Federal Energy Rebates 2024 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Federal Energy Rebates 2024

Federal Energy Rebates 2024

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Federal Rebates Homesol Building Solutions

http://homesolbuildingsolutions.com/wp-content/uploads/2021/08/homesol-federal-rebates-thumbnail.jpg

NJ Clean Energy Rebates Incentives In 2024

https://www.electricrate.com/wp-content/uploads/2023/01/nj-rebates-for-energy-efficient-appliances.jpg

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

What is the Inflation Reduction Act 2 Which provisions in the Inflation Reduction Act IRA establish home energy rebates 3 HOW MUCH MONEY IS THERE FOR HOME ENERGY REBATES 4 What is U S Department of Energy s timeline for distributing these funds to states and Indian Tribes 5 The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

Download Federal Energy Rebates 2024

More picture related to Federal Energy Rebates 2024

The 2022 Inflation Reduction Act HVAC Federal Credit Rebates Explained PECO Heating Cooling

https://www.pecoair.com/wp-content/uploads/2022/10/HVAC-Federal-Credit-Rebates-Explained-3-2048x1367.jpg

Energy Rebates Don t Leave Money On The Table Schmidt Associates

http://schmidt-arch.com/wp-content/uploads/2018/02/Energy-Rebates-Charts.jpg

2023 Heat Pump Rebate For Texas HEEHRA

https://www.lexairconditioning.com/wp-content/uploads/2023/01/2023-Heat-Pump-Rebates-1.jpg

Tax credits for home energy improvements in 2023 The residential clean energy credit Changes to the residential clean energy credit started last year and continue until 2033 You ll get a Energy Efficiency Tax Credits for 2024 Update The tax credits listed below became available on January 1 2023 and can be claimed when you file your income taxes for 2023 As of January 1 2023 there is a federal tax credit for exterior windows and doors The Energy Efficient Home Improvement Credit is worth 30 of the total cost of the

OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE OF CONTENTS What are energy tax credits targeting home improvements Energy Efficient Home Improvement Credit Residential Clean Energy Credit Click to expand Key Takeaways There s also a 1 750 rebate for heat pump water heaters 840 cash back for induction stoves and heat pump clothes dryers and 4 000 for electrical system upgrades The federal government

How To Look For Energy Rebates In Your Location YouTube

https://i.ytimg.com/vi/CLOWU0qwUkg/maxresdefault.jpg

2023 Home Energy Federal Tax Credits Rebates Explained

https://www.nicksairconditioning.com/wp-content/uploads/2023/01/Adjusting-HVAC-System-Temperature.jpg

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

Canadian Clean Energy Rebates Incentives The Sundamentals Project

How To Look For Energy Rebates In Your Location YouTube

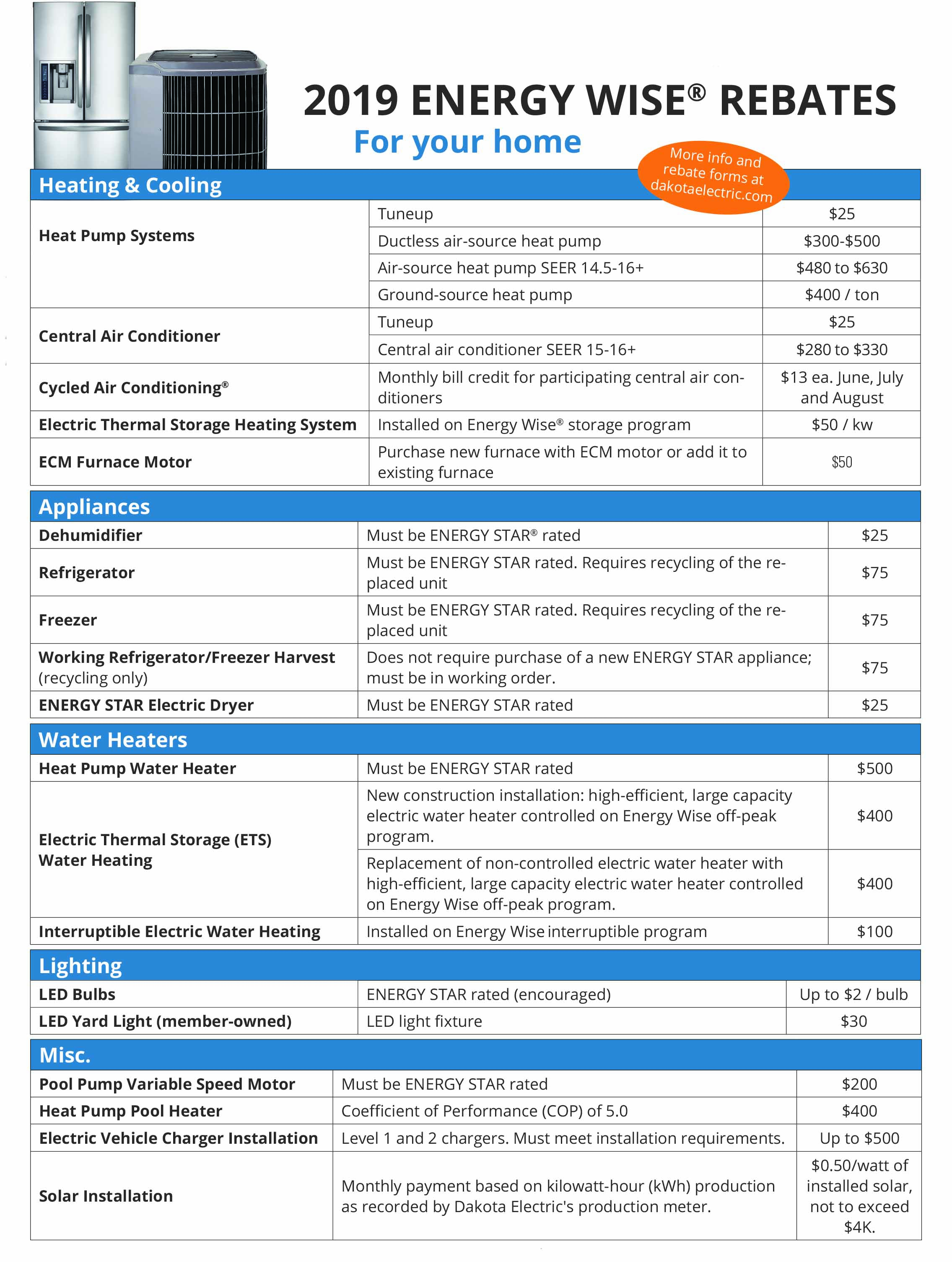

2019 Energy Wise Rebates Dakota Electric Association

Rebate And Tax Credit Management Quick Electricity

2022 Home Energy Rebates Grants And Incentives Top Rated Barrie Windows Doors Company

Energy Rebates And Incentives For Single Family Housing Pay Off

Energy Rebates And Incentives For Single Family Housing Pay Off

300 Federal Tax Credits For Air Conditioners And Heat Pumps 2022 Symbiont Air Conditioning

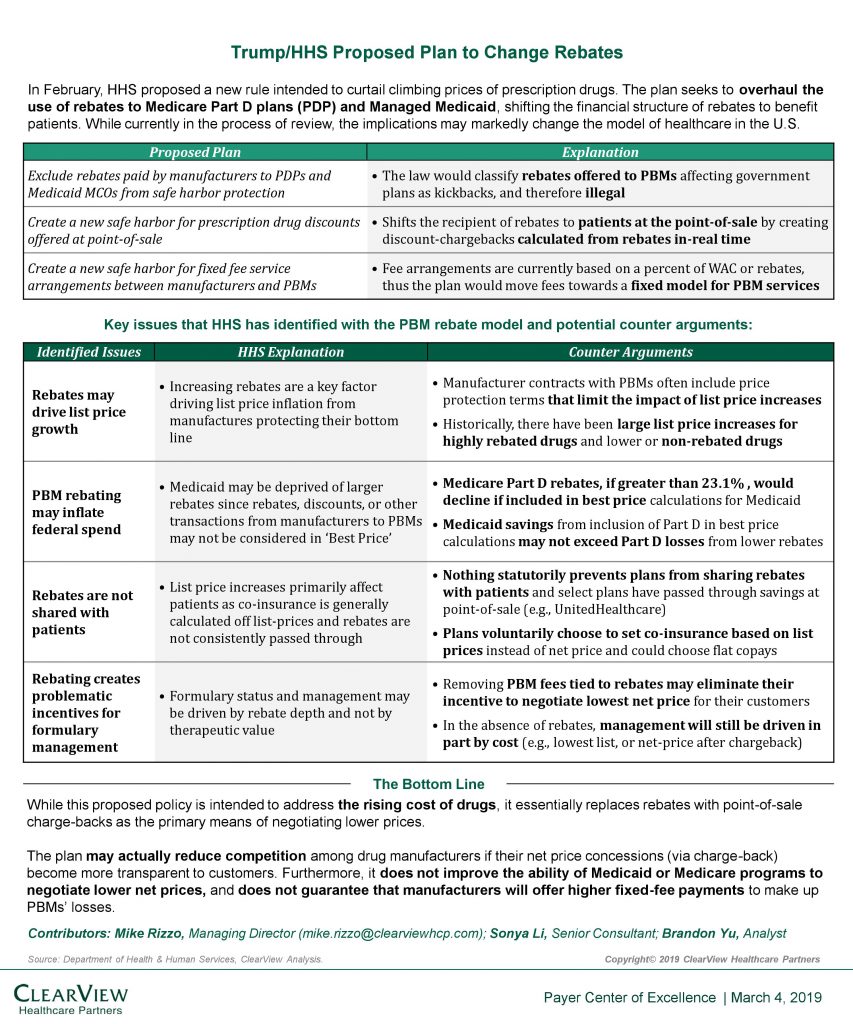

Trump HHS Proposal To Change Federal Drug Rebates Clearview Clearview

Seresto Rebate Form PrintableRebateForm

Federal Energy Rebates 2024 - As we turn to 2024 ODOE looks forward to helping roll out new programs to help Oregonians save energy at home The 2022 Inflation Reduction Act invested dollars in Home Energy Rebates a pair of programs that will help Oregonians make their homes more energy efficient by installing appliances and performing upgrades that will also help