Federal Energy Rebates For 2024 On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings Resolution 1 Save Money Thanks to the Department of Energy s Savings Hub you can easily help determine what clean energy and energy efficiency incentives for home upgrades and appliances are best for you Smart energy efficient upgrades like installing a heat pump or energy efficient lightbulbs can lower electricity costs

Federal Energy Rebates For 2024

Federal Energy Rebates For 2024

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Federal Rebates Homesol Building Solutions

http://homesolbuildingsolutions.com/wp-content/uploads/2021/08/homesol-federal-rebates-thumbnail.jpg

NJ Clean Energy Rebates Incentives In 2024

https://www.electricrate.com/wp-content/uploads/2023/01/nj-rebates-for-energy-efficient-appliances.jpg

States must apply for the federal funds Florida signaled it wouldn t offer the rebates after a recent veto by Gov Ron DeSantis Emilija Manevska Moment Getty Images Consumers may soon be What is the Inflation Reduction Act 2 Which provisions in the Inflation Reduction Act IRA establish home energy rebates 3 HOW MUCH MONEY IS THERE FOR HOME ENERGY REBATES 4 What is U S Department of Energy s timeline for distributing these funds to states and Indian Tribes 5

The 2024 program opening next year will unlock additional capacity for this robust demand Treasury designed the program to encourage participation by the institutions and communities most impacted by energy insecurity by setting aside 50 of the program s capacity for projects that meet additional criteria Approximately one quarter of the For EV customers everything changes on January 1 2024 The Treasury Department has now issued new rules that will turn the federal EV tax credit into what is basically a point of sale rebate

Download Federal Energy Rebates For 2024

More picture related to Federal Energy Rebates For 2024

The 2022 Inflation Reduction Act HVAC Federal Credit Rebates Explained PECO Heating Cooling

https://www.pecoair.com/wp-content/uploads/2022/10/HVAC-Federal-Credit-Rebates-Explained-3-2048x1367.jpg

Energy Rebates Don t Leave Money On The Table Schmidt Associates

http://schmidt-arch.com/wp-content/uploads/2018/02/Energy-Rebates-Charts.jpg

2023 Heat Pump Rebate For Texas HEEHRA

https://www.lexairconditioning.com/wp-content/uploads/2023/01/2023-Heat-Pump-Rebates-1.jpg

The Inflation Reduction Act amended the credit to be worth up to 1 200 per year for qualifying property placed in service on or after January 1 2023 and before January 1 2033 and gave it a new name the Energy Efficient Home Improvement Credit What HVAC Tax Incentives Are Available for Homeowners Energy Efficient Home Improvement income tax credits are available for central air conditioning systems boilers furnaces air source heat pumps and biomass stoves that reach benchmarks for high efficiency The credits apply to units purchased and installed between January 1 2023 and December 31 2034

There s also a 1 750 rebate for heat pump water heaters 840 cash back for induction stoves and heat pump clothes dryers and 4 000 for electrical system upgrades The federal government Key Takeaways You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits

How To Look For Energy Rebates In Your Location YouTube

https://i.ytimg.com/vi/CLOWU0qwUkg/maxresdefault.jpg

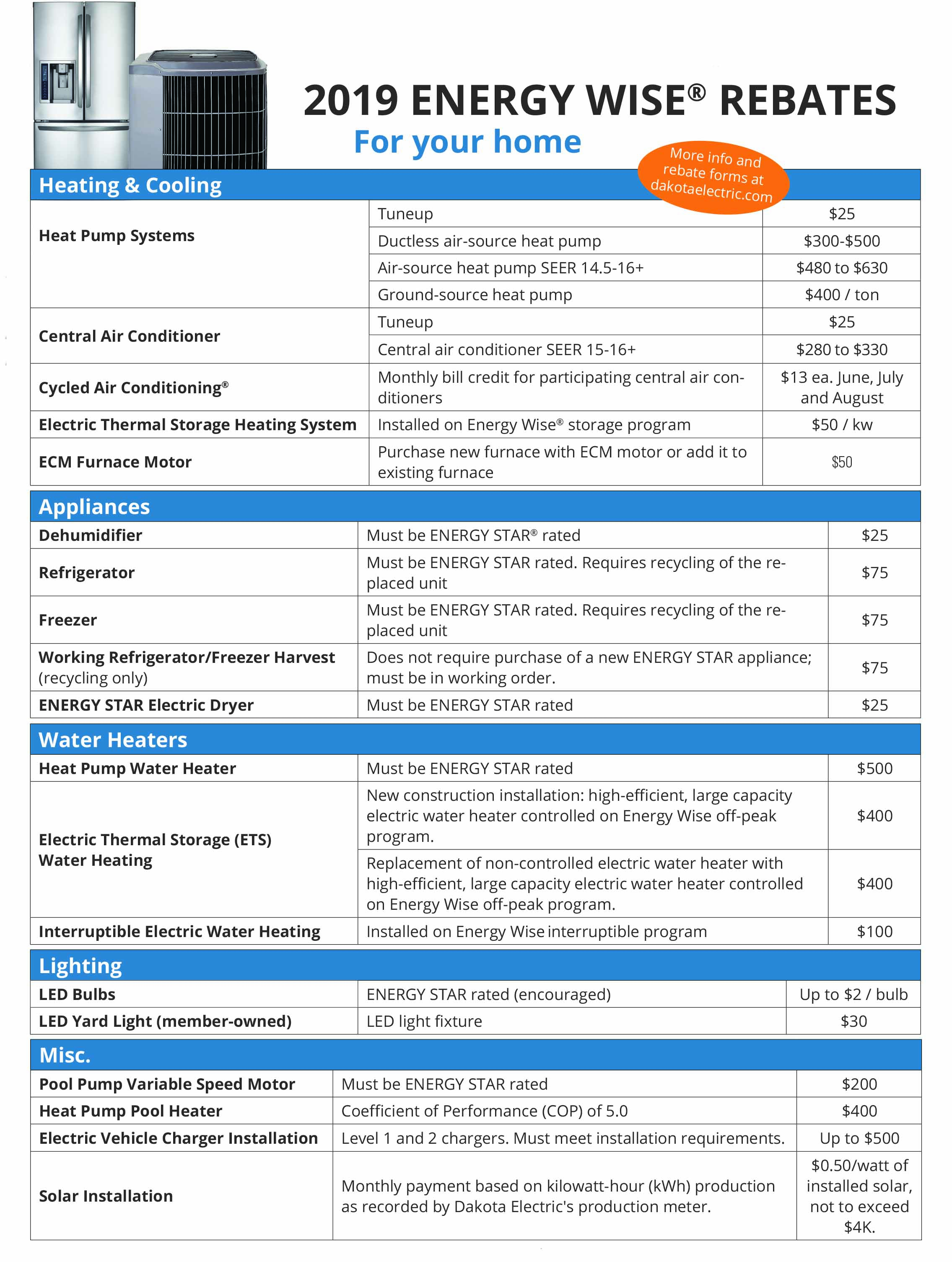

2019 Energy Wise Rebates Dakota Electric Association

https://www.dakotaelectric.com/wp-content/uploads/2019/01/RebateSummary2019-e1548880063852.jpg

https://www.energy.gov/scep/home-energy-rebates-programs

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

https://www.energystar.gov/about/federal_tax_credits

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings

2023 Home Energy Federal Tax Credits Rebates Explained

How To Look For Energy Rebates In Your Location YouTube

Canadian Clean Energy Rebates Incentives The Sundamentals Project

300 Federal Tax Credits For Air Conditioners And Heat Pumps 2022 Symbiont Air Conditioning

Rebate And Tax Credit Management Quick Electricity

2022 Home Energy Rebates Grants And Incentives Top Rated Barrie Windows Doors Company

2022 Home Energy Rebates Grants And Incentives Top Rated Barrie Windows Doors Company

Energy Rebates And Incentives For Single Family Housing Pay Off

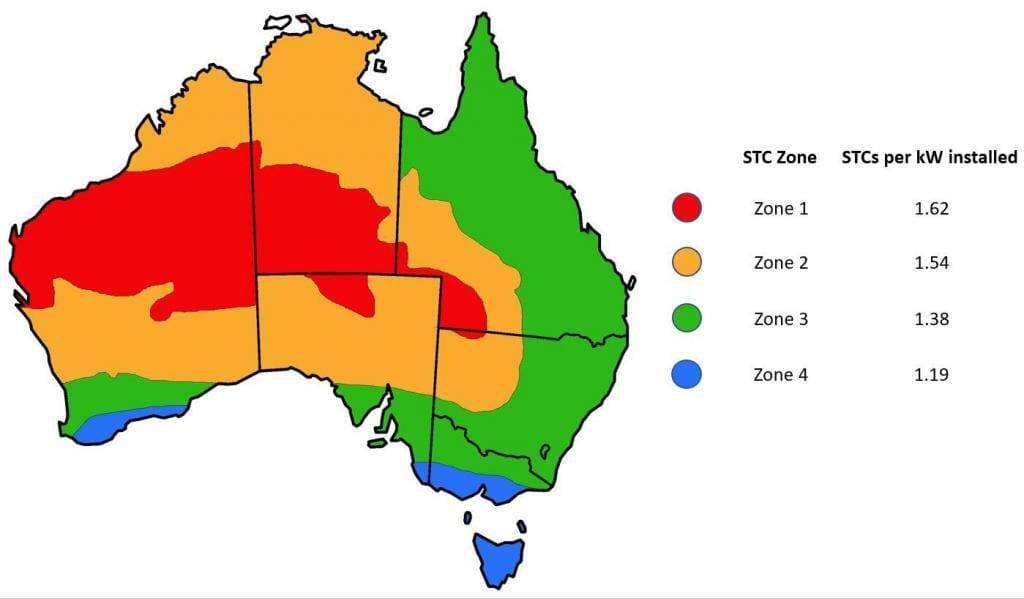

Federal Incentives Solar Rebates For Solar Power Solar Choice

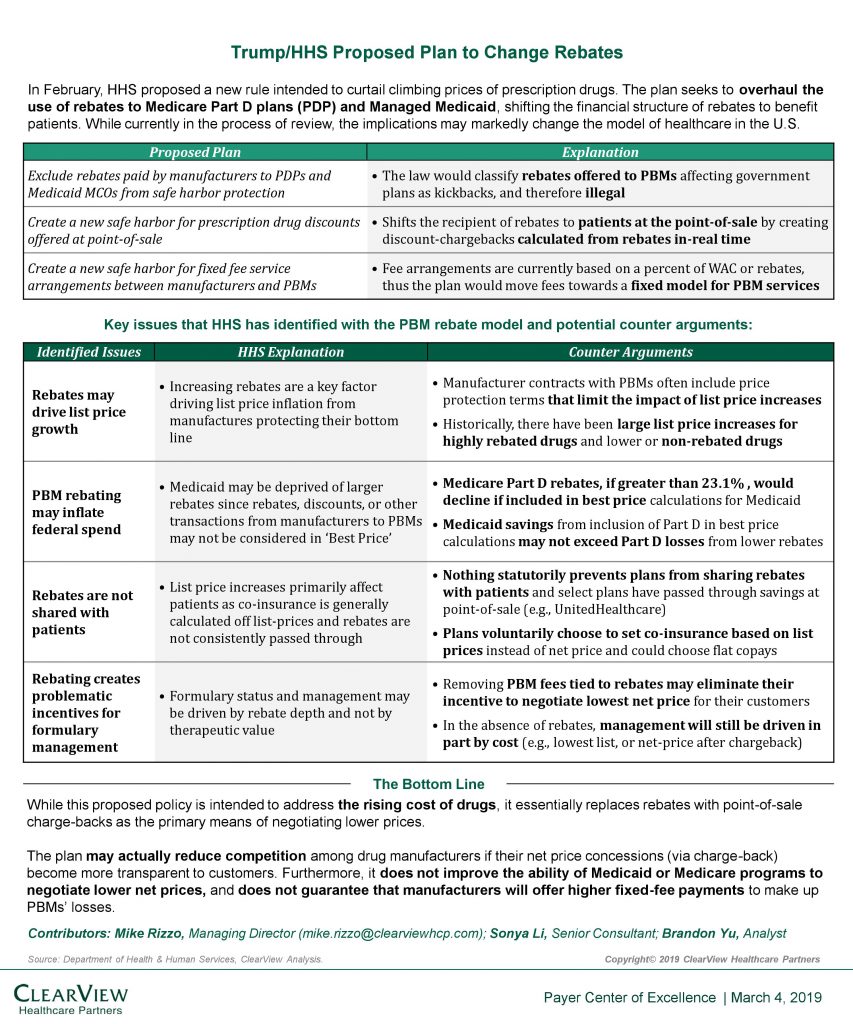

Trump HHS Proposal To Change Federal Drug Rebates Clearview Clearview

Federal Energy Rebates For 2024 - For EV customers everything changes on January 1 2024 The Treasury Department has now issued new rules that will turn the federal EV tax credit into what is basically a point of sale rebate