Farming Tax Incentives Before meeting with a tax consultant or accountant here are some important things to do or consider Gather all 1099 1098 and other tax forms issued by USDA If you have a Farm Loan log into the self service portal on farmers gov to view

Learn how farmers and ranchers can maximize their tax deductions and tax credits to save money Discover the key strategies and deductions available for agricultural businesses Explore our comprehensive policy overview on tax incentives for sustainable farming practices Learn how these incentives can promote eco friendly agriculture and benefit farmers

Farming Tax Incentives

Farming Tax Incentives

https://image.pbs.org/video-assets/UMzGlZf-asset-mezzanine-16x9-DNt0jrp.png?focalcrop=1200x630x50x10&format=auto

Zambian Farmers Clamor For Tax Incentives African Farming

https://www.africanfarming.com/wp-content/uploads/Seb5-1.jpg

Greens Using Forestry Tax Benefits To Undermine Livestock Farming

https://www.interest.co.nz/sites/default/files/feature_images/livestock-farming.jpg

Tax incentives offer financial benefits to farmers practicing eco friendly farming By providing tax breaks subsidies or credits governments encourage farmers to adopt sustainable practices such as organic fertilizers crop rotation and integrated pest management Farm tax credits are incentives provided by the government to encourage agricultural practices and support farmers These credits aim to reduce the tax burden on farmers and promote sustainable farming methods

This publication explains how the federal tax laws apply to farming Use this publication as a guide to figure your taxes and complete your farm tax return If you need more information on a subject get the specific IRS tax publication covering that subject We refer to many of these free publications throughout this publication What farmers need to know to get paid under the Sustainable Farming Incentive SFI how to apply for funding and how to manage your agreement

Download Farming Tax Incentives

More picture related to Farming Tax Incentives

Ten Income Tax Benefits For Farmers CPA Practice Advisor

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/07/21258/farm_1_.56d0c92b1cfaf.png

Tax Incentives For Farm Businesses

https://s3.studylib.net/store/data/008126171_1-af5a38b79c5f9b5d2abcfb22c698dbce-768x994.png

No One Will Dare Enter Into Contracts In The Future If This Is Allowed

https://images-global.nhst.tech/image/cmJNdHcvM25rcGFEcFlnQWF5SnhNU3ZXWEl0bUpYUCt3QkFhQWhIQ2h2TT0=/nhst/binary/f73b7db0b5a6589fa4a61c6d7c1dbf74?image_version=720

Discover how agriculture tax incentives can lower your tax bill and fuel innovation on your farm leading to a sustainable and profitable future Ready to fuel your farm s innovation with substantial tax savings Multiple states have tax incentives designed to promote the operation of small farms The most common incentives are Beginning farmer credits Capital gain exclusions on the sale of farm property Recently Iowa has also created a subtraction for retirement income earned from leasing farmland

Understanding tax regulations helps farmers take advantage of available deductions credits and incentives Additionally staying informed about changes in tax laws enables proactive planning and risk management The following discussion looks at the definition of a farmer from an income tax perspective including the definitions of farm farming and farmers as found in the Internal Revenue Code IRC and Treasury Regulations

SRB Announces Tax Incentive Package KANCO

https://www.kanco.com.pk/wp-content/uploads/2017/05/Tax-Incentive.jpg

Norwegian Government Makes U turn On Details Of Salmon Farming Tax But

https://images-global.nhst.tech/image/VEZ0L1hJWGFlYk1sTk0yS0VtTEhSNUNBUFJybW1YR3hrL1dWWmxIT0FnTT0=/nhst/binary/aa90d3f72abcdc573556cbd168439541?image_version=720

https://www.farmers.gov/your-business/taxes

Before meeting with a tax consultant or accountant here are some important things to do or consider Gather all 1099 1098 and other tax forms issued by USDA If you have a Farm Loan log into the self service portal on farmers gov to view

https://www.taxfyle.com/blog/maximizing-farmer-tax...

Learn how farmers and ranchers can maximize their tax deductions and tax credits to save money Discover the key strategies and deductions available for agricultural businesses

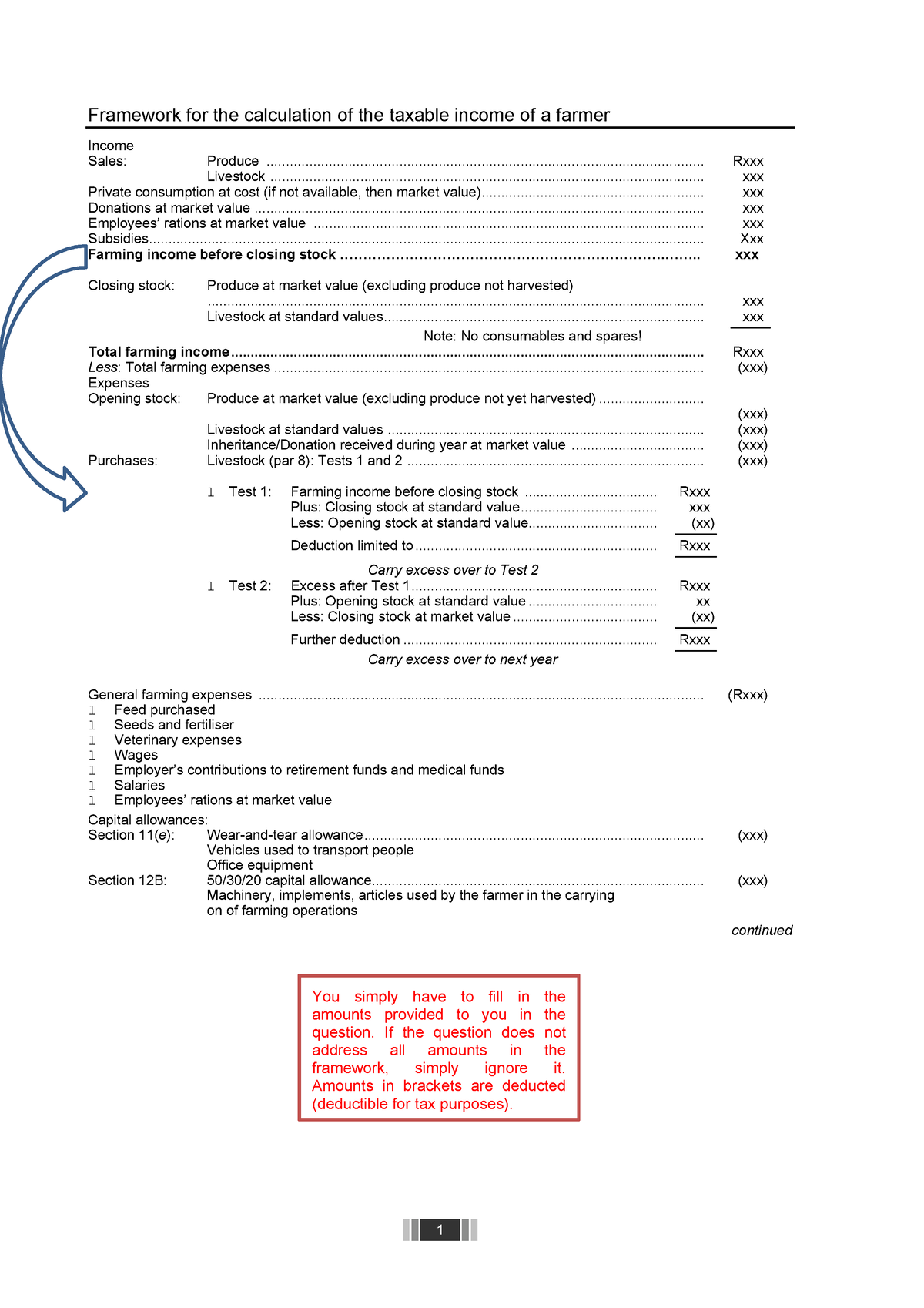

Framework For The Calculation Of The Taxable Income Of A Farmer 2022

SRB Announces Tax Incentive Package KANCO

5 Tax Incentives Every Small Business Owner Should Know About Bytestart

The Tax Landscape Of Farming Tax Adviser

Economic Development Tax Incentives The Pew Charitable Trusts

Crop Farming Steer Incorporated Begin Giving Tax Efficiency

Crop Farming Steer Incorporated Begin Giving Tax Efficiency

11 Types Of Tax Incentives How They Differ In Their Functionality

2018 1040 F 0 IStock

Tax Incentives AudreyGrey

Farming Tax Incentives - Tax incentives offer financial benefits to farmers practicing eco friendly farming By providing tax breaks subsidies or credits governments encourage farmers to adopt sustainable practices such as organic fertilizers crop rotation and integrated pest management