Federal Electric Vehicle Rebat Web 7 janv 2023 nbsp 0183 32 Updated April 3 202311 10 AM ET Camila Domonoske Enlarge this image For the first time in years some Teslas will qualify

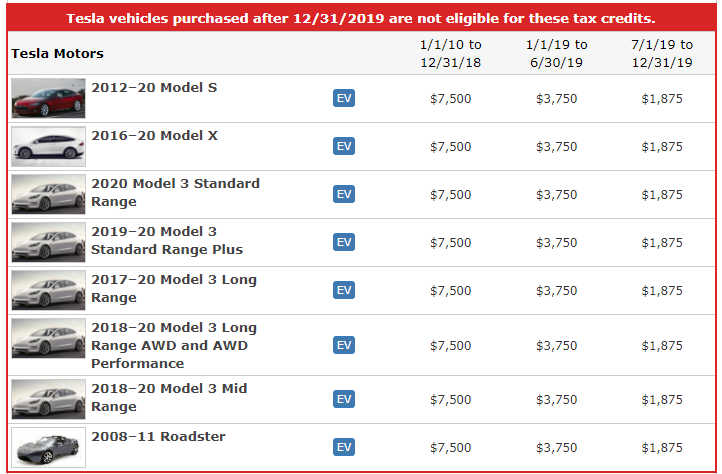

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section Web Tax Incentives New Plug in and Fuel Cell Electric Vehicles Purchased in or after 2023 Get a tax credit of up to 7 500 for new vehicles purchased in or after 2023 Pre Owned

Federal Electric Vehicle Rebat

Federal Electric Vehicle Rebat

https://www.electricrebate.net/wp-content/uploads/2022/08/rebates-and-tax-credits-make-buying-an-electric-vehicle-more-affordable-2.png

Federal Electric Vehicle Rebate ElectricRebate

https://i0.wp.com/www.electricrebate.net/wp-content/uploads/2022/09/federal-electric-vehicle-rebates-announced-youtube-3.jpg

Federal Electric Vehicle Rebate Incentive

http://www.rcinet.ca/en/wp-content/uploads/sites/3/2019/05/car-ev-plugged-in-front-blue-oliver-walter-cbc.jpg

Web 15 avr 2023 nbsp 0183 32 The IRS says the following vehicles are still eligible for both tax credits worth 7 500 Cadillac Lyriq Chevy Bolt EUV Chevy Web All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 The availability of the

Web 5 sept 2023 nbsp 0183 32 A new federal EV tax credit for 2023 is here thanks to the Inflation Reduction Act IRA massive tax and climate legislation promoting clean energy The credit of up Web 7 mai 2022 nbsp 0183 32 1 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only

Download Federal Electric Vehicle Rebat

More picture related to Federal Electric Vehicle Rebat

Federal Electric Car Rebate And Tax Withholdings 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/californians-can-get-an-electric-vehicle-for-free-sly-credit-1.png

Federal Electric Vehicle Rebate ElectricRebate

https://i0.wp.com/www.electricrebate.net/wp-content/uploads/2022/09/federal-electric-vehicle-rebate-uses-half-its-three-year-budget-in-2.jpeg?w=612&h=409&ssl=1

Federal Tax Rebates Electric Vehicles ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/09/rebates-and-tax-credits-for-electric-vehicle-charging-stations-2.jpg

Web 22 avr 2022 nbsp 0183 32 The federal government is expanding its electric vehicle rebate program to include larger vehicles such as vans SUVs and trucks which previously had not Web 18 avr 2023 nbsp 0183 32 For vehicles placed in service before April 18 2023 the available CVC tax credit is a base amount of 2 500 plus for a vehicle that draws propulsion energy from a

Web 5 sept 2023 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of Web 10 ao 251 t 2022 nbsp 0183 32 Regarding the original tax credit according to the IRS For vehicles acquired after December 31 2009 the credit is equal to 2 500 plus for a vehicle which draws

Tax Refund Calculator With Electric Car Rebate 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/inspirational-federal-electric-vehicle-tax-credit-used-cars.png?w=541&h=428&ssl=1

Famous Federal Incentive Electric Car 2022 Cars Protection

https://i2.wp.com/www.rcinet.ca/en/wp-content/uploads/sites/3/2019/05/car-electric-two-charging-white-city-of-london-768x432.jpg

https://www.npr.org/2023/01/07/1147209505

Web 7 janv 2023 nbsp 0183 32 Updated April 3 202311 10 AM ET Camila Domonoske Enlarge this image For the first time in years some Teslas will qualify

https://www.irs.gov/credits-deductions/credits-for-new-electric...

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Electric Vehicle With Most Federal Rebate ElectricRebate

Tax Refund Calculator With Electric Car Rebate 2023 Carrebate

State Offering Rebate On New Electric Vehicles The Legislative Gazette

Federal Government Rebate On Electric Cars KnowYourGovernment

Is There A Federal Rebate For Electric Cars 2022 Carrebate

Federal Rebates For Electric Vehicle Purchases Now In Effect CTV News

Federal Rebates For Electric Vehicle Purchases Now In Effect CTV News

Federal Government Expands Electric Vehicle Rebate Program The Global

New Federal Electric Car Rebate 2023 Carrebate

Federal Tax Rebate For Electric Cars 2023 Carrebate

Federal Electric Vehicle Rebat - Web 25 juil 2023 nbsp 0183 32 Some cars and trucks also qualify for a state rebate or tax credit Together those incentives could cut as much as 15 000 off the price of a new EV And falling