Fd Interest Rebate In Income Tax For Senior Citizen Web 18 janv 2022 nbsp 0183 32 The TDS deduction rate for interest income from fixed deposits for senior citizens is the same as the rest However the basic exemption limit is Rs 50 000 for a

Web 4 avr 2018 nbsp 0183 32 Section 80TTB is a provision whereby a taxpayer who is a resident senior citizen aged 60 years and above at any time during a Financial Year FY can claim a Web 9 ao 251 t 2020 nbsp 0183 32 According to Section 80TTB of the Income Tax Act senior citizens can avail a tax deduction of maximum upto 50 000 on

Fd Interest Rebate In Income Tax For Senior Citizen

Fd Interest Rebate In Income Tax For Senior Citizen

https://img.etimg.com/photo/msid-62914770/tax_calculation_80yr_senior_citizen_1-2cr-1.jpg

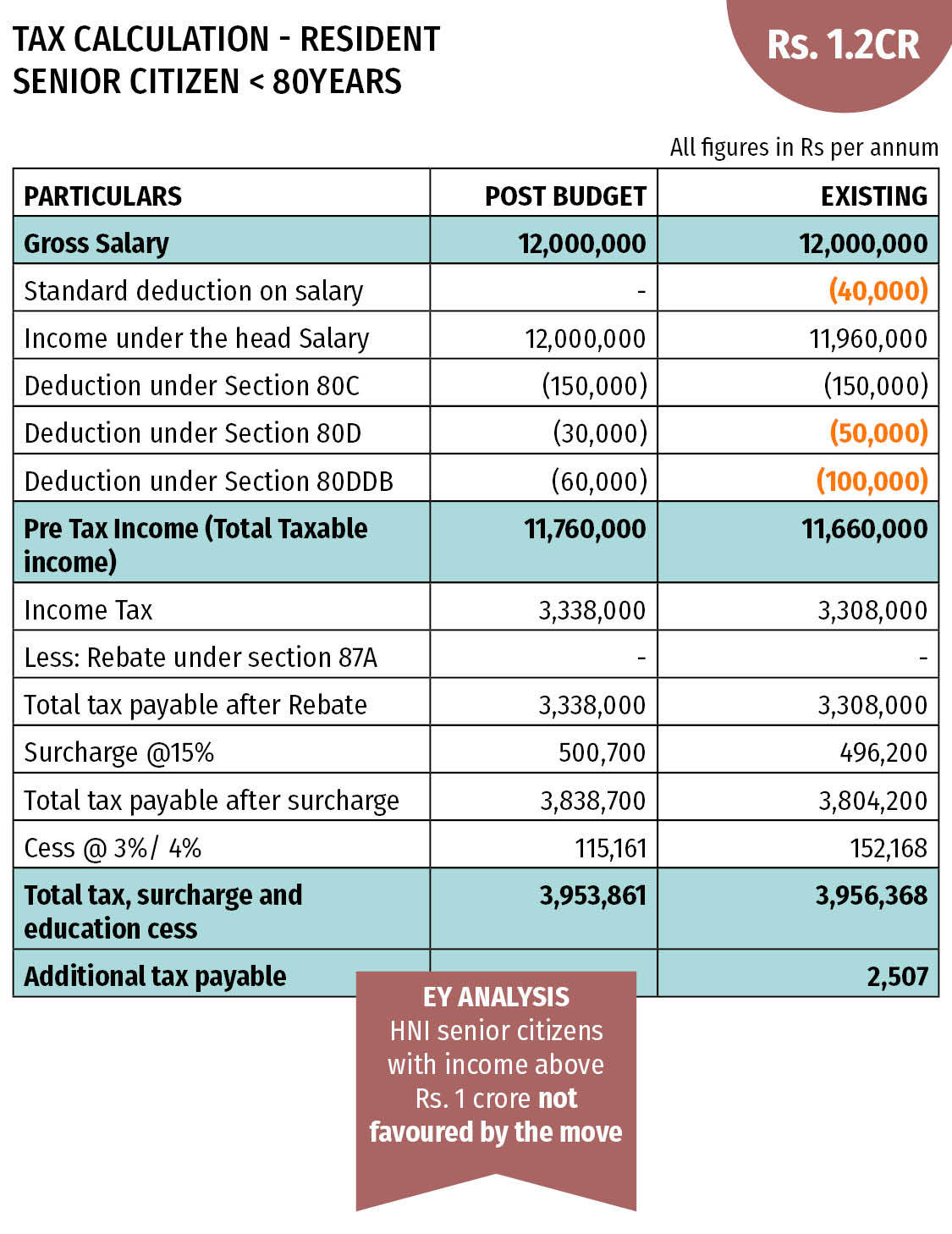

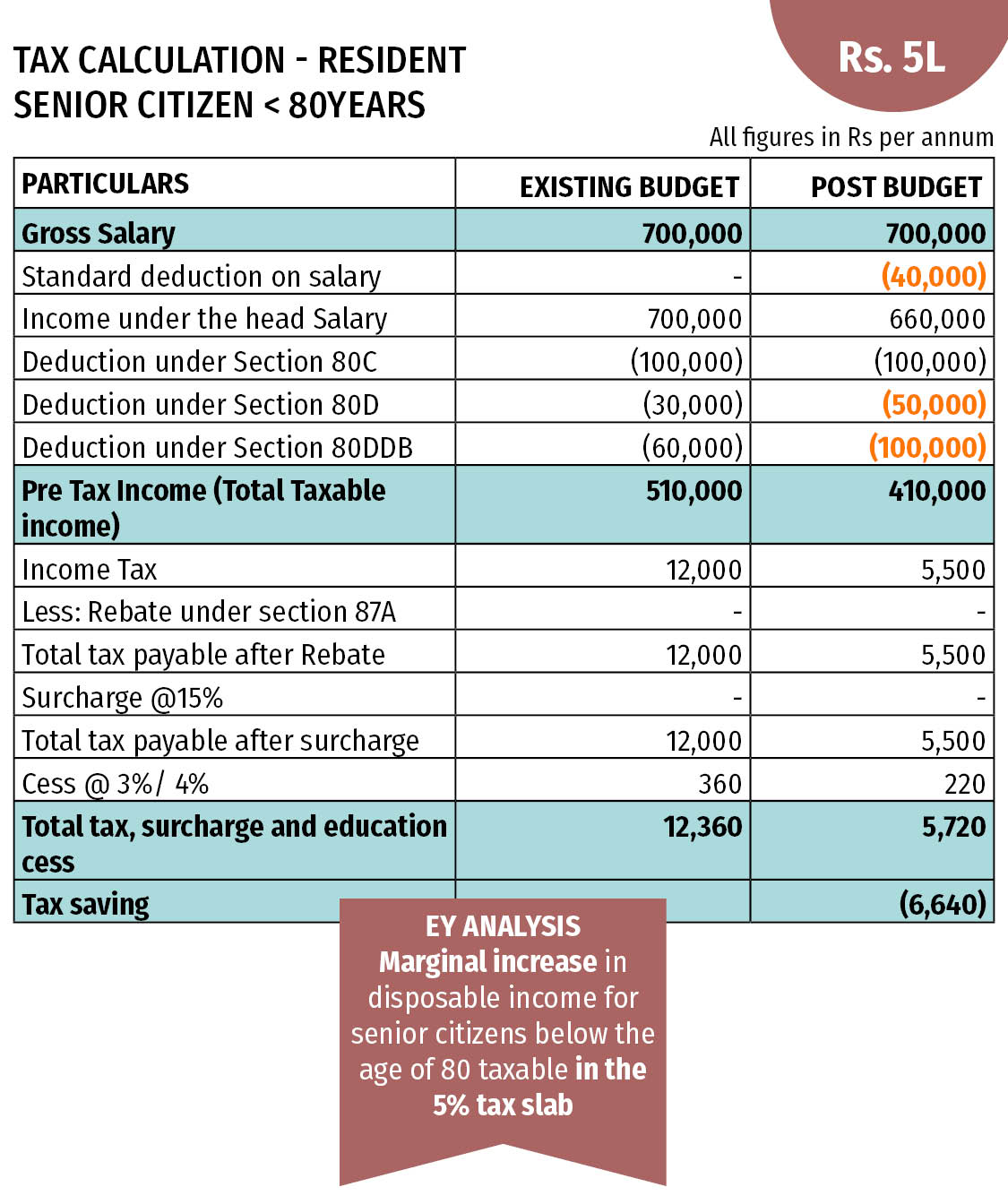

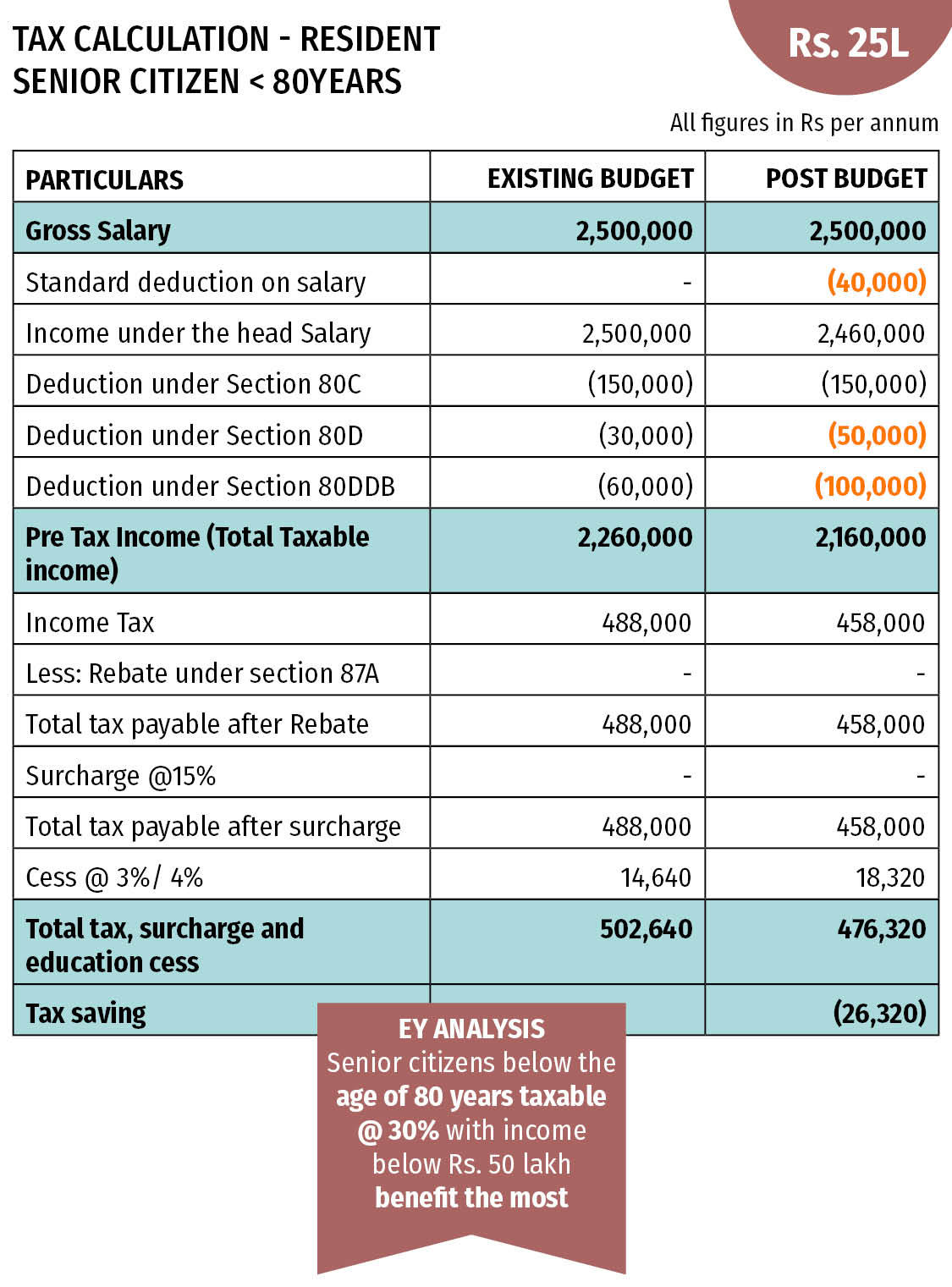

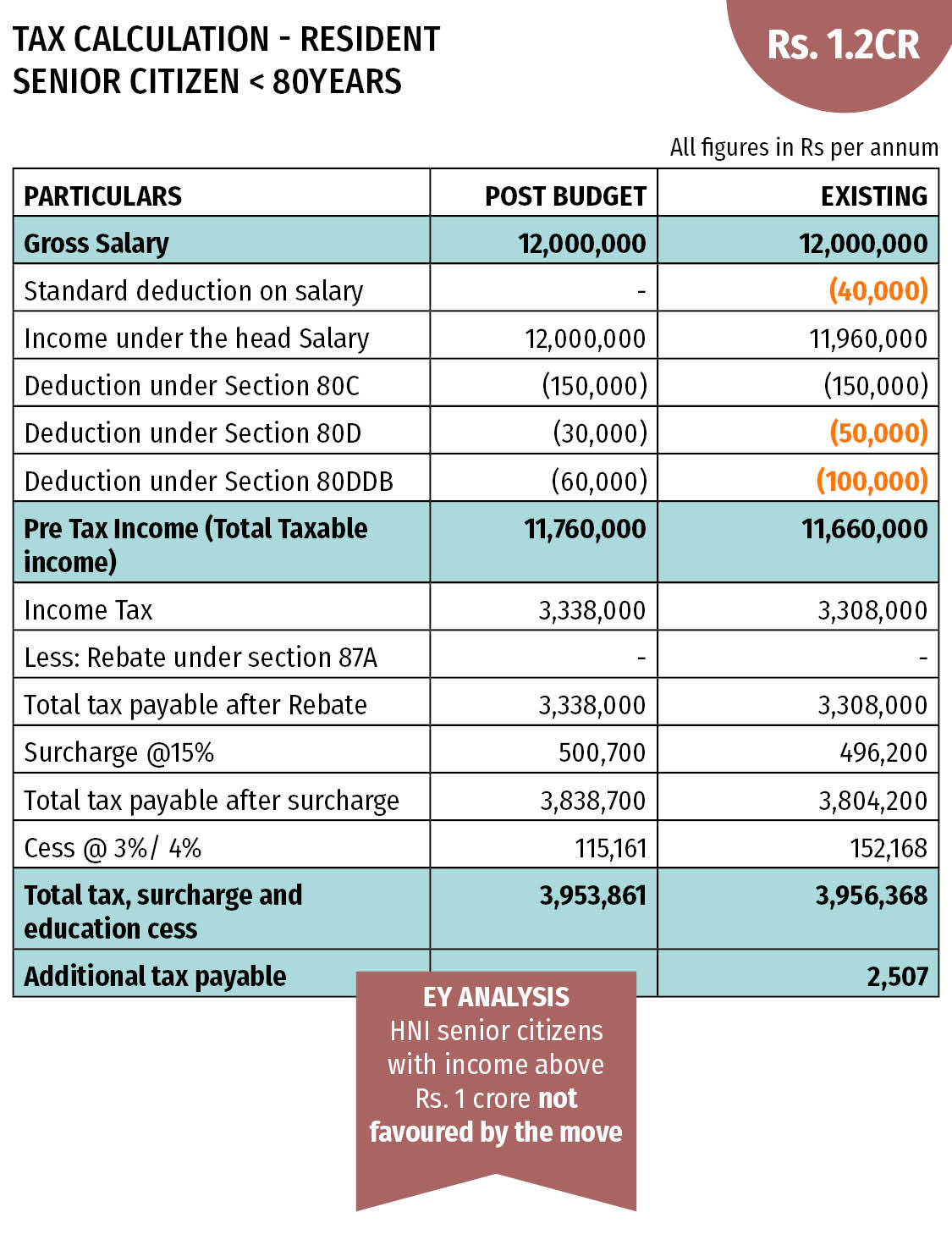

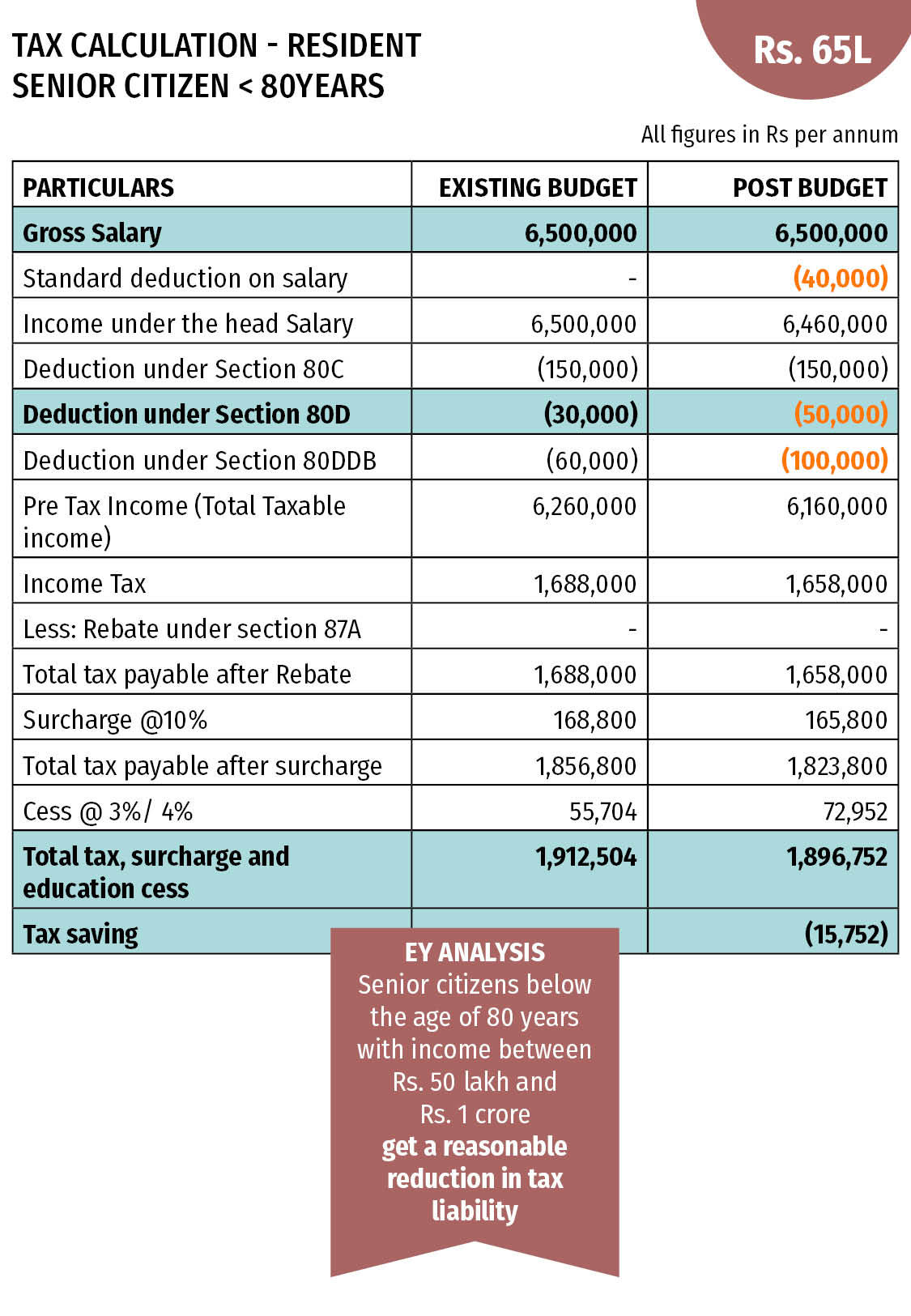

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

https://img.etimg.com/photo/msid-62914754/tax_calculation_80yr_senior_citizen_65l-1.jpg

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

https://i.ytimg.com/vi/rfW84weCMCs/maxresdefault.jpg

Web 31 mars 2023 nbsp 0183 32 Senior citizens or those who are of the age of 60 years or more can claim a deduction of up to Rs 50 000 from their gross total income under Section 80TTB of the Income tax Act 1961 This tax Web 12 juil 2023 nbsp 0183 32 Section 80TTB of the Income Tax Act 1961 allows a resident senior citizen to claim a deduction against interest on the deposit Section 80TTB is popular for

Web 29 juin 2022 nbsp 0183 32 Fixed Deposits Tax Saving FD for Sec 80C Deductions Benefits amp Interest Rates Risks Limits Updated on Jun 29 2022 12 14 25 AM Budget 2021 update It Web 22 juil 2023 nbsp 0183 32 Compare interest income with the maximum limit If your interest income is equal to or less than Rs 50 000 you can claim the entire interest income as a deduction under Section 80TTB If your

Download Fd Interest Rebate In Income Tax For Senior Citizen

More picture related to Fd Interest Rebate In Income Tax For Senior Citizen

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

https://img.etimg.com/photo/msid-62914728,quality-100/tax_calculation_80yr_senior_citizen_5l-2.jpg

.jpg)

Important Deduction For Income Tax For Salaried Persons Employees On

https://d1avenlh0i1xmr.cloudfront.net/6935e541-d1ae-4702-be59-bae61802b2e3/income-tax-slab-rate-(senior-citizen).jpg

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

https://img.etimg.com/photo/msid-62914737/tax_calculation_80yr_senior_citizen_25l-1.jpg

Web The deduction is allowed for a maximum interest income of up to 50 000 earned by the Senior Citizen Both the interest earned on saving deposits and fixed deposits are Web 29 juin 2022 nbsp 0183 32 Show more 13 Exclusive Benefits Available to Senior Citizens In Income Tax Senior Citizen Tax Benefits 2022 In this video I have discussed many benefits exclusively available to senior

Web 9 mars 2022 nbsp 0183 32 Individuals over the age of 60 seniors can earn an extra 0 25 percent to 0 65 percent interest rate over standard FD rates Although interest rates have Web 22 mars 2023 nbsp 0183 32 Senior citizens can compare the interest rates of tax saving FDs and then invest Tax saving fixed deposits FDs are one of the most preferred investment options

![]()

Income Tax Slabs FY 2020 21 AY 2021 22 Wealthtech Speaks

https://cdn.shortpixel.ai/client/q_lossy,ret_img,w_645/https://wealthtechspeaks.in/wp-content/uploads/2020/02/Existing-Senior-Citizen-Tax.png

Income Tax India On Twitter RT nsitharamanoffc As Announced In

https://pbs.twimg.com/media/FlsE477aMAA8oz_.jpg

https://navi.com/blog/taxability-of-interest-on-fixed-deposits

Web 18 janv 2022 nbsp 0183 32 The TDS deduction rate for interest income from fixed deposits for senior citizens is the same as the rest However the basic exemption limit is Rs 50 000 for a

https://cleartax.in/s/section-80ttb

Web 4 avr 2018 nbsp 0183 32 Section 80TTB is a provision whereby a taxpayer who is a resident senior citizen aged 60 years and above at any time during a Financial Year FY can claim a

Method Of Calculating Income Tax For Senior Citizen Pensioners

Income Tax Slabs FY 2020 21 AY 2021 22 Wealthtech Speaks

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

What Is Rebate In Income Tax Nirmala Sitaraman Gives Big Relief To

SENIOR CITIZEN INCOME TAX CALCULATION FY 2019 20 REBATE 87A TAX

Income Tax Slab For Senior Citizen Super Senior Citizen Income Tax

Income Tax Slab For Senior Citizen Super Senior Citizen Income Tax

INCOME TAX Relief Senior Citizens Change In FORM 15H Rebate 87A Senior

INCOME TAX SLAB FY 2019 20 AY20 21 FOR INDIVIDUAL SENIOR CITIZEN HUF

Income Tax Slabs Rates And Exemptions For Senior Citizens Know How

Fd Interest Rebate In Income Tax For Senior Citizen - Web 8 sept 2023 nbsp 0183 32 Apply Now Fixed Deposit Income Tax Deduction available under Section 80TTB According to Section 80TTB of the Income Tax Act senior citizens can avail of