Fbt On Discounted School Fees 6 000 school fees MantCo uses the type 2 rate to gross up the fringe benefits that did not include GST 6 000 1 8868 11 321 rounded to the nearest

Reimbursing an expense incurred by an employee such as school fees giving an employee a discounted loan giving benefits under a salary sacrifice Reimbursed school fees discounted loans salary sacrifice arrangements with staff If you re giving your staff extras that are subject to FBT take these four steps

Fbt On Discounted School Fees

Fbt On Discounted School Fees

https://p2a-images.s3.amazonaws.com/production/customers/1856/IDFNhXisdEKfm81vlfyc15870682361464

SCHOOL FEES School Fees In Covid 19 Right Or Wrong Personality

https://i.ytimg.com/vi/GVDs1Pfm6zo/maxresdefault.jpg

Discounted School Fees In Dubai For The Third Term MyBayut

https://mybayutcdn.bayut.com/mybayut/wp-content/uploads/cover-school-fee-discount-dubai-200420.jpg

GST free for example school fees input taxed for example residential accommodation These are referred to as non GST creditable benefits The rate you Reimbursement of expenses incurred by the employee for instance school fees Giving discounted loan to an employee Giving some benefits to an employee

For example if someone uses a company car for personal use or if you reimburse school fees or if you offer discounted loans from the company you ll have What is fringe benefits tax A fringe benefit is a payment made to an employee which is not their salary or wages These benefits are subject to fringe benefits tax FBT which

Download Fbt On Discounted School Fees

More picture related to Fbt On Discounted School Fees

School Fees Transfer YouTube

https://i.ytimg.com/vi/FfBU_C_kYLQ/maxresdefault.jpg

Parents Fail To Raise School Fees For Form 1 Admission YouTube

https://i.ytimg.com/vi/rpzOWi9s79w/maxresdefault.jpg

Is Offering Discounted Tuition Fees Worth It Accru Melbourne

http://accrumelb.com.au/wp-content/uploads/2021/10/Discounted-Tuition-fees-Accru-Melbourne-scaled.jpg

The most common items that can be included in a salary packaging agreement are car fringe benefits through a novated lease expense payment fringe benefits such as Answer Whether higher education course fees result in a FBT liability or not depends on whether the employee would have been entitled to a deduction for the fees

However for some benefits the taxable value is calculated using a statutory formula e g car benefits which doesn t necessarily reflect the actual cost to your employer it s used Payment incurred for the particular private expenditure e g school fees of the employee s children utilities bills non work related medical expenses medical insurance premiums

School Fees L cole Trilingue

https://lecoletrilingue.com/en/img/asset/Y292ZXJzL0ZyYWlzLmpwZw==?w=768&h=631&fit=crop&s=58a15a350f3504ecc4f8bf9876bd5f49

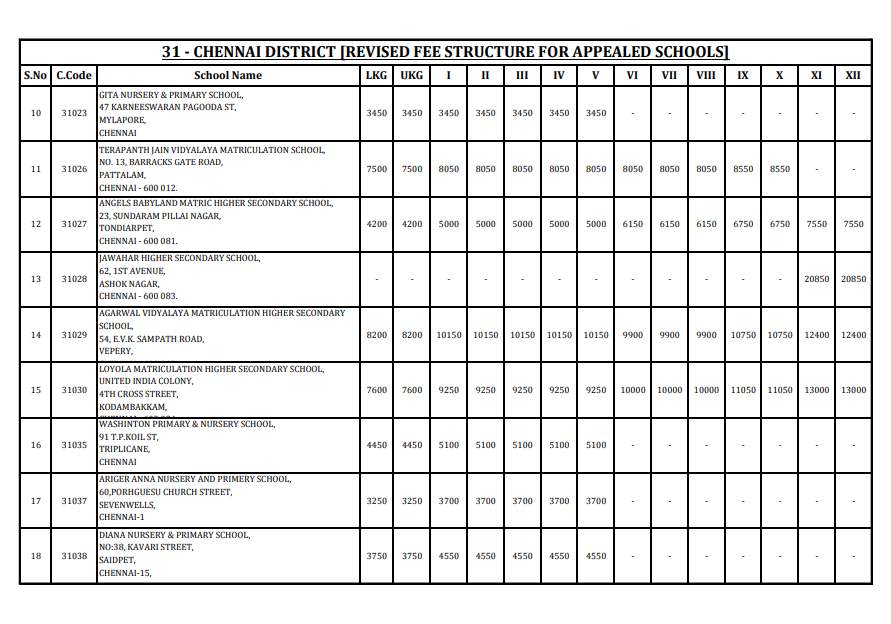

Revised Marticulation School Fees 2023 2024 EduVark

https://eduvark.com/img/m/revised-marticulation-school-fees-2.jpg

https://www.ato.gov.au/.../fringe-benefits-tax/calculating-your-fbt

6 000 school fees MantCo uses the type 2 rate to gross up the fringe benefits that did not include GST 6 000 1 8868 11 321 rounded to the nearest

https://www.ato.gov.au/businesses-and...

Reimbursing an expense incurred by an employee such as school fees giving an employee a discounted loan giving benefits under a salary sacrifice

Tuition Fees ACG School Jakarta

School Fees L cole Trilingue

Tuition Fees Per Semester

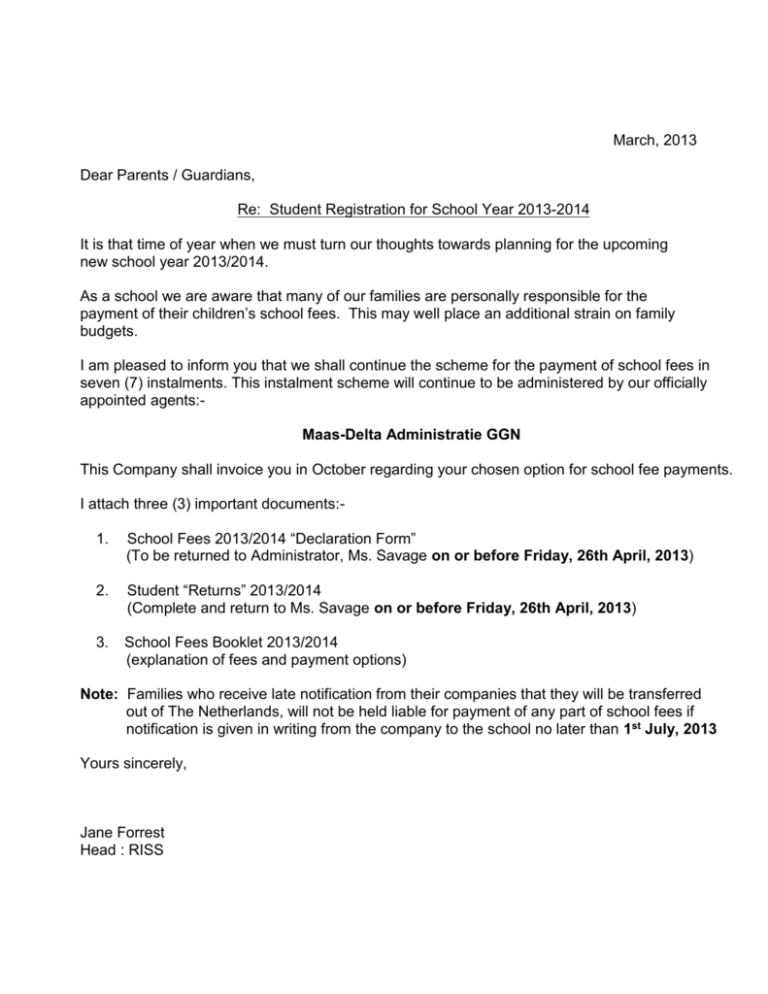

School Fees 2013 2014

Parents Protest Seek 50 Cut In School Fees Ezyschooling

Parents Protest Seek 50 Cut In School Fees Ezyschooling

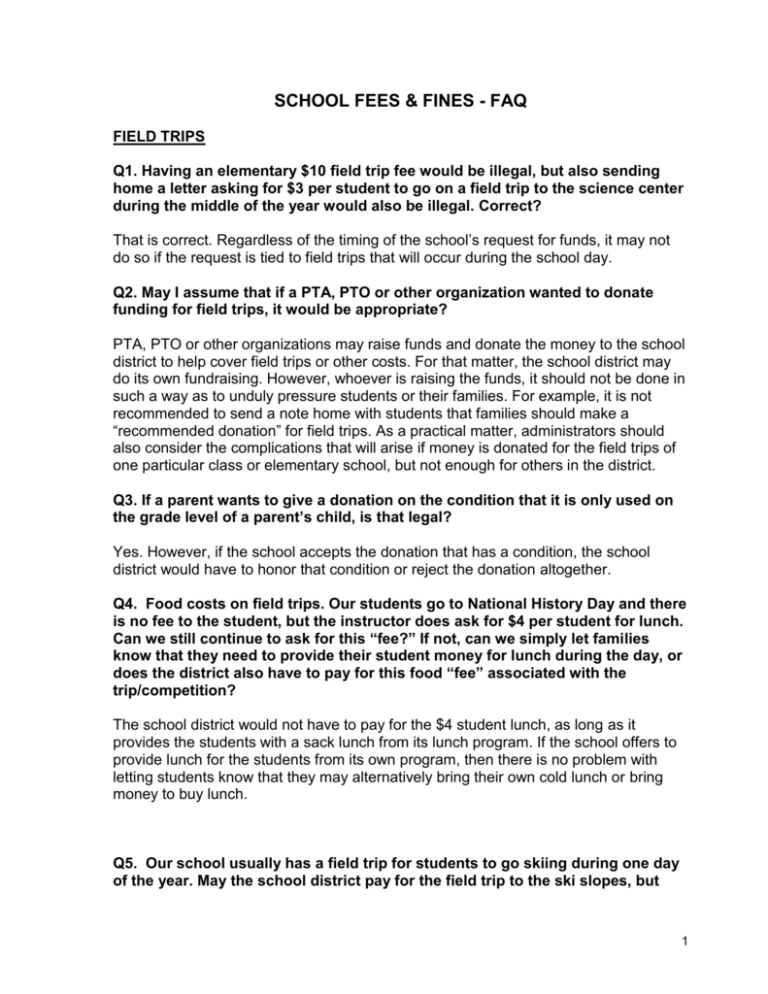

School Fees Q A From SAI Fall 2008 Legal Lab

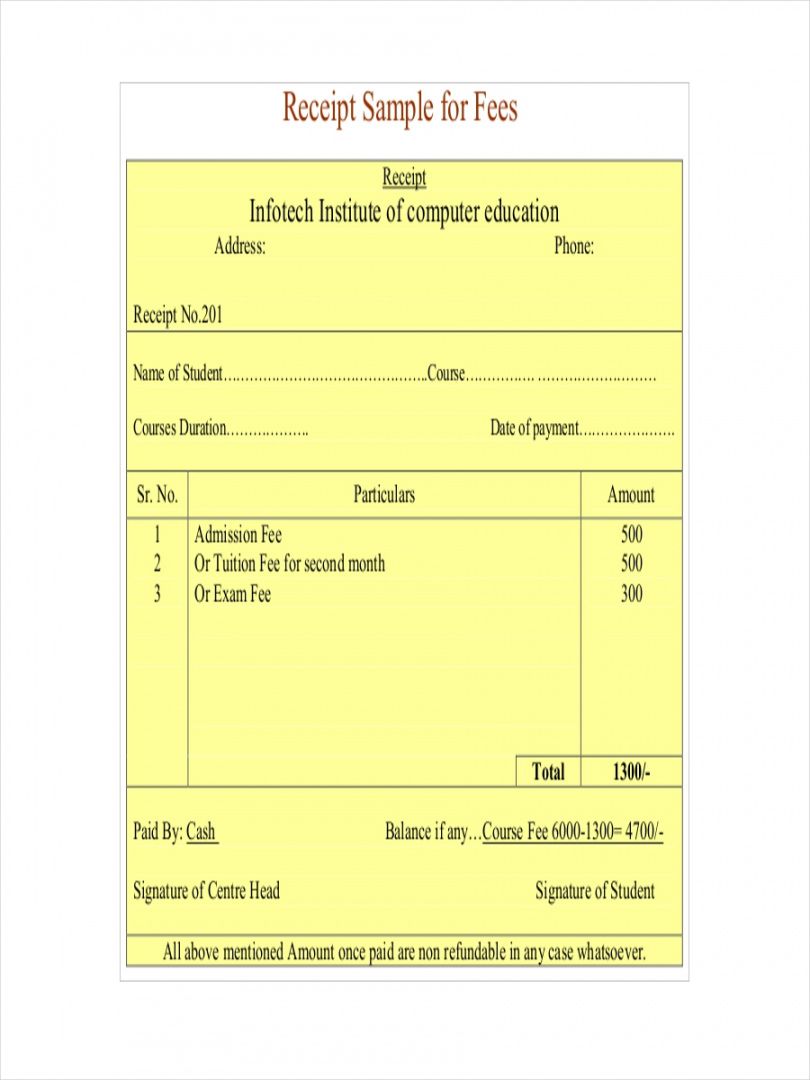

Editable Free 6 School Receipt Examples Samples In Pdf Examples

School Fees Donations

Fbt On Discounted School Fees - After the FBT return is lodged the department will issue an invoice to those schools that caused an FBT liability based on the information in FBT Tracker In this invoice the