Federal Ev Charger Rebate 2024 The US Treasury s EV charger tax credit which is claimed on IRS Form 8911 is limited to 1 000 for individuals claiming for home EV charging and 100 000 up from 30 000 for business

If you are considering buying an electric car in 2024 there s good news and bad news A hefty federal tax credit for electric vehicles is going to get easier to access this year but fewer Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

Federal Ev Charger Rebate 2024

Federal Ev Charger Rebate 2024

https://www.electricvehiclechargers.net/wp-content/uploads/elementor/thumbs/ev-charge-dc-charger-1-ppbgsz6529j64nh7kmmqtg2w4o99aynn4ei94g67ig.jpg

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

Ev Car Tax Rebate Calculator 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/tax-credits-drive-electric-northern-colorado.png

CNN The Internal Revenue Service updated the rules for electric vehicle tax credits again starting with the first day of 2024 bringing some good and bad news The bad news is that fewer Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 The availability of the credit will depend on several factors including the vehicle s MSRP its final assembly location battery component and or critical

What You Need To Know About 2024 EV Tax Credits Vehicles that qualify The IRS keeps an updated this of qualifying vehicles that you can check at any time Qualifying Electric Vehicles Transferability Transferability of the New Clean Vehicle Tax Credit 30D and Used Clean Vehicle Tax Credit 25E go into effect on Jan 1 2024 WASHINGTON Today the U S Department of the Treasury and Internal Revenue Service IRS released additional guidance under President Biden s Inflation Reduction Act IRA to lower Americans energy bills by providing clarity on eligibility for incentives to install electric vehicle charging stations and other alternative fuel refueling stations The Department of Energy is also

Download Federal Ev Charger Rebate 2024

More picture related to Federal Ev Charger Rebate 2024

Commercial Multifamily EV Chargers In Washington EV Support

https://evsupport.com/wp-content/uploads/2021/10/multi-family-ev-charger-installation-in-washington-1536x2048.jpeg

The Canadian Federal Rebate For Electric Cars Encouraging Canadians To Switch To Electric

https://cdn.osvehicle.com/how_much_is_canadian_ev_rebate.jpg

More Vehicles Now Qualify For The Federal EV Rebate In Canada CreditcardGenius

https://cms.creditcardgenius.ca/wp-content/uploads/2022/04/federal-ev-rebate-canada.jpg

EV tax credit changes for 2024 The IRS updated its electric vehicle tax credit rules as of Jan 1 which makes it easier to see immediate savings on an EV purchase Practically speaking buyers Consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle tax credit on their annual tax filing Starting in 2024 the Inflation Reduction Act establishes a mechanism that will allow car buyers to transfer the credit to dealers at the point of sale so that it can directly reduce the purchase price

EV prices in the US remain high compared to traditional combustion vehicles despite some recent decreases Fewer vehicles qualify for the 7 500 federal tax rebate in 2024 but it s now easier to EV tax credits are credits you receive when you file your income taxes that can offset the cost of purchasing and owning an electric vehicle There are EV tax credits that apply

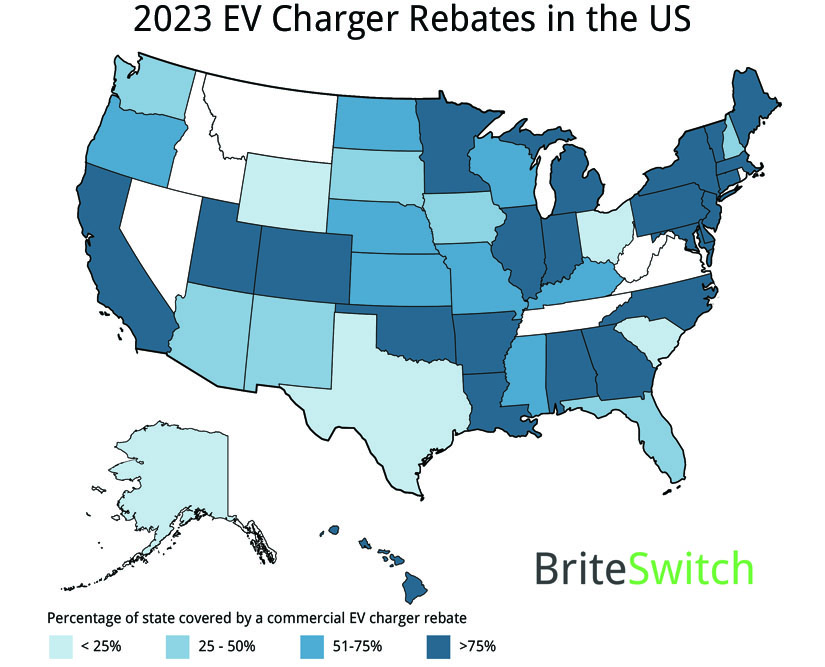

EV Charger Rebate Trends For 2023

https://insights.regencysupply.com/hubfs/EV Charger Rebate Trends.jpg

Canadian Federal EV Rebate Program Expansion YouTube

https://i.ytimg.com/vi/cswvmLqjVvA/maxresdefault.jpg

https://electrek.co/2024/01/19/the-us-treasury-just-released-ev-charger-tax-credit-guidance-heres-how-to-find-out-if-you-qualify/

The US Treasury s EV charger tax credit which is claimed on IRS Form 8911 is limited to 1 000 for individuals claiming for home EV charging and 100 000 up from 30 000 for business

https://www.npr.org/2023/12/28/1219158071/ev-electric-vehicles-tax-credit-car-shopping-tesla-ford-vw-gm

If you are considering buying an electric car in 2024 there s good news and bad news A hefty federal tax credit for electric vehicles is going to get easier to access this year but fewer

The California Electric Car Rebate A State Incentive Program OsVehicle Californiarebates

EV Charger Rebate Trends For 2023

Types Of Rebate Programs By Charger Type Graphs

EV Charger Rebate Program In BC BPM Electric

Electric Vehicle Charger Rebate Independence Light Power Telecommunications

Ev Charger Rebate Trends For 2023 YouTube

Ev Charger Rebate Trends For 2023 YouTube

EV Charger Rebates Trends For 2023

EV Charger Rebate Finder For Websites BriteSwitch

Your State Might Pay For Your Home EV Charger Installation

Federal Ev Charger Rebate 2024 - Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 The availability of the credit will depend on several factors including the vehicle s MSRP its final assembly location battery component and or critical