Federal Government Electricity Rebate 2024 The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034 About Home Energy Rebates On Aug 16 2022 President Biden signed the landmark Inflation Reduction Act The law includes nearly 400 billion to support clean energy and address climate change including 8 8 billion in Home Energy Rebates which will provide two separate rebates to consumers The Home Efficiency Rebates will provide 4 3 billion to discount the price of energy saving

Federal Government Electricity Rebate 2024

Federal Government Electricity Rebate 2024

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

2021 Energy Federal Tax Credit And Rebate Programs Epic Energy

https://www.thinkepic.com/wp-content/uploads/2021/06/AdobeStock_165208034-scaled.jpeg

Federal Government Decides To Further Increase Electricity Prices Significantly

https://timesofislamabad.com/digital_images/large/2021-01-17/federal-government-decides-to-further-increase-electricity-prices-significantly-1610883544-6257.jpg

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit 2034 22 no annual maximum or lifetime limit Get details on the Residential Clean Energy Credit Resources Tax Deductions for Commercial Buildings Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

What s new for 2024 instant rebate Starting in January EV buyers won t have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead DOE does not recommend that households wait to accomplish needed home energy upgrades or projects Households looking for home energy upgrades assistance today cannot yet access these rebates but may be eligible for other federal programs including tax credits the Weatherization Assistance Program and other state local and utility programs A homeowner can access rebates through the Home

Download Federal Government Electricity Rebate 2024

More picture related to Federal Government Electricity Rebate 2024

Teaching Jobs In Federal Government Educational Institutions 2021 Yari pk

https://yari.pk/today/wp-content/uploads/2021/04/librarian-jobs-in-federal-government-educational-institutions-2021-yari-pk-jobs-in-pakistan-yari.pk.jpg?v=1617599995

Mass Save Rebate Form 2021 PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2021/12/Residential-Mass-Save-Rebate-Form-2021-768x513.png

Federal Government Not Considering Removing Medicare Rebate For After Hours GPs Despite Doctors

https://images.perthnow.com.au/publication/C-797734/358bf8194ff68266276b85415982505fe9012655-16x9-x0y78w1500h844.jpg?imwidth=1200

There s also a 1 750 rebate for heat pump water heaters 840 cash back for induction stoves and heat pump clothes dryers and 4 000 for electrical system upgrades The federal government Communities across the U S experiencing the most significant effects of poverty represent a quarter of applications received WASHINGTON Today the U S Department of the Treasury and Internal Revenue Service IRS in partnership with the Department of Energy DOE announced remarkable demand in the initial application period for solar and wind facilities through the Inflation Reduction

The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as the For EV customers everything changes on January 1 2024 The Treasury Department has now issued new rules that will turn the federal EV tax credit into what is basically a point of sale rebate

What You Need To Know Federal Carbon Tax Takes Effect In Ont Manitoba Sask And N B Today

https://i.cbc.ca/1.4875360.1540329689!/fileImage/httpImage/image.png_gen/derivatives/original_620/federal-government-s-carbon-tax-and-rebate-plan.png

What Is The Queensland Government Electricity Rebate ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/09/the-edge-markets-two-sen-kwh-electricity-rebate-for-all-users-from-jan-1.jpg

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

You Could Be Getting A 150 Electricity Rebate From The Alberta Government News

What You Need To Know Federal Carbon Tax Takes Effect In Ont Manitoba Sask And N B Today

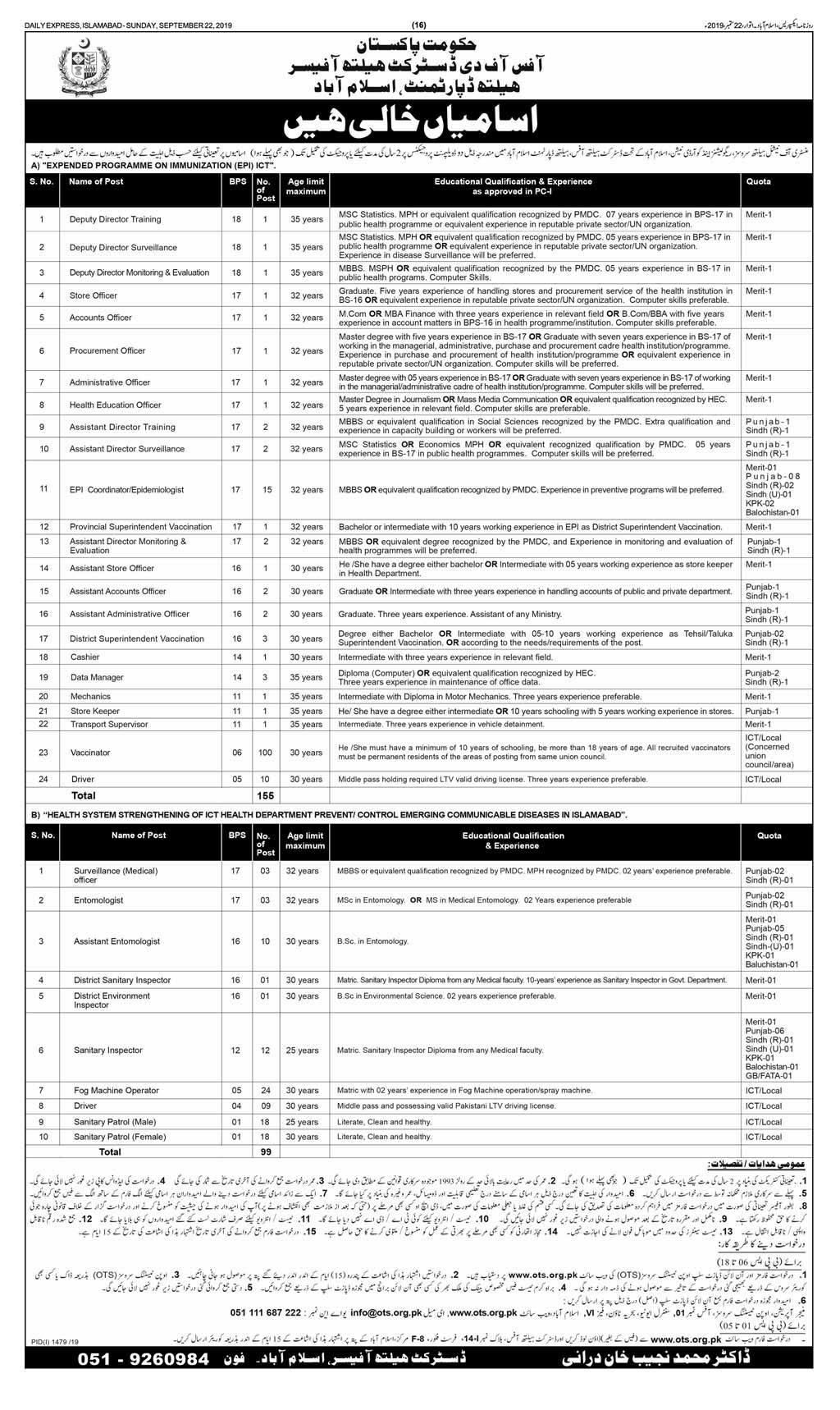

Government Of Pakistan Health Department Islamabad Jobs 2019 OTS

Residential Services Watts Energy

Electricity Bill Rebate Plan Gets The Green Light From Agency Radio Sweden Sveriges Radio

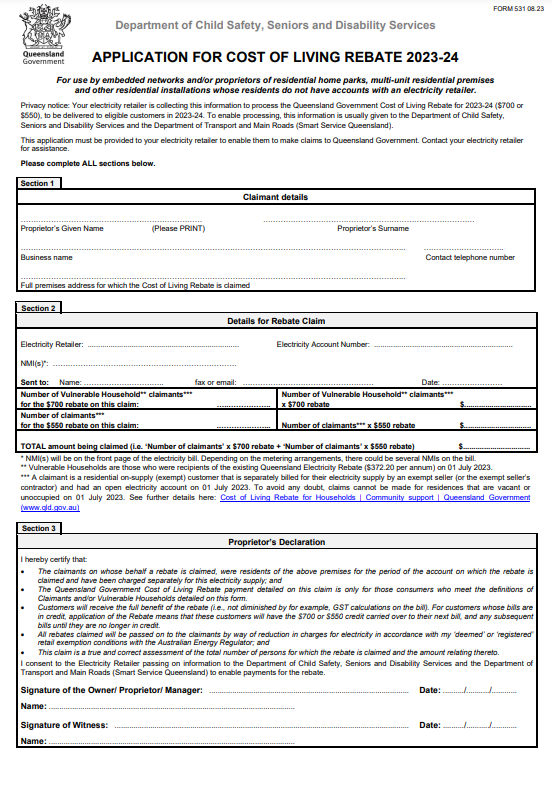

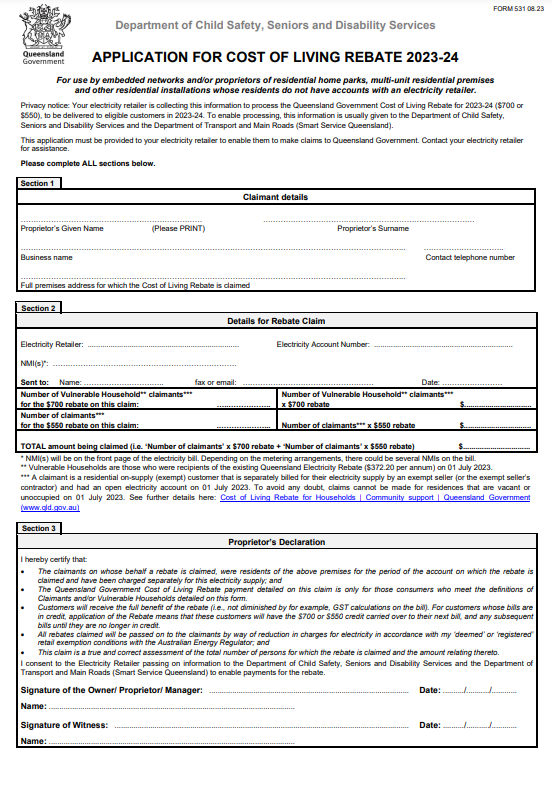

QLD Government Electricity Rebate 2023 PrintableRebateForm

QLD Government Electricity Rebate 2023 PrintableRebateForm

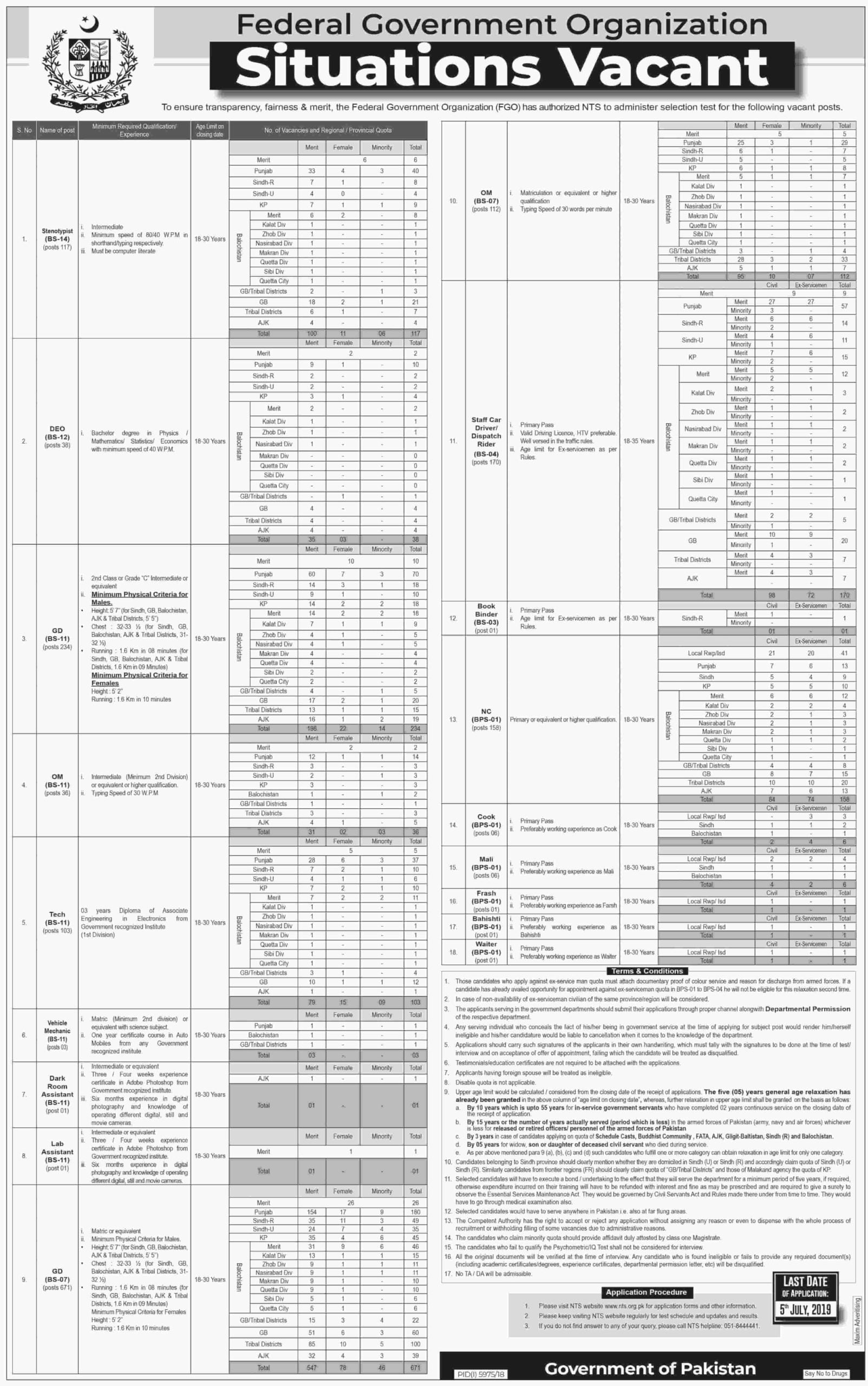

Federal Government Organization Www nts pk Jobs 2019 NTS

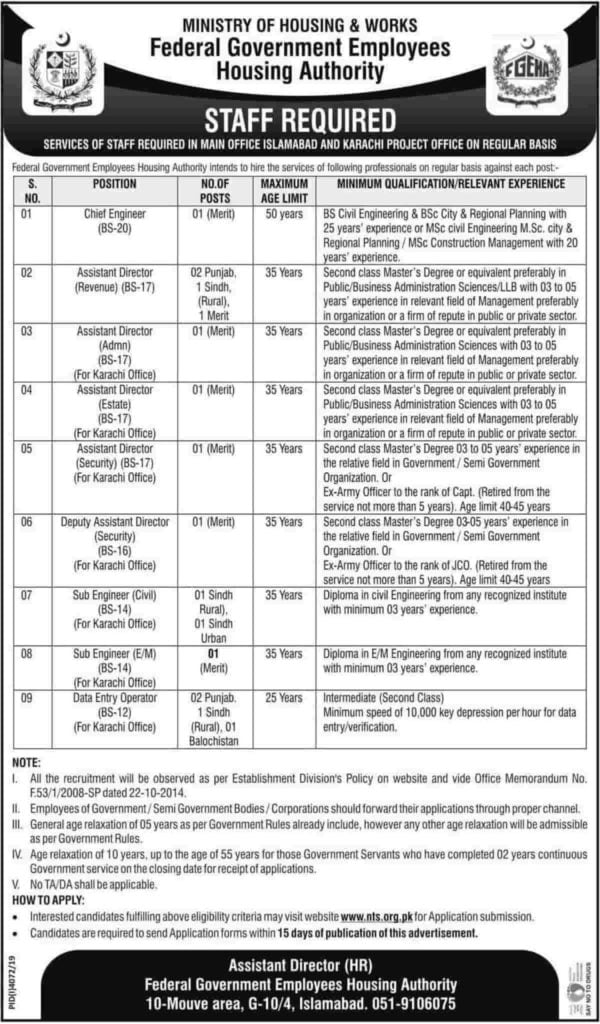

Federal Government Employees Housing Authority Jobs 2020 NTS

Federal Electricity And Water Authority Signs MoU With The Royal Danish Consulate General In

Federal Government Electricity Rebate 2024 - Tax Deductions for Commercial Buildings Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent