Federal Electric Vehicle Rebate Income Web 7 janv 2023 nbsp 0183 32 Which vehicles are eligible for the 7 500 federal tax credit has changed dramatically compared to a previous version of the credit

Web 5 sept 2023 nbsp 0183 32 EV INCOME LIMITS QUALIFYING VEHICLES EV NEWS AND UPDATES CLAIMING THE EV TAX CREDIT EV LEASES HOME EV CHARGERS OTHER IRA Web 27 ao 251 t 2022 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of

Federal Electric Vehicle Rebate Income

Federal Electric Vehicle Rebate Income

https://www.carrebate.net/wp-content/uploads/2022/08/californians-can-get-an-electric-vehicle-for-free-sly-credit-1.png

Famous Federal Incentive Electric Car 2022 Cars Protection

https://i2.wp.com/www.rcinet.ca/en/wp-content/uploads/sites/3/2019/05/car-ev-plugged-in-front-blue-oliver-walter-cbc.jpg

Tax Refund Calculator With Electric Car Rebate 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/inspirational-federal-electric-vehicle-tax-credit-used-cars.png?w=541&h=428&ssl=1

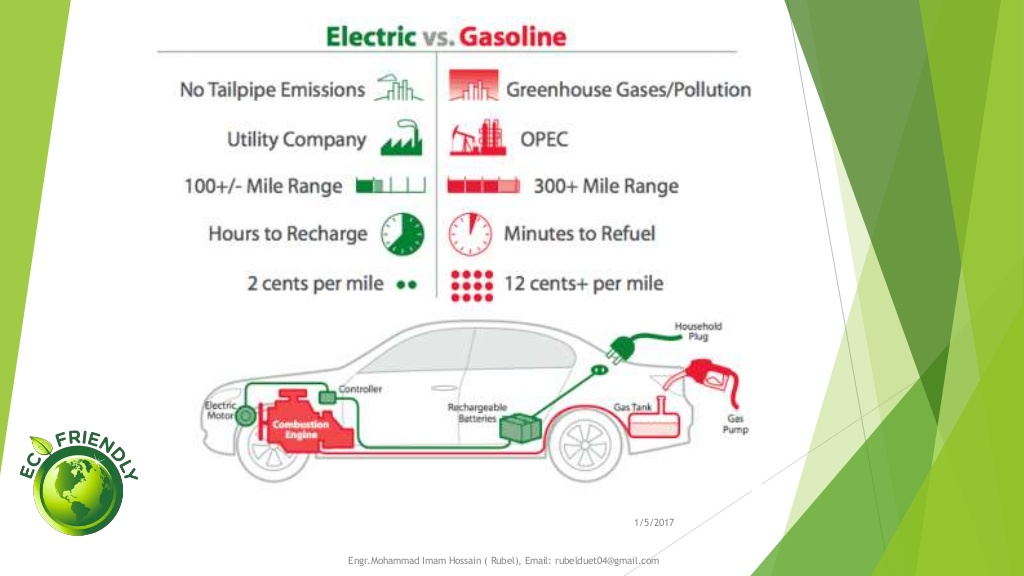

Web All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 The availability of the credit Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

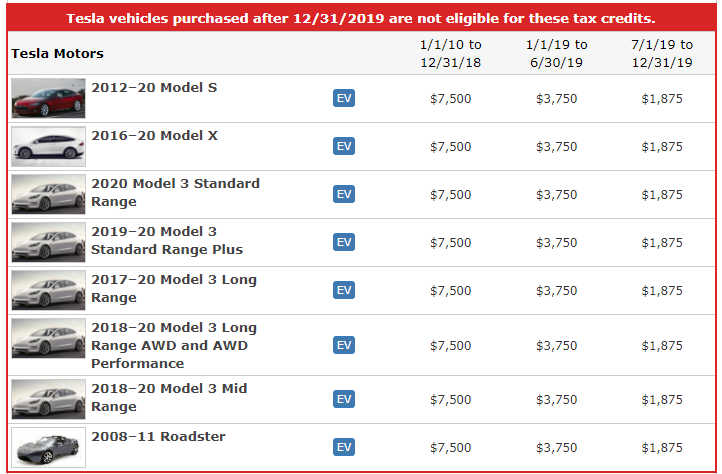

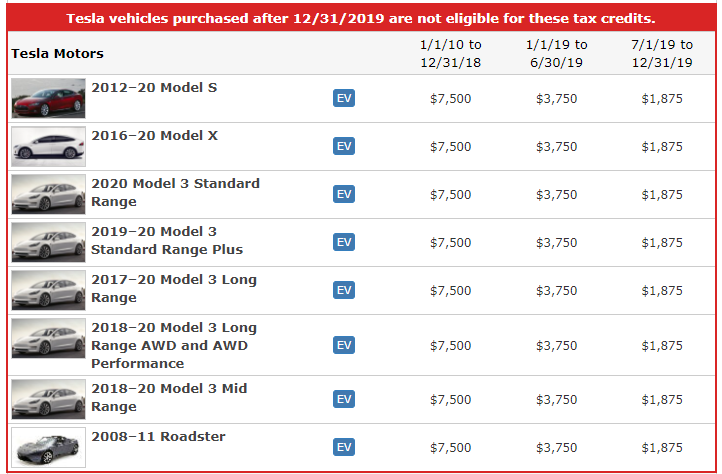

Web 17 ao 251 t 2022 nbsp 0183 32 All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount Web 7 mai 2022 nbsp 0183 32 1 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only

Download Federal Electric Vehicle Rebate Income

More picture related to Federal Electric Vehicle Rebate Income

Federal Electric Car Rebate Rules ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/08/rebates-and-tax-credits-make-buying-an-electric-vehicle-more-affordable-2.png

Federal Electric Vehicle Rebate ElectricRebate

https://i0.wp.com/www.electricrebate.net/wp-content/uploads/2022/09/federal-electric-vehicle-rebate-uses-half-its-three-year-budget-in-2.jpeg?w=612&h=409&ssl=1

Electric Car Available Rebates 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/electric-vehicle-rebates-now-available-in-maine-nrcm-1.jpg

Web 17 ao 251 t 2023 nbsp 0183 32 For the first time used EVs will be eligible for federal tax credits of up to 4 000 or 30 of the sales price whichever is lower The sales price must be less than Web Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used

Web Income cap for EV tax credit For the most part these changes took effect on Jan 1 2023 and will remain in effect until Jan 1 2032 Always check the IRS website for updates Web 2 sept 2022 nbsp 0183 32 It also amends the Qualified Plug in Electric Drive Motor Vehicle Credit also known as IRC 30D which gave consumers up to 7 500 in tax credits for buying a

Federal Rebate For Electric Cars FederalProTalk

https://www.federalprotalk.com/wp-content/uploads/electric-vehicle-rebate-available-until-331-mcleod-cooperative-power.png

Federal Electric Car Rebate 2022 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/federal-electric-vehicle-rebate-incentive-rci-english-1.jpg

https://www.npr.org/2023/01/07/1147209505

Web 7 janv 2023 nbsp 0183 32 Which vehicles are eligible for the 7 500 federal tax credit has changed dramatically compared to a previous version of the credit

https://www.kiplinger.com/taxes/ev-tax-credit

Web 5 sept 2023 nbsp 0183 32 EV INCOME LIMITS QUALIFYING VEHICLES EV NEWS AND UPDATES CLAIMING THE EV TAX CREDIT EV LEASES HOME EV CHARGERS OTHER IRA

Federal Rebate Set To Make Electric Cars More Affordable See 100M Go

Federal Rebate For Electric Cars FederalProTalk

What Is The Tax Rebate For Electric Cars 2023 Carrebate

Should Income Dictate Eligibility For Electric Vehicle Rebates

What Electric Vehicle Rebates Can I Get RateGenius

Electric Vehicle Rebates For Lower income Buyers Go Virtually Unused In

Electric Vehicle Rebates For Lower income Buyers Go Virtually Unused In

Ca Electric Car Rebate Income ElectricRebate

Federal Tax Rebates Electric Vehicles ElectricRebate

Electric Vehicle Rebates EClips Extra

Federal Electric Vehicle Rebate Income - Web All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 The availability of the credit