Federal Fuel Tax Rebate Web The Inflation Reduction Act of 2022 the Act provides the section 40B sustainable aviation fuel SAF credit for sales or uses after 2022 and the credit is added as line 10d

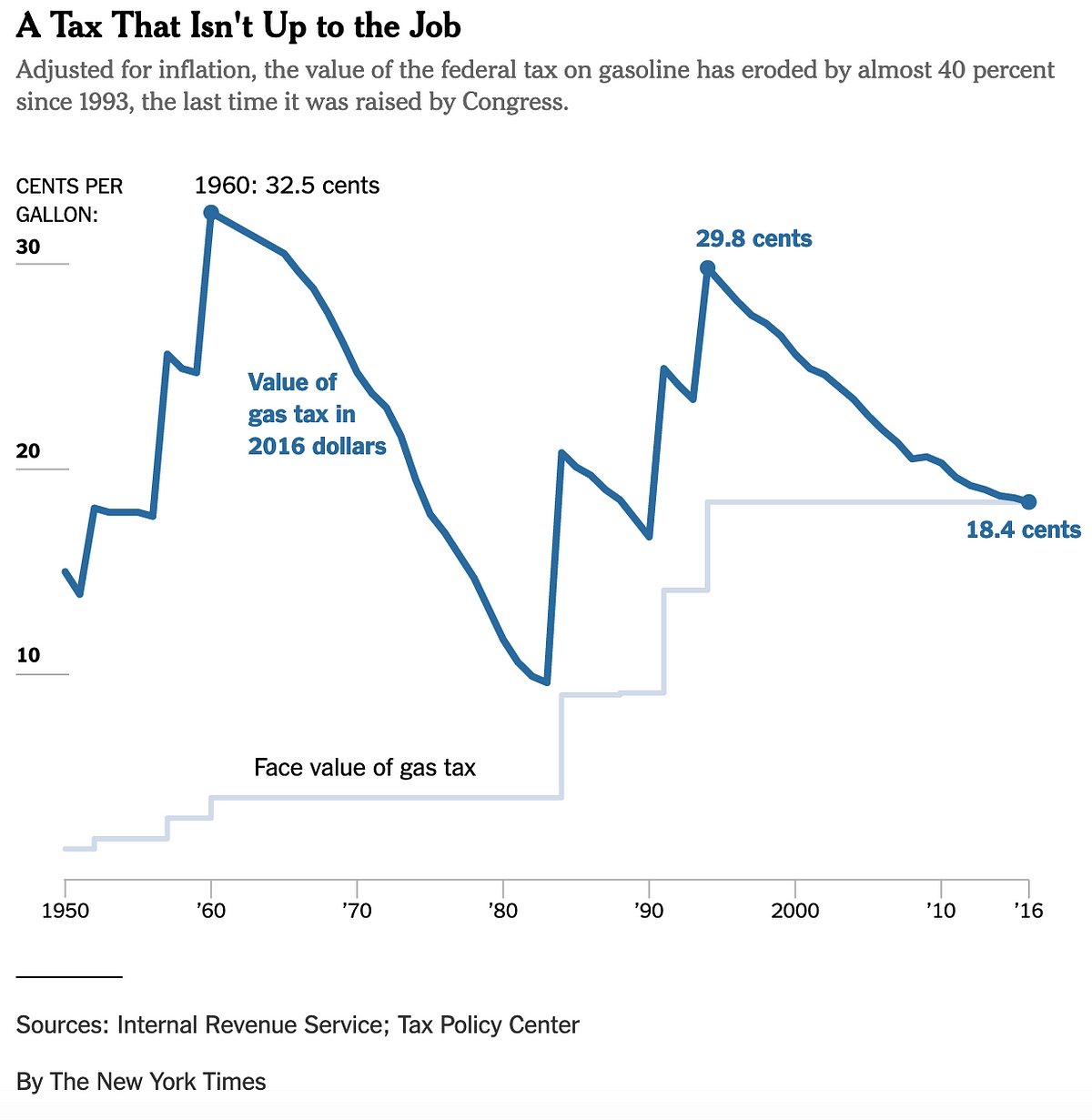

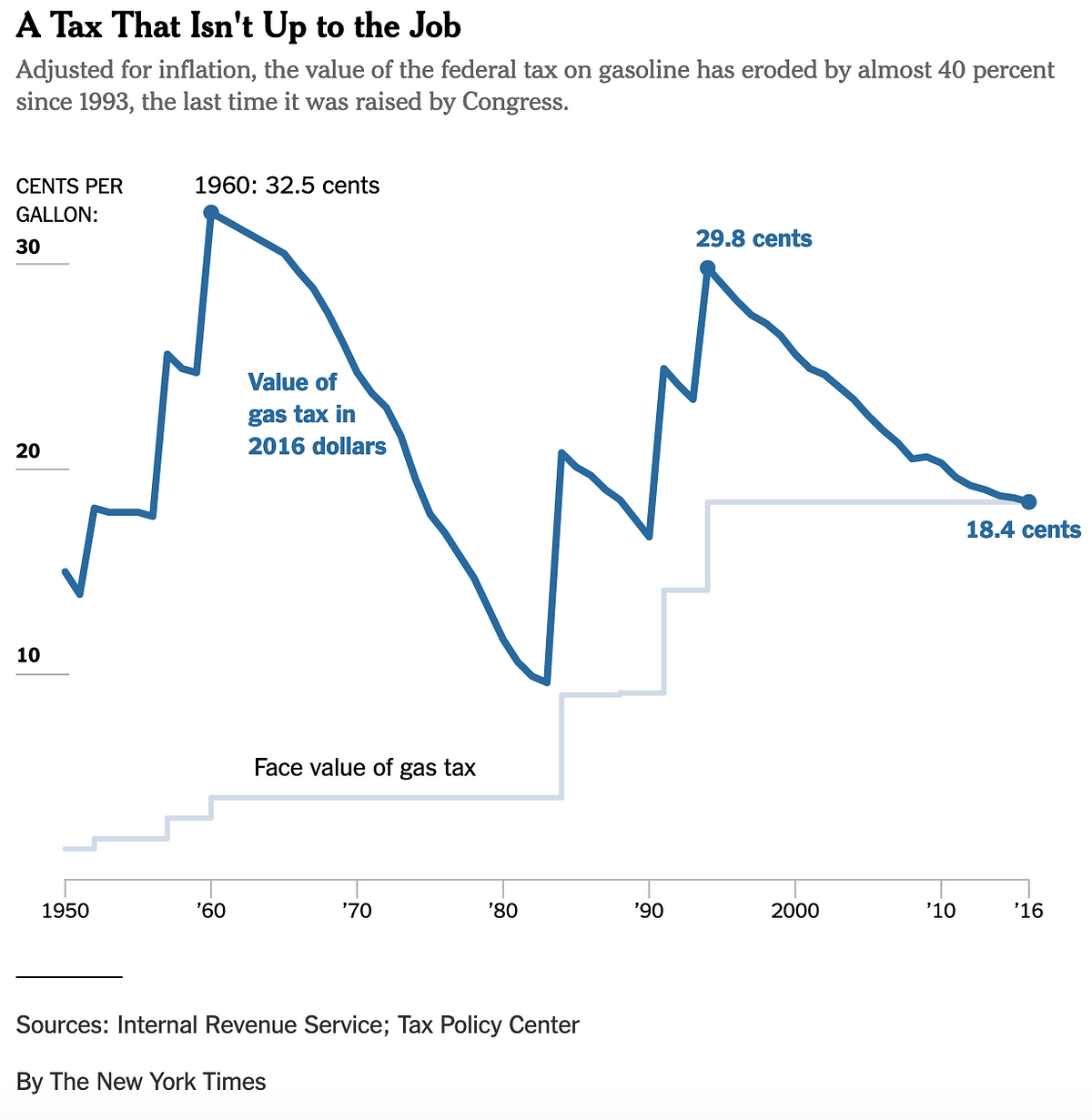

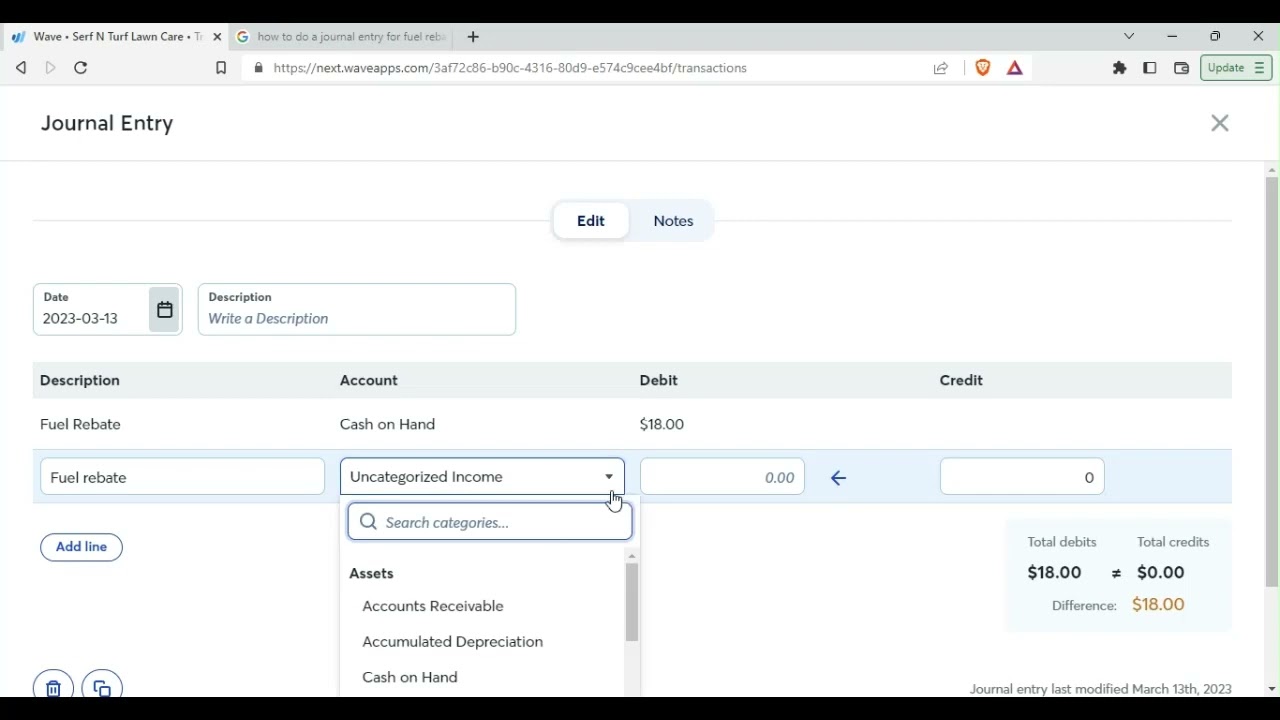

Web About Form 4136 Credit For Federal Tax Paid On Fuels Use Form 4136 to claim A credit for certain nontaxable uses or sales of fuel during your income tax year The Web 22 juin 2022 nbsp 0183 32 Right now the federal government charges an 18 cent tax per gallon of gasoline and a 24 cent tax per gallon of diesel Those taxes fund critical highways and

Federal Fuel Tax Rebate

Federal Fuel Tax Rebate

https://miro.medium.com/max/1200/1*Yt1Plh9y1ouJbjJ5X5JIhQ.png

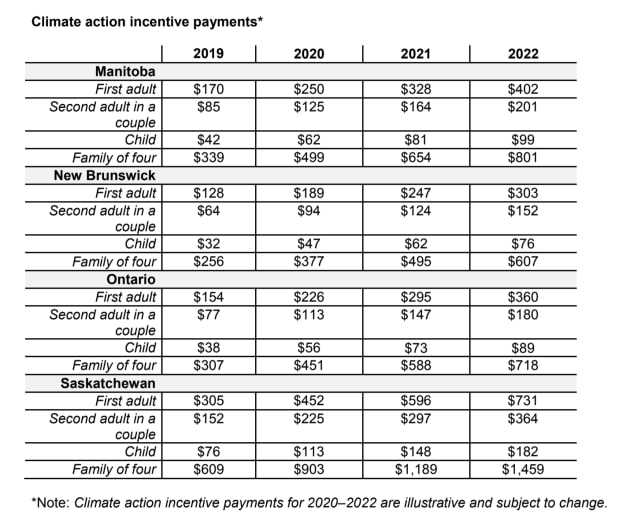

How To Record A Fuel Tax Rebate YouTube

https://i.ytimg.com/vi/Tc3tx70o3CM/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgZShlMA8=&rs=AOn4CLAr6O11zrpddv_hG-iJQCss1UIp4w

How High Are Gas Taxes In Your State Laura Strashny

https://files.taxfoundation.org/20210727173044/2021-gas-tax-rates-and-2021-state-gas-tax-rankings.-How-much-is-gas-tax-rates-in-each-state.-Which-state-has-the-highest-gas-tax-rate.-1200x1033.png

Web Credit for Federal Tax Paid on Fuels Go to www irs gov Form4136 for instructions and the latest information OMB No 1545 0162 2022 Attachment Sequence No 23 Name as Web Get a tax credit of up to 7 500 for new vehicles purchased in or after 2023 Pre Owned Plug in and Fuel Cell Electric Vehicles Purchased in or after 2023 Get a credit of up to

Web 2 juin 2023 nbsp 0183 32 The one most familiar to taxpayers is probably the federal gas tax 18 4 cents gallon as of 2021 which pays for road projects across the country Certain uses of fuels are untaxed however and fuel users can Web For current tax rates on motor fuels see IRS Form 720 2 The federal excise tax rate on CNG is currently 0 183 cents per gasoline gallon equivalent GGE A GGE for

Download Federal Fuel Tax Rebate

More picture related to Federal Fuel Tax Rebate

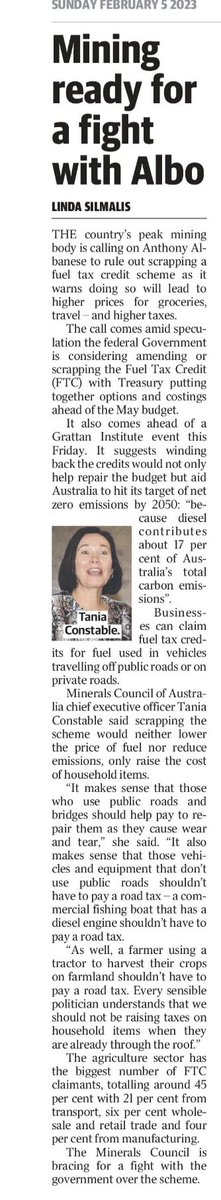

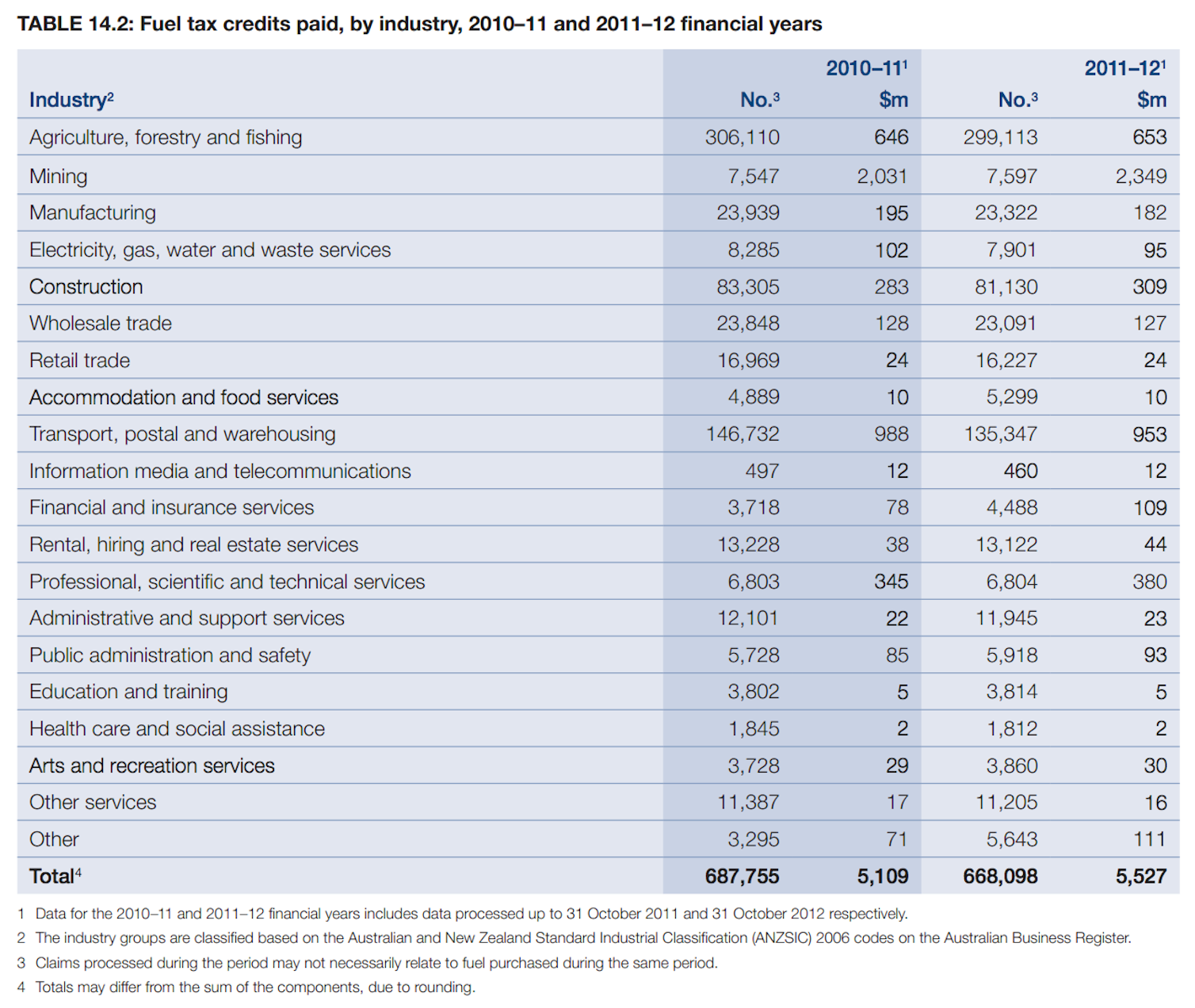

Tom Chesson On Twitter Labor Looking To Scrap The Fuel Tax Credits

https://pbs.twimg.com/media/FoKu6CGaMAEmesO.jpg

Federal Tax Rebates LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/federal-recovery-rebates-california-budget-and-policy-center-768x591.png

Viewpoints Should Fuel Tax Credits Be Cut In The Budget

https://images.theconversation.com/files/47595/original/3cfp2vcz-1398993376.jpg?ixlib=rb-1.1.0&q=30&auto=format&w=754&h=636&fit=crop&dpr=2

Web 24 janv 2023 nbsp 0183 32 Excise gasoline tax refund If you have a permanent mobility impairment and cannot safely use public transportation you can ask for a refund of part of the federal Web Alternative Fuel Infrastructure Tax Credit Fueling equipment for natural gas propane liquefied hydrogen electricity E85 or diesel fuel blends containing a minimum of 20

Web The Alternative Fuel Refueling Property Credit extends the credit sunset and increases the 30 credit cap Extends tax credit to property placed into service before 2033 Increases Web Alternative Fuel Excise Tax Propane and compressed natural gas CNG are subject to a federal excise tax of 0 183 per gasoline gallon equivalent GGE The liquefied natural

Reporting Fuel Tax Rebate Agrimaster

https://support.agrimaster.com.au/hc/article_attachments/360002878975/fuelrebatereport.PNG

Electric Car Tax Rebate California ElectricCarTalk

https://www.electriccartalk.net/wp-content/uploads/californias-ev-rebate-changes-a-good-model-for-the-federal-ev-tax.png

https://www.irs.gov/pub/irs-pdf/i4136.pdf

Web The Inflation Reduction Act of 2022 the Act provides the section 40B sustainable aviation fuel SAF credit for sales or uses after 2022 and the credit is added as line 10d

https://www.irs.gov/forms-pubs/about-form-4136

Web About Form 4136 Credit For Federal Tax Paid On Fuels Use Form 4136 to claim A credit for certain nontaxable uses or sales of fuel during your income tax year The

Oklahoma Natural Gas Rebate Application Fill Out Sign Online DocHub

Reporting Fuel Tax Rebate Agrimaster

Fillable Form 4136 Credit For Federal Tax Paid On Fuels 2012

Motor Fuels Tax Section F

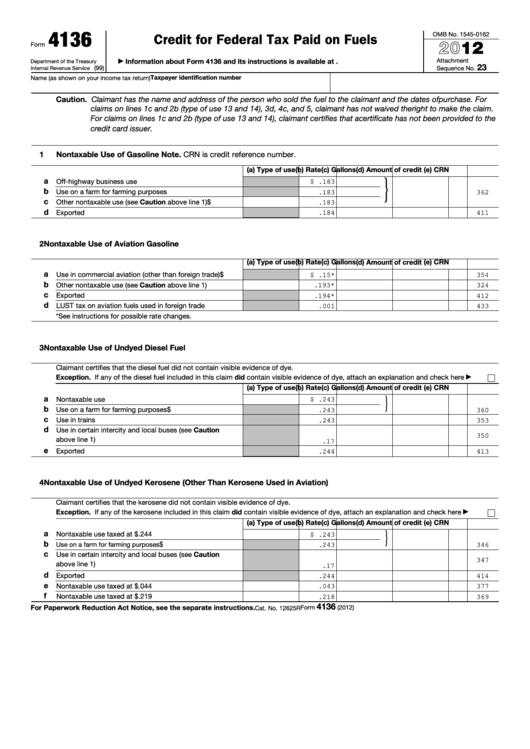

Carbon Tax Rebates Coming To Provinces That Rejected Federal Plan

Federal Tax Rebate 2023 Maximize Your Savings And Boost Your Finances

Federal Tax Rebate 2023 Maximize Your Savings And Boost Your Finances

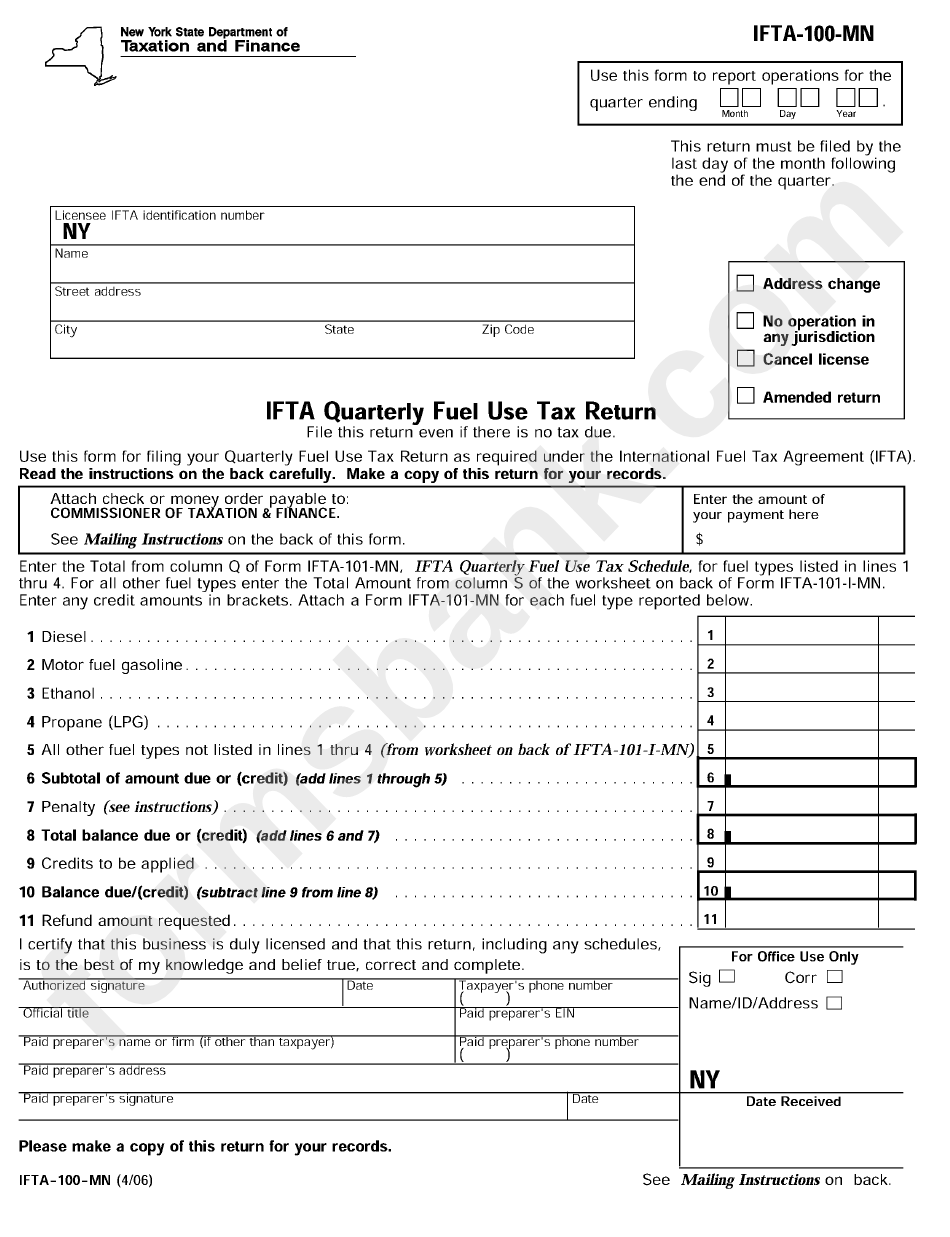

Form Ifta 100 Mn Ifta Quarterly Fuel Use Tax Return Printable Pdf

This Is An Attachment Of 2023 LG Rebates Printable Rebate Form From

Biden Weighing Federal Gas Tax Holiday Sending Out Gas Rebate Cards

Federal Fuel Tax Rebate - Web Credit for Federal Tax Paid on Fuels Go to www irs gov Form4136 for instructions and the latest information OMB No 1545 0162 2022 Attachment Sequence No 23 Name as