Fd Interest Exemption For Senior Citizens In Income Tax Most banks offer higher FD interest rates to senior citizens of age 60 and above Senior citizens can get an additional benefit of 0 25 to 0 80 p a interest rates

Senior citizens or those who are of the age of 60 years or more can claim a deduction of up to Rs 50 000 from their gross total income under Section 80TTB of the Discover the benefits of Section 80TTB a special income tax deduction for senior citizens Learn about eligibility criteria deduction limits and how to claim this

Fd Interest Exemption For Senior Citizens In Income Tax

Fd Interest Exemption For Senior Citizens In Income Tax

https://images.indianexpress.com/2020/08/documents-for-income-tax-return-1200.jpg

People Aged 75 May Not Have To Pay 10 TDS On FD Interest Mint

https://images.livemint.com/img/2021/09/08/original/fd_1631129194092.png

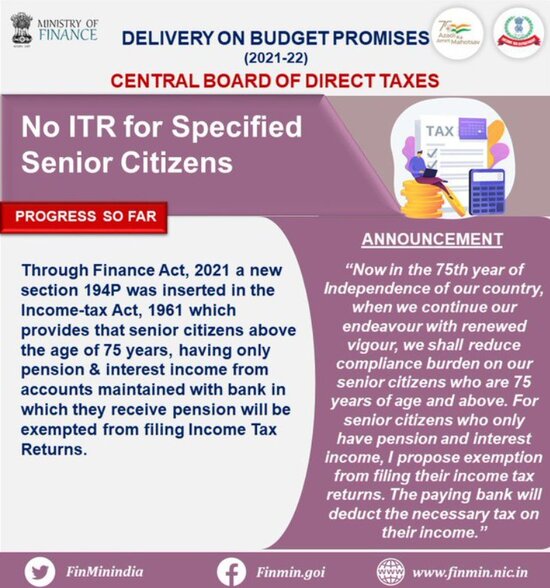

Budget 2021 Income Tax Returns Exemption Senior Citizens Above 75 Years

https://resize.indiatvnews.com/en/resize/newbucket/1200_-/2021/02/eth6sfpu0auony6-1612164111.jpg

Section 80TTB of the Income tax Act 1961 allows a resident senior citizen to claim a deduction against interest income on the deposit All you need to know about Section 194P has been newly inserted to enforce the banks to deduct tax on senior citizens more than 75 years of age who have a pension and interest income from

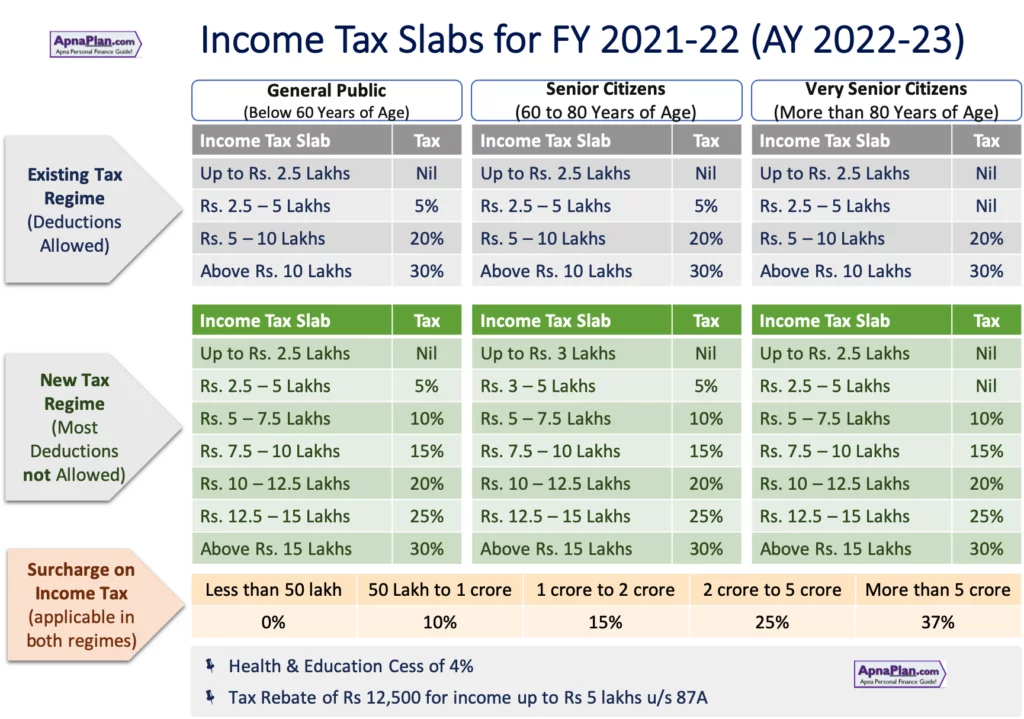

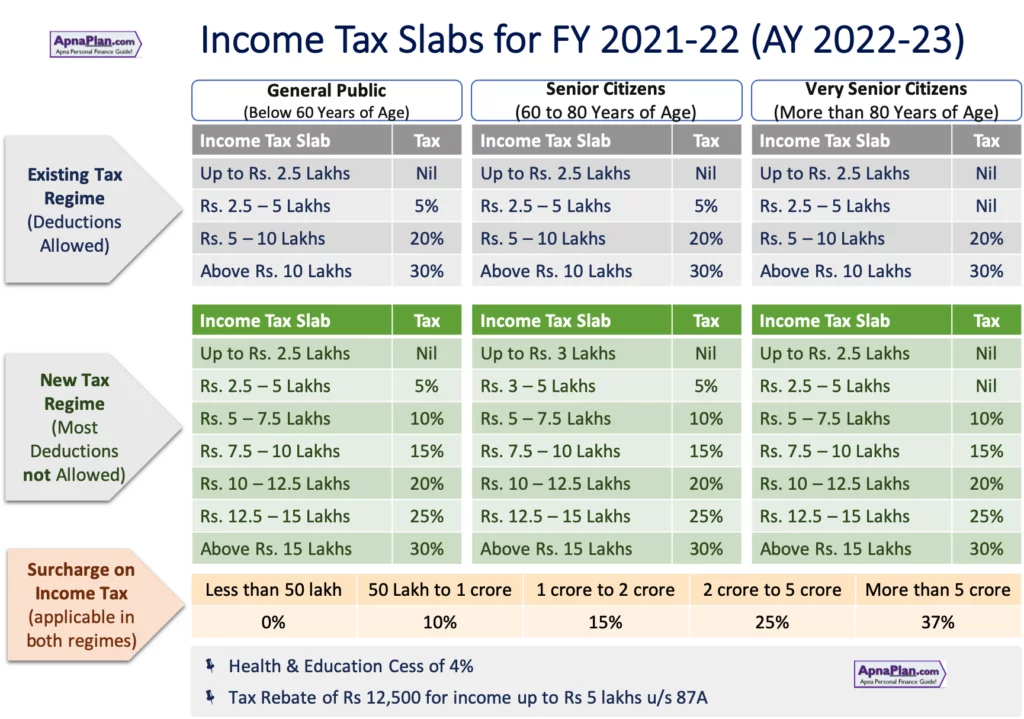

For Senior Citizens the Interest income earned on Fixed Deposits Recurring Deposits will be exempted till Rs 50 000 This deduction can be claimed under new Section 80TTB Section 80TTB of the Income Tax Act provides tax benefits for senior citizens on interest income from deposits allowing a deduction of Rs 50 000 on

Download Fd Interest Exemption For Senior Citizens In Income Tax

More picture related to Fd Interest Exemption For Senior Citizens In Income Tax

Senior Citizens Income Tax And Other Benefits

https://taxconcept.net/wp-content/uploads/2022/03/union-budget-tax-exemption-for-senior-citizens.jpg

House Of Representatives Files Bill Of Tax Exemption For Senior

https://filipinojournal.com/wp-content/uploads/2021/03/senior_citizen_task_force_web.jpg

No ITR For Specified Senior Citizens Through Finance Act 2021 A New

https://www.staffnews.in/wp-content/uploads/2022/01/no-itr-for-specified-senior-citizens-through-finance-act-2021.jpg

Notably senior citizens with a deposit account like a fixed deposit account recurring deposit accounts and savings account can claim a deduction of the interest they The exemption limit for TDS on FDs is Rs 40 000 for individuals excluding senior citizens This means TDS will not be deducted if the interest earned on an FD in a financial year

Section 80TTB of the Income Tax Act 1961 allows a resident senior citizen to claim a deduction against interest on the deposit Section 80TTB is popular for If the interest you earn on your FD exceeds 40 000 50 000 in the case of senior citizens you are liable to pay a 10 tax on the FD interest earned If you still

20 Online Tax Estimator BenHollyanne

https://www.apnaplan.com/wp-content/webp-express/webp-images/uploads/2021/03/Income-Tax-Slabs-for-FY-2021-22-AY-2022-23-1024x719.png.webp

Income Tax India On Twitter RT nsitharamanoffc As Announced In

https://pbs.twimg.com/media/FlsE477aMAA8oz_.jpg

https://www.paisabazaar.com/fixed-deposit/tax...

Most banks offer higher FD interest rates to senior citizens of age 60 and above Senior citizens can get an additional benefit of 0 25 to 0 80 p a interest rates

https://economictimes.indiatimes.com/wealth/invest/...

Senior citizens or those who are of the age of 60 years or more can claim a deduction of up to Rs 50 000 from their gross total income under Section 80TTB of the

Income Tax On Interest On Savings Bank FD Account In India Fintrakk

20 Online Tax Estimator BenHollyanne

Sample Letter Exemptions Form Fill Out And Sign Printable PDF

Income Tax Rules For Senior Citizens Income Tax Exemption For Senior

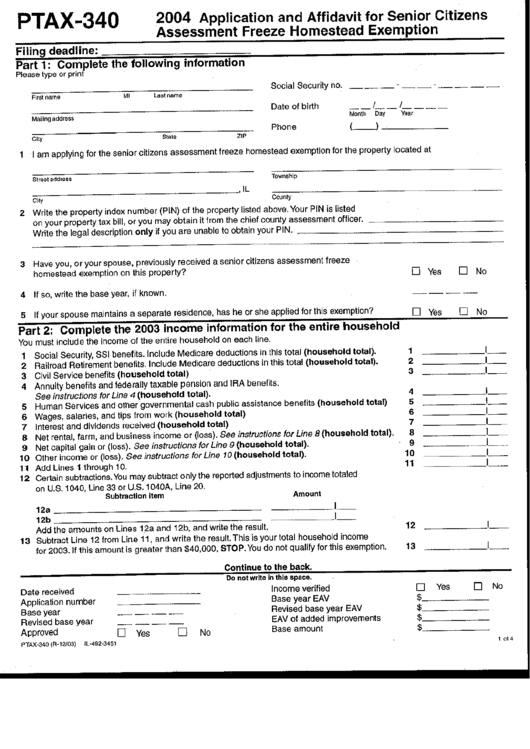

Senior Citizen Assessment Freeze Exemption Cook County Form

Bharat Bank

Bharat Bank

County Legislature Increases Senior Citizen Tax Exemption Rodney J

PNB Hikes Interest Rates On Savings Accounts And FDs

Income Tax Return New Rule Senior Citizens 75 Years Money Musingz

Fd Interest Exemption For Senior Citizens In Income Tax - Section 80TTB of the Income Tax Act provides tax benefits for senior citizens on interest income from deposits allowing a deduction of Rs 50 000 on