Federal Child Care Tax Credit 2023 You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit

Introduction This publication explains the tests you must meet to claim the credit for child and dependent care expenses It explains how to figure and claim the credit You may be able to claim the credit if you pay someone to care for your dependent who is under age 13 or for your spouse or dependent who isn t able to care for themselves The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or parent unable to

Federal Child Care Tax Credit 2023

Federal Child Care Tax Credit 2023

https://www.sittercity.com/wp-content/uploads/2020/02/GettyImages-1180592592-1-scaled-e1581105297103.jpg

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

Child Tax Credit Portal Now Open For Non filers How To Claim Up To

https://www.the-sun.com/wp-content/uploads/sites/6/2021/06/NINTCHDBPICT000653939782-7.jpg

For tax year 2023 you can claim the child tax credit and the additional child tax credit on the federal tax return Form 1040 or 1040 SR that was due by April 15 2024 or by Oct Child and dependent care tax credit If you paid for your child s or a dependent s care while you worked or looked for a job you may be eligible for a credit on your tax return Your eligibility to claim the child and dependent care credit will depend on the amount you paid to care for a qualifying child spouse or other dependent

For 2023 the refundable portion of the credit is 1 600 For the prior year only 1 500 was refundable Note Keep in mind that not everyone can receive the full amount of the 2023 child tax Tax credit per child for 2023 The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax credit you

Download Federal Child Care Tax Credit 2023

More picture related to Federal Child Care Tax Credit 2023

New 2023 IRS Income Tax Brackets And Phaseouts

https://imageio.forbes.com/specials-images/imageserve/637d001647ac19edd4588245/0x0.jpg?format=jpg&width=1200

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

https://mfiworks.com/wp-content/uploads/2021/05/the-child-tax-credit-and-the-dependent-care-credit.jpg

Child And Dependent Care Credit 2022 2022 JWG

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

You can claim from 20 to 35 of your care expenses up to a maximum of 3 000 for one person or 6 000 for two or more people tax year 2023 Benefits of the tax credit The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with We ll cover the maximum the credit is worth for the 2023 tax year the criteria for qualifying plus other tax credits that can assist moderate or low income families What is the child tax credit

How the child tax credit will look in 2023 The child tax credit isn t going away but it has returned to its previous levels There are a handful of requirements that you and your kids must The Child Tax Credit is one of the nation s strongest tools to provide tens of millions of families with some support and breathing room while raising children It has also being shown to be

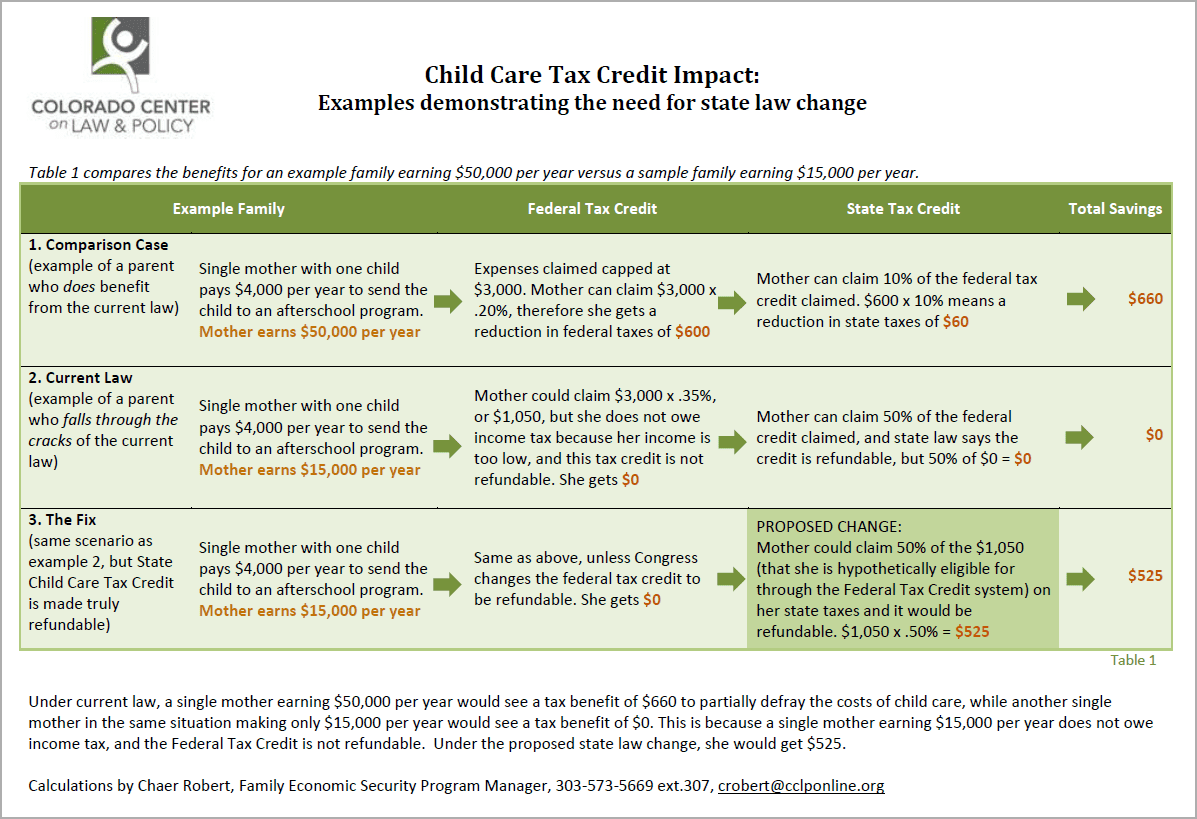

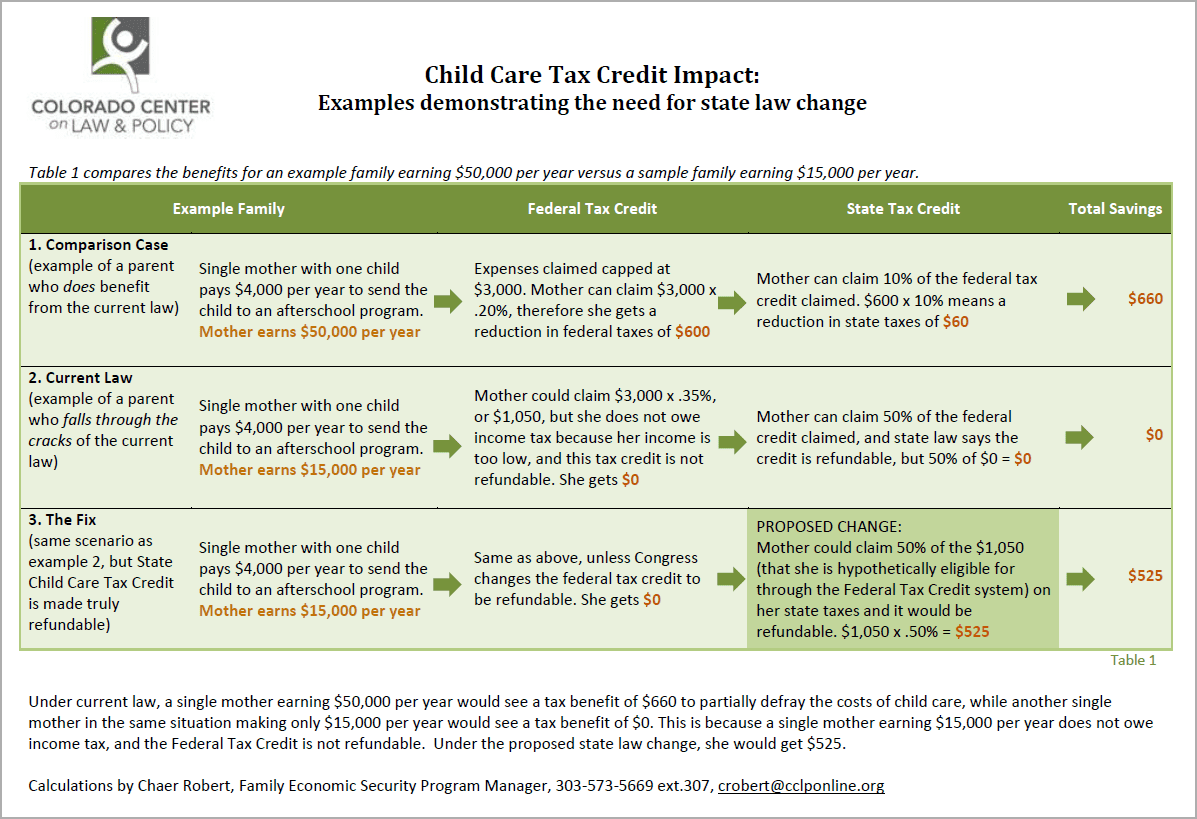

Fixing The Child Care Tax Credit EOPRTF CCLP

http://cclponline.org/wp-content/uploads/2014/02/Child-Chare-Tax-Credit-Impact-Chart.png

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2022/11/GettyImages-1398954446.jpg

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit

https://www.irs.gov/publications/p503

Introduction This publication explains the tests you must meet to claim the credit for child and dependent care expenses It explains how to figure and claim the credit You may be able to claim the credit if you pay someone to care for your dependent who is under age 13 or for your spouse or dependent who isn t able to care for themselves

How Many Monthly Child Tax Credit Payments Were There Leia Aqui How

Fixing The Child Care Tax Credit EOPRTF CCLP

Bipartisan Bill To Improve Child Care Tax Credit Introduced In Senate

Aca Percentage Of Income 2022 INCOMUNTA

Child Tax Credit Payments 06 28 2021 News Affordable Housing

What Is The Phase Out For Dependent Care Credit Latest News Update

What Is The Phase Out For Dependent Care Credit Latest News Update

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

Take Advantage Of The Child Care Tax Credit Care HomePay

Federal Child Care Tax Credit 2023 - The child tax credit is limited to 2 000 for every dependent you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year Modified adjusted gross income MAGI thresholds for single taxpayers and heads of household are set at 200 000 to qualify and 400 000 for joint