Federal Electric Car Rebate Limits Web 5 sept 2023 nbsp 0183 32 A new federal EV tax credit for 2023 is here thanks to the Inflation Reduction Act IRA massive tax and climate legislation promoting clean energy The credit of up

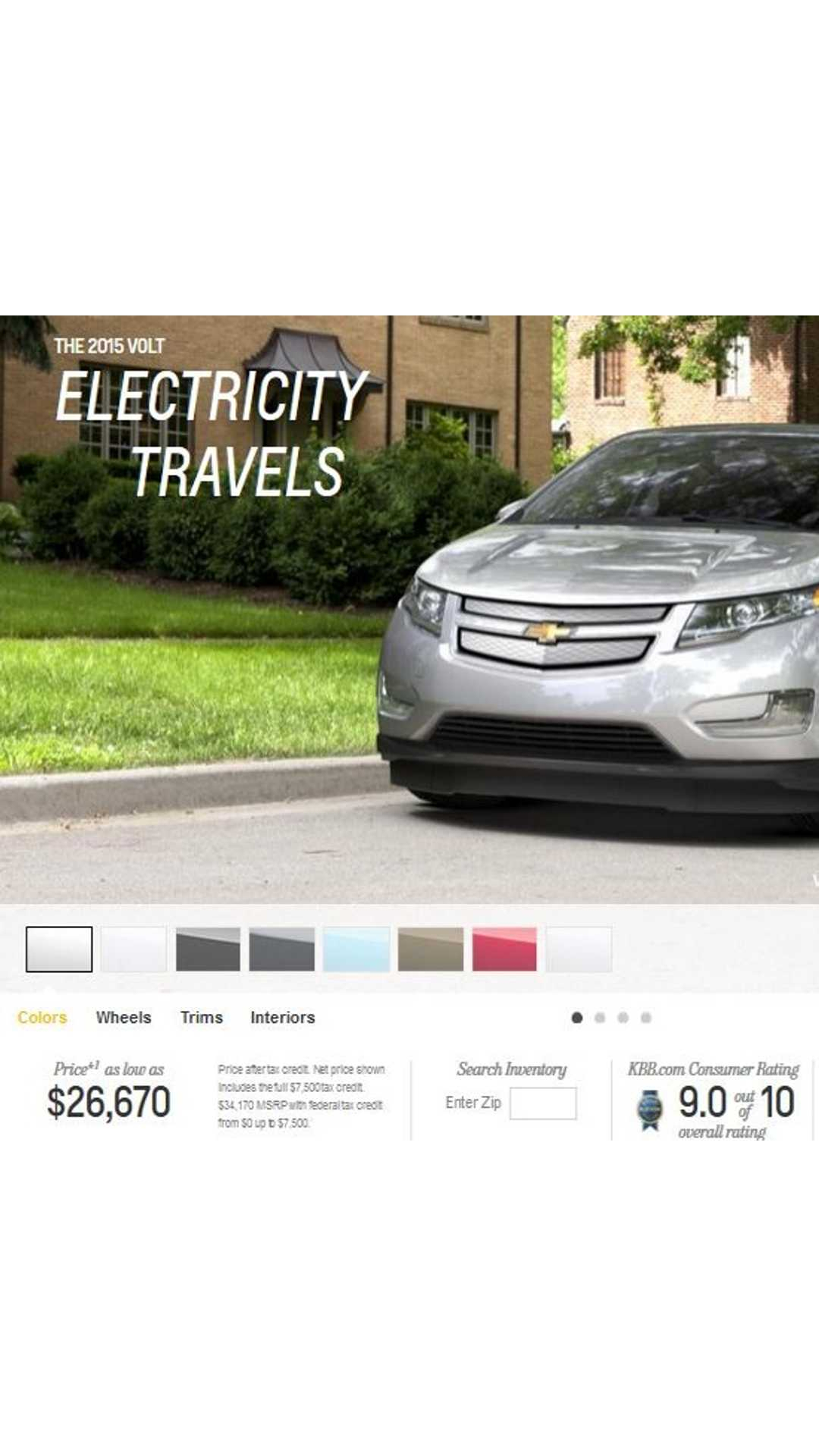

Web 7 janv 2023 nbsp 0183 32 You can get a 7 500 tax credit but it won t be easy Updated April 3 202311 10 AM ET Camila Domonoske Enlarge this image For Web 26 d 233 c 2022 nbsp 0183 32 The credit of up to 7 500 will be offered to people who buy certain new electric vehicles as well as some plug in gas electric hybrids and hydrogen fuel cell

Federal Electric Car Rebate Limits

Federal Electric Car Rebate Limits

https://www.carrebate.net/wp-content/uploads/2022/08/californians-can-get-an-electric-vehicle-for-free-sly-credit-1.png

Federal Electric Car Rebate Rules ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/08/rebates-and-tax-credits-make-buying-an-electric-vehicle-more-affordable-2.png

Electric Car Rebates Federal 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/federal-electric-vehicle-rebates-announced-youtube.jpg

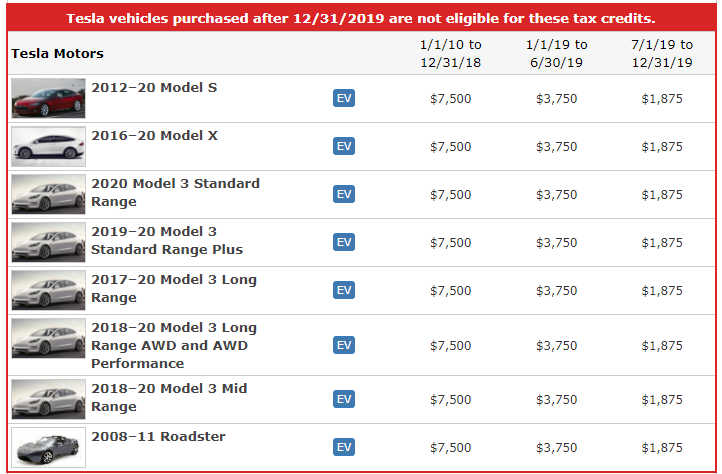

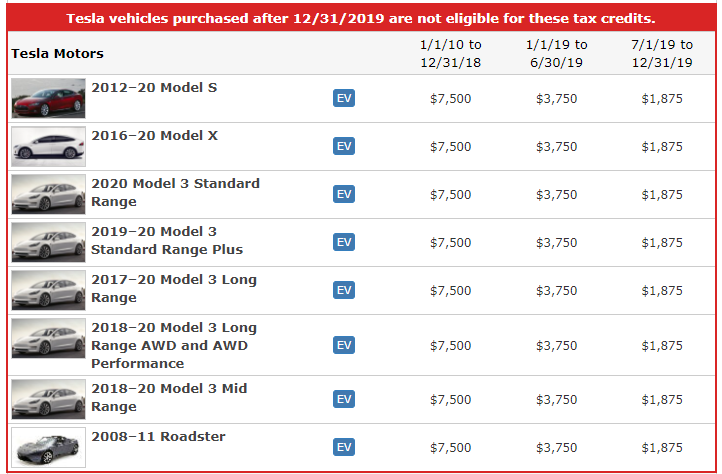

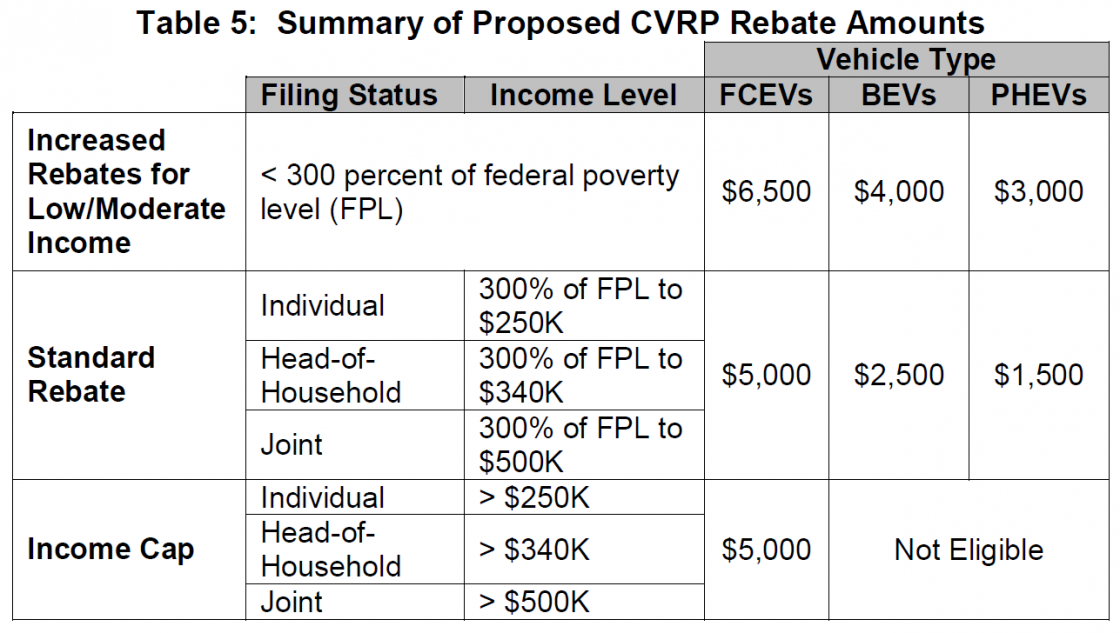

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section Web 10 ao 251 t 2022 nbsp 0183 32 The law also limits the new tax credit to individuals with an income of 150 000 or less 300 000 or less for those taxpayers who are married and file a joint

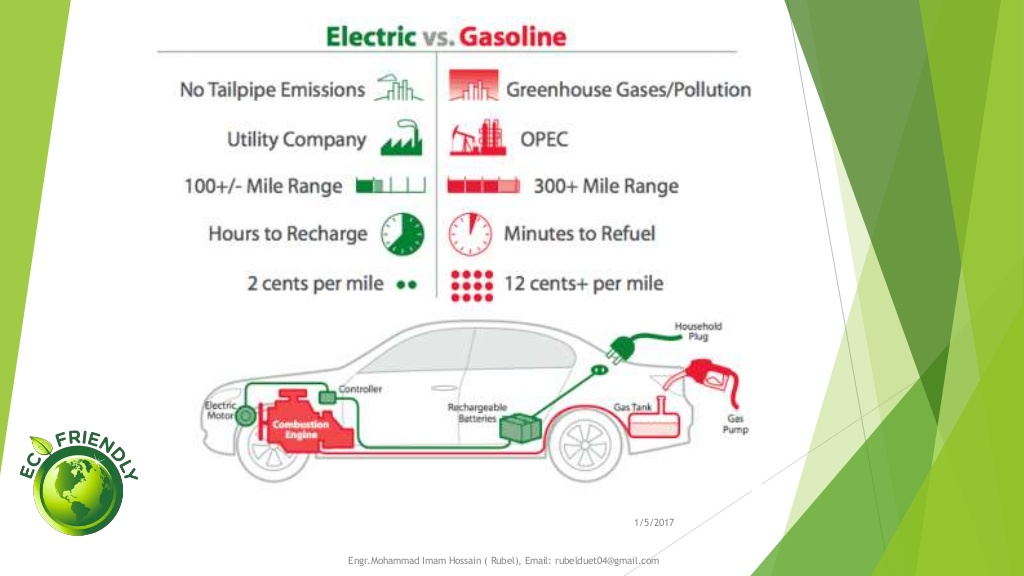

Web 7 mai 2022 nbsp 0183 32 1 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only Web Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to

Download Federal Electric Car Rebate Limits

More picture related to Federal Electric Car Rebate Limits

Cars That Meet Federal Rebate On Electric Cars 2022 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/federal-rebate-for-electric-cars-2022-carrebate-2.jpg

Is There A Federal Rebate For Buying An Electric Car 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/federal-electric-car-rebate-usa-2022-electricrebate-2.png?w=840&ssl=1

Federal Electric Car Rebate 2022 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/federal-electric-vehicle-rebate-incentive-rci-english-1.jpg

Web 25 juil 2023 nbsp 0183 32 They include a federal income tax credit of up to 7 500 for some new EVs And don t forget added rebates and other perks from state and local utilities While this Web 22 ao 251 t 2022 nbsp 0183 32 Only singles with incomes up to 150 000 a year and couples who file taxes jointly who earn up to 300 000 will qualify This income cap requirement is meant to help less affluent

Web 21 juin 2011 nbsp 0183 32 Federal EV tax credits in 2023 top out at 7 500 if you re buying a new car and 4 000 if you re buying a used car while the automakers themselves take a 7 500 tax credit for EV leases but Web 31 mars 2023 nbsp 0183 32 President Joe Biden and auto companies face a conundrum as they try to exponentially increase the number of electric vehicles on the road The federal tax

Canada Federal Electric Car Rebate 2022 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/federal-electric-car-rebate-canada-2022-carrebate-2.jpg

Electric Car Rebate Ca 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/ca-electric-car-rebate-income-limit-electricrebate-13.png?resize=840%2C436&ssl=1

https://www.kiplinger.com/taxes/ev-tax-credit

Web 5 sept 2023 nbsp 0183 32 A new federal EV tax credit for 2023 is here thanks to the Inflation Reduction Act IRA massive tax and climate legislation promoting clean energy The credit of up

https://www.npr.org/2023/01/07/1147209505

Web 7 janv 2023 nbsp 0183 32 You can get a 7 500 tax credit but it won t be easy Updated April 3 202311 10 AM ET Camila Domonoske Enlarge this image For

Tax Refund Calculator With Electric Car Rebate 2023 Carrebate

Canada Federal Electric Car Rebate 2022 2022 Carrebate

Electric Car Available Rebates 2023 Carrebate

Federal Electric Car Rebate 2022 2023 Carrebate

Ca Electric Car Rebate Income Limit ElectricRebate

Rebates For Hybrid Cars In California 2023 Carrebate

Rebates For Hybrid Cars In California 2023 Carrebate

Federal Rebate On Electric Cars ElectricCarTalk

2022 Tax Rebate For Electric Cars 2023 Carrebate

Do Electric Cars Still Qualify For A Tax Rebate ElectricRebate

Federal Electric Car Rebate Limits - Web Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to