Federal Energy Tax Credit For Insulation The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements

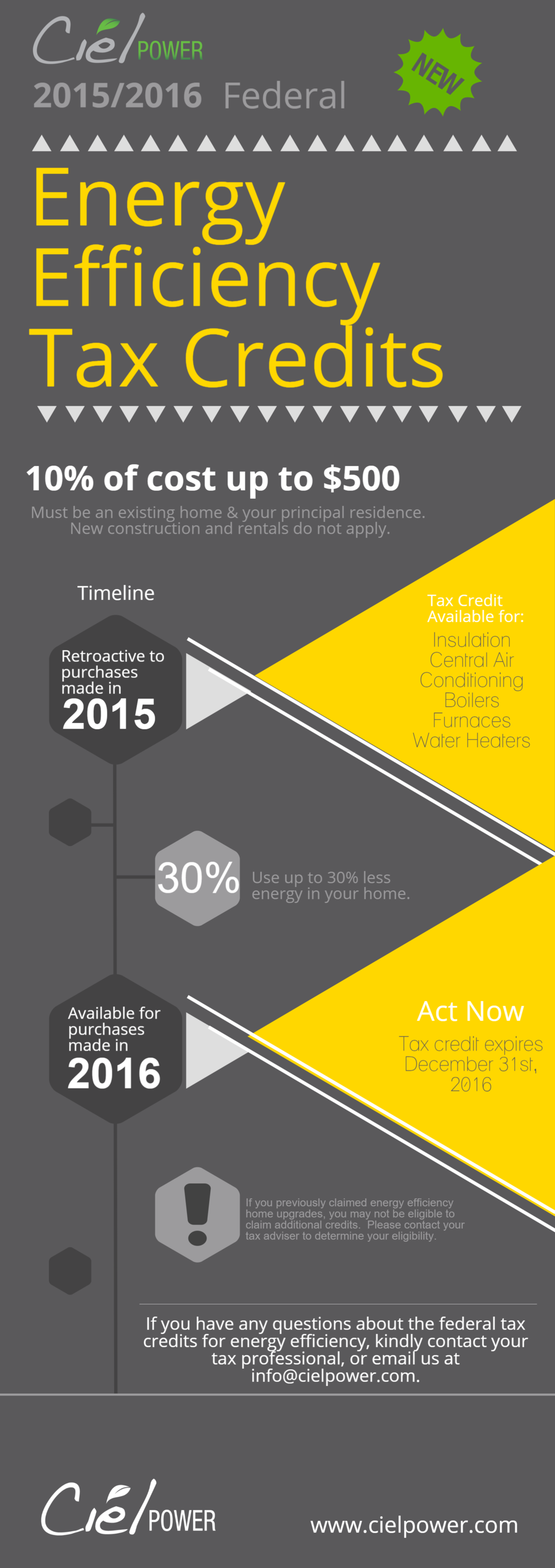

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual Federal tax credits can help you cover the cost of insulation saving you money on energy and keeping your home more comfortable Fokusiert Getty Images

Federal Energy Tax Credit For Insulation

Federal Energy Tax Credit For Insulation

https://static1.squarespace.com/static/55b78a58e4b0e36966db31f9/t/56c73587cf80a157221137e4/1455896001786/

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

Federal Tax Credit For Attic Insulation Bird Family Insulation

https://birdinsulation.com/wp-content/uploads/elementor/thumbs/IMG_3358-pze8n0tf8snl7o1gxaaq5ak87jitysx13y600w87m0.jpg

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide Credits are typically applied to a taxpayer s income tax liability and thereby can offset the cost of energy saving improvements such as insulation

If you invest in renewable energy for your home solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you

Download Federal Energy Tax Credit For Insulation

More picture related to Federal Energy Tax Credit For Insulation

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

What Is An R D Tax Credit

https://www.letsbegamechangers.com/wp-content/uploads/2020/01/load-image-2020-01-24T030638.645-1536x1024.jpeg

Tution Tax Credit For Students NCS CA

https://www.ncscorp.ca/wp-content/uploads/2022/03/Untitled-design-12-e1648708763193.png

December 21 2022 Office of Policy Making Our Homes More Efficient Clean Energy Tax Credits for Consumers Visit our Energy Savings Hub to learn more about saving money Weatherize your home with a 30 percent tax credit on insulation doors and windows 5 Ask a Pro Don t know where to begin Not a problem Home energy auditors are here to help Get a 150 tax

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change Energy Efficency Federal Tax Credits Are Now Available On Aug 16 2022 Congress approved the most significant piece of clean energy legislation in the Nation s history

EU built Electric Vehicle Tax Credit Approval Will Face Internal And

https://s1.cdn.autoevolution.com/images/news/approval-of-tax-credit-for-union-built-evs-will-face-internal-and-foreign-disputes-173073_1.jpg

Make Sure You Get These Federal Energy Tax Credits Consumer Reports

https://article.images.consumerreports.org/prod/content/dam/CRO%20Images%202017/Home%20and%20Garden/March/CR-Home-Hero-Claim-your-energy-tax-credit-03-17

https://www.energystar.gov/about/federal_tax_credits/insulation

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements

https://www.irs.gov/credits-deductions/home-energy-tax-credits

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

EU built Electric Vehicle Tax Credit Approval Will Face Internal And

Federal Energy Property Tax Credits Reinstated HB McClure

IRA Tax Credit For Insulation Standard Insulating Co NC

Carbon Emissions Solution Proposal For A Production Tax Credit For CO2

TAX CREDIT Signa System

TAX CREDIT Signa System

Georgia Tax Credits For Workers And Families

FAQ Energy Tax Credit For New Windows 2023 Inflation Reduction Act

2023 Residential Clean Energy Credit Guide ReVision Energy

Federal Energy Tax Credit For Insulation - If you invest in renewable energy for your home solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax