Federal Government Rebate Program 2024 How To Apply The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

High Efficiency Electric Home Rebate Act HEEHRA This provides rebates for low and middle income families to electrify their homes such as by installing heat pumps or electric clothes Office of State and Community Energy Programs Home Energy Rebate Programs Requirements and Application Instructions Home Energy Rebate Programs Requirements and Application Instructions Updated October 13 2023 Washington DC 20585 202 586 5000 Sign Up for Email Updates

Federal Government Rebate Program 2024 How To Apply

Federal Government Rebate Program 2024 How To Apply

https://content.api.news/v3/images/bin/04cd5b5f0170a26ba9d245f09755c5ae

Gainpoint Grant Specialists

https://gainpoint.com.au/wp-content/uploads/2022/12/Untitled-design-19-1024x1024.png

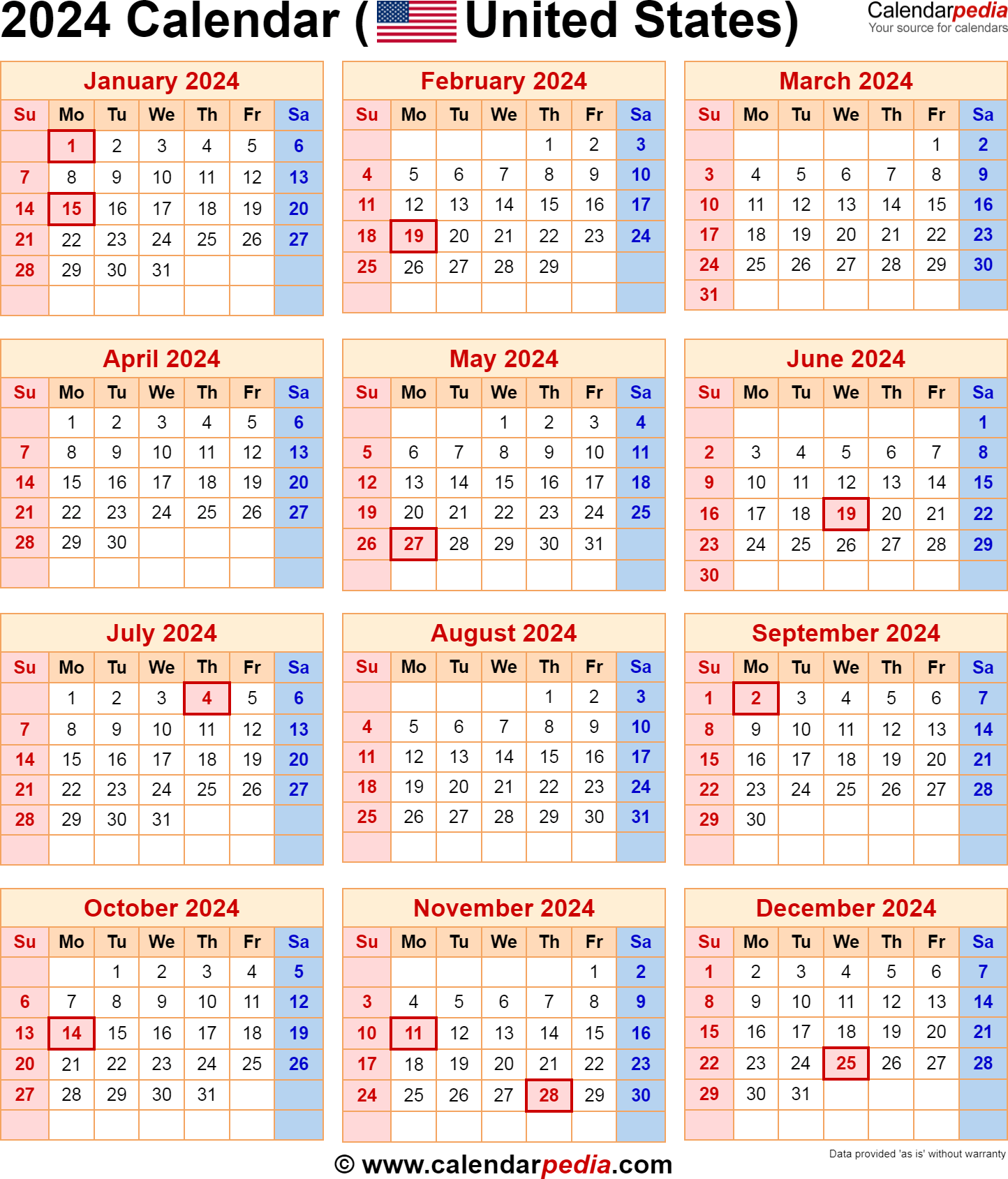

Labor Day 2024 Calendar With Holidays

https://www.calendarpedia.com/images-large/2024-calendar-usa.png

Home Energy Rebate Programs Requirements Application Instructions i INFLATION REDUCTION ACT HOME ENERGY REBATES Home Efficiency Rebates Program Sec 50121 Home Electrification and Appliance Rebates Program Sec 50122 PROGRAM REQUIREMENTS APPLICATION INSTRUCTIONS Applications Due by January 31 2025 VERSION 1 1 Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

The legislation includes 4 5 billion in funding for states to provide rebates for the purchase of new electric appliances including ranges cooktops and wall ovens The Department of Energy For EV customers everything changes on January 1 2024 The Treasury Department has now issued new rules that will turn the federal EV tax credit into what is basically a point of sale rebate

Download Federal Government Rebate Program 2024 How To Apply

More picture related to Federal Government Rebate Program 2024 How To Apply

Mass Save PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2021/12/Residential-Mass-Save-Rebate-Form-2021-768x513.png

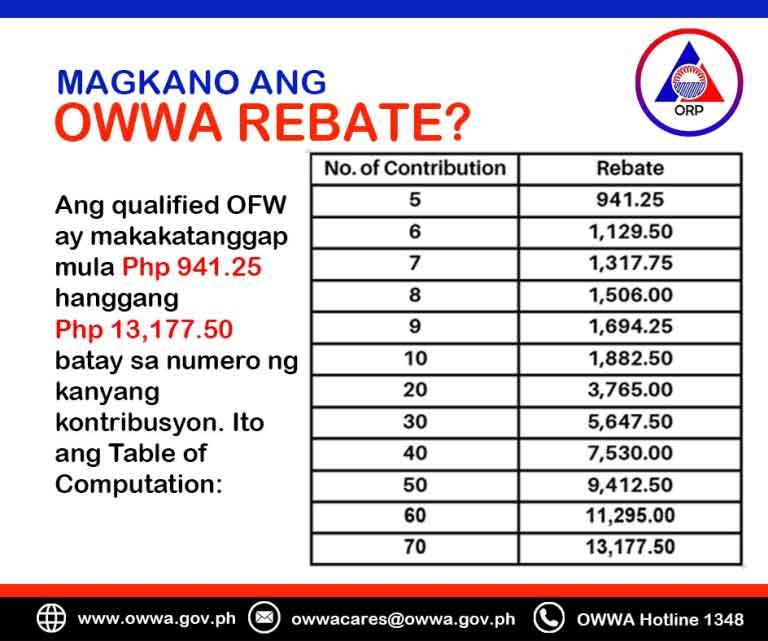

How To Apply OWWA Rebate Program POLO OWWA

https://polo-owwa.com/wp-content/uploads/2022/01/how-to-apply-for-owwa-rebate.jpg

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Starting in January Inflation Reduction Act Provision Will Allow Consumers to Transfer Credit to Car Dealer Reducing Purchase Price of New and Previously Owned Clean Vehicles at Time of SaleWASHINGTON As part of Bidenomics and the Biden Harris Administration s Investing in America agenda the U S Department of the Treasury and the Internal Revenue Service IRS today released guidance A 7 500 tax credit for electric vehicles has seen substantial changes in 2024 It should be easier to get because it s now available as an instant rebate at dealerships but fewer models qualify

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034 Eligible Canadians will receive their first carbon pricing rebate of 2024 from the federal government starting Monday The rebate officially called the Climate Action Incentive payment will be

Federal Government Solar Rebate Solar Rebate Australia

https://www.pioneersolar.com.au/wp-content/uploads/2020/09/Untitled-design-2-e1600757607431.png

How To Apply On OWWA Rebate Program Kwentong OFW

https://www.kwentongofw.com/wp-content/uploads/2022/08/OWWA-REBATE-1.jpg

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

https://www.cbsnews.com/news/inflation-reduction-act-joe-biden-climate-energy-home-upgrades/

High Efficiency Electric Home Rebate Act HEEHRA This provides rebates for low and middle income families to electrify their homes such as by installing heat pumps or electric clothes

Rebate Program Get Up To 5000 Mister Contractor

Federal Government Solar Rebate Solar Rebate Australia

Government Rebate For Hybrid Cars Ontario 2023 Carrebate

Pennsylvania s Property Tax Rent Rebate Program May Help Low income Households Apply By 12 31

PA Rent Rebate Form Printable Rebate Form

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

Federal Government Solar Rebate Solar Rebate Australia

Awasome Tax Rebate On Health Insurance References

Pennsylvania s Property Tax Rent Rebate Program May Help Low income Households Apply By 12 31

Federal Government Rebate Program 2024 How To Apply - Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent