Federal Electric Car Rebate For Married Filing Separately Web If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit Find information on credits for

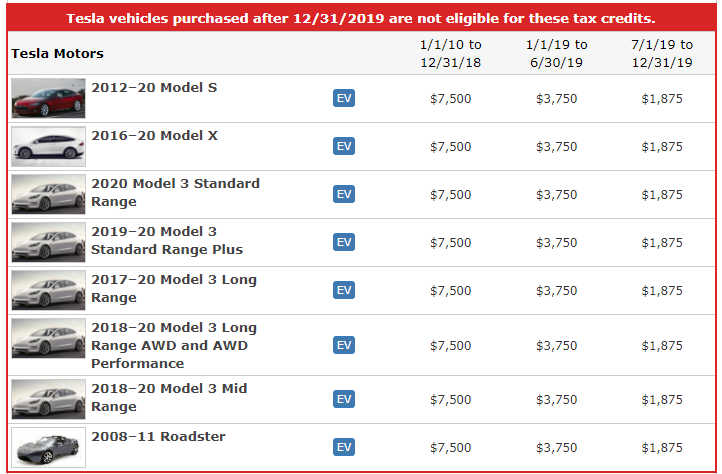

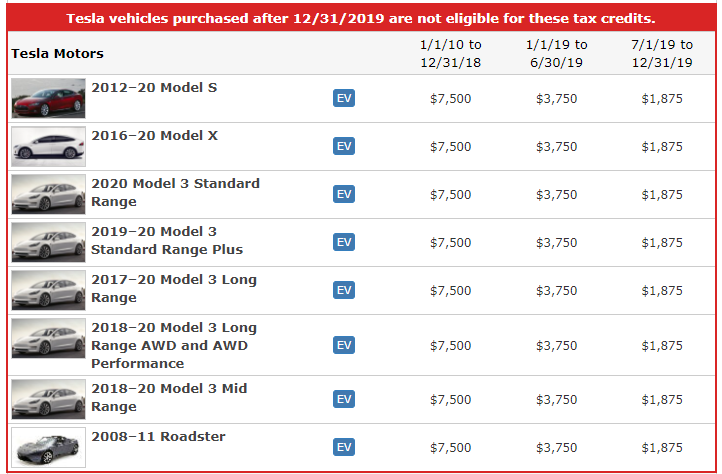

Web 27 ao 251 t 2022 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of Web 5 sept 2023 nbsp 0183 32 150 000 for married filing jointly or a surviving spouse 112 500 for heads of households 75 000 for all other filers

Federal Electric Car Rebate For Married Filing Separately

Federal Electric Car Rebate For Married Filing Separately

https://www.carrebate.net/wp-content/uploads/2022/08/californians-can-get-an-electric-vehicle-for-free-sly-credit-1.png

Canada Federal Electric Car Rebate 2022 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/federal-electric-car-rebate-canada-2022-carrebate-2.jpg

Federal Electric Car Rebate 2022 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/federal-electric-vehicle-rebate-incentive-rci-english-1.jpg

Web 31 mars 2023 nbsp 0183 32 Married filing jointly or filing as a qualifying surviving spouse or a qualifying widow er 300 000 Head of household 225 000 All other taxpayers 150 000 Web 3 oct 2022 nbsp 0183 32 To claim the EV tax credit for a used electric vehicle you will need to earn 75 000 or less as a single taxpayer The limit is 112 500 for single heads of household

Web 7 sept 2023 nbsp 0183 32 Advice How Do Electric Car Tax Credits Work in 2023 By Renee Valdes 09 07 2023 12 00pm Quick Facts About Federal Incentives for Electric Cars EV buyers Web Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Purchased in 2023 or After fueleconomy gov Verifying the manufacturer s suggested retail price final

Download Federal Electric Car Rebate For Married Filing Separately

More picture related to Federal Electric Car Rebate For Married Filing Separately

New Federal Electric Car Rebate 2022 Carrebate Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/03/new-federal-electric-car-rebate-2022-carrebate-3.jpg

Cars That Meet Federal Rebate On Electric Cars 2022 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/federal-rebate-for-electric-cars-2022-carrebate-2.jpg

Recovery Rebate Credit 2023 Married Filing Separately Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/strategies-to-maximize-the-2021-recovery-rebate-credit-18.png

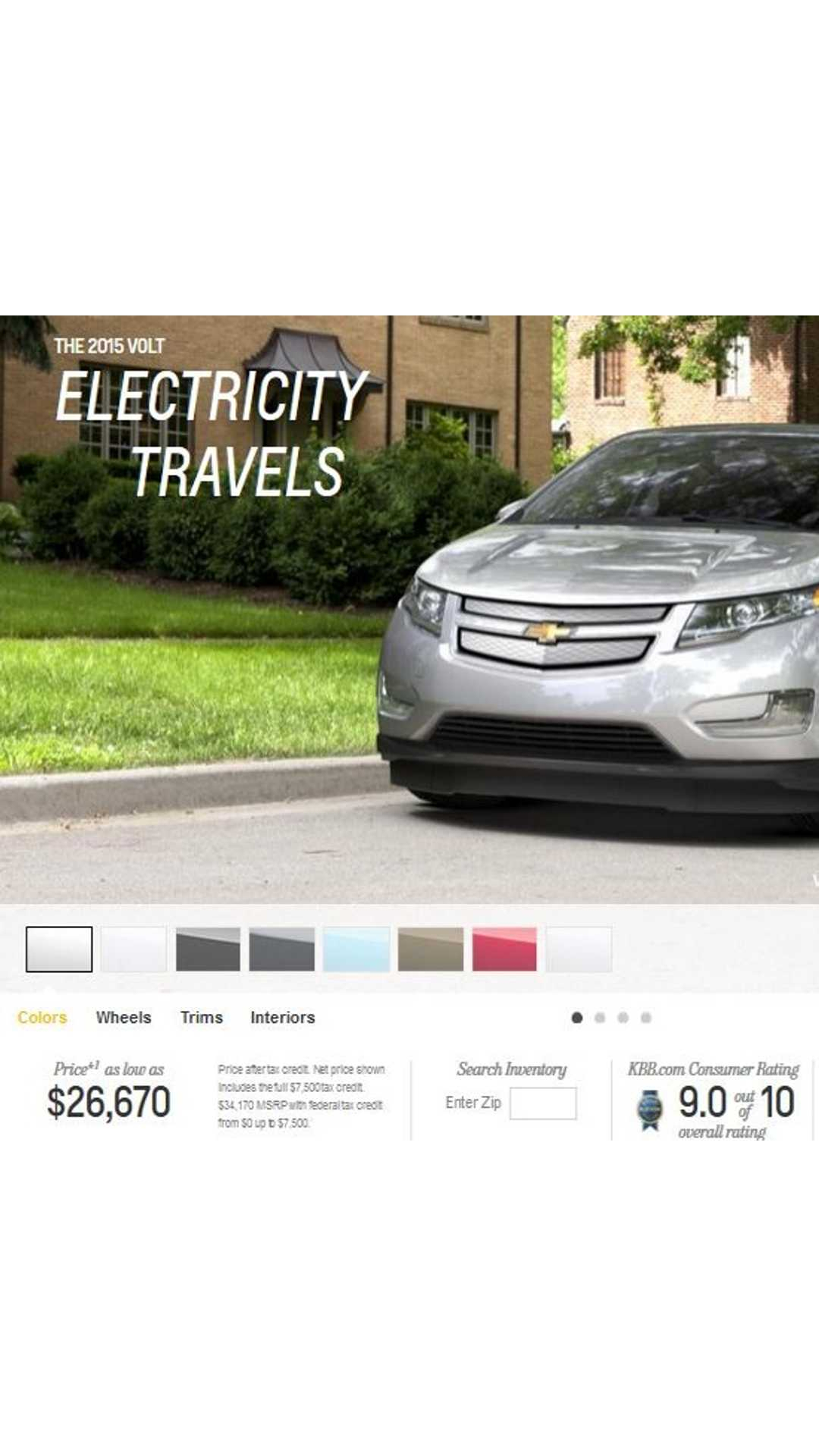

Web Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Purchased in 2023 or After Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell Web The Inflation Reduction Act broke the credit into two halves You can claim 3 750 if at least half of the value of your vehicle s battery components are manufactured or assembled in

Web 25 juil 2023 nbsp 0183 32 Also your modified adjusted gross income AGI may not exceed 300 000 for married couples filing jointly or 225 000 for heads of households The AGI limit is Web 23 janv 2023 nbsp 0183 32 The EV tax credit is a financial incentive built by the government that will allow you to earn money back in the form of a credit up to 7 500 if you buy a qualified

Electric Car Rebates Federal 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/looking-at-buying-an-electric-car-new-federal-rebates-kick-in-may-1-3.jpg

Hybrid Cars Rebate 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/federal-rebates-for-hybrid-cars-2022-2022-carrebate-1.jpg?w=836&h=993&ssl=1

https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles...

Web If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit Find information on credits for

https://www.nerdwallet.com/article/taxes/ev-tax-credit-electric...

Web 27 ao 251 t 2022 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of

Canada Federal Electric Car Rebate 2022 2022 Carrebate

Electric Car Rebates Federal 2023 Carrebate

Federal Rebates For Hybrid Cars 2023 Carrebate

Federal Rebates For Hybrid Cars 2022 2022 Carrebate

Is There A Federal Rebate For Buying An Electric Car 2023 Carrebate

Electric Car Available Rebates 2023 Carrebate

Electric Car Available Rebates 2023 Carrebate

Federal Government Rebate On Electric Cars KnowYourGovernment

New Electric Car Rebate Canada 2023 Carrebate

Electric Car Rebates Canada 2021

Federal Electric Car Rebate For Married Filing Separately - Web 7 sept 2023 nbsp 0183 32 Advice How Do Electric Car Tax Credits Work in 2023 By Renee Valdes 09 07 2023 12 00pm Quick Facts About Federal Incentives for Electric Cars EV buyers