Federal Education Tax Credit 2022 IRS Tax Tip 2022 123 August 11 2022 Anyone pursuing higher education including specialized job training and grad school knows it can be pricey Eligible taxpayers who

Education Credits Internal Revenue Service How is the amount of an education credit determined What expenses qualify for an education credit Do The American opportunity tax credit lets you claim all of the first 2 000 you spent on tuition school fees and books or supplies

Federal Education Tax Credit 2022

Federal Education Tax Credit 2022

https://phantom-marca.unidadeditorial.es/988259e034d1160741cebb5cc94b0719/resize/1320/f/jpg/assets/multimedia/imagenes/2021/12/18/16398410536614.jpg

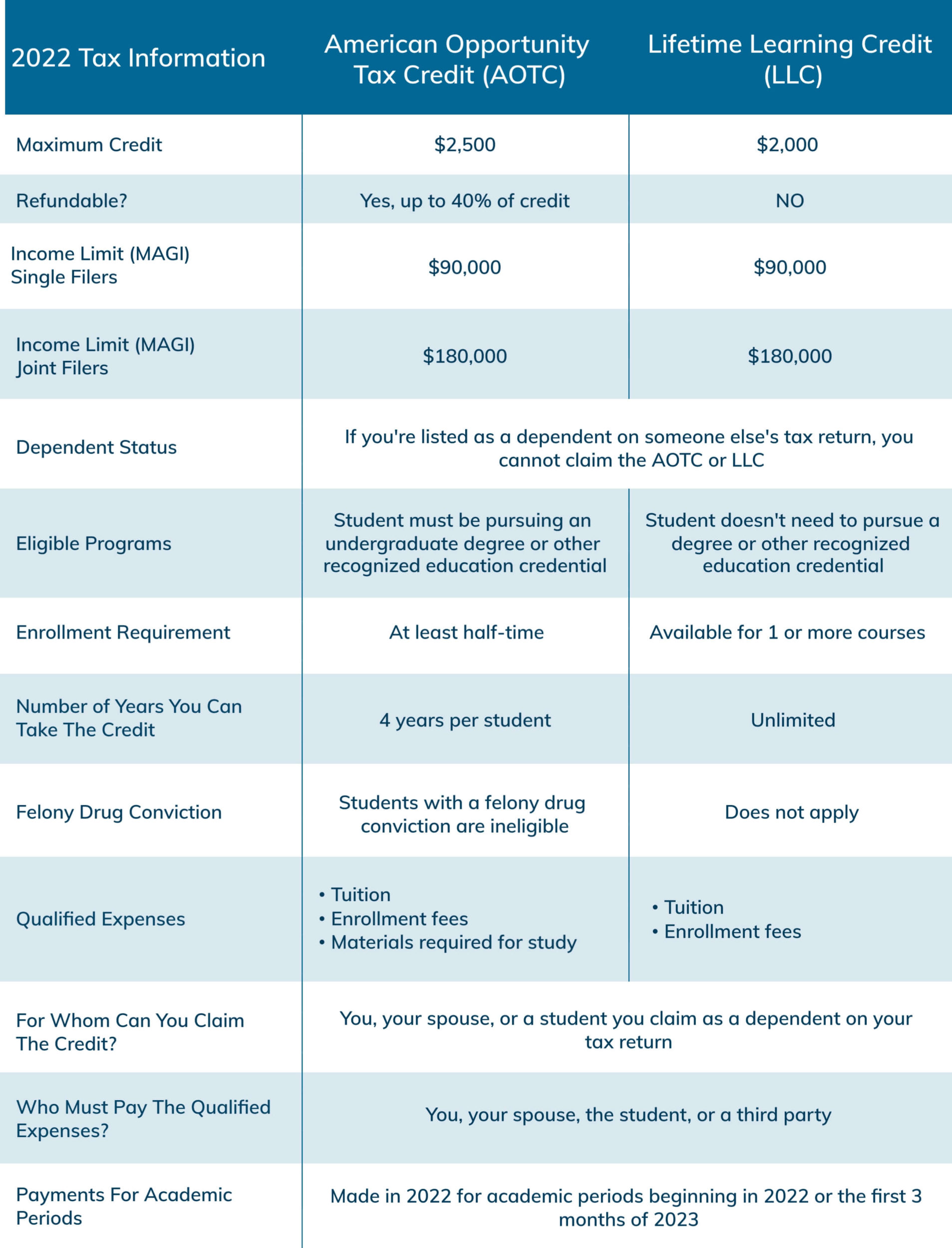

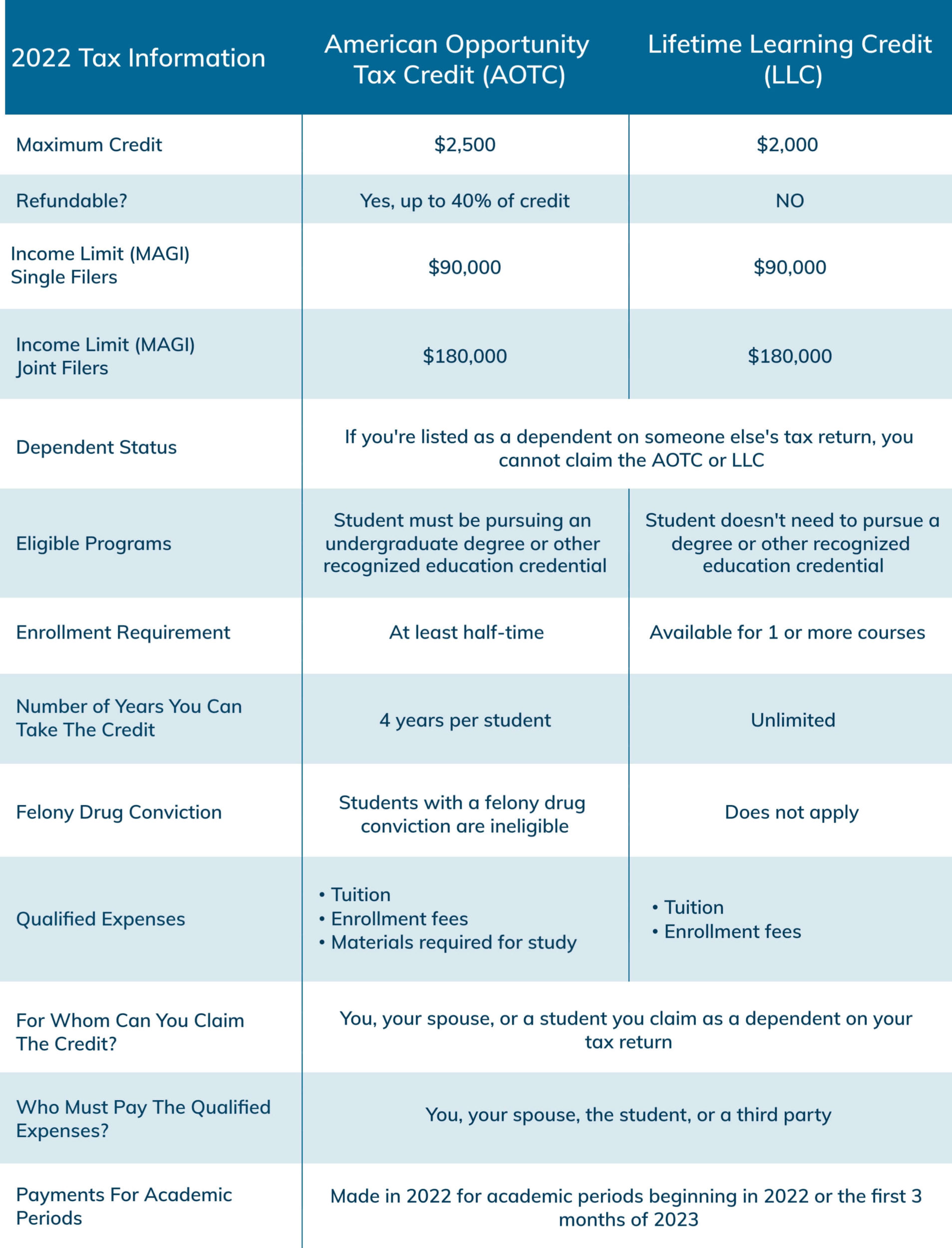

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-1907x2500.jpg

Mock Tax Return 2020 DomenicHibba

https://www.pdffiller.com/preview/579/104/579104355/large.png

Published January 4 2022 Last Updated October 24 2023 Education Tax Credits and Deductions Did you know there can be tax benefits for pursuing higher education and or Meaghan Hunt October 27 2023 8 min read Key takeaways Tax credits and deductions can help students their parents and educators offset the costs of higher education and

What Are Education Tax Credits Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2023 October 19 2023 7 36 AM Guide to education tax credits and deductions for 2022 taxes Meaghan Hunt Posted October 27 2023 Last updated October 27 2023 Key takeaways Tax

Download Federal Education Tax Credit 2022

More picture related to Federal Education Tax Credit 2022

Child Tax Credit 2022 Income Phase Out Latest News Update

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/t21-0190.gif

Cool Tax Credits Usa 2022 Finance News

https://i2.wp.com/i.ytimg.com/vi/tiTLw0XHeBE/maxresdefault.jpg

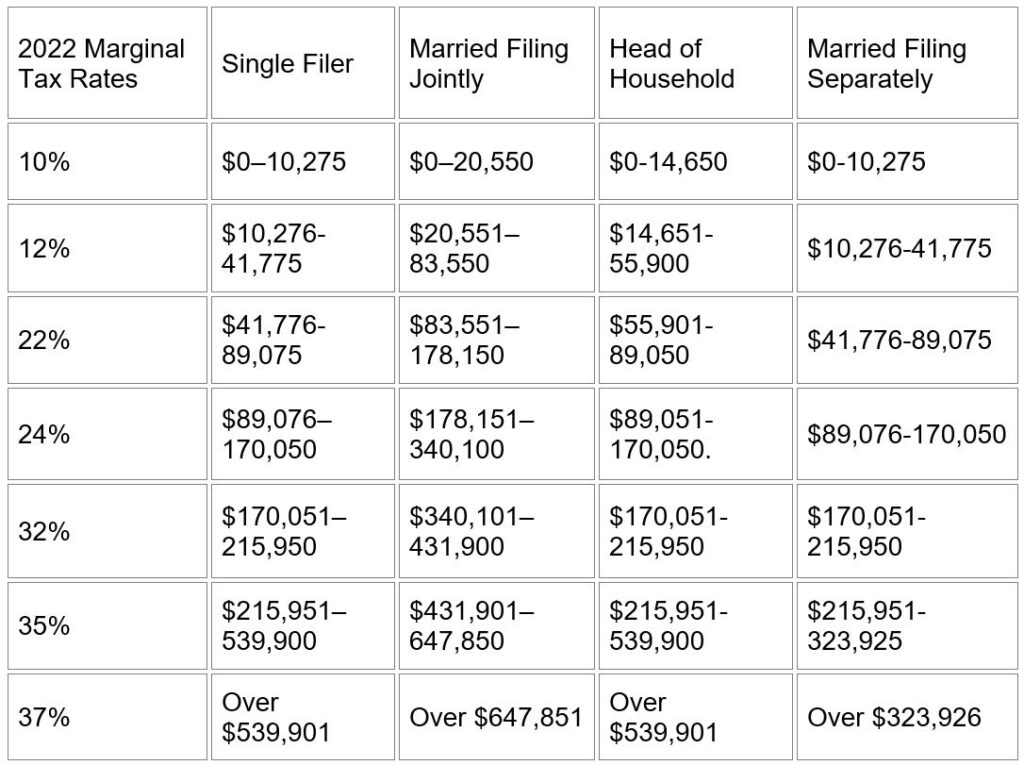

New 2022 IRS Income Tax Brackets And Phaseouts For Education Tax Breaks

https://imageio.forbes.com/specials-images/imageserve/618c20ffbb2bc42be3bd8357/0x0.jpg?format=jpg&width=1200

The Tuition and Fees Deduction has been permanently repealed The income phaseouts for the American Opportunity Tax Credit and Lifetime Learning Tax Eligibility for Tuition Tax Credits There are two tax credits which are based on amounts spent on tuition and fees books supplies and equipment for a student who is either the taxpayer

By Katelyn Washington last updated 10 days ago It s not always easy to determine which education tax credits and deductions you qualify for and you might What education tax credits are available for college students There are two higher education tax credits for students in tax year 2022 the American Opportunity Tax Credit

Irs Tax Table 2022 Married Filing Jointly Latest News Update

https://i0.wp.com/www.whitecoatinvestor.com/wp-content/uploads/2020/12/tax-brackets-2022-img-1024x597.jpg

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

https://static01.nyt.com/images/2022/12/14/upshot/14up-child-tax-credit-promo-promo/14up-child-tax-credit-promo-promo-mediumSquareAt3X.png

https://www.irs.gov/newsroom/college-students...

IRS Tax Tip 2022 123 August 11 2022 Anyone pursuing higher education including specialized job training and grad school knows it can be pricey Eligible taxpayers who

https://www.irs.gov/faqs/childcare-credit-other-credits/education-credits

Education Credits Internal Revenue Service How is the amount of an education credit determined What expenses qualify for an education credit Do

Missouri Property Tax Credit Form 2022 Fill Out Sign Online DocHub

Irs Tax Table 2022 Married Filing Jointly Latest News Update

The 2 Education Tax Credits For Your Taxes Credible

Income Tax Ordinance 2022 Pdf Latest News Update

2022 Paye Tax Tables Brokeasshome

How To Claim The Education Tax Credit Cgsva

How To Claim The Education Tax Credit Cgsva

22 Questions Answered For 2022 Tax Filing Emerald Advisors

Tax Return 2022 Eitc Latest News Update

The Education Tax Credit How Does It Work THE JOSIAH BARTLETT

Federal Education Tax Credit 2022 - Published January 4 2022 Last Updated October 24 2023 Education Tax Credits and Deductions Did you know there can be tax benefits for pursuing higher education and or