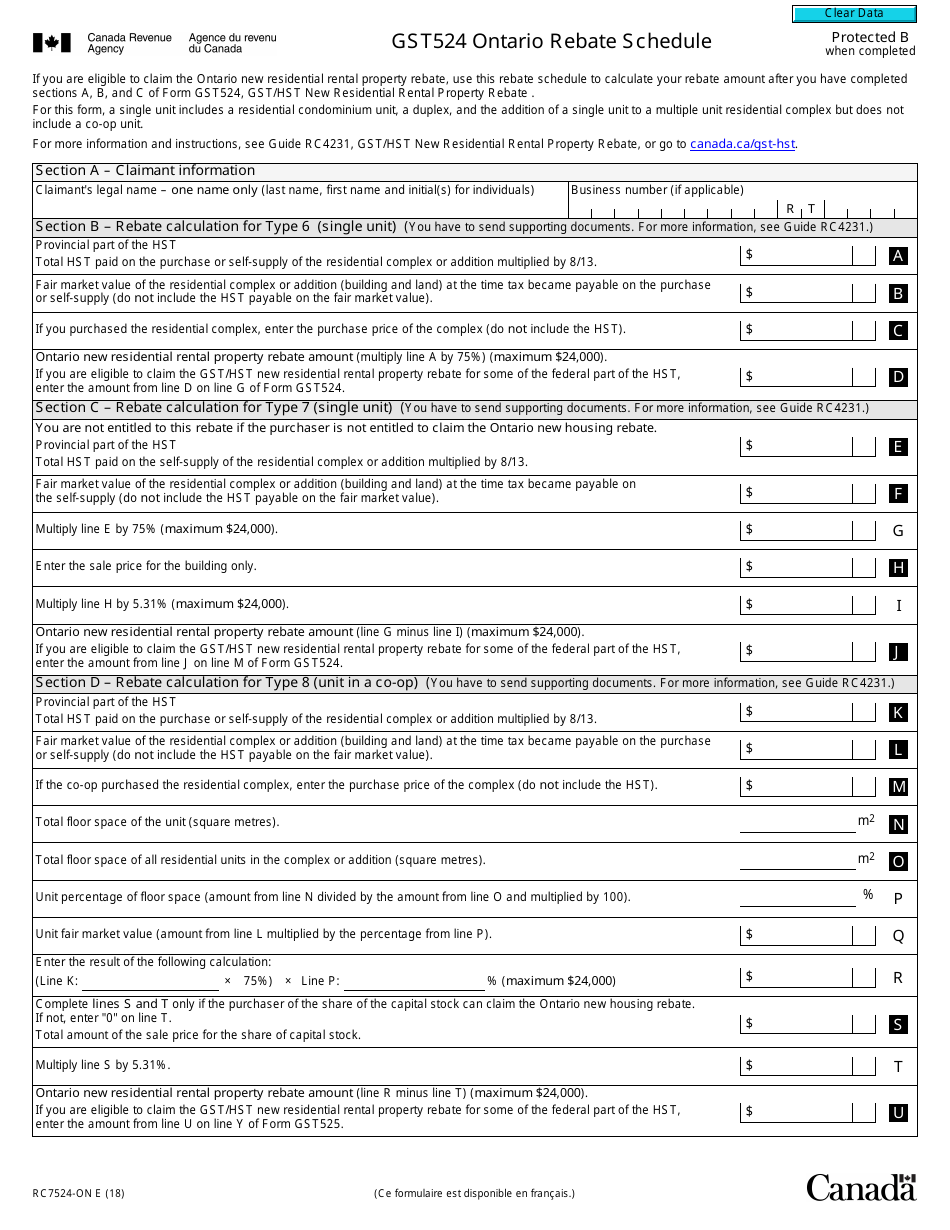

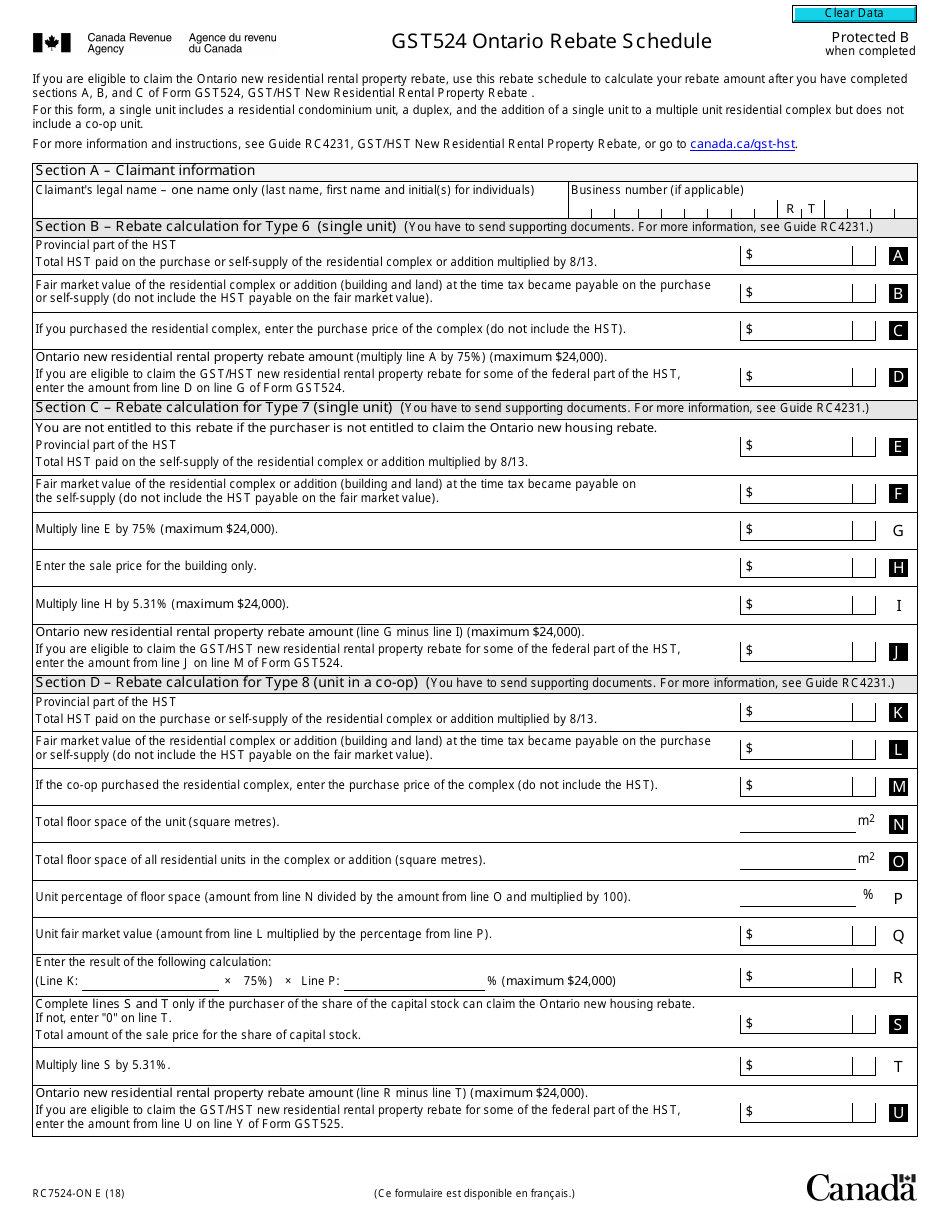

https://data.templateroller.com/pdf_docs_html/1868/18689/1868978/form-rc7524-on-gst524-ontario-rebate-schedule-canada_print_big.png

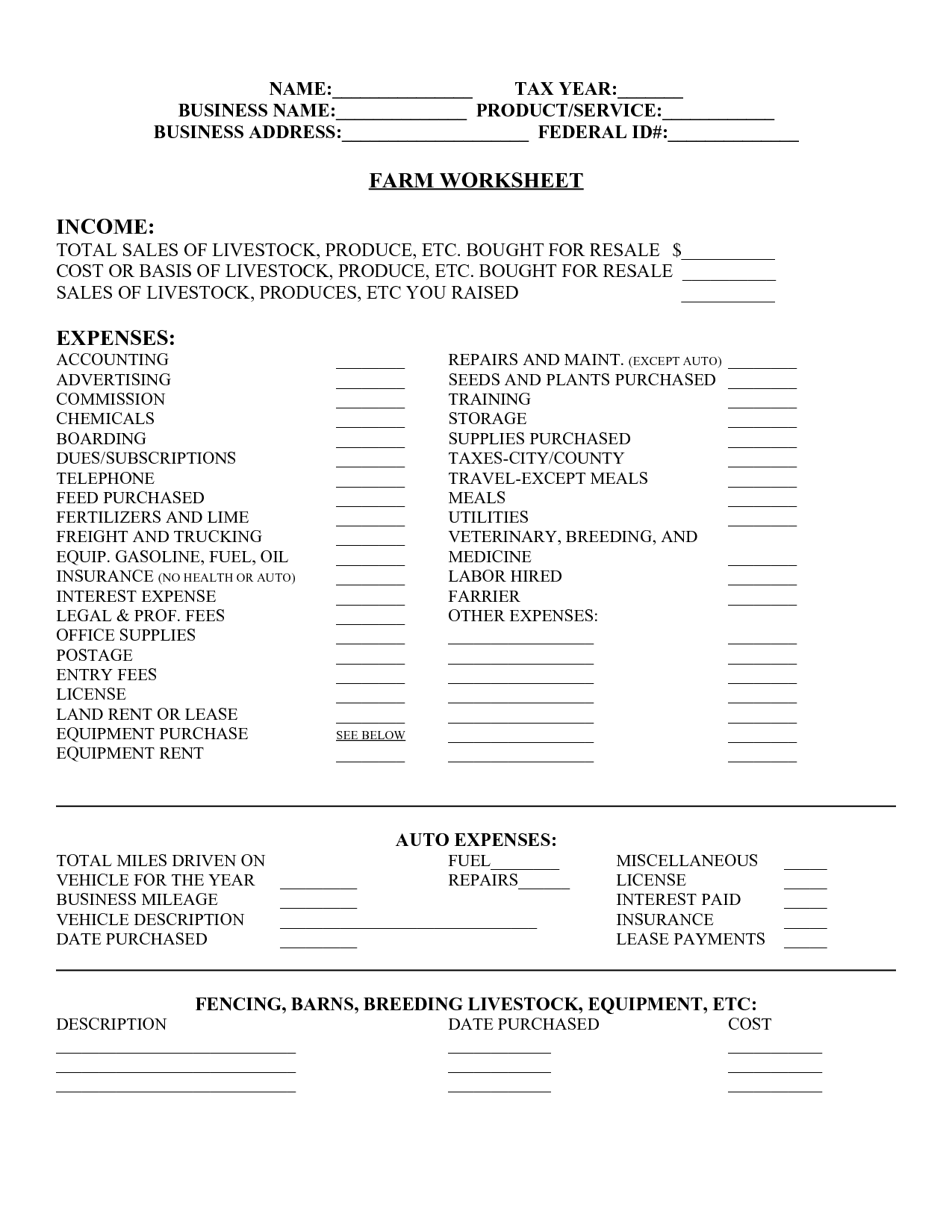

I ve Been A Family Farmer For 30 Years Here s My IRS Schedule F

https://civileats.com/wp-content/uploads/2018/04/180420-mike-madison-schedule-f-tax-form-2.jpg

Land Transfer Taxes 101 Susan Bandler Toronto Real Estate

http://www.susanbandler.com/wp-content/uploads/2015/12/Ontario-Land-Transfer-Tax-Table-1.jpg

Web The small business tax rate will benefit small to moderate farming operations in Ontario The small business tax rate applies to Ontario Web 14 d 233 c 2021 nbsp 0183 32 For 2021 the refundable tax credit rate has been set at 1 47 for every 1000 in eligible farm expenses incurred The rate will increase to 1 73 for 2022

Web Ontario farm businesses that gross 7 000 or more in annual farm income are required by law to register their businesses with Agricorp each year under the Farm Business Web 27 janv 2023 nbsp 0183 32 The FBR annual fee is set at 255 00 plus HST for the 2023 registration year Payment of this fee makes you eligible to join the Ontario Federation of Agriculture

Download Farm Tax Rebate Ontario

More picture related to Farm Tax Rebate Ontario

Taxes Ontario HST

https://revelup-techpubs.s3-us-west-2.amazonaws.com/support/hc/en-us/205770235/taxes5.png

HST Rebate Forms Ontario Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/HST-Rebate-Form-2021-768x997.png

Tax Deductions For Farm

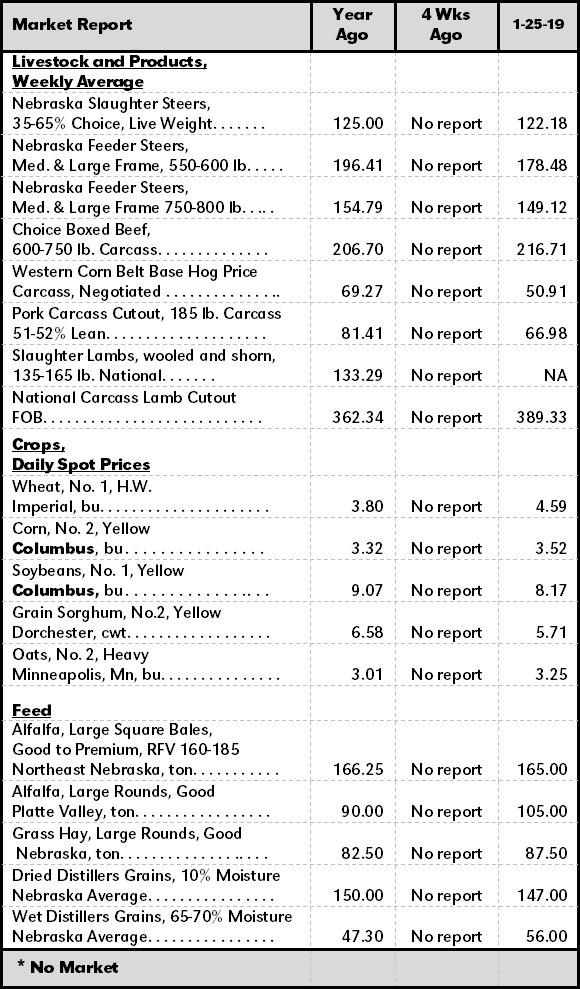

https://agecon.unl.edu/cornhusker-economics/2019/january-30-2019-markets.jpg

Web The AQITC is a refundable tax credit equal to 25 of your total ventilation expenses incurred from September 1 2021 to December 31 2022 to improve ventilation or air Web Under the Conservation Land Tax Incentive Program portions of your property that have eligible natural heritage features may qualify for a 100 property tax exemption The

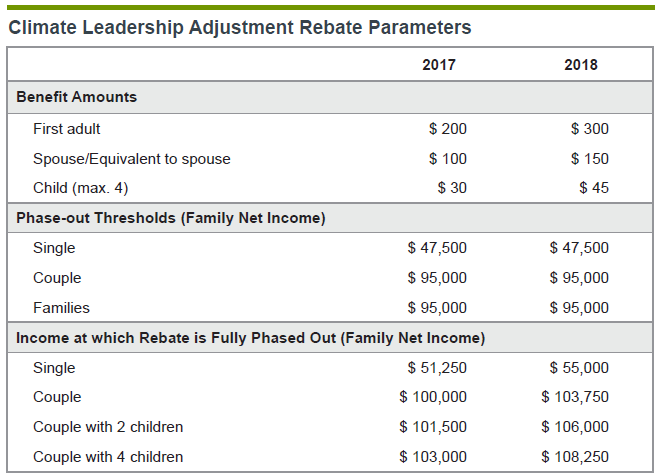

Web 14 janv 2022 nbsp 0183 32 Carbon Tax Rebate for farmers The federal government s 2021 fall economic update on Dec 14 proposed to return fuel charge proceeds directly to farming businesses in backstop jurisdictions that is Web 9 juin 2023 nbsp 0183 32 Farm Property Class Tax Rate Program Process Updated June 9 2023 The Ontario Ministry of Agriculture Food and Rural Affairs administers the Farm Property

FARM Turf Rebate Programs Firsttuesday Journal

http://journal.firsttuesday.us/wp-content/uploads/TurfRebatePrograms.png

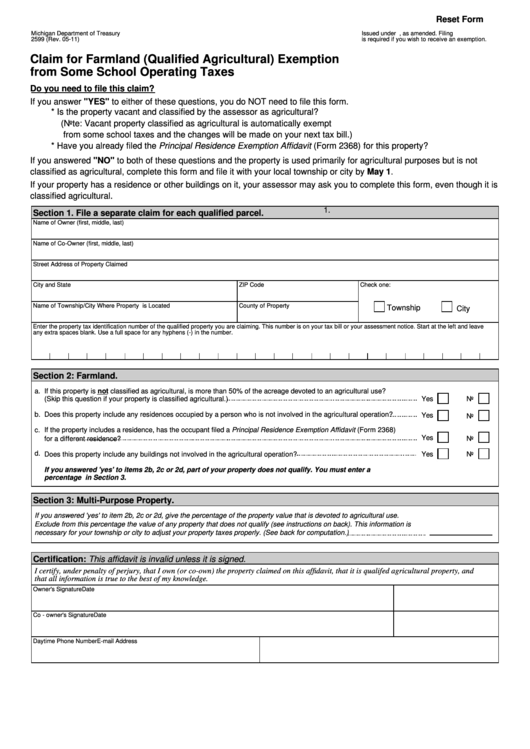

Fillable Form 2599 Claim For Farmland Qualified Agricultural

https://data.formsbank.com/pdf_docs_html/341/3414/341429/page_1_thumb_big.png

https://www.mpac.ca/en/MakingChangesUpdates/QualifyingFarmTaxInce…

Web Effective January 2022 the Government of Ontario introduced a second optional subclass for both the industrial and commercial subclasses to provide further support to small

https://www.agricorp.com/en-ca/Programs/FarmTaxProgram

Web One of the ways the Government of Ontario supports agriculture is through the Farm Property Class Tax Rate Program also known as the quot Farm Tax Program quot If you are

2007 Tax Rebate Tax Deduction Rebates

FARM Turf Rebate Programs Firsttuesday Journal

Application For Rebate Of Property Taxes Niagara Falls Ontario

14 Monthly Income Expense Worksheet Template Worksheeto

Guide To HST Rebates In Ontario Pierre Carapetian

H S Farm Tax Newsletter H S Companies

H S Farm Tax Newsletter H S Companies

Online Rebates Blain s Farm Fleet

Alberta Budget 2016 How Much Is This Carbon Tax Going To Cost Me

Lasopacleveland Blog

Farm Tax Rebate Ontario - Web Ontario farm businesses that gross 7 000 or more in annual farm income are required by law to register their businesses with Agricorp each year under the Farm Business