Federal Ev Tax Credit Income Limit 2022 If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D

IRS guidance limits the number of EVs that qualify for the full 7 500 EV tax credit Those EV tax credit rules address requirements for critical mineral and battery component requirements for The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel

Federal Ev Tax Credit Income Limit 2022

Federal Ev Tax Credit Income Limit 2022

https://electrek.co/wp-content/uploads/sites/3/2021/07/EV-Federal-Tax-Credit-Hero-2.jpg?quality=82&strip=all

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

https://theicct.org/wp-content/uploads/2022/06/epv-us-tax-credit-fig-jun22.png

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Treasury and the Internal Revenue Service released guidance and FAQs with information on how the North America final assembly requirement will work so consumers can determine what vehicles are eligible and claim a Tax credits up to 7 500 are available for eligible new electric vehicles and up to 4 000 for eligible used electric vehicles You can claim the credit yourself or work with your dealership Make sure you meet the requirements below

Effective immediately after enactment of the Inflation Reduction Act after August 16 2022 the tax credit is only available for qualifying electric vehicles for which final assembly occurred in North America Further changes to the eligibility rules will begin in 2023 The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit in 2024

Download Federal Ev Tax Credit Income Limit 2022

More picture related to Federal Ev Tax Credit Income Limit 2022

Universal Credit Income Limit What It Is In 2022

https://www.your-benefits.co.uk/wp-content/uploads/2022/08/comppexels-nataliya-vaitkevich-8927654-1-e1659619292835.jpg

Should These EVs Qualify For The Federal EV Tax Credit EVAdoption

https://evadoption.com/wp-content/uploads/2021/08/Should-these-EVs-qualify-for-the-federal-EV-tax-credit.png

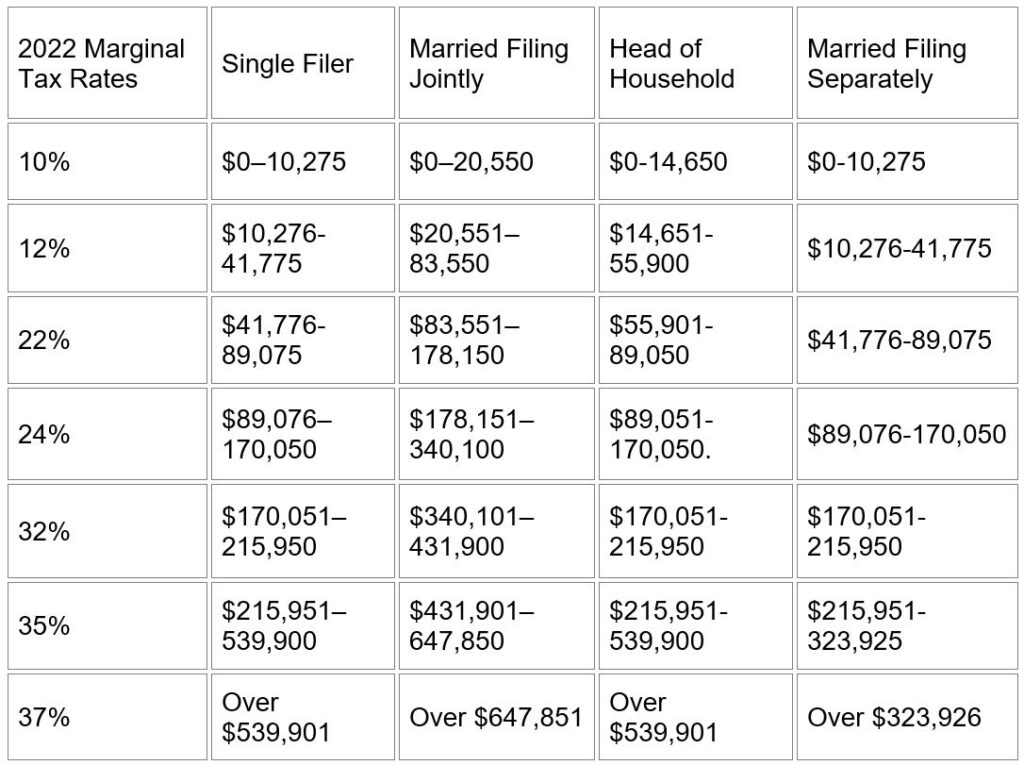

2022 Tax Tables Married Filing Jointly Printable Form Templates And

https://www.ntu.org/Library/imglib/2021/11/ntuf-table1.png

Tucked inside the massive Inflation Reduction Act of 2022 that was signed into law in August is a complex set of requirements around which EVs and other clean vehicles do and do not qualify for a Simply put the Inflation Reduction Act includes a 7 500 tax credit at the point of sale for new EVs and 4 000 for used EVs The new tax credits replace the old incentive system which only

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 Multiple factors determine whether an EV purchased in 2022 qualifies for federal tax credits Many EVs purchased before August 16 2022 qualify for a tax credit of up to 7 500 with smaller amounts available for certain makes and models

.png)

Health Insurance Income Limits For 2023 To Receive ACA Premium S

https://img1.wsimg.com/isteam/ip/cdfbdeb1-9bb8-4d54-828b-6c8a27c8b1f0/image (1).png

U S Federal EV Tax Credit Update For January 2019

https://cdn.motor1.com/images/mgl/kw3bM/s1/u-s-federal-ev-tax-credit-update-for-january-2019.jpg

https://www.irs.gov/credits-deductions/credits-for...

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D

https://www.kiplinger.com/taxes/ev-tax-credit

IRS guidance limits the number of EVs that qualify for the full 7 500 EV tax credit Those EV tax credit rules address requirements for critical mineral and battery component requirements for

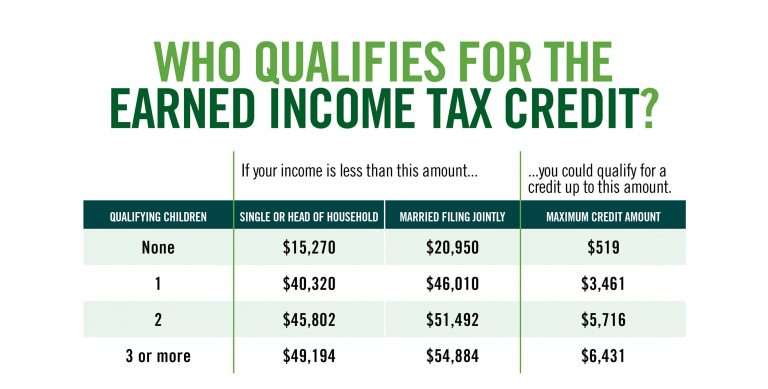

Earned Income Tax Credit EITC Who Qualifies

.png)

Health Insurance Income Limits For 2023 To Receive ACA Premium S

Earning Income Tax Credit Table

Ev Tax Credit 2022 Retroactive Shemika Wheatley

Income Tax Ordinance 2022 Pdf Latest News Update

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

2022 Child Tax Credit Calculator Internal Revenue Code Simplified

Tax Filing 2022 Eitc Latest News Update

22 Questions Answered For 2022 Tax Filing Emerald Advisors

Federal Ev Tax Credit Income Limit 2022 - Treasury and the Internal Revenue Service released guidance and FAQs with information on how the North America final assembly requirement will work so consumers can determine what vehicles are eligible and claim a