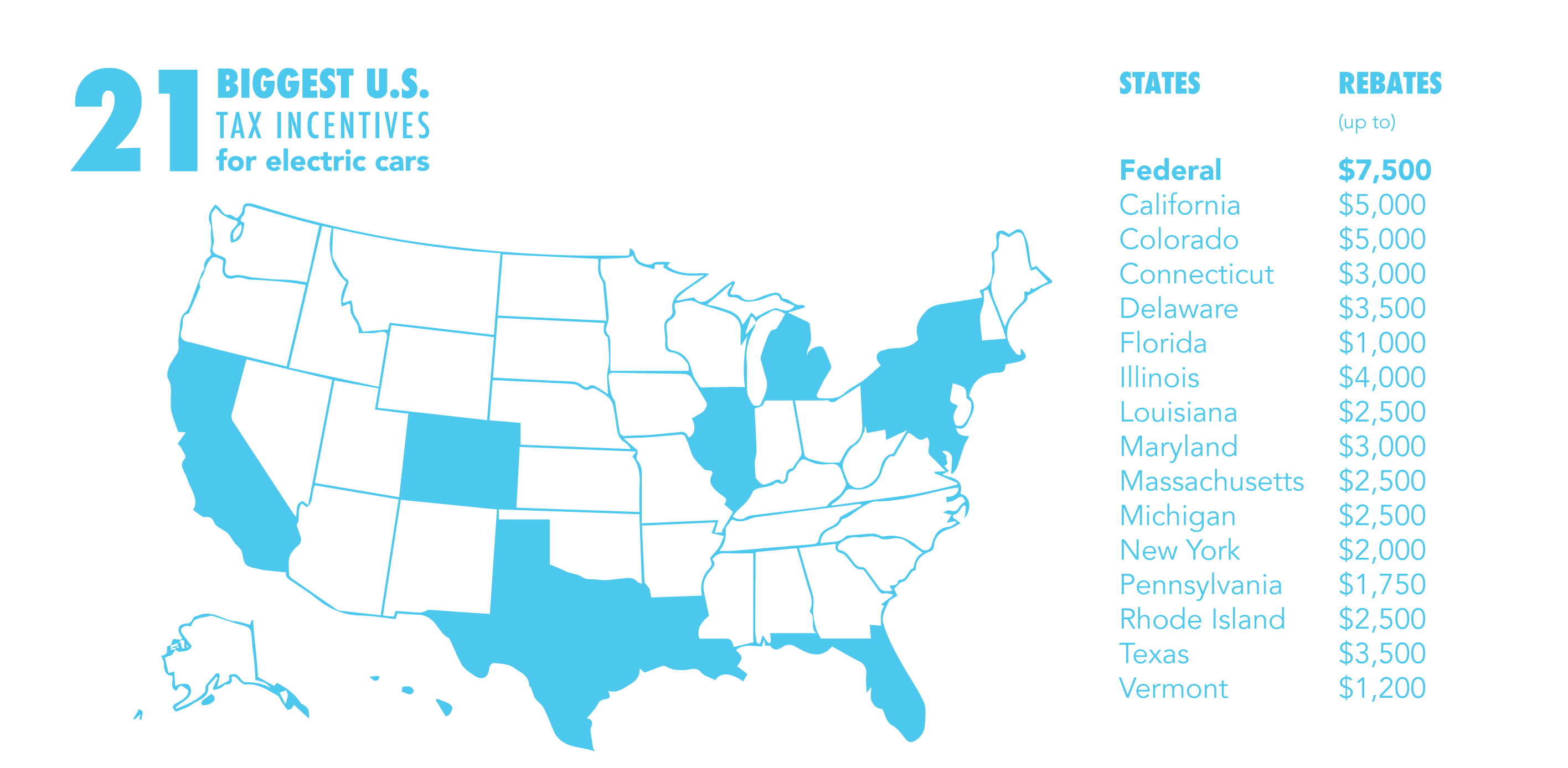

Fed Tax Rebate Battery Powered Car Web 20 avr 2023 nbsp 0183 32 Tesla s website now claims every new Model 3 is eligible for the full 7 500 federal tax credit in the United States after those credits were previously cut in half on

Web 2 d 233 c 2022 nbsp 0183 32 The tax credit is limited to cars under 55K MSRP and under 80K MSRP for trucks and SUVs The IRS updated their guidelines on February 3 qualifying more EVs as SUVs increasing the credit limit Web 27 ao 251 t 2022 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of

Fed Tax Rebate Battery Powered Car

Fed Tax Rebate Battery Powered Car

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/federal-tax-rebate-for-electric-cars-osvehicle.jpg?w=840&ssl=1

Electric Car Rebates Washington State 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/ma-tax-rebates-electric-cars-2022-carrebate-2.jpg?w=358&h=537&ssl=1

Tax Rebates Electric Cars 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/21-biggest-us-tax-incentives-for-electric-cars.png

Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed Web 25 janv 2023 nbsp 0183 32 The IRS expects to issue guidance on the clean vehicle credit in March Experts think the rules around car batteries will limit who can get the credit

Web 25 juil 2023 nbsp 0183 32 GM CEO Mary Barra said GM would reintroduce a new Bolt EV soon powered by Ultium battery technology The Bolt has always been one of the most Web 31 mars 2023 nbsp 0183 32 The latest rules determining which vehicles are eligible for up to 7 500 for a clean vehicle this includes all electric plug in hybrids and alternative energy sources like hydrogen fuel cells

Download Fed Tax Rebate Battery Powered Car

More picture related to Fed Tax Rebate Battery Powered Car

Tax Rebates On New Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/electric-car-tax-credits-and-rebates-charged-future-1.jpeg

Government Tax Rebates For Hybrid Cars 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2023/05/are-the-tax-rebates-for-electric-and-hybrid-cars-worth-it-lionsgate-7.png

The Role Of Electric Cars In Combatting Climate Change

https://sustainabilityawakening.com/wp-content/uploads/2023/04/wkqhu1g2_sg-1024x576.jpg

Web 31 janv 2023 nbsp 0183 32 And if you cover both you could receive the full 7 500 These percentage requirements are set to increase each year possibly rising to 40 percent battery mineral Web 18 avr 2023 nbsp 0183 32 A total of 18 electric and hybrid plug in vehicles are eligible for either partial or the full 7 500 tax rebate Cars that meet just one of the battery component or raw material requirements will

Web 7 sept 2023 nbsp 0183 32 The Treasury Department has released updated rules for electric car buyers this time related to where EV battery components and minerals come Web 19 d 233 c 2022 nbsp 0183 32 Some EVs may qualify for tax credits through March 2023 As reported by Reuters the US Treasury Department has delayed its battery guidance for qualifying EV

CATL Launched A lithium Ore Rebate Plan To Car Companies To Reduce

https://eastwestconn.com/wp-content/uploads/2023/02/413b-1-768x432.png

Tax Rebat Electric Cars Business 2022 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/china-extends-tax-rebate-for-electric-cars-hybrids-daily-ft.jpg?w=840&ssl=1

https://www.theverge.com/2023/4/20/23691597/ev-tax-credit-eligible...

Web 20 avr 2023 nbsp 0183 32 Tesla s website now claims every new Model 3 is eligible for the full 7 500 federal tax credit in the United States after those credits were previously cut in half on

https://electrek.co/2022/12/02/ev-tax-credit-lis…

Web 2 d 233 c 2022 nbsp 0183 32 The tax credit is limited to cars under 55K MSRP and under 80K MSRP for trucks and SUVs The IRS updated their guidelines on February 3 qualifying more EVs as SUVs increasing the credit limit

Delaware Electric Car Tax Rebate Printable Rebate Form

CATL Launched A lithium Ore Rebate Plan To Car Companies To Reduce

Dodge Intros Under 30K PHEV Dodge Hornet CUV With 15 5KW Battery That

2019 Ford Fusion First Look Seventh Year Itch FordRebates

EV Rebates Suggest Uptake In Battery powered Cars Soared In Spring

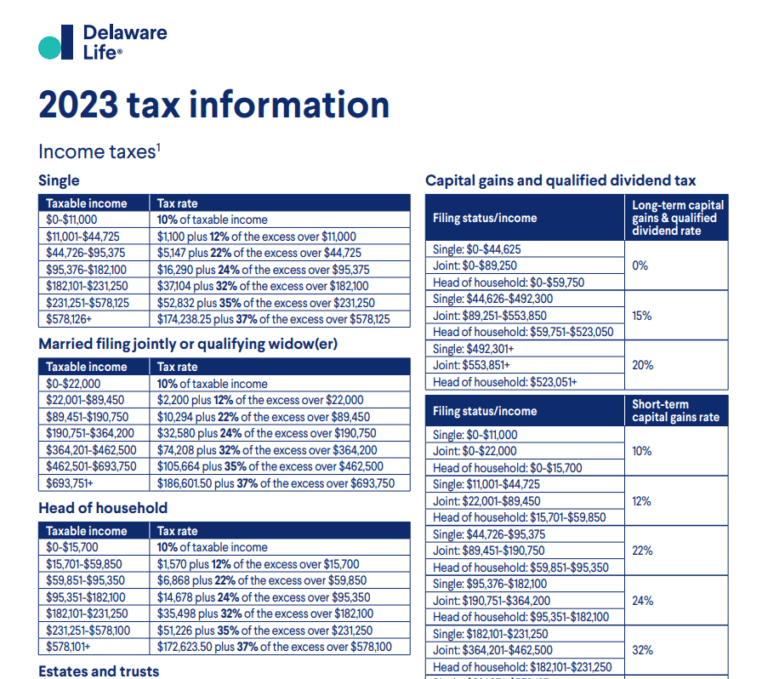

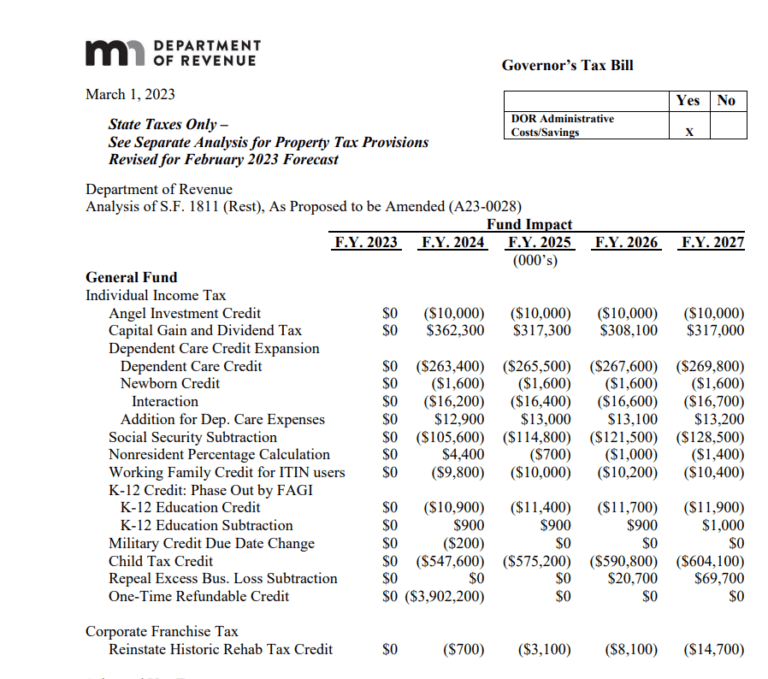

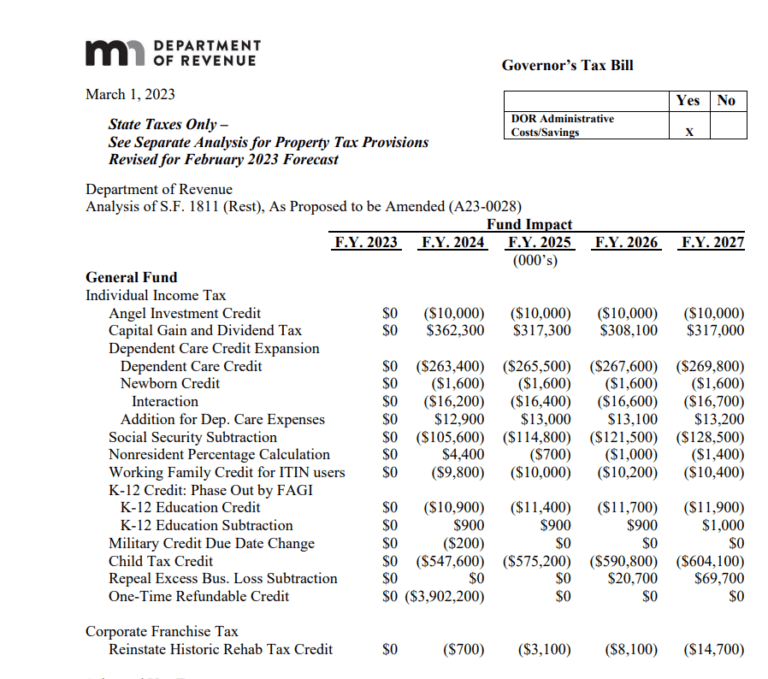

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

Connected Homes Program

Kids Powered Car Lupon gov ph

Buy KASPURO 2 Seater Battery Powered Cars For Kids Electric Cars For

Fed Tax Rebate Battery Powered Car - Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed