Federal Electric Car Rebate Web Get a tax credit of up to 7 500 for new vehicles purchased in or after 2023 Pre Owned Plug in and Fuel Cell Electric Vehicles Purchased in or after 2023 Get a credit of up to 4 000 for used vehicles purchased from a dealer for 25 000 or less The amount equals 30 of purchased price with a maximum credit of 4 000 Other requirements apply

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh Web 7 janv 2023 nbsp 0183 32 You can get a 7 500 tax credit but it won t be easy Updated April 3 202311 10 AM ET Camila Domonoske Enlarge this image For

Federal Electric Car Rebate

Federal Electric Car Rebate

https://www.carrebate.net/wp-content/uploads/2022/08/californians-can-get-an-electric-vehicle-for-free-sly-credit-1.png

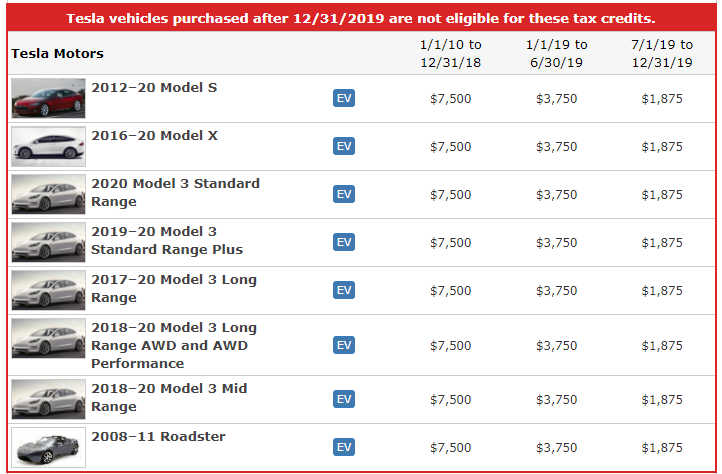

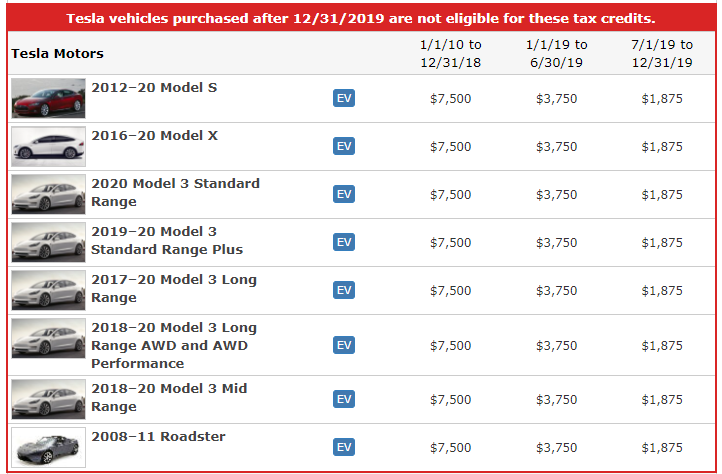

Cars That Meet Federal Rebate On Electric Cars 2022 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/federal-rebate-for-electric-cars-2022-carrebate-2.jpg

Is There A Federal Rebate For Buying An Electric Car 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/federal-electric-car-rebate-usa-2022-electricrebate-2.png?w=840&ssl=1

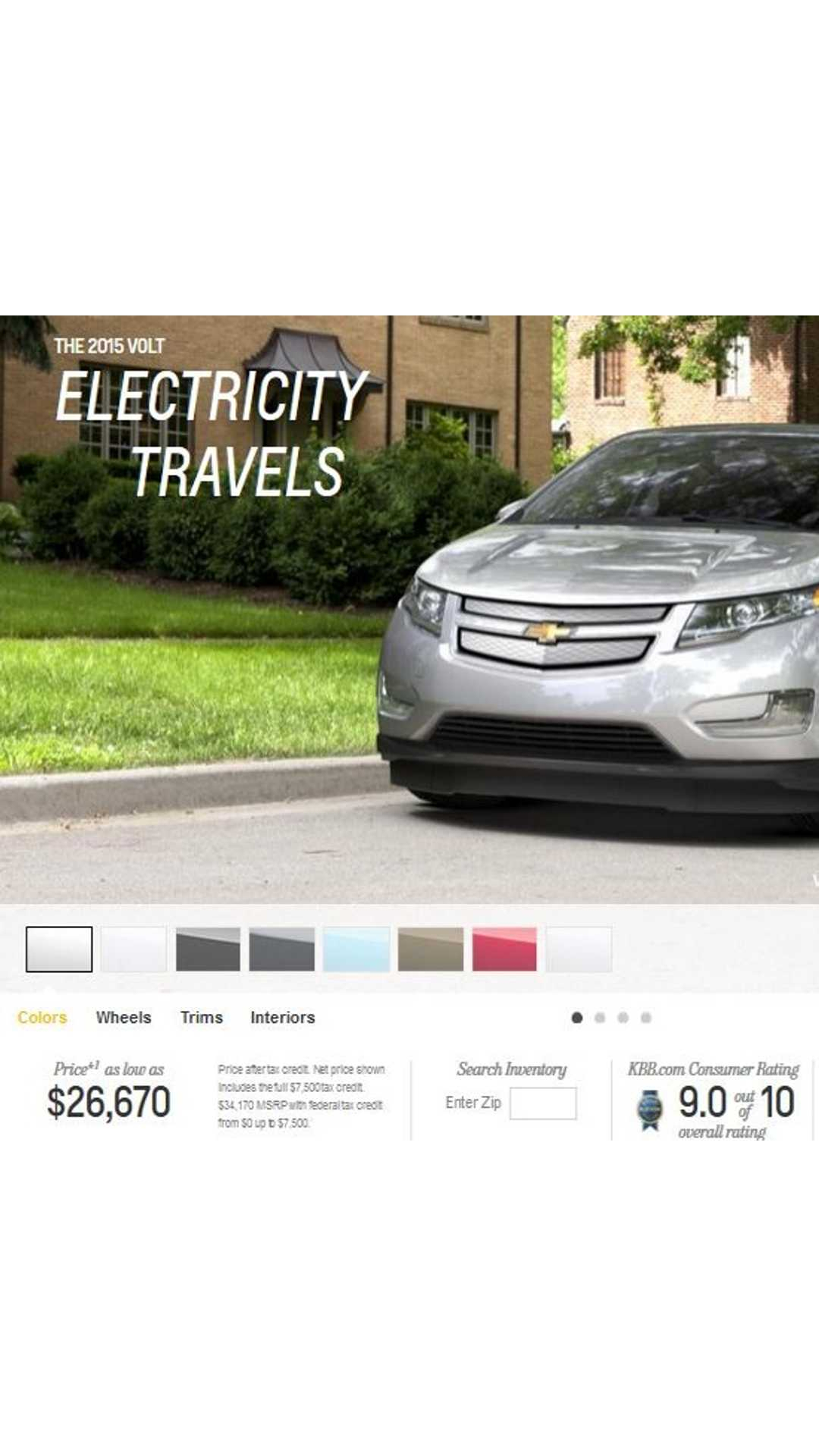

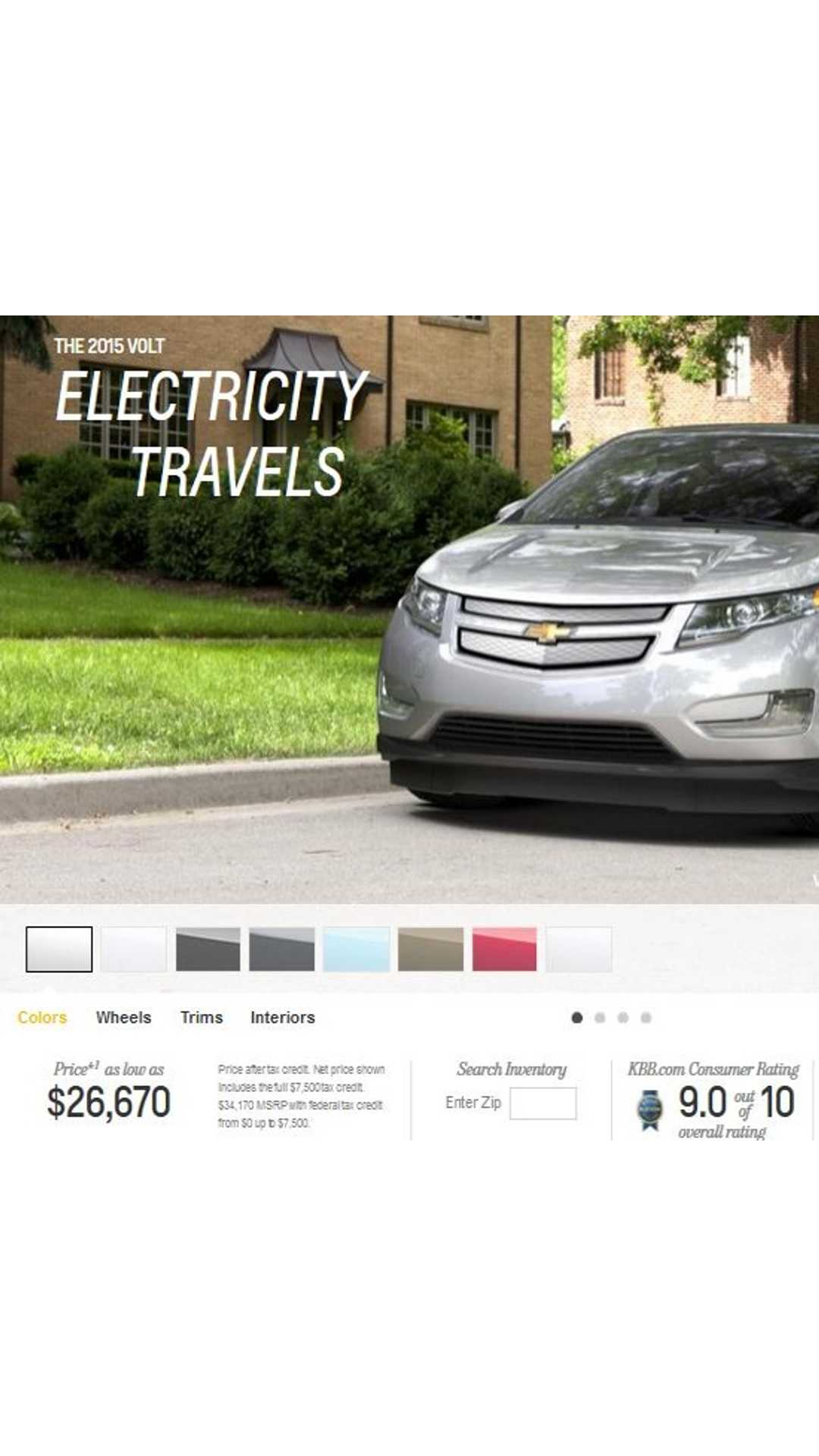

Web 7 mai 2022 nbsp 0183 32 1 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only qualifies for the leasing Web Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Purchased in 2023 or After Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for

Web 15 avr 2023 nbsp 0183 32 A 7 500 tax credit for purchasers of new electric vehicles is changing again after the U S unveiled new guidelines that will impact the list of car models that qualify Scott Olson Getty Web 17 avr 2023 nbsp 0183 32 The Treasury Department has revealed which cars will be eligible for the new electric vehicle tax credits Fewer models are eligible for the new subsidy than in previous years but some of the

Download Federal Electric Car Rebate

More picture related to Federal Electric Car Rebate

Tax Refund Calculator With Electric Car Rebate 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/inspirational-federal-electric-vehicle-tax-credit-used-cars.png?w=541&h=428&ssl=1

Canada Federal Electric Car Rebate 2022 2022 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/federal-electric-car-rebate-canada-2022-carrebate-1.jpg

Federal Rebate For Electric Cars FederalProTalk

https://www.federalprotalk.com/wp-content/uploads/electric-vehicle-rebate-available-until-331-mcleod-cooperative-power.png

Web 2 sept 2023 nbsp 0183 32 The credit of up to 7 500 for certain electric vehicles called clean vehicles is supposed to encourage more people to use EVs However a year has passed since the IRA was enacted and there Web 3 ao 251 t 2023 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of 2023 The EV tax credit

Web 6 juin 2023 nbsp 0183 32 As it stands the credit only applies to EVs that are assembled in the U S and further depends upon its battery component and or critical minerals sourcing and a vehicle s sticker price maximum Web 28 oct 2021 nbsp 0183 32 Keep the 7 500 incentive for new electric cars for 5 years Make the 7 500 incentive a point of sale discount instead of tax credit EVs with battery pack smaller than 40 kWh are limited to a

Federal Rebates For Hybrid Cars 2022 2022 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/federal-rebate-for-electric-cars-2022-carrebate-7.jpg?resize=840%2C473&ssl=1

Rebates For Hybrid Cars In California 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/federal-rebates-for-hybrid-cars-2022-2022-carrebate-7.jpg?w=467&h=554&ssl=1

https://fueleconomy.gov/feg/taxcenter.shtml

Web Get a tax credit of up to 7 500 for new vehicles purchased in or after 2023 Pre Owned Plug in and Fuel Cell Electric Vehicles Purchased in or after 2023 Get a credit of up to 4 000 for used vehicles purchased from a dealer for 25 000 or less The amount equals 30 of purchased price with a maximum credit of 4 000 Other requirements apply

https://www.irs.gov/credits-deductions/credits-for-new-electric...

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh

Federal Tax Rebate Electric Car 2022 Process 2022 Carrebate

Federal Rebates For Hybrid Cars 2022 2022 Carrebate

Canada Federal Electric Car Rebate 2022 2022 Carrebate

Federal Rebate For Electric Cars 2022 2023 Carrebate

Federal Rebate On Electric Cars ElectricCarTalk

New Federal Electric Car Rebate 2022 Carrebate Rebate2022

New Federal Electric Car Rebate 2022 Carrebate Rebate2022

Government Rebate For Electric Cars 2022 2023 Carrebate

Federal Electric Car Rebate 2022 2023 Carrebate

Electric Car Available Rebates 2023 Carrebate

Federal Electric Car Rebate - Web 6 juin 2023 nbsp 0183 32 Which EVs and PHEVs Are Eligible for a Federal Tax Credit The revised credit applies to new EVs and PHEVs bought by individuals for personal use in 2023 or later An initial requirement that the