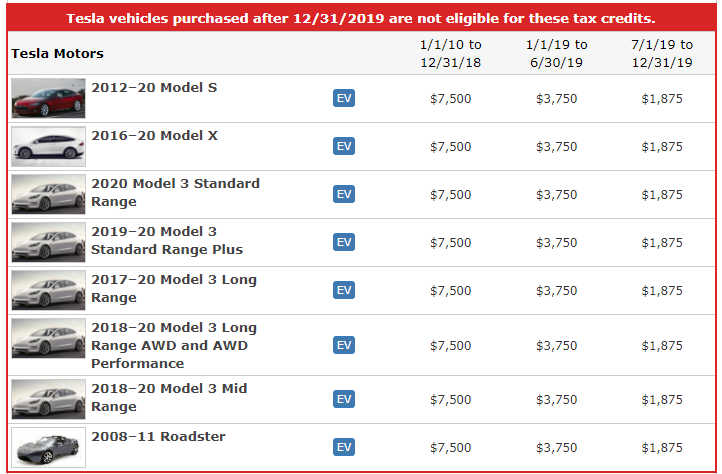

Federal Ev Car Rebate Web 7 janv 2023 nbsp 0183 32 Which vehicles are eligible for the 7 500 federal tax credit has changed dramatically compared to a previous version of the credit

Web 24 avr 2023 nbsp 0183 32 How the EV Tax Credits Work America s electric car revolution is underway with sales boosted partly by federal state local and utility incentives in an effort to get Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed

Federal Ev Car Rebate

Federal Ev Car Rebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/california-s-ev-rebate-changes-a-good-model-for-the-federal-ev-tax-23.png?w=576&h=281&ssl=1

More Vehicles Now Qualify For The Federal EV Rebate In Canada

https://cms.creditcardgenius.ca/wp-content/uploads/2022/04/federal-ev-rebate-canada.jpg

Federal Electric Car Rebate And Tax Withholdings 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/californians-can-get-an-electric-vehicle-for-free-sly-credit-1.png

Web 27 ao 251 t 2022 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Web 28 oct 2021 nbsp 0183 32 The reform to the federal electric vehicle incentive program which includes an increased 12 500 EV incentive has survived President Biden s updated Build Back Better proposal Web Get a tax credit of up to 7 500 for new vehicles purchased in or after 2023 Pre Owned Plug in and Fuel Cell Electric Vehicles Purchased in or after 2023 Get a credit of up to

Download Federal Ev Car Rebate

More picture related to Federal Ev Car Rebate

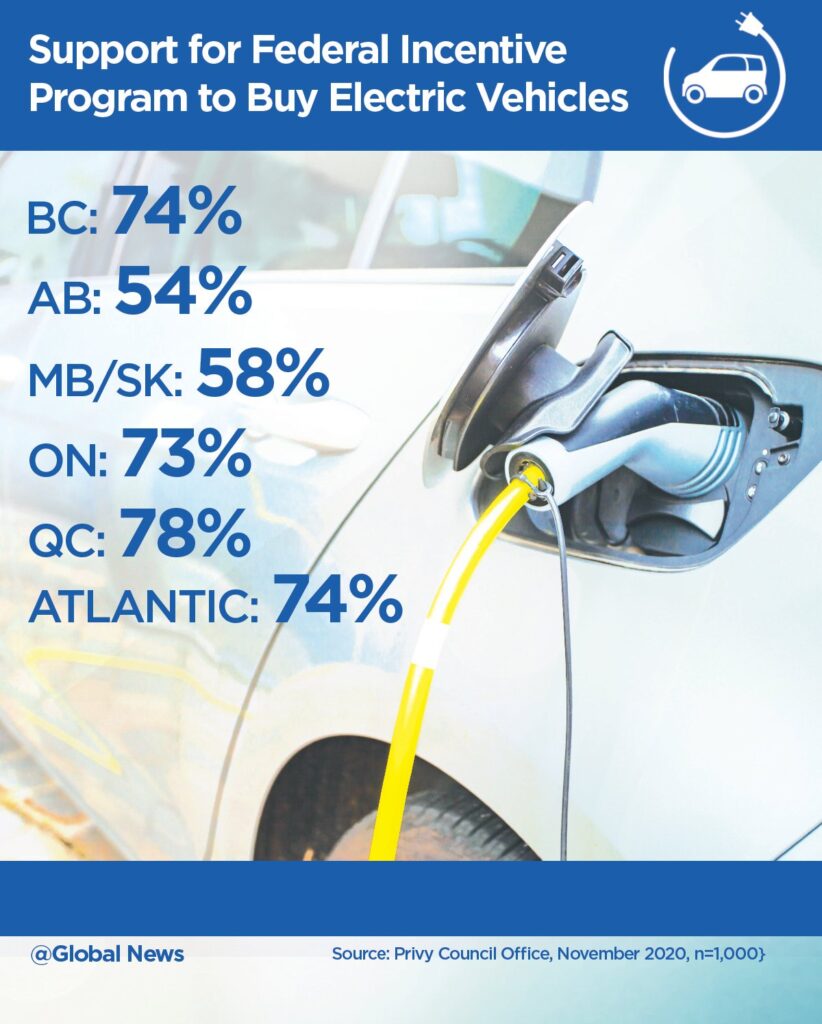

Canadians Support Federal EV Rebates Shows Internal Govt Poll

https://cdn.teslanorth.com/wp-content/uploads/2021/02/canada-ev-rebate-support-822x1024.jpg

Federal Tax Rebate For Electric Cars 2022 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/2022-tax-brackets-jeanxyzander-5.jpg

2022 Tax Rebate For Electric Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/federal-rebate-for-electric-cars-2022-carrebate-4.jpg

Web Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used Web Eligible vehicles From Transport Canada If you are looking to lease or purchase a new zero emission vehicle and would like to know whether it is eligible for the Incentives for

Web Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Purchased in 2023 or After Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric Web 11 ao 251 t 2021 nbsp 0183 32 The US Senate has voted to approve a non binding resolution setting a 40 000 threshold on the price of electric cars that would be eligible for a 7 500 federal

2023 Federal EV Charging Infrastructure Rebates Part 2 Incentive

https://incentiverebate360.com/wp-content/uploads/2023/03/2023-Federal-EV-Charging-Infrastructure-Rebates-–-Part-2.jpg

2023 Federal EV Charging Infrastructure Rebates Part 1 Incentive

https://incentiverebate360.com/wp-content/uploads/2023/03/2023-Federal-EV-Charging-Infrastructure-Rebates-–-Part-1.jpg

https://www.npr.org/2023/01/07/1147209505

Web 7 janv 2023 nbsp 0183 32 Which vehicles are eligible for the 7 500 federal tax credit has changed dramatically compared to a previous version of the credit

https://cars.usnews.com/cars-trucks/advice/how-does-the-electric-car...

Web 24 avr 2023 nbsp 0183 32 How the EV Tax Credits Work America s electric car revolution is underway with sales boosted partly by federal state local and utility incentives in an effort to get

What Is The Tax Rebate For Electric Cars 2023 Carrebate

2023 Federal EV Charging Infrastructure Rebates Part 2 Incentive

Rebates For Hybrid Cars In California 2023 Carrebate

Claiming The 7 500 Electric Vehicle Tax Credit A Step by Step Guide

Electric Car Rebates Federal 2023 Carrebate

New Federal Electric Car Rebate 2022 Carrebate Rebate2022

New Federal Electric Car Rebate 2022 Carrebate Rebate2022

Does Your EV Qualify For A 7 500 Federal Tax Rebate Mike Anderson

This Is An Attachment Of Electric Vehicle EV Discounts And Incentives

The UAW Wants Federal EV Rebates Only On Vehicles Built In The US

Federal Ev Car Rebate - Web 25 juil 2023 nbsp 0183 32 Some cars and trucks also qualify for a state rebate or tax credit Together those incentives could cut as much as 15 000 off the price of a new EV And falling