Federal Government Rebates Web On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act IRA into law The law includes 391 billion to support clean energy and address climate

Web Beginning in 2023 state programs offer low and moderate income households rebates for heat pumps at the point of sale cutting costs of purchase and installation up to 8 000 If Web 13 avr 2022 nbsp 0183 32 Below are frequently asked questions about the 2021 Recovery Rebate Credit separated by topic Please do not call the IRS Topic A General Information

Federal Government Rebates

Federal Government Rebates

https://images.thewest.com.au/publication/S-1719397/040517m_MedicareFreeze_1280x720.jpg?imwidth=810&impolicy=wan_v3

Government Rebate For New Air Conditioner KnowYourGovernment

https://www.knowyourgovernment.net/wp-content/uploads/american-standard-air-conditioner-rebates-central-ac-units-air.jpeg

Suppose That The Federal Government Announced A Tax Rebate Of 500 For docx

https://cdn.slidesharecdn.com/ss_thumbnails/supposethatthefederalgovernmentannouncedataxrebateof500for-230202043610-4b250b0c-thumbnail.jpg?width=640&height=640&fit=bounds

Web 9 sept 2022 nbsp 0183 32 High Efficiency Electric Home Rebate Act HEEHRA This provides rebates for low and middle income families to electrify their homes such as by installing heat Web Energy gov Tax Credits Rebates amp Savings Please visit the Database of State Incentives for Renewables amp Efficiency website DSIRE for the latest state and federal incentives

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat

Download Federal Government Rebates

More picture related to Federal Government Rebates

Government Rebates Total Electrics And Air Conditioning

https://www.totalelectricsandac.com.au/wp-content/uploads/2021/08/total-electric-government-rebat-768x205.jpg

Awasome Tax Rebate On Health Insurance References

https://i2.wp.com/navyhealth.com.au/wp-content/uploads/2018/03/Federal-Government-Rebate-1-APR-2019.png

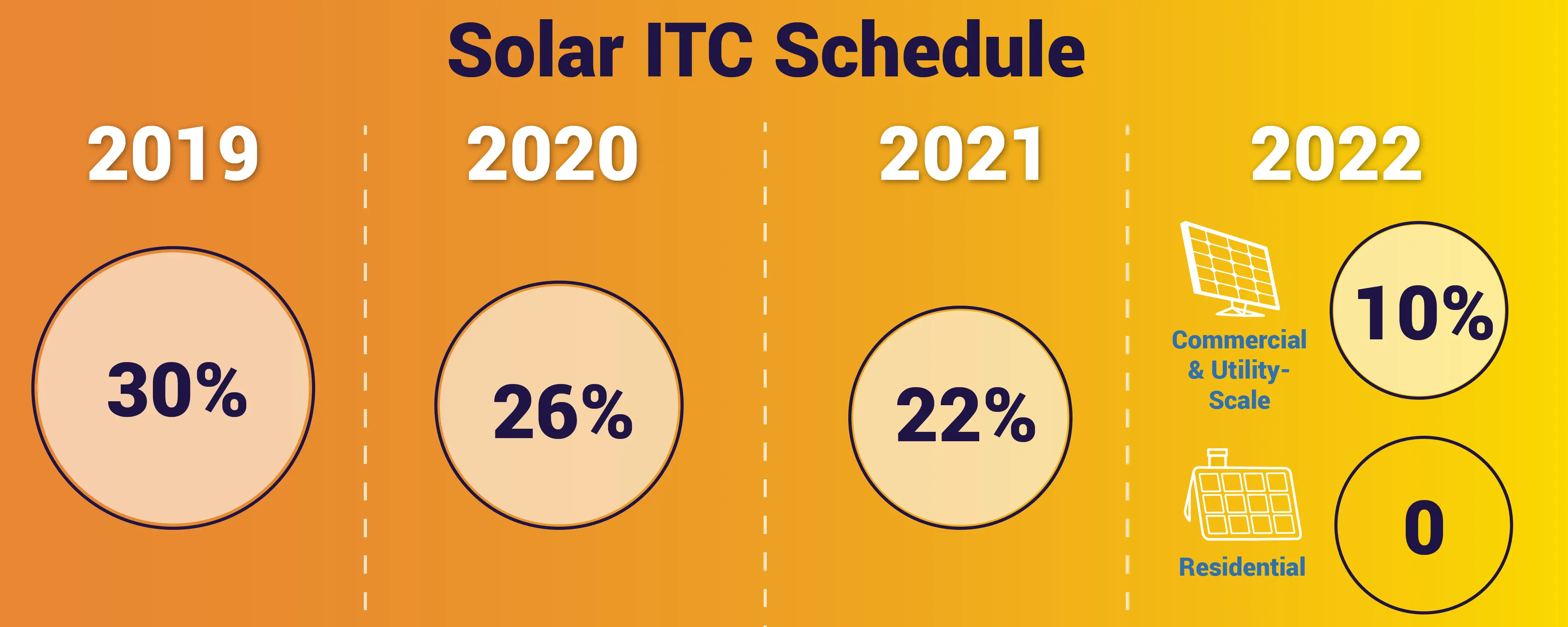

Federal Government Solar Tax Credit KnowYourGovernment

https://www.knowyourgovernment.net/wp-content/uploads/solar-panel-rebates-solar-tax-incentives-greenlight.png

Web 15 janv 2021 nbsp 0183 32 Recovery Rebate Credit and other benefits IRS Free File is all taxpayers need to claim the Recovery Rebate Credit and other tax benefits such as the Earned Web 27 mai 2021 nbsp 0183 32 Homeowners will be able to receive grants of up to 5 000 to make energy efficient retrofits to their primary residences and up to 600 to help with the cost of

Web 21 ao 251 t 2023 nbsp 0183 32 The Canada Greener Homes Loan is an interest free loan of up to 40 000 with a repayment term of 10 years open to homeowners who have an active application Web 15 juil 2022 nbsp 0183 32 The first instalment of the federal government s Climate Action Incentive payment landed in Canadian bank accounts Friday but only for residents of Alberta

Federal Government Heat Pump Rebate PumpRebate

https://www.pumprebate.com/wp-content/uploads/2022/09/rebates-on-mitsubishi-air-conditioning-ductless-duct-free-mini-split-68.jpg

Federal Government Considers Household Energy Rebates 10 News First

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=1209073469679549&get_thumbnail=1

https://www.energy.gov/scep/home-energy-rebate-program

Web On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act IRA into law The law includes 391 billion to support clean energy and address climate

https://www.whitehouse.gov/cleanenergy

Web Beginning in 2023 state programs offer low and moderate income households rebates for heat pumps at the point of sale cutting costs of purchase and installation up to 8 000 If

Federal Rebate Set To Make Electric Cars More Affordable See 100M Go

Federal Government Heat Pump Rebate PumpRebate

Power Bill Increase Federal Government Negotiates Rebates As Steep

Government Rebate For Furnaces Printable Rebate Form

Will There Be A 4th Stimulus Check Approved State Rebate Programs In

Federal Government Solar Rebate Solar Rebate Australia

Federal Government Solar Rebate Solar Rebate Australia

What You Need To Know Federal Carbon Tax Takes Effect In Ont

2020 Government Rebates Incentives

Federal Government Told To Pay Up On Household Rebates The Australian

Federal Government Rebates - Web 9 sept 2022 nbsp 0183 32 High Efficiency Electric Home Rebate Act HEEHRA This provides rebates for low and middle income families to electrify their homes such as by installing heat