Fd Interest Rebate In Income Tax For Senior Citizens Web 9 ao 251 t 2020 nbsp 0183 32 According to Section 80TTB of the Income Tax Act senior citizens can avail a tax deduction of maximum upto 50 000 on

Web 18 janv 2022 nbsp 0183 32 The TDS deduction rate for interest income from fixed deposits for senior citizens is the same as the rest However the basic exemption limit is Rs 50 000 for a Web The deduction is allowed for a maximum interest income of up to 50 000 earned by the Senior Citizen Both the interest earned on saving deposits and fixed deposits are

Fd Interest Rebate In Income Tax For Senior Citizens

Fd Interest Rebate In Income Tax For Senior Citizens

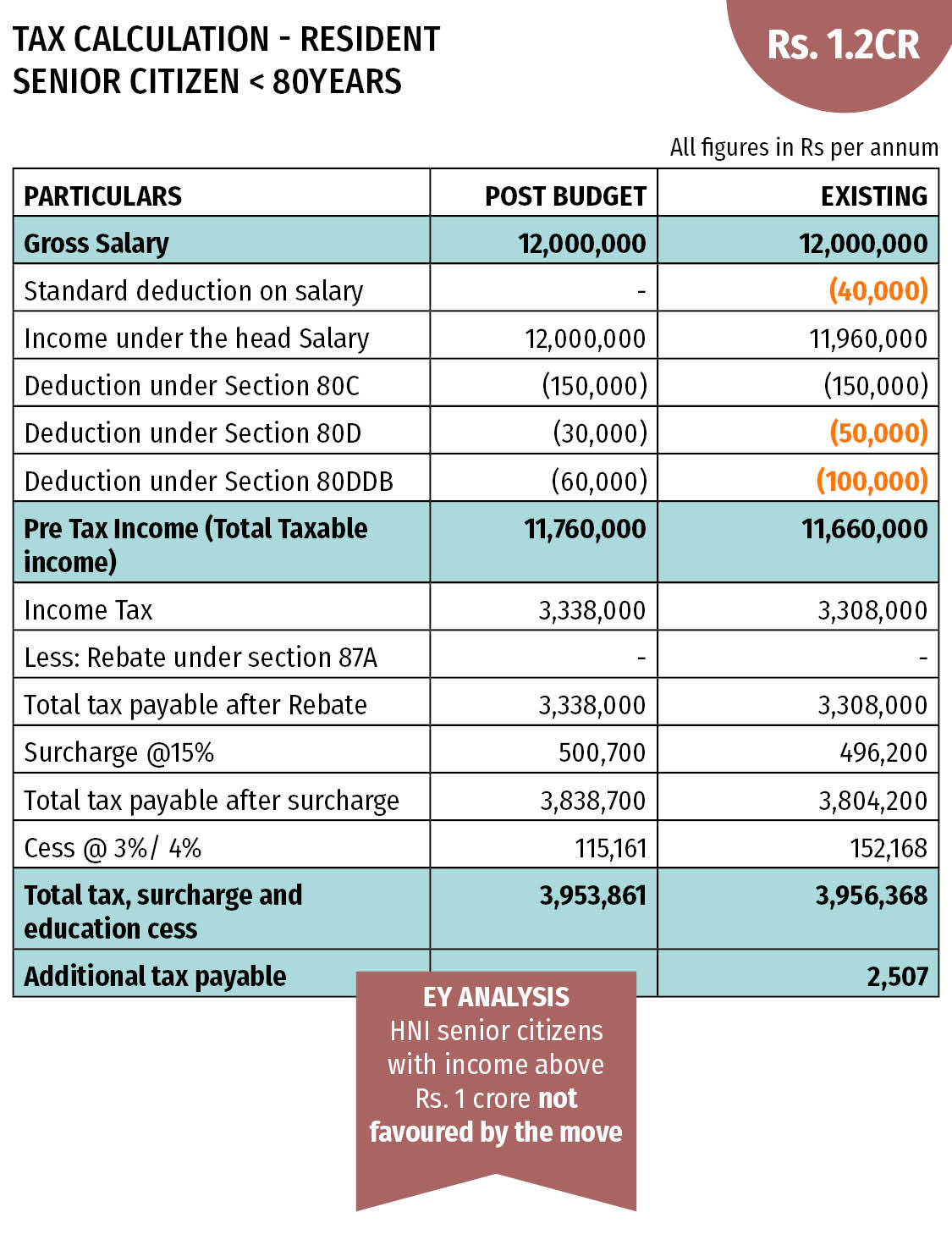

https://img.etimg.com/photo/msid-62914770/tax_calculation_80yr_senior_citizen_1-2cr-1.jpg

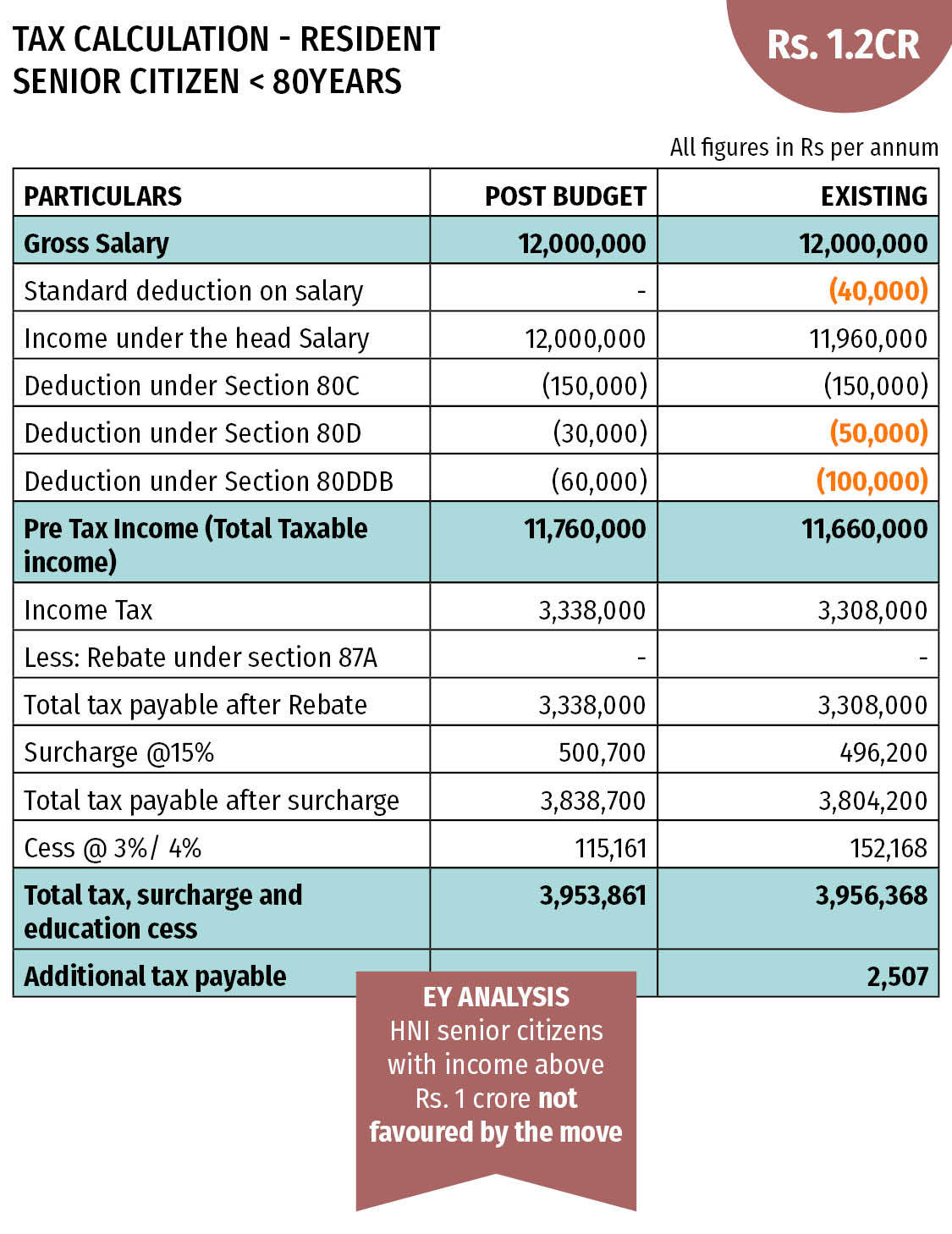

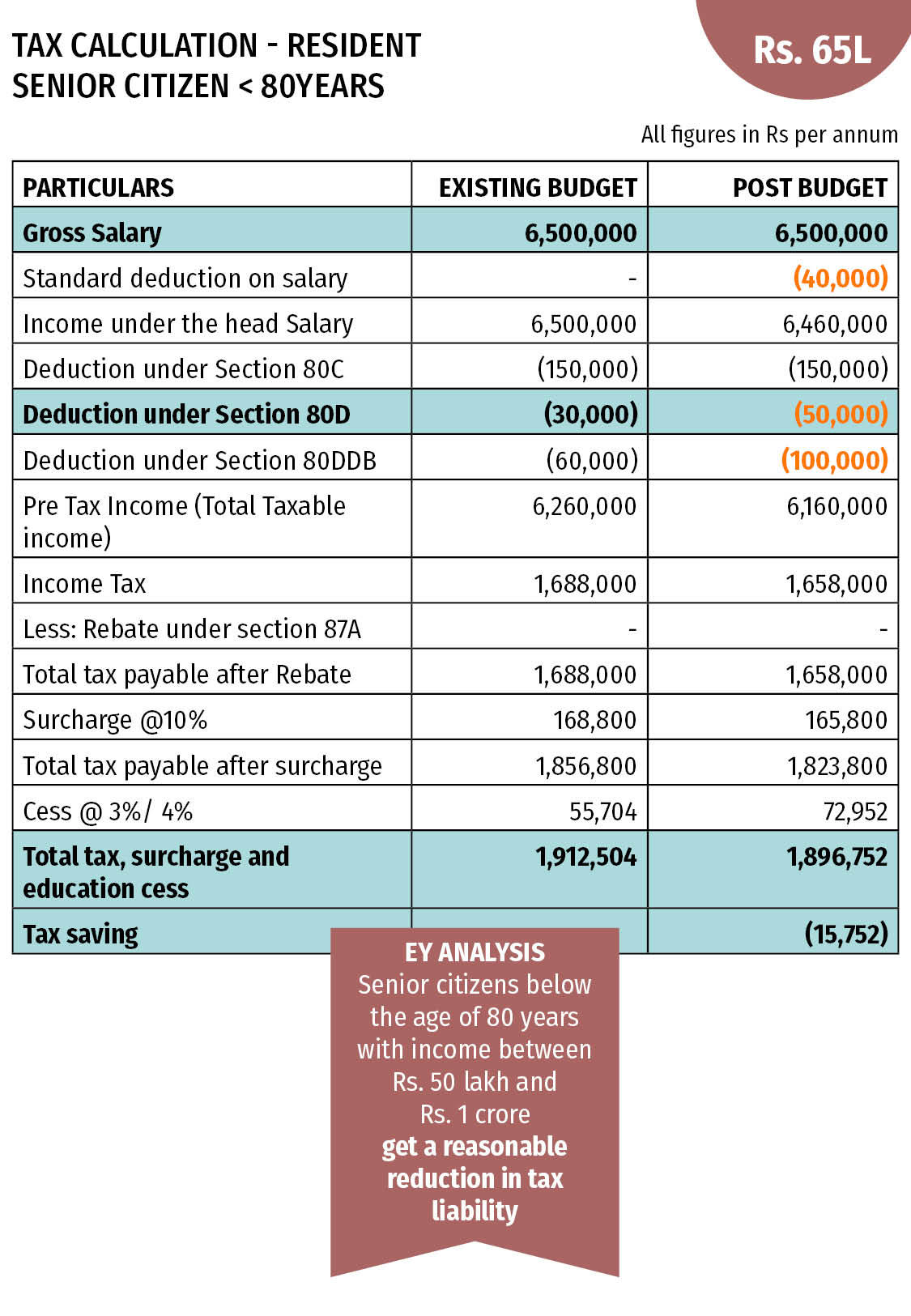

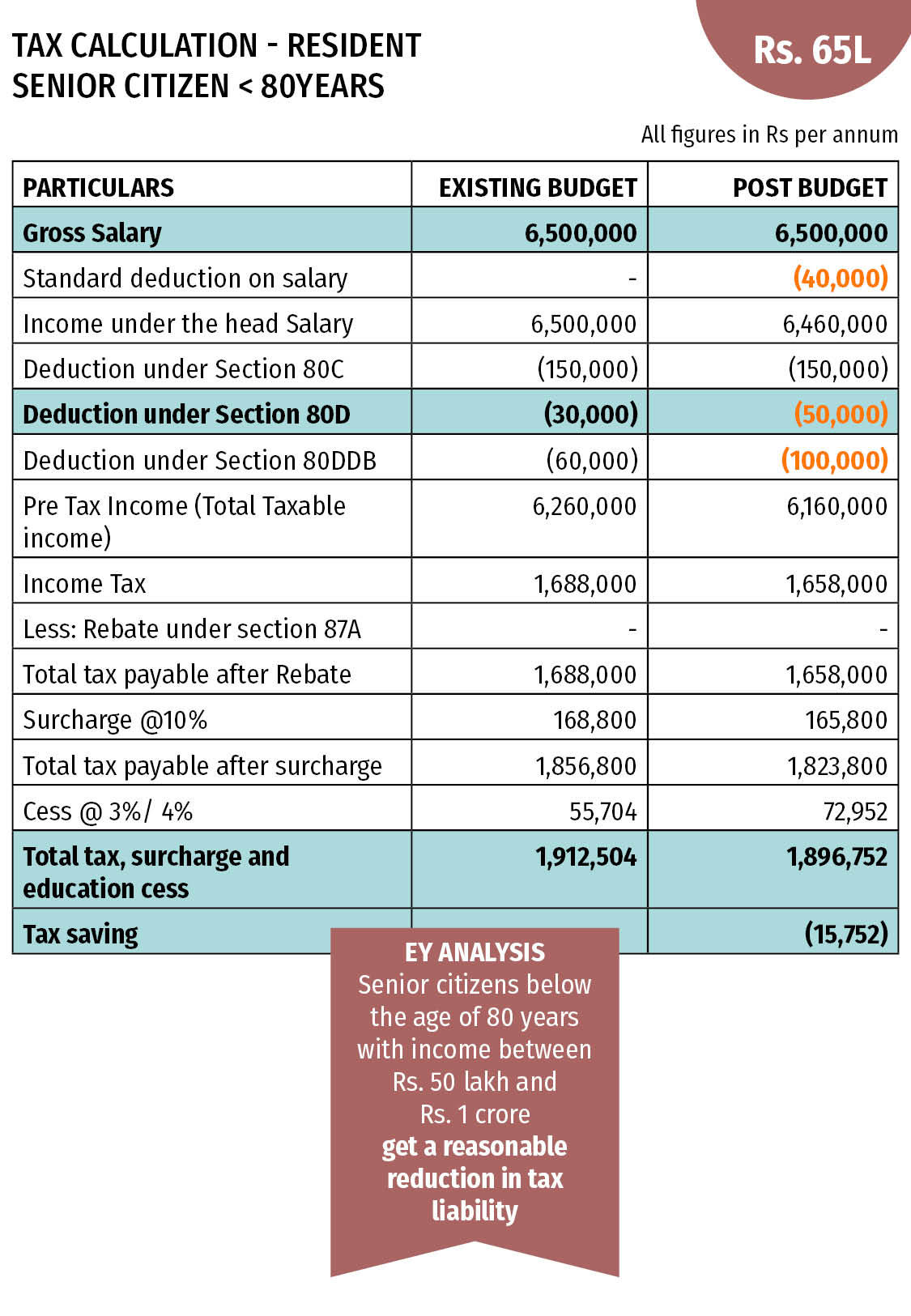

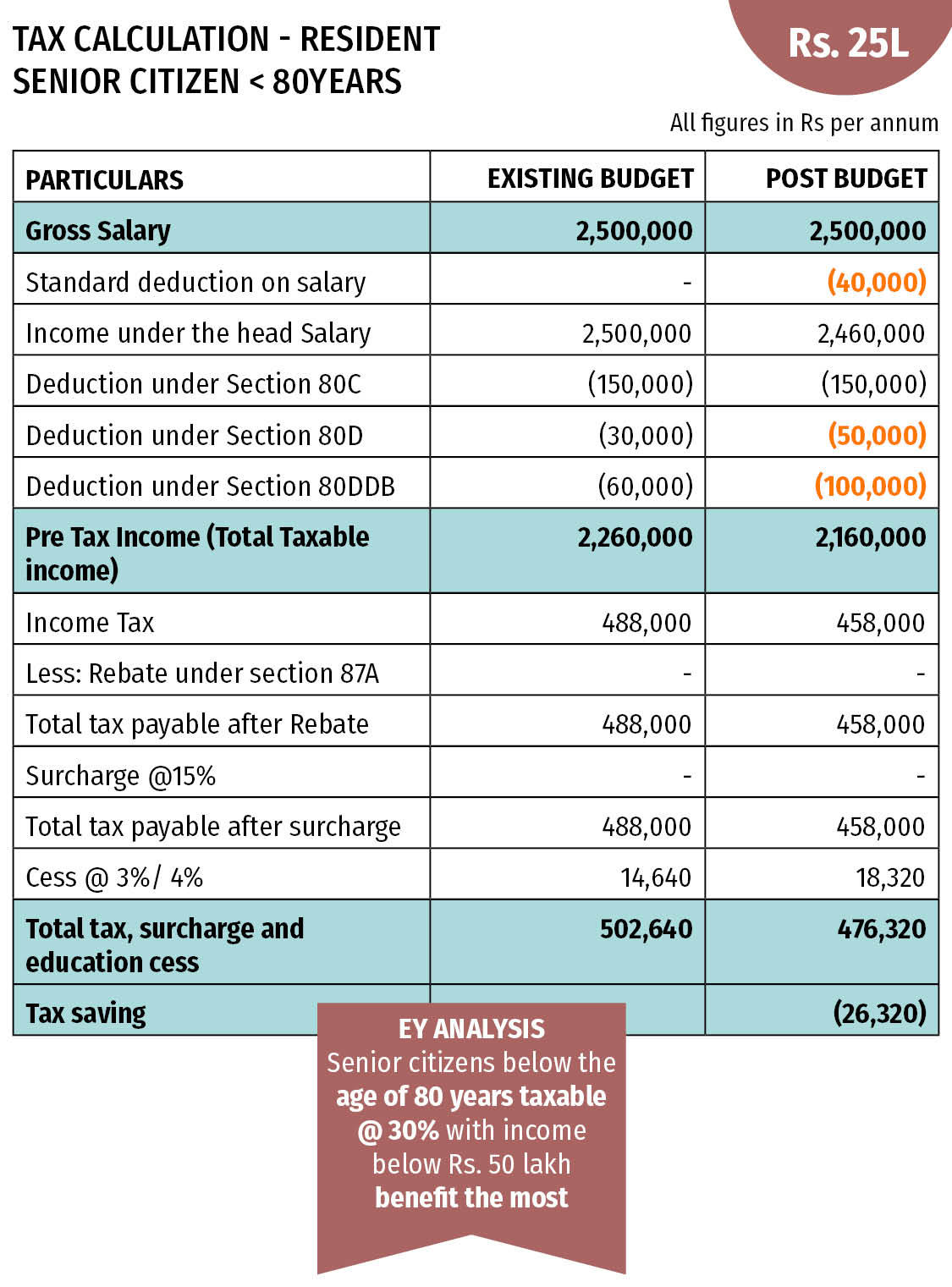

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

https://img.etimg.com/photo/msid-62914754/tax_calculation_80yr_senior_citizen_65l-1.jpg

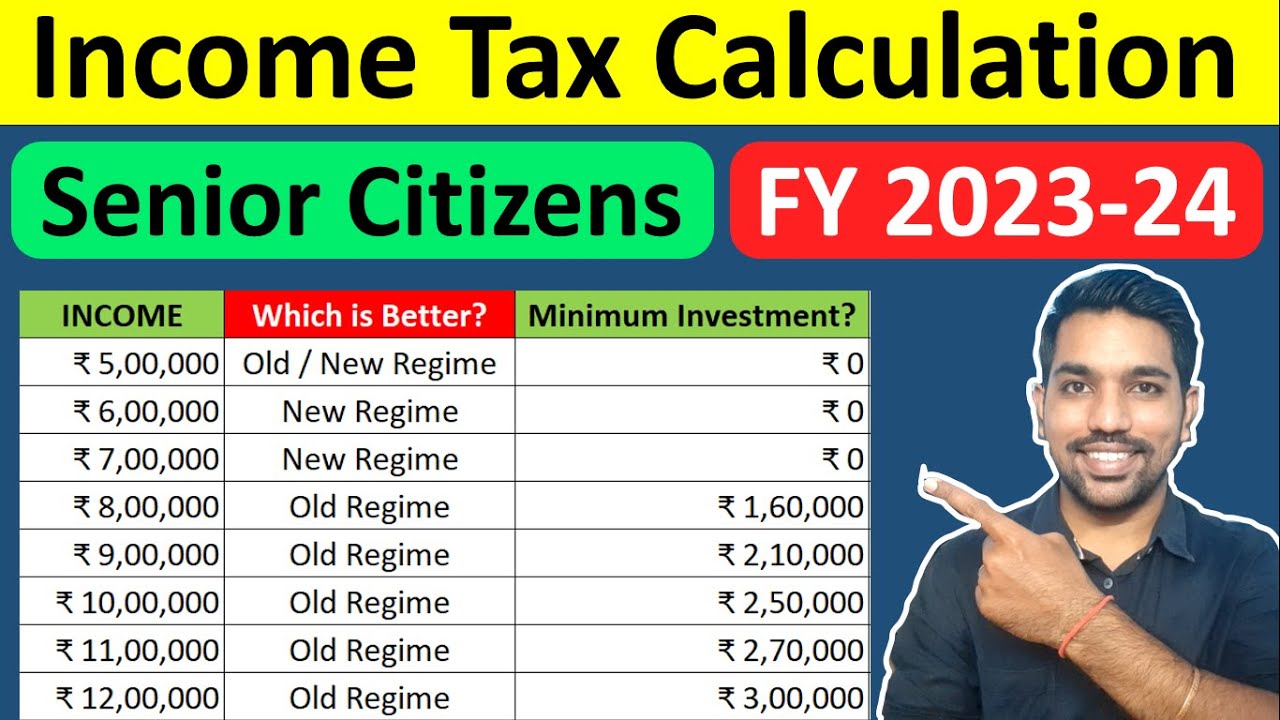

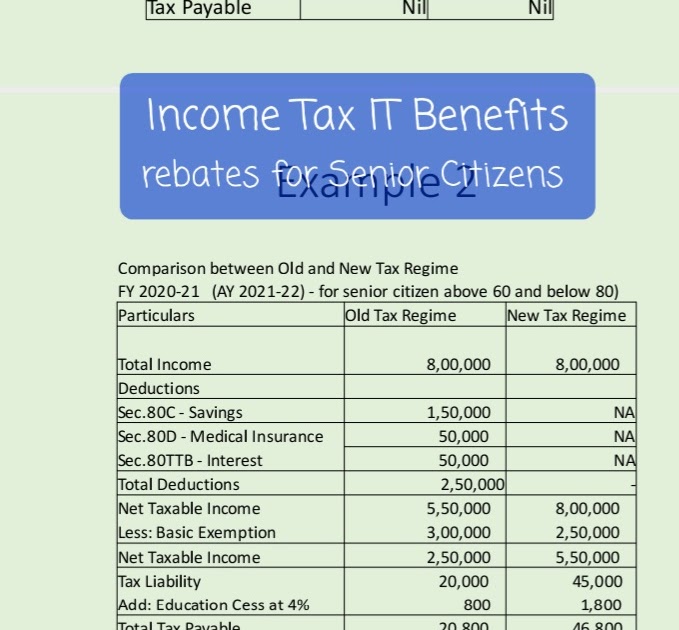

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

https://i.ytimg.com/vi/rfW84weCMCs/maxresdefault.jpg

Web 31 mars 2023 nbsp 0183 32 Senior citizens or those who are of the age of 60 years or more can claim a deduction of up to Rs 50 000 from their gross total income under Section 80TTB of the Income tax Act 1961 This tax Web 29 juin 2022 nbsp 0183 32 Fixed Deposits Tax Saving FD for Sec 80C Deductions Benefits amp Interest Rates Risks Limits Updated on Jun 29 2022 12 14 25 AM Budget 2021 update It

Web 14 mars 2023 nbsp 0183 32 Section 80TTB is a provision whereby a taxpayer who is a resident senior citizen aged 60 years and above at any time during a Financial Year FY can claim a Web 8 avr 2021 nbsp 0183 32 Interest earned from bank fixed deposits is fully taxable for individuals while senior citizens can claim a deduction of up to 50 000 against the interest earned on savings and fixed deposit

Download Fd Interest Rebate In Income Tax For Senior Citizens

More picture related to Fd Interest Rebate In Income Tax For Senior Citizens

.jpg)

Important Deduction For Income Tax For Salaried Persons Employees On

https://d1avenlh0i1xmr.cloudfront.net/6935e541-d1ae-4702-be59-bae61802b2e3/income-tax-slab-rate-(senior-citizen).jpg

Income Tax India On Twitter RT nsitharamanoffc As Announced In

https://pbs.twimg.com/media/FlsE477aMAA8oz_.jpg

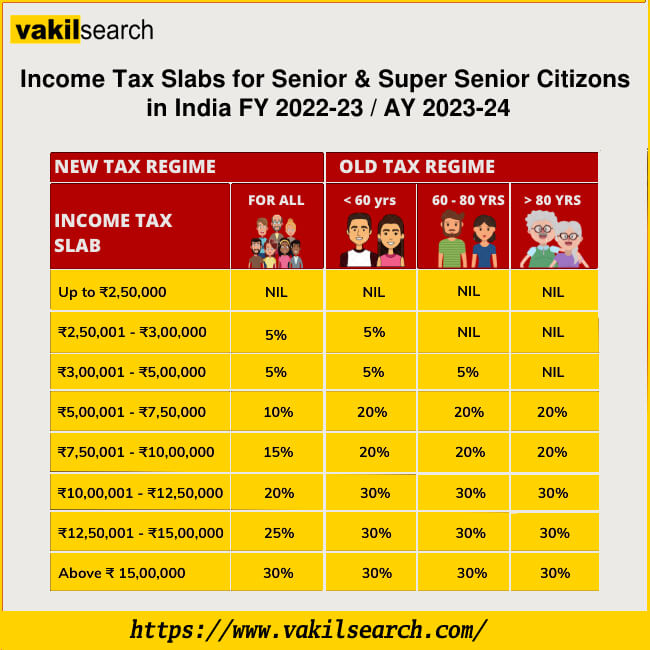

Method Of Calculating Income Tax For Senior Citizen Pensioners

https://d3l793awsc655b.cloudfront.net/blog/wp-content/uploads/2022/09/Income-Tax-Slab-for-Senior-and-Super-Senior-Citizons-FY-2022-23-AY-2023-24.jpg

Web 22 juil 2023 nbsp 0183 32 Compare interest income with the maximum limit If your interest income is equal to or less than Rs 50 000 you can claim the entire interest income as a deduction under Section 80TTB If your Web 12 juil 2023 nbsp 0183 32 Section 80TTB of the Income Tax Act 1961 allows a resident senior citizen to claim a deduction against interest on the deposit Section 80TTB is popular for

Web The exemption from TDS on FD interest income provides significant relief to senior citizens who rely on FDs as a source of income It enables them to receive the full Web 8 sept 2023 nbsp 0183 32 According to Section 80TTB of the Income Tax Act senior citizens can avail of a deduction of up to Rs 50 000 on the interest on deposits which includes fixed

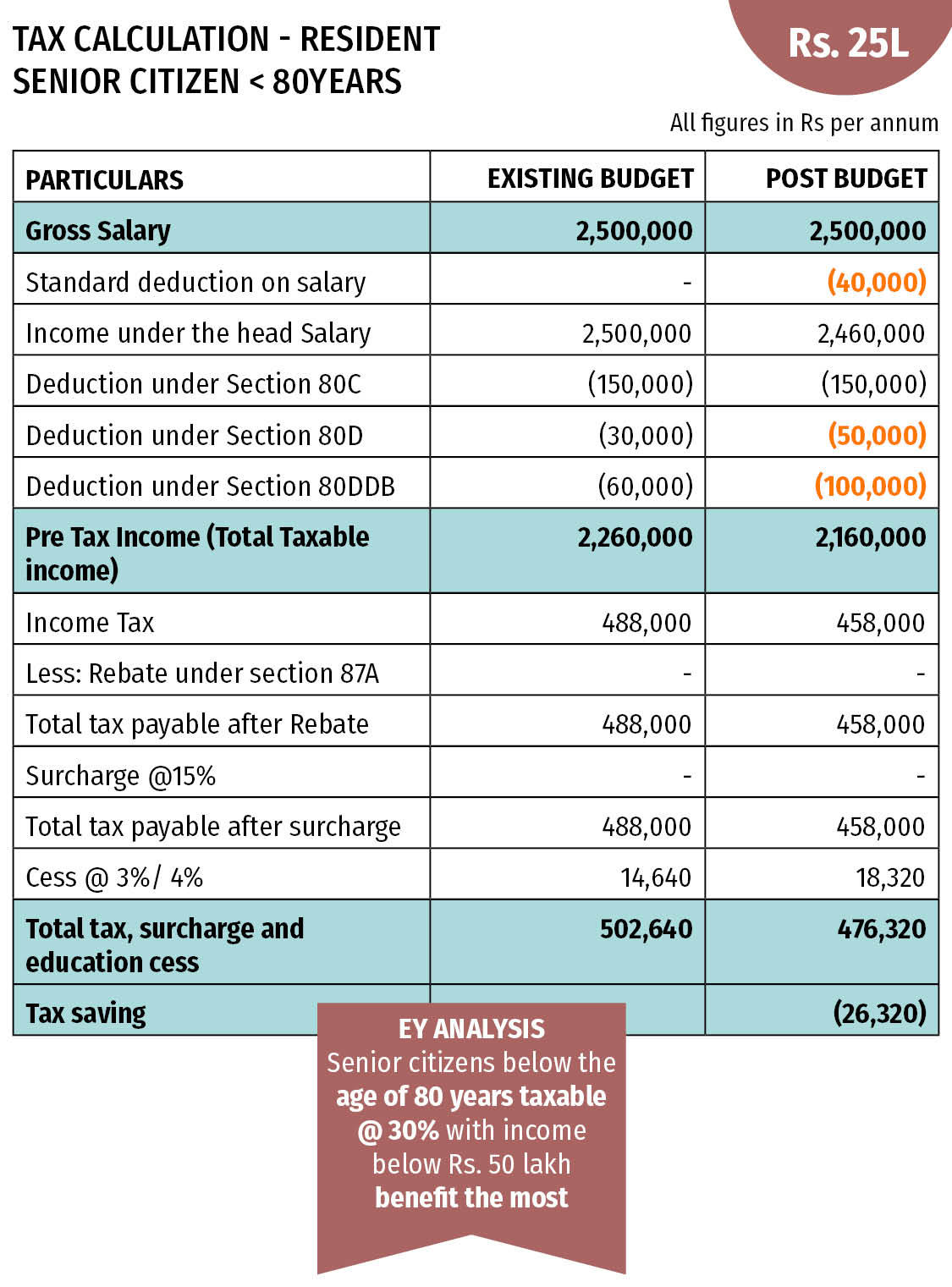

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

https://img.etimg.com/photo/msid-62914737/tax_calculation_80yr_senior_citizen_25l-1.jpg

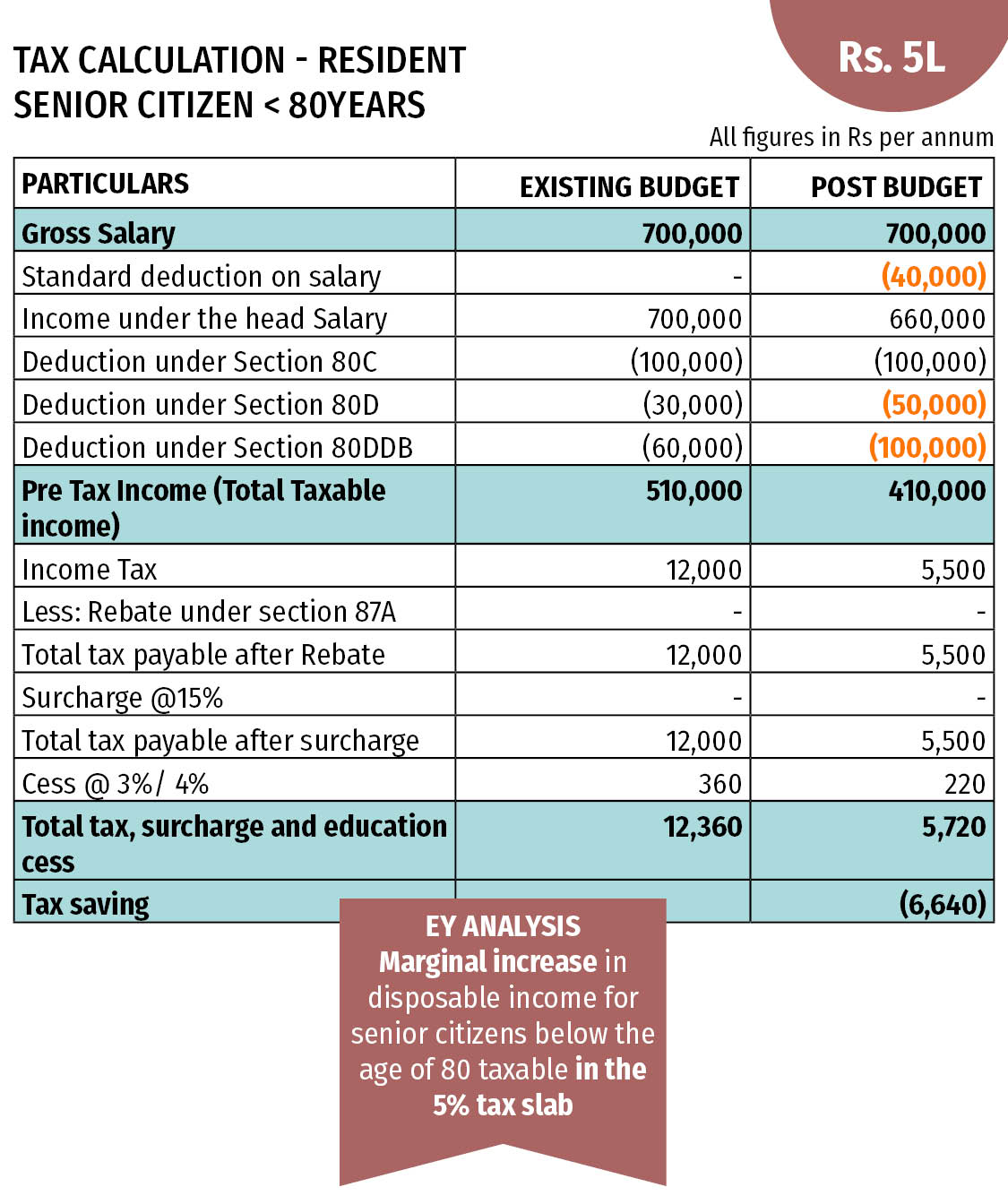

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

https://img.etimg.com/photo/msid-62914728,quality-100/tax_calculation_80yr_senior_citizen_5l-2.jpg

https://www.livemint.com/money/personal-fina…

Web 9 ao 251 t 2020 nbsp 0183 32 According to Section 80TTB of the Income Tax Act senior citizens can avail a tax deduction of maximum upto 50 000 on

https://navi.com/blog/taxability-of-interest-on-fixed-deposits

Web 18 janv 2022 nbsp 0183 32 The TDS deduction rate for interest income from fixed deposits for senior citizens is the same as the rest However the basic exemption limit is Rs 50 000 for a

Income Tax Slabs FY 2020 21 AY 2021 22 Wealthtech Speaks

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Income Tax Slab For Senior Citizen Super Senior Citizen Income Tax

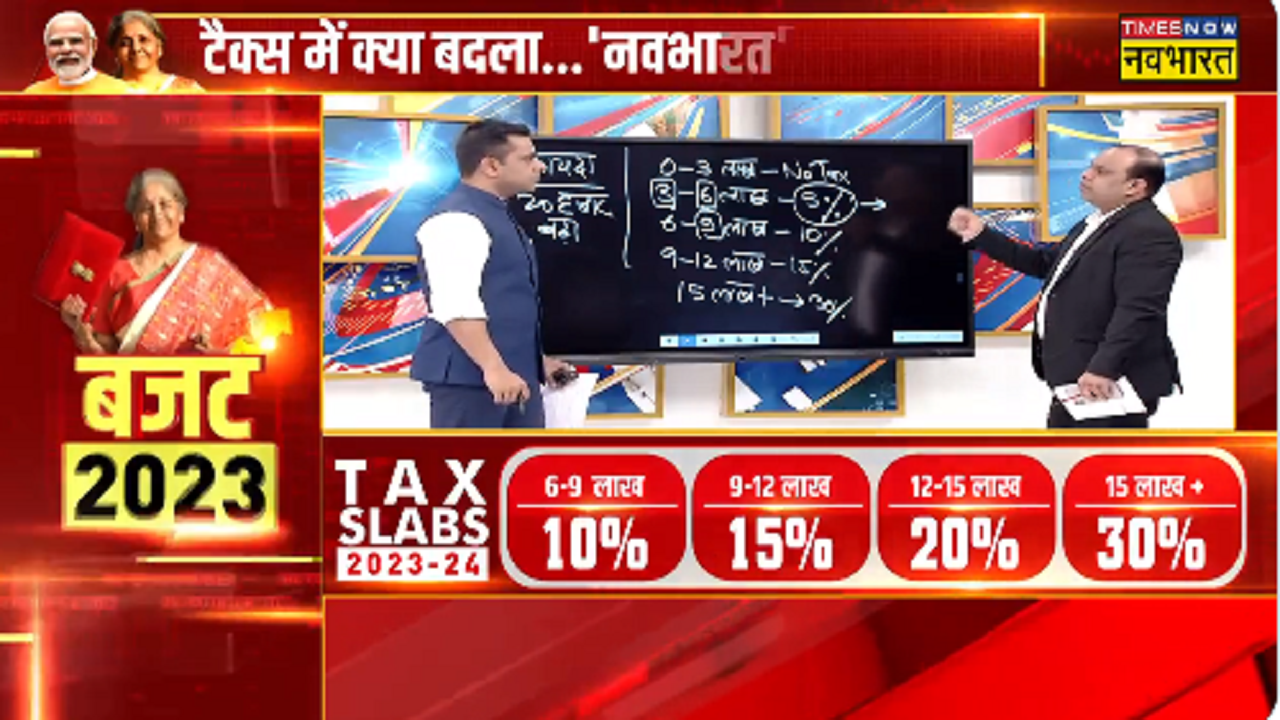

What Is Rebate In Income Tax Nirmala Sitaraman Gives Big Relief To

Income Tax Rules For Senior Citizens Senior Citizens Income Tax Slabs

Income Tax Rules For Senior Citizens Senior Citizens Income Tax Slabs

The Advantages Of FD Are Many But The Disadvantages Are Not Less It Is

SENIOR CITIZEN INCOME TAX CALCULATION FY 2019 20 REBATE 87A TAX

INCOME TAX Relief Senior Citizens Change In FORM 15H Rebate 87A Senior

Fd Interest Rebate In Income Tax For Senior Citizens - Web Show more 13 Exclusive Benefits Available to Senior Citizens In Income Tax Senior Citizen Tax Benefits 2022 In this video I have discussed many benefits exclusively