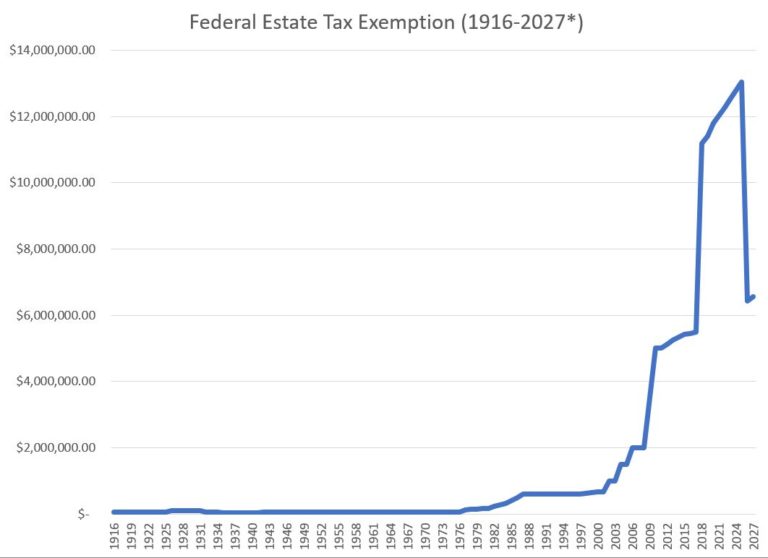

Federal Estate Tax Exemption Limit Get information on how the estate tax may apply to your taxable estate at your death The Estate Tax is a tax on your right to transfer property at your death It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF

In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a person s cumulative taxable gifts and taxable estate to arrive at a net tentative tax Any tax due is determined after applying a credit based on an applicable exclusion amount For 2024 the federal estate tax threshold is 13 61 million for individuals which means married couples don t have to pay estate if their estate is worth 27 22 million or less For 2023 the threshold was 12 92 million for individuals and 25 84 million for married couples

Federal Estate Tax Exemption Limit

Federal Estate Tax Exemption Limit

https://plestateplanning.com/wp-content/uploads/2021/06/6355404323_7ec7219643_k.jpg

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready

https://www.adviceperiod.com/wp-content/uploads/2022/03/EG-tax-scaled.jpeg

Federal Estate Tax Limit Gift Tax Exclusion Limit Changing In 2024

https://static.wixstatic.com/media/7682e8_3fb12472d2fb46dc868a7ab355e5e751~mv2.jpeg/v1/fill/w_1280,h_961,al_c/7682e8_3fb12472d2fb46dc868a7ab355e5e751~mv2.jpeg

The estate tax is a tax on property left after you die For tax year 2022 your estate will be taxed if the total of the gross assets at hand exceeds 12 06 million 12 92 million for tax year 2023 The estate tax exemption is related to the gift tax exemption An estate tax return Form 706 must be filed if the gross estate of the decedent who is a U S citizen or resident increased by the decedent s adjusted taxable gifts and specific gift tax exemption is valued at more than the filing threshold for the year of the decedent s death as shown in the table below

In 2023 the federal estate tax exemption is 12 92 million affecting a limited number of people in the country Twelve states and the District of Columbia levy their own estate taxes and most states have a lower threshold than the federal exemption For people who pass away in 2023 the exemption amount will be 12 92 million it s 12 06 million for 2022 For a married couple that comes to a combined exemption of 25 84 million

Download Federal Estate Tax Exemption Limit

More picture related to Federal Estate Tax Exemption Limit

What Are Estate Taxes And How Will They Affect Me Wallstreet

https://wallstfinancialgroup.com/wp-content/uploads/2021/05/Excel-Chart-of-Federal-Estate-Tax-Exemption-1-768x558-1.jpg

Federal Estate Tax Exemption Sunset The Sun Is Still Up But It s

https://monumentwealthmanagement.com/wp-content/uploads/2022/08/Federal-Estate-Tax-Exemption-Sunset-scaled.jpg

Update 2019 Federal Estate Tax Exemption Odgers Law Group

https://odgerslawgroup.com/wp-content/uploads/2018/01/Ceramics-Store-Etsy-Banner.png

Your estate wouldn t be subject to the federal estate tax when it is filed in 2023 if it s worth 12 059 million and you were to die in 2022 The exemption is indexed for inflation so it tends to increase most years even when tax legislation doesn t affect it Gift and Estate Tax Exemption The amount you can give during your lifetime or at your death and be exempt from federal estate and gift taxes has risen from 12 060 000 to 12 920 000

The federal lifetime gift and estate tax exclusion will increase from 12 06 million in 2022 to 12 92 million for 2023 There could also be increases for inflation for both 2024 and 2025 The federal estate tax as of the 2023 tax year applies only on the value of an estate that exceeds 12 92 million In 2024 the exemption rises to 13 61 million Surviving spouses are

IRS Increases The Federal Estate Tax Exemption Amount In 2020 Odgers

https://odgerslawgroup.com/wp-content/uploads/2020/11/Federal-Tax-Exemption-Example-2021.png

Update 2019 Federal Estate Tax Exemption Odgers Law Group

https://odgerslawgroup.com/wp-content/uploads/2018/01/Federal-Tax-Exclusion-Amount-2019.png

https://www.irs.gov/.../estate-tax

Get information on how the estate tax may apply to your taxable estate at your death The Estate Tax is a tax on your right to transfer property at your death It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF

https://www.irs.gov/newsroom/estate-and-gift-tax-faqs

In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a person s cumulative taxable gifts and taxable estate to arrive at a net tentative tax Any tax due is determined after applying a credit based on an applicable exclusion amount

Budget 2023 All You Need To Know About Current Income Tax Exemption

IRS Increases The Federal Estate Tax Exemption Amount In 2020 Odgers

Estate Tax Exemption Changes Coming In 2026 Estate Planning

IRS Here Are The New Income Tax Brackets For 2023 Economics

Federal Estate Tax Exemption Set To Expire Are You Prepared

IMPORTANT 2017 FEDERAL TAX AND EXEMPTION AMOUNTS FLORIDA ESTATE

IMPORTANT 2017 FEDERAL TAX AND EXEMPTION AMOUNTS FLORIDA ESTATE

Estate Tax And Date Of Death DOD Appraisal Services Colorado

Estate Tax Chart Fairview Law Group

PROJECTED 2018 ESTATE AND GIFT TAX EXEMPTION AMOUNTS FLORIDA ESTATE

Federal Estate Tax Exemption Limit - In 2023 the federal estate tax exemption is 12 92 million affecting a limited number of people in the country Twelve states and the District of Columbia levy their own estate taxes and most states have a lower threshold than the federal exemption